Search

Democracy Links

Member's Off-site Blogs

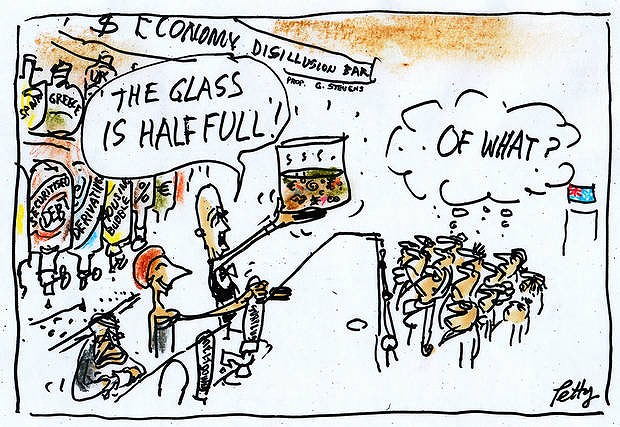

we can't have it all ....

The next election will be austere if the Treasury boss, Martin Parkinson, gets his way.

Back in June, Dr Parkinson told the Committee for the Economic Development of Australia in Canberra that Australians should get real and realise they couldn't ''have it all''.

Ageing and rising expectations were likely to put ''enormous pressure'' on budgets, he said. The taxation base was ''weaker than had been imagined in the mid-noughties''.

''Much of the debate assumes we can have it all, with people simultaneously believing we can maintain or even reduce taxation levels while keeping the current range of social policy interventions with limited targeting and self-provision - and indeed adding to this with a long list of worthy, but expensive, new proposals,'' he told the conference.

''The key point is that choices need to be explicitly debated. The examples of the United States and Europe, where decisions have repeatedly been put off in good times, are not models to emulate.''

Australia needed a ''sensible discussion on what we expect governments to provide, and the tax system needed to support these expectations''.

Treasury will soon publicly release its methodologies for costing political promises, giving the community and political parties a clearer idea of how it evaluates policies. It was severely criticised by the Coalition after the 2010 election, when it found what it said were up to $10.6 billion worth of errors in costings the Coalition had had certified by two Perth accountants. The Coalition said the accountants were unable to replicate the Treasury's methods because it had not made them public.

Treasury will also make the methodologies available to the new Parliamentary Budget Office, which will independently cost political promises on request.

Dr Parkinson told the conference the typical Australian voter was ageing. By 2050, almost one-quarter of Australians would be aged over 65.

''It is unclear what impact this will have on future Australian policy debates, but the experience in Europe and Japan hardly suggests that ageing populations are enthusiastic advocates of structural reform,'' he said.

Australia's economic success had been built on the ''three pillars'' of a floating exchange rate, an independent monetary policy and budget policy that aimed at running surpluses over the business cycle to build national savings.

''In the current environment of volatility and uncertainty with what can seem overwhelming global and domestic pressures, some have been tempted to suggest dismantling or undermining this framework,'' Dr Parkinson said.

''I refer to a range of views - from questioning the value of the Reserve Bank's current mandate, proposing a return to industry protection or exchange rate intervention, to significant restrictions on foreign investment while ignoring the role of foreign capital in raising Australian living standards.''

The Reality Is, Australians Can't Have It All - Treasury Boss

The only person who needs to 'get real' here is Dr Parkinson.

With 40% of the Awstraylen workforce now 'casualised' & denied the opportunity to aspire to a certain future, a new 'underclass' of poor has been created (compare the average hourly rate of pay for all full-time employees of $47 to that for casual workers of $17 & you might just begin to understand the size of the growing gap).

Add-in the families of those casual workers & then those citizens struggling to survive on fixed incomes & you have a situation where more than half of Awstraylens aren't consumed about 'having it all' but with simply surviving.

That Dr Parkinson, Julia Dullard, Tonocchio Abbott & the rest of the 'elites' think everyone should be so grateful says more about how out-of-touch they are with the realities of our modern world .... a pox on all of them I say.

For those who might question my thesis, look at the share of wealth (GDP) going to our nation's shareholders today vs the share of wealth going to wage/salary earners .... the skew in favour of shareholdrs (the wealthy) has never been higher.

- By John Richardson at 20 Sep 2012 - 12:26pm

- John Richardson's blog

- Login or register to post comments

Recent comments

7 hours 30 min ago

7 hours 42 min ago

8 hours 32 min ago

8 hours 42 min ago

9 hours 50 min ago

11 hours 40 min ago

11 hours 54 min ago

12 hours 42 min ago

1 day 4 min ago

1 day 1 hour ago