Search

Recent comments

- google bias...

11 hours 59 sec ago - other games....

11 hours 4 min ago - נקמה (revenge)....

12 hours 4 min ago - "the west won!"....

14 hours 7 min ago - wagenknecht......

14 hours 48 min ago - the game of war....

17 hours 12 min ago - three packages....

18 hours 32 min ago - russian oil.....

18 hours 39 min ago - crime against peace....

1 day 2 hours ago - why is Germany supporting the ukrainian nazis?....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

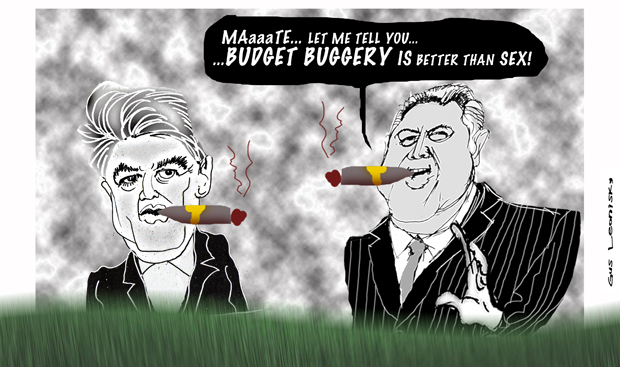

smoking after the deed...

- By Gus Leonisky at 11 May 2014 - 8:04am

- Gus Leonisky's blog

- Login or register to post comments

generational warfare...

Generational warfare: is it what young Australians have to look forward to?

For all his rhetoric about the need to ensure the prosperity of future generations, Joe Hockey's first budget will not redress the issues of intergenerational inequity

Brendan Churchill

theguardian.com, Friday 9 May 2014 11.55 AEST

...

... The government is set to also punish students by demanding they contribute a greater share to their degree costs at a higher interest rate, as recommended by Commission of Audit. This will not make university study any more attractive to potential students, and will expose this generation to greater risk of high student debt.The education minister Christopher Pyne has justified these changes on the basis that graduates “are likely to have [an] unemployment rate below 1% and they will earn, over a lifetime, 75% more than a person without a university degree.” This is, however, far from the experience of recent graduates as evidenced by Graduate Career Australia, which notes that the labour market for recent graduates has been stagnant since the global financial crisis, with some signs that it has deteriorated over the last year. Further, the government is proposing students repay their student debt earlier by lowering the income threshold at which students begin repaying their debt, a decision which directly which target Generations X and Y graduates.

For all his rhetoric about the need to ensure the prosperity of future generations, the treasurer’s first budget will not seriously redress the issues of intergenerational inequity. In reality, the budget is an exercise in intergenerational warfare that protects older generations at the expense of younger generations. The budget is making cuts that directly affect these younger generations at the most important time of their lives: as they make the transition from education to employment. It will make this transition harder, and risks this generations’ future.

The labour market is not the same as it was when the baby boomers began their working lives, as the experience of young adults in very precarious and increasingly casualised work demonstrates. This younger generation needs unemployment benefits that won’t punish or impoverish and affordable education that will lead to, not prevent employment.

Should these proposed measures be confirmed on budget night, the government will certainly be guilty of squandering this generations’ future. And there is very little to stop them. Younger generations do not hold the same electoral clout as working families or pensioners. If generations X and Y want to make it to the pension age at 70 without suffering the burden of the baby boomers, they will need to develop a political voice, and quickly.

read more: http://www.theguardian.com/commentisfree/2014/may/09/generational-warfare-is-this-what-young-australians-have-to-look-forward-to

joe is only breaking the concept of promises, not promises...

Joe Hockey has sought to head off voters’ anger about higher petrol taxes and the deficit levy, arguing that his first budget would not break any promises because the Coalition had not said it would “never change a tax”.

With two days until he delivers his first major economic blueprint, the treasurer used a television interview to declare that the overall tax burden would be lower under the Coalition government and any increase in fuel excise would go towards road construction.

In a preview of one of the messages the government would seek to promote on Tuesday night, Hockey said the federal government would spend $40bn on roads over the next six years, to be matched by $42bn in state and private sector investment.

He also sought to bolster the government’s argument that every person must make a contribution towards the task of repairing the budget by flagging efforts to freeze the pay of federal politicians, departmental secretaries and high-level public servants for 12 months..

read more: http://www.theguardian.com/world/2014/may/11/joe-hockey-adamant-budget-will-not-break-any-promises-on-taxes

kicking cripples and buying useless planes...

There is growing evidence that Joe Hockey is the dumbest Australian politician ever.

After an ‘anti-entitlement’ Budget, he smokes a cigar. He imagines ‘entitlement’ is the dole paid to jobless youth whose jobs machines have stolen, and special monies paid to the disabled, for whom jobs as waitresses and receptionists and paper boys are impossible. He imagines these disabled do not have two million relatives and two million friends. He imagines these four million will vote for this persecution of cripples.

He imagines ‘entitlement’ does not include the $3 million a year his wife brings home. He imagines it does not include the $¼ million Arthur Sinodinos got for 50 hour’s work, or the $20 million he was promised for three hours more. He imagines it includes the $50,000 or $80,000 a year earned by Holden workers in a business that needed, for a while, what all western car manufacturers get — some government help.

He imagines ‘entitlement’ is what a bricklayer aged fifty-five lately thought he had — a pension at sixty-five. He is entitled now, Joe thinks, only to be ‘retrained’ as a shelf-packer, despite his bad back, or maybe a nurse in a mental hospital.

Joe thinks this persecution of future old people will not worry those who are old already. But these he has told he will take away their pension if the inner-city tenement they bought for fifty thousand is now worth a million and they persist in living in it. This is eighty per cent of all old age pensioners and he thinks he has kept their vote.

He thinks all this will improve consumer confidence and they will buy more now, though 10 or 15 per cent of what they spent last year is unavailable this year. He imagines this ‘austerity’ programme, which demands people spend more while earning less, will be the first to work in world history.

He thinks mothers who used to get $1,500 or $2,000 a year to clothe and equip their kids at school will be thankful they don’t get it now. They will ‘trust’ he knows what he is doing, while smoking a cigar, enjoying his wife’s millions and planning himself to retire, not at seventy, but at fifty-eight.

Joe thinks that spending $24 billion, or $1,770 dollars per taxpayer, on a plane that still can’t fly near storms to defend Australia will not be resented, in an era when such planes are never used and drones, which do the work, cost one two-hundredth as much, will be joyfully applauded by the caring parents of the struggling disabled.

He thinks kicking cripples and buying useless planes is a good look.

http://www.independentaustralia.net/politics/politics-display/the-stupidity-of-joe-hockey,6466

plenty of smoke and mirrors...

This whole triumphalist Budget is built around the proposition that there is a sucker born every minute. Didn't the Coalition prove that last September? Mungo MacCallum writes.

For many, the enduring image of the 2014 Budget will be the memory of Treasurer Joe Hockey and Finance Minister Mathias Cormann sucking smugly on their cigars as they relaxed before unleashing their brutal Budget on the fearful populace.

But a still more potent symbol can be found in the education budget. The puffing pair cut some $30 billion worth of funding out of the money committed to schools, trashing the visionary and egalitarian Gonski reforms in the process. But they were able to find a quarter of a billion extra for chaplains - chaplains from established religions, that is, none of that secular subversion.

Sack the teachers, send in the missionaries. Pie in the sky when you die. Captain Catholic rules, OK?

This perverse priority should perhaps have been expected in Tony Abbott's first serious move as Prime Minister, an agenda that appears to be based more on spite, revenge and raw ideology than on any serious economic or social program.

To start with, the cruel hoax of the budget emergency was finally put to rest with massive new spending on business tax cuts, roads, medical research and, of course, on Abbott's much derided paid parental leave scheme.

The Australian - hardly the Government's harshest critic - estimates the overall spending for 2013-2014, a fiscal year in which the Coalition has been at the helm for nine of the 12 months, at around $410 billion - an increase of nearly $50 billion over the previous, supposedly profligate, year of Julia Gillard and Kevin Rudd. And why not? Revenue collected by Tony ("our taxes will always be lower") Abbott will rise from 23 to nearly 25 per cent of GDP.

But now, of course, they are cutting back - we are all doing the heavy lifting for the sake of our children. It's just some of us are doing more of it than others.

Business, for instance, gets a tax cut of 1.5 per cent - even big business, which will pay for some (but by no means all) of the PPL scheme will break even. And the richest 3 per cent will be asked to weather a very small, very temporary tax hike that they will easily absorb through their multifarious untaxed lurks - superannuation concessions, dividend imputation, negative gearing and family trusts, to only scratch the surface.

The politicians - sharing the burden - will have their lavish pay packets frozen for just 12 months while those long since retired to wallow in their accumulated loot will have a tad shaved off their gold pass entitlements. But while some are to be briefly lashed with a feather, others are to be stretched on an ever-tightening rack for the foreseeable future.

Petrol excise will rise twice yearly; the pension will fall further and further behind average wages. Health care and education will become more expensive, welfare will be harder to get and there will be less of it and the states are to be forced to raise new regressive taxes of their own.

These changes are not just for a couple of years but forever. And the carnage will take place against a background of cuts to Aboriginal grants, the environment, the ABC and foreign aid.

But don't worry, there's some good news too. There will be more roads - well, in the cities at least - and extra medical research. And of all the lies in the this mendacious Budget, these are perhaps the most cynical: the new taxes are being sold on the fantastic premise that somehow their proceeds will be returned to those who pay them.

Thus the $7 charge for seeing a previously bulk-billing GP will be spent - well, at least some of it - on setting up the super-dooper Medical Research Foundation, so it is actually for the benefit of the sick. As if the hope of an eventual cure for Alzheimer's will somehow console the desperate mother scrabbling for the cash to get treatment for her sick child.

In fact, of course, the money is going, as all taxes do, straight into consolidated revenue, and will have to be re-appropriated before it can be spent anywhere.

And the motive for the tax is partly to raise money, but even more importantly to begin the demolition of universal health care, a system attacked by Abbott last week as "socialised medicine" - the pejorative epithet coined by the Tories 40 years ago to oppose Gough Whitlam's introduction of Medibank. Medical research is an afterthought, a pacifier for the supposedly gullible victims.

And even sillier is the pretence that all the money raised by re-indexing fuel excise (for all but the miners, farmers and truckies, of course, who will continue to get theirs subsidised by the rest of us) will be spent on building highways for the motorists who buy the petrol.

For starters, most of the money is coming from allocations already made, a lot of them by the previous government, and from contributions by the states - to that extent it's just another con.

But consider: do punters seriously expect gambling taxes to be spent on bigger and better casinos and racetracks? Does even the most sozzled drinker believe that alcohol taxes go to building pubs, breweries and distilleries and to subsidising the production of hops and barley? Do smokers fantasise that the taxes on their fags will end up in the hands of tobacco farmers, or even the specialists who attend to their inevitable health problems?

A tax (or for that matter a levy, a duty, a tithe or a tariff) is raised to be used by the government as it sees fit, and anyone who supposes otherwise is a candidate for the first scammer who comes by with an offer of a lease on the Sydney Harbour Bridge. But that is hardly to worry Abbott, Hockey and Cormann as they peddle their nauseating snake oil around the country.

After all, this whole triumphalist Budget is built around the proposition that there is a sucker born every minute. Didn't they prove that last September?

Mungo Wentworth MacCallum is a political journalist and commentator. View his full profile here.

http://www.abc.net.au/news/2014-05-19/maccallum-budget-fairness-goes-up-in-cigar-smoke/5461390

budgets always have room for more defence cash...

This 1963-64 Menzies budget "balance" shows a certain deficit by planning present expenditures on future incomes, while defence gets a "multiplying" cash factor to buy more whizz-bang-boom equipment... The pie charts are more like the newfangled pizza sliced — as discovered from the import of new migrants from old Europe... I will explore the idea of migrants in another article...

drop in the number of women who smoke while pregnant...

A drop in the number of women who smoke while pregnant has helped push down the number of infants going into hospital, according to researchers.

A study of all 788,798 children born in New South Wales between 2001 and 2009, published in the Medical Journal of Australia, shows a 10.5% drop in the number of infants under a year old being re-admitted to hospital, from 18.4 per 100 births in 2001 to 16.5 in 2009.

The report, authored by researchers from the University of NSW, Royal North Shore Hospital and Sydney Medical School, states 55% of this decrease can be attributed to just a few changes.

The increasing average age of mothers at the time of giving birth, improved hospital care and a fall in smoking rates while pregnant are cited as key improvements in infant health.

The proportion of infants born to mothers who smoked decreased from 17% to 12% during the study period.

“Maternal smoking rates have been declining over the past 15 years in Australia,” the study states.

“Older mothers are less likely to smoke during pregnancy, while mothers who attend antenatal care earlier in their pregnancy are more likely to stop smoking.”

Numerous public health campaigns over the past decade have warned women about the dangers of smoking when pregnant.

According to the federal government’s Quit Now project, referencing US department of health data, smoking when pregnant increases the chances of premature birth, low birth weight, stillbirth and infant mortality.

http://www.theguardian.com/society/2014/jul/07/infant-hospital-visits-down-fewer-pregnant-women-smoke

This is when an inquisitive passer by looked a Joe Hockey's cigar and glanced at his girth, a glance to which Joe's snapped:

"I'm not pregnant!"...

budget buggery...

Tony Abbott's "razor gang" considered banning anyone under 30 from accessing income support in a radical proposal ahead of the 2014 budget, according to cabinet documents obtained by the ABC.

Key points:The expenditure review committee was made up of then-prime minister Mr Abbott, then-treasurer Joe Hockey and Finance Minister Mathias Cormann.

It requested then-social services minister Kevin Andrews look at how to ban "job snobs" from receiving the welfare payments.

In one document marked "protected", "sensitive" and "cabinet in confidence", Mr Andrews proposed three options to permanently or temporarily halt income support for job seekers under 30.

They included cutting off under-30s entirely, cutting off under-30s in areas with employment opportunities, and limiting income support to young people with a work history.

There was also an option to roll out an income-managed basics card to "lessen the harshness of the measure".

Read more:

http://www.abc.net.au/news/2018-01-29/tony-abbotts-razor-gang-considered...

See toon at top...