Search

Democracy Links

Member's Off-site Blogs

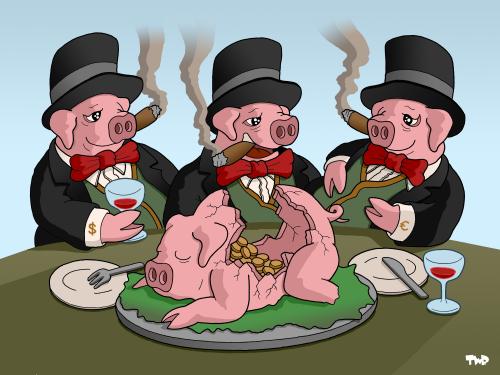

a bankstering we will go .....

Mainstream media is abuzz with suggestions Australian Treasurer Joe Hockey will introduce a 0.5% tax on deposits into bank accounts with up to $250000 in them. This latter figure is the level up to which government underwrites and guarantees payment in the event of a run on the banks.

Instead of a tax on bank accounts, how about a super profits tax on the most profitable banks in the world. Price control their offerings too.

Now it may surprise you, but Australia’s big four banks are bastards. The ANZ, Commonwealth, NAB and Westpac have been ripping customers off for years. In fact they are the global champions at fleecing us.

You don’t have to just take my word for it. Or rely on your own gut feeling that bankers couldn’t give a toss about you but do care about their profits.

The Bank of International Settlements has confirmed what we all thought – Australian banks are the biggest bastards in the world. Again.

The Bank of International Settlements is the bank of the reserve banks of the world.

In their recently released 82nd Annual Report, in chapter VI called Post-crisis evolution of the banking sector BIS has a table at page 79 on the profitability of the banks measured as a percentage of their total assets.

In 2011, the big 4 Australian banks were the most profitable in the world in terms of pre-tax income. And just for good measure, they came in first in 2010.

The most profitable in the world.

After Austria, Spain and the US our big four banks’ net interest margins (NIMs) are the largest.

What they have also done, as well as keeping NIMs almost the same as last year despite increased competition, is cut costs dramatically. In other words they’ve cut back on staff and services.

What they also seem to have done is expand internationally, replacing along with banks from a few other countries, European and North American lenders in emerging markets.

These are the same banks of course who can’t pass on to customers the full RBA cut in interest rates because of their precarious international position and the increased cost of borrowing. Hmmm, what word best describes this? Bullshit springs to mind.

Here’s what KPMG said in its Major Australian Banks: Year End 2011 Report. ‘The majors’ statutory profit before tax of $31.1 bn in 2011 was up 12 percent from the 2010 result of $28.5 bn.’ They go on to say that ‘return on equity for the year was 16.7% compared to 15.9% in 2010…’

Only the mining industry has a better return on equity. You now, the mining industry which is about to have a mini-me Resource Rent Tax imposed on it to tax economic rent.

The Labor Government beat the banks with a wet lettuce for failing to pass on the full RBA rates cuts.

Instead why not tax their super profits and redistribute some their profit to the working class in the form of better social services like health and education, increases in Newstart and tax cuts for workers?

And, given you can’t trust the banks, something their actions have shown, how about regulating their interest rates and other offerings? Price controls over interest rates looks like a good start.

Australia’s big 4 banks are the biggest bastards in the world

- By John Richardson at 30 Mar 2015 - 7:12pm

- John Richardson's blog

- Login or register to post comments

Recent comments

48 min 15 sec ago

1 hour 17 min ago

1 hour 29 min ago

1 hour 33 min ago

3 hours 2 min ago

5 hours 20 min ago

6 hours 48 min ago

7 hours 41 min ago

7 hours 44 min ago

11 hours 49 min ago