Search

Recent comments

- google bias...

3 hours 48 min ago - other games....

3 hours 52 min ago - נקמה (revenge)....

4 hours 51 min ago - "the west won!"....

6 hours 55 min ago - wagenknecht......

7 hours 36 min ago - the game of war....

10 hours 34 sec ago - three packages....

11 hours 20 min ago - russian oil.....

11 hours 27 min ago - crime against peace....

19 hours 39 min ago - why is Germany supporting the ukrainian nazis?....

20 hours 52 min ago

Democracy Links

Member's Off-site Blogs

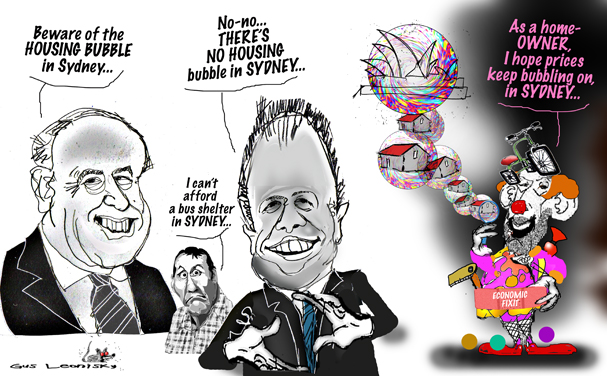

bubbling along while tony bumbles along and his mate josh says it's not happening in sydney....

"In Melbourne, you can get a three-bedroom brick veneer home 35 kilometres west in Werribee for $360,000 or $370,000. But in Sydney's Kellyville, 40 kilometres out of the city, you're paying $450,000. Melbourne delivers better affordability than Sydney and over the last decade-and-a-half, people have voted with their feet and increasingly chosen Melbourne over Sydney."

This exodus is reshaping Sydney's social fabric, Salt warns.

"It's almost like the Manhattan effect, you only attract rich people on to the Manhattan island, and the rest live out in Brooklyn etc."

Sydney is increasingly segregated between the inner city, home to a global workforce, and its sprawling suburbs.

"Should a global city like Sydney really offer a place for everyone? That's a social question," says Salt.

Some have suggested Sydney should decouple from the rest of the country, with interest rates set higher to stop the nascent property bubble.

But the chief economist at Bank of America Merrill Lynch, Saul Eslake, dismisses the idea as "nonsense".

"You can't do it any more than you could have different interest rates for Greece and Germany." Sure, Australia could devolve into autonomous countries with separate economies. "Yes, but do you want fluctuating exchange rates across Australia?"

And where would you set Sydney rates? Higher Sydney interest rates, designed to burst a bubble, would only dampen other parts of the economy necessary for jobs growth. Lower Sydney rates, designed to help out more indebted households, would only add to housing demand and price pressure.

- By Gus Leonisky at 7 Jun 2015 - 2:49pm

- Gus Leonisky's blog

- Login or register to post comments

when is a bubble not a bubble? answer: when it bursts...

There is no housing bubble, according to Assistant Treasurer Josh Frydenberg, despite Treasury secretary John Fraser warning that Sydney is showing "unequivocal" signs of over-investment.

When asked about Mr Fraser's comments on Sunday, Mr Frydenberg said he did not agree.

Property bubbles are feared in Sydney and Melbourne.

"Housing prices have gone up, but it went up higher in the early 2000s."

Mr Frydenberg, who holds the inner Melbourne seat of Kooyong, said regulators like the Reserve Bank were keeping an eye on housing price growth.

"At the same time, we have seen strong housing prices before," he said.

"In the early 2000s, housing prices increased by 20 per cent for three years in a row and then were steady for a decade. And there wasn't a bubble that led to a major correction."

Mr Frydenberg's comments sit in stark contrast to his departmental secretary, Mr Fraser's. During Senate estimates last week, Mr Fraser spoke of his concern about low interest rates and the housing bubble.

"When you look at the housing price bubble evidence, it's unequivocally the case in Sydney, unequivocal," Mr Fraser said.

"It does worry me that the historically low level of interest rates are encouraging people to perhaps over-invest in housing."

Reserve Bank assistant governor Malcolm Edey also told senators: "I know that a lot of people do think it's a bubble.

"Serious people think that. And we agree that this is a situation where the market is strong, it's over-heated, it's a risky situation. Some people call that a bubble."

The average NSW home price today costs almost five times the average NSW household income, according to Barclays Bank analysis.

On Sunday, Mr Frydenberg said the increases in house prices were due to a "number of things".

"It's a function of population growth, it's a function of state governments not engaged in enough land release. It's a function also of foreign investment."

read more: http://www.smh.com.au/federal-politics/political-news/assistant-treasurer-josh-frydenberg-bursts-real-estate-bubble-speculation-20150607-ghif6l.html

-----------------------------

When is a bubble not a bubble? Answer: when it bursts... Thus many people are tightening their arse to prevent the bubble from exploding in broad daylight... But in real term, the problem is to get s foothold in the Sydney housing market, one needs to work three times as hard, in order to pay the cash, the taxes and live on a pittance... Sydney is a lovely place to live in as well.

not a bubble...

Bank of America Merrill Lynch chief economist Saul Eslake said rising house prices were not just hurting Australians' budgets.

"I would say they are causing social harm because they are widening the gap between those who have houses and those who don't, and freezing younger generations out of home ownership," he told Fairfax Media.

The Australian Bureau of Statistics says the average Sydney house price has jumped by more than 30 per cent since the end of 2011.

Amid concern about rising costs in the housing market, Mr Frydenberg said he did not agree with Treasury Secretary John Fraser that Sydney was facing a housing bubble.

"I don't think there is a housing bubble," Mr Frydenberg said on Sunday. "Housing prices have gone up, but it went up higher in the early 2000s."

Mr Frydenberg, who holds the inner Melbourne seat of Kooyong, said regulators like the Reserve Bank were keeping an eye on housing price growth.

"In the early 2000s housing prices increased by 20 per cent for three years in a row and then were steady for a decade. And there wasn't a bubble that led to a major correction."

Mr Frydenberg's comments sit in stark contrast to his departmental Secretary's.

"When you look at the housing price bubble evidence, it's unequivocally the case in Sydney – unequivocal," Mr Fraser told Senate estimates last week.

"It does worry me that the historically low level of interest rates are encouraging people to perhaps over-invest in housing."

Reserve Bank assistant governor Malcolm Edey also told senators: "We agree that this is a situation where the market is strong. It's over-heated – it's a risky situation. Some people call that a bubble."

Mr Eslake said Mr Fraser and Mr Frydenberg could both be right, because among economists there was no "agreed definition" for the "emotionally laden term bubble", which is usually identified after it bursts.

"What I do say, without any hesitation at all, is that Australian prices of housing in most Australian cities, and particularly in Sydney, are, as [Reserve Bank governor] Glenn Stevens called them in September last year, 'elevated'," he said.

read more: http://www.smh.com.au/federal-politics/political-news/rising-house-prices-causing-social-harm-as-property-bubble-debate-continues-20150607-ghiihi.html