Search

Democracy Links

Member's Off-site Blogs

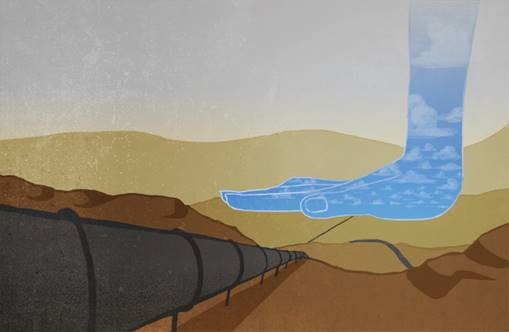

an invisible hand ...

Is the hydrocarbon economy too big to fail?

If the woefully inadequate outcome of the Paris climate conference is any indication, the answer is still a resounding "Yes!" That's because the overly optimistic agreement conspicuously ignored the core issue driving up the earth's temperature and warping the world's already misshaped markets.

The problem is Big Oil.

Simply put, Big Oil is a bad investment fueled by irrational exuberance, chronic cronyism and an increasingly indefensible misallocation of capital. And decades of throwing good money after bad has produced a distorted economic system that socializes risk, privatizes profits, externalizes costs and misallocates capital. This continues because policy makers sustain it with taxpayer-funded subsidies, costly tax breaks and low-overhead access to publicly held resources.

By failing to institute much-needed cost internalization mechanisms and by completely avoiding the key problem of government subsidization, the cork-popping cadre of COP21 tacitly admitted what most cynics already knew - policy makers still believe "Big Oil" is far too big to fail. But, like other distorted markets in history, the correction is coming. The growing impact of climate change is exposing the key fallacy at the heart of the hydrocarbon economy: Big Oil cannot simply exempt itself from the natural economy governing all things in this closed system called planet Earth.

Read more …

Mother Nature's Invisible Hand Strikes Back Against the Carbon Economy

- By John Richardson at 17 Jan 2016 - 11:07am

- John Richardson's blog

- Login or register to post comments

Recent comments

3 hours 24 min ago

3 hours 28 min ago

4 hours 28 min ago

6 hours 31 min ago

7 hours 12 min ago

9 hours 36 min ago

10 hours 56 min ago

11 hours 3 min ago

19 hours 15 min ago

20 hours 28 min ago