Search

Recent comments

- cartoon corner.....

6 hours 10 sec ago - slavery and capitalism....

6 hours 4 min ago - cameron hypocrite.....

7 hours 12 min ago - sad to watch....

7 hours 19 min ago - a novel virus.....

11 hours 22 min ago - no grad.....

14 hours 4 min ago - wrong end....

14 hours 20 min ago - jews own USA....

17 hours 30 min ago - nasty japs....

17 hours 36 min ago - middle-east USA....

17 hours 50 min ago

Democracy Links

Member's Off-site Blogs

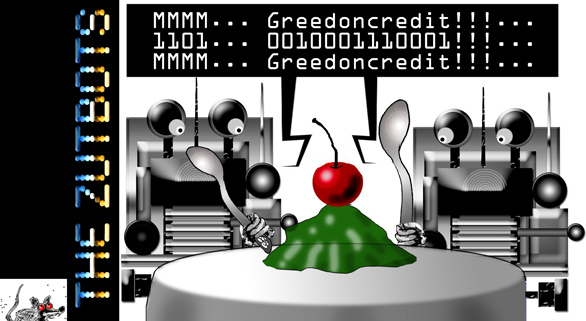

the day of the machines...

- By Gus Leonisky at 2 Feb 2016 - 4:37pm

- Gus Leonisky's blog

- Login or register to post comments

the rise of the derivative greedy machines...

MARK COLVIN: "We've locked ourselves into a dysfunctional cycle of quarterly earnings reports, while too many executives enrich themselves at their investors' expense."

That's not Occupy Wall Street talking - it's the visiting Professor of Economics at the London School of Economics, Fellow of St John's College, Oxford, and Financial Times columnist, John Kay.

John Kay’s latest book is called Other People's Money. To quote him again; “The scale of exposures on financial derivative contracts, the esoteric best that financial institutions make between themselves, is today around three times the value of all the assets in the world.”

He says markets have become unreal, and he told me they’re increasingly run not by human traders, but complex computer algorithms.

JOHN KAY: It's not people at all, and at least in the old days you could sort of see what was happening.

MARK COLVIN: Is there a reason to be in the markets now?

JOHN KAY: Well it's still true that over the long term you've made more money holding real assets - equities and properties and so on - than you have in bonds, and that's even more true today with interest rates at ridiculously low levels.

read more: http://www.abc.net.au/pm/content/2015/s4398043.htm

God does not like the greedy man. ANON. (A greedy man God hates — Old Scots proverb)

The greedy man delegates machines to do the greed for him. GUS

The machines kill the greedy man and keep the loot. THE TERMINATOR

your cash is theirs to gamble with...

Are you angry about the banks? A lot of Australians are. And a lot of people in the United States and Europe are a lot angrier than we are, with good cause.

In Oz, we're annoyed mainly by the banks' very big profits and the way they never seem to miss a trick in keeping those profits high.

This game can continue for as long as everything's on the up and the bubble's getting bigger. Once it bursts, of course, former supposed profits become present, unavoidable losses.

In other countries, people are angry about the way the banks and other financial institutions, having stuffed up their affairs to the point where they almost brought the global economy to its knees, were promptly bailed out at taxpayers' expense, so that few went bust, with almost no executives going to jail and many not even being fired.

By now, however, you're probably used to bankers and economists saying you don't understand and are quite unreasonable in your criticisms.

That's why you need to know about the book, Other People's Money, by John Kay. Kay, who's visiting Australia and this week spoke to a meeting organised by the Grattan Institute, says he wrote the book to help ordinary people understand "what it is they're angry about".

You want the dirt on the banks? No one's better qualified to spill the beans than Kay, an economics professor from Oxford and columnist for the Financial Times, who was commissioned to write a report on the sharemarket for the British government.

He starts by noting that over the past 30 or 40 years, each of the developed economies has experienced "financialisation" – huge growth in the size of what these days is called their "financial services sector" to the point where it's among their biggest industries.

For years, we've been told this is a wonderful thing, a sign of our economy's growing sophistication and ability to manage risk. Kay doesn't believe it.

We've always had a financial sector composed of banks, insurance companies and other institutions, and we've always needed one.

We've needed it to help us make payments to each other, to bring people wanting to save together with homeowners and businesses wanting to borrow, to help us save for retirement and to help individuals and businesses manage the risks associated with daily life and economic activity (insurance policies being the obvious example).

We need a financial sector to service the needs of the "real economy" of households and businesses producing and consuming goods and services. But none of this justifies the huge growth in the financial sector we've seen.

Read more: http://www.smh.com.au/comment/banks-are-using-us-to-hedge-their-bets-20160201-gmj9f8.html#ixzz3z3Tosebz

Follow us: @smh on Twitter | sydneymorningherald on Facebook