Search

Recent comments

- a peace deal....

17 hours 54 min ago - peace now!

19 hours 19 min ago - a nasty romance....

19 hours 25 min ago - blackmail?.....

21 hours 56 min ago - ukraine's agony has not started yet....

1 day 15 hours ago - all defeated.....

1 day 15 hours ago - beyond crime.....

1 day 16 hours ago - the end....

1 day 16 hours ago - odessa....

1 day 17 hours ago - weitz....

1 day 19 hours ago

Democracy Links

Member's Off-site Blogs

car crash economics...

Last week, in the lead up to the new parliament, the treasurer Scott Morrison sought to outline his economic vision. Unfortunately, rather than provide any clear ideas of where he sees the nation’s economy heading, the speech was a mishmash of internal inconsistencies, statistical misreadings, and statements which made less sense the more you paid attention to them.

The big take away from the speech was Morrison’s desire to ape Joe Hockey’s outlook of the world as being divided into two types. Where Joe Hockey talked of “lifters and leaners” Scott Morrison has decided that “there is a new divide – the taxed and the taxed nots”.

Sigh.

I guess then we can also say that there is a new divide in treasurers – those who simplistically view the world through ill-thought out binary oppositions, and those who don’t.

Morrison’s shtick about net-taxpayers comes from the finding by the National Centre for Social and Economic Modelling (Natsem) that 53% of households in Australia are net taxpayers – down from 56% in 2005.

Now suggesting that this means “more Australians are ... likely today to be net beneficiaries of the government than contributors” as Morrison did is dopey enough, but the treasurer went further. He argued it meant “on current settings, more Australians today are likely to go through their entire lives without ever paying tax than for generations”.

The problem is the Natsem modelling is a snapshot. It doesn’t look at people’s paying of tax throughout their lifetime.

Morrison’s use of the snapshot to suggest things about people’s lifetimes would be like looking at the current unemployment rate of 5.7% and saying the rate means you have a 5.7% chance of being unemployed at some point in your life.

Thus the treasurer arguing that “more Australians” are “never paying more tax than they receive in government payments” is a gross exaggeration.

Never? Really, treasurer?

The Natsem data shows the major reason for the decline in the number of net-taxpayers is the ageing population. While 53% of Australians are net-taxpayers, when you exclude those over 65 the figure rises to 67%...

of the 33% others many are low employed, who earn peanuts, the unemployed and the rich who do not have "income" in this country...

- By Gus Leonisky at 29 Aug 2016 - 3:56pm

- Gus Leonisky's blog

- Login or register to post comments

revisiting an oldie...

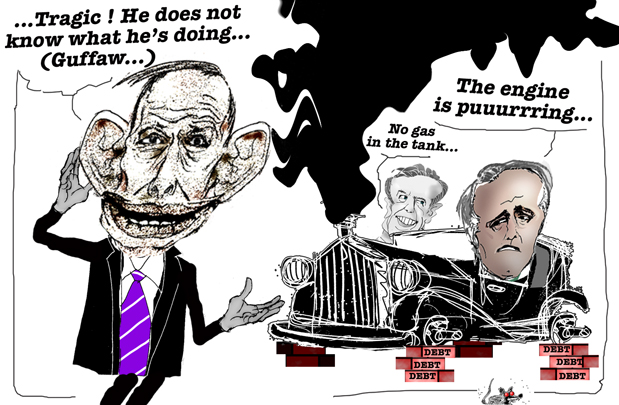

road kill, soon...the amazing tony and his contortionistic skills...

missing oranges...

Malcolm Turnbull’s effort to seize the economic agenda on the first business day of the new parliament was undermined late on Wednesday when the government was forced to correct an error in its “omnibus” savings bill.

The prime minister navigated early procedural turbulence on Wednesday, seeing off motions launched by Labor relating to a royal commission into the banking sector, and a separate foray on negative gearing.

Anticipating that Labor would attempt to challenge the prime minister’s authority on the floor of the parliament, the government unveiled a new investigation by the small business ombudsman to examine how banks treat their small business customers.

But the new inquiry may not be enough to head off a separate banking motion to be launched in the Senate on Thursday. That procedural foray looks as though it could succeed, and the Labor leader, Bill Shorten, is also due to meet with victims of banking scandals in Canberra on Thursday.

Turnbull fired up during question time, declaring the Shorten was intent on “posing as some sort of latter-day Jack Lang” – a populist champion of the battler and small business.

But Labor pointed out during question time that one of the government’s signature budget repair bills, the savings bill worth $6.1bn, appeared to have a $100m hole in the explanatory memorandum tabled in the parliament.

The omnibus bill was introduced by the treasurer, Scott Morrison, earlier on Wednesday. In the original explanatory memorandum accompanying the proposed legislation, item 11 claimed a saving of $405.6m from changes to student startup scholarships – but the sum of the annual savings, as reported, only adds to $298m.

https://www.theguardian.com/australia-news/2016/aug/31/turnbulls-bid-to-seize-economic-agenda-undermined-by-budget-repair-bill-error

Jack Lang was actually quite successful enough in his economic management plans, very successful with the electorate, but his government was sacked by the then Governor general, Sir Philip Game, who claimed that Jack Lang was a communist. Jack Lang was also a "white Australia" supporter like all politicians at the time, especially the Tories. And he built the Sydney Harbour Bridge...

Lang's plan to fight the Depression:

reduction of interest on all government debts to Australians

suspension of all loan payments to all overseas creditors

the expansion of public works programmes

bank funding of government works through controlled credit expansion.

The "Conservatives" immediately equated the Lang plan with communism, condemned his nationalism as "anti-British" and mobilised against him.