Search

Recent comments

- waste of cash....

1 hour 55 min ago - marles' bluster....

2 hours 17 min ago - fascism français....

2 hours 21 min ago - russian subs in swedish waters....

3 hours 15 sec ago - more polling....

2 hours 28 min ago - they know....

7 hours 17 min ago - past readings....

8 hours 16 min ago - jihadist bob.....

8 hours 22 min ago - macronicon.....

10 hours 17 min ago - fascist liberals....

10 hours 18 min ago

Democracy Links

Member's Off-site Blogs

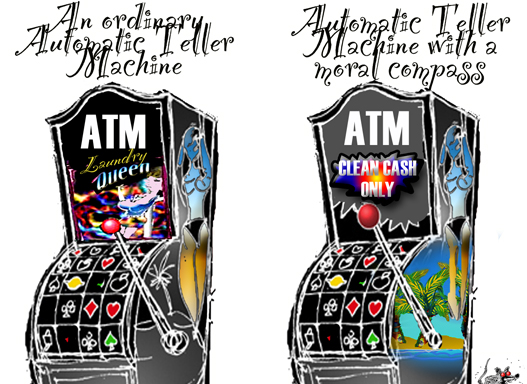

honest banking...

- By Gus Leonisky at 15 Aug 2017 - 9:11am

- Gus Leonisky's blog

- Login or register to post comments

soft belly in the underware...

The Commonwealth Bank is embroiled in a scandal that may have allowed terrorists and criminals to launder millions of dollars.

AUSTRAC, Australian's financial spy agency, filed its case against the CBA last week, alleging it failed to report 53,506 transactions.

They are known as TTRs, or "threshold transaction reports".

Basically, banks have to let AUSTRAC know within 10 business days if it processes a transaction of $10,000 or more.

So how did it happen?

The CBA says it all comes down to a "software error" in the bank's smart ATMs.

But what are these fancy smart ATMs, and how could the bank miss a coding error that has lead to a massive civil proceeding in the Federal Court?

How can smart ATMs help the bad guys?The CBA first rolled out the Intelligent Deposit Machines (IDMs) in May 2012.

You might have seen IDMs around. They're a type of ATM that automatically counts the cash as it goes into the CBA customer's account.

It's convenient and saves the bank money, since fewer human tellers are required.

Read more:

http://www.abc.net.au/news/2017-08-07/commonwealth-bank-how-smart-atms-a...

Meanwhile, in attempting to pin responsibility for its predatory culture on outgoing CEO, Ian Narev, chair of Commbank, Catherine Livingstone, damned them both by helpfully stating that his replacement must possess a “moral compass”.

Anonymously Transferring Money...

The case relates to the use of intelligent deposit machines, a type of ATM launched in 2012, which allows customers to anonymously deposit and transfer cash, even when banks are closed.

Commonwealth Bank is accused of failing to report properly to Austrac on $77m worth of suspicious transactions.

“Six of those relate to cash transactions by five customers with respect to whom the bank has assessed have a potential link to terrorism or terrorism financing,” Clark said on Friday.

“We’ve looked at the other [major] banks in particular and we have not identified the same issues with those banks,” he said.

Austrac has already alleged that CBA’s ATMs were used by four money-laundering syndicates, including three linked to drug importation and distribution networks.

The syndicates used the machines to deposit and transfer cash, often at amounts just low enough to avoid arousing suspicion.

One money-laundering operation involved more than $21m being deposited into 11 CBA accounts between February 2015 and May 2016, most of which came through the intelligent machines, Austrac says.

The money was allegedly the illicit proceeds of a drug importation operation, and was quickly transferred to domestic accounts.

read more:

https://www.theguardian.com/australia-news/2017/aug/19/six-commonwealth-...

old fashioned robbery with a forklift...

A daring early hour heist has seen an outdoor ATM lifted from its foundations at an Arkansas bank. Police are looking for help in identifying the culprits, whom they suspect may work in the construction industry.

read more:

https://www.rt.com/usa/400326-forklift-used-steal-atm/