Search

Recent comments

- crime against peace....

5 hours 22 min ago - why is Germany supporting the ukrainian nazis?....

6 hours 35 min ago - sanctioning....

9 hours 19 min ago - politico blues....

9 hours 59 min ago - gender muddles....

10 hours 19 min ago - war crimes and war crimes....

13 hours 8 min ago - new yourp....

13 hours 48 min ago - piracy not included....

14 hours 17 min ago - faceblock......

16 hours 14 min ago - 22-......

17 hours 20 min ago

Democracy Links

Member's Off-site Blogs

all the way to the bank...

The incoming chief of the Commonwealth Bank is expecting such an uncomfortable and confronting week at the royal commission he has written an email warning 14,000 of his retail staff to prepare.

"There will be cases highlighted next week where customers have been treated unfairly by us," Matt Comyn wrote.

Read more:

http://www.abc.net.au/news/2018-03-19/banking-royal-commission-commonwea...

- By Gus Leonisky at 19 Mar 2018 - 11:27am

- Gus Leonisky's blog

- Login or register to post comments

tax evasion...

http://www.abc.net.au/news/2018-03-24/report-critical-of-tax-evasion-cau...

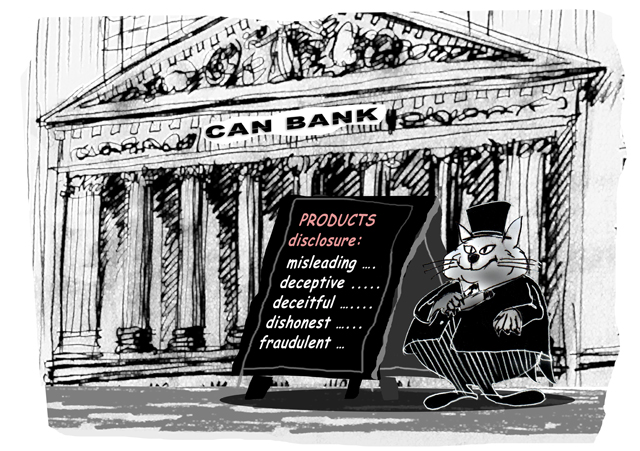

picture of mr moneybags...

Mungo MacCallum: The banks are bastards

The banks are bastards. Every Australian knows that and has known it from birth — it is fixed in our DNA. Deep in our psyche is the indelible picture of Mr Moneybags, the bloated cigar-smoking capitalist, shovelling in the loot and grinding the faces of the poor.

But it was still a shock to hear the first few days of testimony of the Royal Commission exposing the greed, perfidy, fraud and sheer depravity in which our money masters have indulged at our expense. And that, of course, is why they and their political clients worked so hard to prevent the Commission taking place at all.

Utterly unnecessary, Malcolm Turnbull reassured us. There were perfectly adequate regulations and safeguards already implemented by a diligent and caring Government.

We had ASIC, APRA – a whole series of ineffective acronyms constantly on the case – and as a clincher, the bank executives would have to come before a Parliamentary committee at regular intervals to apologise for their unconscionable conduct and promise to do better in future.

As it turned out they had no difficulty in concealing, obfuscating and at times downright lying about their manifest offences against their customers, which, by and large, we accepted as par for the course — after all, the banks are bastards. We can look forward to the rest of the year as the implacable and imperturbable Kenneth Hayne exposes at least some of their more egregious sins.

Read more:

https://independentaustralia.net/life/life-display/mungo-maccallum-the-b...

not paying "attention fees" to the banks...

The most shocking thing about the Banking Royal Commission is how shocked so many profess to be by its findings.

The grandly titled Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry is, daily, hearing more outrageous examples of financial institutions’ shameless fleecing of their clientele.

The most recent instance being news this week that Australia’s largest wealth manager had charged clients fees for advice they didn’t receive, lied to ASIC about it 20 times and then doctored a so-called “independent” report by lawyers Clayton Utz into the matter. AMP explained to Commissioner Kenneth Hayne that it prioritised shareholders’ interests over clients’.

As so many have said they were by the Commission’s revelation, former Labor MP Bernie Ripoll declared himself “shocked” by the affair:

“I thought I couldn’t be shocked, but I was wrong. I think all the misconduct that’s coming out from the Royal Commission demonstrates why the banks and others pushed so hard against it. It shows they’ve been having a lend of everybody — of their clients, of the government and of regulators.”

Yes, Bernie is right, the money lenders are having a lend of us — but “shocked”? If he was shocked, then he simply can’t have been paying attention.

Read more:

https://independentaustralia.net/business/business-display/editorial-the...

Read from top.

their hands in your pockets...

The royal commission's public hearings changed this week.

The first hearings were tragically comic. Awful, dumb stuff: gym owners helping to write $122 million in loans, shonky car dealers selling lemons to hard-luck customers, a gambling addict given credit card limit increases.

But what we heard this week from senior financial institution executives was utterly shocking.

Extraordinary deception. Atrocious behaviour. No concern about consequences.

This week was consequential. The political environment around the commission has changed.

Read more:

http://www.abc.net.au/news/2018-04-21/royal-commission-changed-this-week...

liberals are "always better" than their own shit...

The line from the government has been to demand praise by ludicrously suggesting that the terms of reference they proposed were broader than what the ALP or the Greens wanted, and are actually the reason why we have heard testimony this week from AMP, CBA and Westpac.

Scott Morrison told reporters that the evidence this week “demonstrate that the Government was right to ensure that when the Commission was put in place that it wasn’t just looking at the banks, that it needed to be a broader inquiry which looked certainly at these issues and also superannuation which is yet to appear before the Commission.”

The prime minister in London parroted this idiocy as well, telling reporters the royal commission “was established on very broad terms of reference, much broader than those that have been proposed by our opponents.”

The revenue and financial services minister, Kelly O’Dwyer, was also very much in step, telling the ABC’s Sabra Lane that “I think it is right that we have a broad inquiry that can look into all aspects of misconduct in the financial services sector. The ALP had argued for a very narrow one: simply into the banks. The revelations that, obviously, we have heard about AMP are included in scope because of the inquiry that we have put in place.”

The line is not even just misleading, it contradicts what O’Dwyer said just four months ago in December.

Responding to criticism of the inclusion of superannuation funds into the terms of reference she noted “previous calls for a Royal Commission by both the Labor Party and by the Greens had also called for superannuation to be included in a banking inquiry”.

So in December she highlighted the ALP’s argument for a broad terms of reference, but now she, Turnbull and Morrison would have us believe the ALP did not want a broad terms of reference.

One day perhaps this government will not treat voters like fools, but it seems we shall have to wait a bit longer.

But the real problem for the government is not just that they look shifty, or that they are losing airtime in what should be a time when the talk is about their budget.

The problem is that the past two weeks have provided ample evidence to show that their foundational belief about how the economy should operate is in complete tatters.

Yes, it was a bad week for the government, but it was an even worse one for unfettered capitalism.

Read more:

https://www.theguardian.com/business/grogonomics/2018/apr/20/what-happen...

too much suds...

The Commonwealth Bank has agreed to pay the biggest fine in Australian corporate history for breaches of anti-money laundering and counter-terrorism financing laws that resulted in millions of dollars flowing through to drug importers.

CBA will pay $700 million plus legal costs after federal financial intelligence agency AUSTRAC last year accused the bank of serious and systemic failures to report suspicious deposits, transfers and accounts.

As part of the settlement, CBA admitted to the late filing of 53,506 reports of transactions of $10,000 or more through its "intelligent deposit machines" (IDMs).

Banks are required to report these large transactions within 10 business days, so that AUSTRAC can monitor them to see if the money might be going to crime gangs or terrorist networks.

The Commonwealth Bank had originally considered challenging the number of breaches, arguing that a single coding error had led to the failure to report the 53,506 transactions.

However, it later decided to admit most of the alleged breaches and try to reach a settlement.

Read more:

http://www.abc.net.au/news/2018-06-04/commonwealth-bank-pay-$700-million-fine-money-laundering-breach/9831064

media sleeping with bankers?...

The Australian Financial Review has a peculiar view of bank malpractice: that it doesn’t exist. All this kerfuffle is really the result of bank customers’ complaining about the tragic consequences of their own failings.

The Sydney Morning Herald has devoted months to reproducing fake news on world affairs. Its stablemate has maintained comparable standards regarding coverage of Banking Royal Commission hearings.

On 5 December 2017, the Fin deferred to David Murray, the former Commonwealth Bank CEO, for whom the impending Banking Royal Commission was a threat to the system’s stability. This blowhard drove the CBA’s concerted thrust into an ethics-free culture, yet he is still sought after as expert commentator.

In Part 1 (8 December) of my Clayton’s Banking Royal Commission series, I noted that Tony Boyd, the AFR’s decades-long financial columnist, pooh-poohed the necessity of a Royal Commission. Boyd’s opinion set the scene for much ensuing commentary.

On 13 December, fellow AFR writer Aaron Patrick declaims, with respect to a story involving Westpac:

'But the self-styled whistleblowers and bank victims may find that disillusionment awaits, and possibly come to wish the government had immediately gone ahead with its plan for an independent tribunal to hear their complaints and order compensation.'

The disgruntled borrowers are the source of the conflict. Patrick assumes that the bank’s belatedly constructed “customer advocate” centres are independent. These centres merely dig victims further into the mire, as is their intention.

The editorial of 12 February is representative. It claims:

'The financial sector royal commission … is fundamentally a political response to the core problem of dysfunctional politics, rather than of fundamental problems in Australia's banks. … there is no evidence of systemic corruption, criminality or even widespread unethical behaviour in Australia's big banks.'

The author of this garbage finds no evidence because s/he hasn’t been looking. If s/he had cared to contact me, I could have given them a long earful.

Read more:

https://independentaustralia.net/business/business-display/banking-quislings-fake-news-at-the-financial-review,11612

Read from top...

W bank...

Westpac has reached a deal with financial crimes regulator to settle more than 23 million alleged breaches of anti-money laundering laws by paying a record $1.3 billion penalty.

The penalty is the biggest in Australian corporate history, and is almost double the previous record $700 million fine paid by the Commonwealth Bank for almost 54,000 money laundering breaches, revealed by the ABC in 2017.

Attorney-General Christian Porter said the massive fine should serve as a wake-up call for the banking industry.

In a statement, AUSTRAC said Westpac had admitted to breaching the Anti-Money Laundering and Counter-Terrorism Financing Act more than 23 million times.

These breaches included a failure to properly report more than 19.5 million international funds transfer instructions (IFTI) amounting to more than $11 billion.

AUSTRAC said the breaches included suspicious transactions associated with possible child exploitation as well as failure to assess risks of money laundering and terrorism financing.

“Our role is to harden the financial system against serious crime and terrorism financing and this penalty reflects the serious and systemic nature of Westpac’s non-compliance,” AUSTRAC chief executive Nicole Rose said in the statement.

“Westpac’s failure to implement effective transaction monitoring programs, and its failure to submit IFTI reports to AUSTRAC and apply enhanced customer due diligence in relation to suspicious transactions, meant AUSTRAC and law enforcement were missing critical intelligence to support police investigations.”

Westpac’s chief executive Peter King once again apologised for the contraventions.

Read more:

https://thenewdaily.com.au/finance/finance-news/banking/2020/09/24/westpac-austrac-money-laundering/

Read from top.