Search

Recent comments

- google bias...

4 hours 6 min ago - other games....

4 hours 10 min ago - נקמה (revenge)....

5 hours 10 min ago - "the west won!"....

7 hours 13 min ago - wagenknecht......

7 hours 54 min ago - the game of war....

10 hours 18 min ago - three packages....

11 hours 38 min ago - russian oil.....

11 hours 45 min ago - crime against peace....

19 hours 57 min ago - why is Germany supporting the ukrainian nazis?....

21 hours 10 min ago

Democracy Links

Member's Off-site Blogs

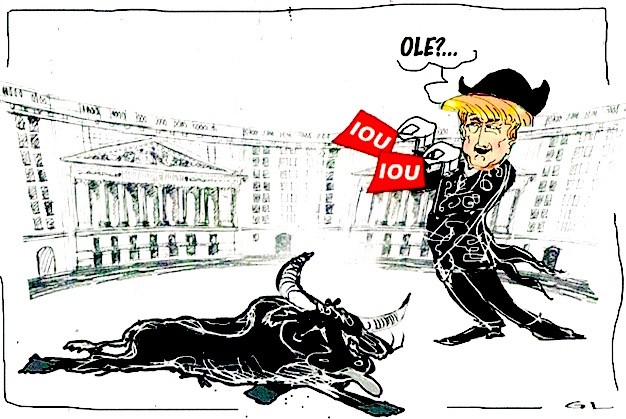

the genius at work: robbing paul to pay peter... (or donald)...

bull market...

bull market...

The S&P 500 enjoyed its biggest one-day gain since January last Tuesday after Federal Reserve chief Jerome Powell indicated he was open to cutting interest rates if global trade tensions start to bite. No doubt, Donald Trump shared investors’ enthusiasm, given he has been pressuring the Fed to lower rates for some time now, prompting Gluskin Sheff strategist David Rosenberg to suggest: maybe Trump really is a genius.

“What if he finally gets the steep Fed rate cuts he has been demanding?” tweeted Rosenberg. “After that, he ends the trade wars, tariffs go to zero, and the stock market surges to new highs – just in time for the 2020 election!”

Just days earlier, Rosenberg had asked if Trump wanted to lose the 2020 election by harming the US economy via tariffs on Mexican imports, so it’s fair to say he doesn’t believe Trump to be a “genius”. Still, a growing number of commentators are asking if Trump is thinking along these lines.

Nobel economist Paul Krugman, who only days earlier scoffed there was no method to Trump’s actions (“policy by tantrum, autocratic and irrational at the same time”) also asked if Trump might be encouraged by the market response. Trump pays attention to stock markets, suggested Krugman, so the market surge might convince him he can slap tariffs on Mexico and get bailed out by bullying the Fed.

Trump has since called off his Mexican tariff threat, but the broader point holds: if Trump thinks he can bully the Fed into slashing rates via risky economic policies, he might just do so.

Markets may be underestimating odds of no-deal Brexit

Are markets underpricing the risk of a no-deal Brexit? Sterling will tank if there’s a no-deal Brexit, according to a Reuters poll of strategists last week, with the median forecast saying it would end up trading between $1.15 and $1.20 compared with $1.27 last week. Currently €1 is worth about 89p, but almost half of respondents said the euro could go to parity.

Either way, your savings will end up below zero while the rich will add more zeros to their inflated fortunes.

- By Gus Leonisky at 20 Jun 2019 - 3:43pm

- Gus Leonisky's blog

- Login or register to post comments

trust in US dollar has been in decline...

Russian President Vladimir Putin on Friday renewed calls to revisit the role of the US dollar in global trade and accused Washington of seeking to dominate the world.

Speaking at an economic forum alongside Chinese President Xi Jinping, the Russian president called for deep reform, claiming that trust in the dollar has been on the decline.

Changes in the global economy "call for the adaptation of international financial organisations (and) rethinking the role of the dollar which... has turned into an instrument of pressure by the country of issue on the rest of the world," Putin said.

Putin –– whose country has chafed under numerous rounds of US sanctions –– has repeatedly slammed the global financial system established by Washington in the aftermath of World War II.

In a speech at a plenary session, Putin accused Washington of seeking to "extend its jurisdiction to the whole world."

"But this model not only contradicts the logic of normal international communication. The main thing is, it does not serve the interests of the future."

Read more:

https://www.trtworld.com/asia/role-of-dollar-should-be-revisited-in-glob...

making cash out of the misfortune of tensions...

Trump took to Twitter Monday to, once again, call out world governments for supposedly freeloading off the US, this time by allegedly getting premium American protection services in the Strait of Hormuz.

China gets 91% of its Oil from the Straight, Japan 62%, & many other countries likewise. So why are we protecting the shipping lanes for other countries (many years) for zero compensation.

While the plan has a certain mafioso quality to it, Trump did suggest the alternative that everyone defend their own ships from any of the future tanker attacks John Bolton blames on Iran.

Read more:

https://www.rt.com/news/462572-trump-countries-pay-protection-gulf/

The Mafia would be proud of Donald. You threaten people with breaking someone's windows, as you make others pay for not being hit by shards of glass... Brilliant Al Capone bullshit! Now to tax evasion...

Read from top.

verpasste Geschäftsmöglichkeiten ...

"Counterproductive" US sanctions against Russia have cost German companies billions of euros in lost business opportunities, the German-Russian Chamber of Commerce (AHK) said Wednesday.

More than 140 firms that participated in a recent survey reported more than €1.1 billion ($1.25 billion) in losses since the sanctions came into effect five years ago, the group said.

"The total figure amounts to several billion euros when these numbers are projected onto the entire German economy and the more than 4,500 companies operating in Russia," AHK CEO Matthias Schepp added.

Read more: Do sanctions against Russia work?

The United States and the European Union imposed sanctions after Russia annexed the Crimean peninsula from Ukraine in early 2014. EU sanctions have by contrast had a relatively limited impact on German companies active in Russia, Schepp said.

Read more:

https://www.dw.com/en/german-firms-slam-costly-us-sanctions-against-russ...

Read from top. title: Lost business opportunities...