Search

Recent comments

- a peace deal....

5 hours 12 min ago - peace now!

6 hours 38 min ago - a nasty romance....

6 hours 43 min ago - blackmail?.....

9 hours 14 min ago - ukraine's agony has not started yet....

1 day 2 hours ago - all defeated.....

1 day 2 hours ago - beyond crime.....

1 day 3 hours ago - the end....

1 day 3 hours ago - odessa....

1 day 5 hours ago - weitz....

1 day 6 hours ago

Democracy Links

Member's Off-site Blogs

non-renewable energy falling demand caused by the spread of the coronavirus...

Oil prices crashed in Asia on Monday by around 30% in what analysts are calling the start of a price war.

Top oil exporter Saudi Arabia slashed its oil prices at the weekend after it failed to convince Russia on Friday to back sharp production cuts.

Oil cartel Opec and its ally Russia had previously worked together on production curbs.

The benchmark Brent oil futures plunged to a low of $31.02 a barrel on Monday, in volatile energy markets.

Oil prices have tumbled since Friday, when Opec's 14 members led by Saudi Arabia met with its allies Russia and other non-Opec members.

They met to discuss how to respond to falling demand caused by the growing spread of the coronavirus.

But the two sides failed to agree on measures to cut production by as much as 1.5 million barrels a day.

That initially saw Brent drop below $50 a barrel on Friday with the downward trend carrying over to Asia on Monday after Saudi Arabia at the weekend sharply cut the prices it charges customers. The region is home to some major importers including China, Japan, South Korea and India.

Read more:

https://www.bbc.com/news/business-51796748

Note: even without the virus, the US fracking industry was running at a massive loss and could have been based on fraudulent practices...

- By Gus Leonisky at 9 Mar 2020 - 6:54pm

- Gus Leonisky's blog

- Login or register to post comments

coronavirus outbreak to slow renewables...

The coronavirus outbreak is threatening to slow the global solar energy revolution as it cuts the supply of key equipment for solar and wind farms in China and beyond.

As cases of the disease mounted over the last week, manufacturers including Trina Solar Ltd. sounded the alarm over production delays while developers such as Manila Electric Co. in the Philippines said projects would be held up.

“If the virus outbreak lasts beyond the first quarter and spreads to more geographies, as is currently happening in Korea and Italy, then it may very well slow down global renewable energy deployment,” said Ali Izadi-Najafabadi, head of analysis in Asia for BloombergNEF, which has downgraded its outlook for installations this year.

While China is slowly starting to get back to work after an extended shutdown to contain the virus’ spread, many factories are still not at full capacity amid a lack of staff and raw materials. Green manufacturers are not spared, with analysts and industry groups flagging the potential for higher costs and a hit to overseas operations, especially if the outbreak continues.

Read more:

https://www.latimes.com/business/story/2020-02-28/china-solar-coronavirus

oil glut...

Australia's petrol prices could soon fall to around $1 a litre, economists have predicted, as oil prices take a battering.

Key points:The impact of coronavirus had already put global oil prices under pressure, but now with Saudi Arabia starting a price war with Russia, oil stocks are getting smashed around the world.

Saudi Arabia and Russia cannot agree on how much oil should be produced, and the argument is having real-world ramifications.

The standoff saw the price of oil plunge more than 30 per cent overnight, and was a major factor in why more than $140 billion in value was wiped from Australia's share market on Monday.

Read more:

https://www.abc.net.au/news/2020-03-09/the-oil-price-plunge-petrol-prices-in-australia-$1-litre/12039762

killing fracking...

For the last three years, two factors have been hugely influential in the oil markets. The first has been the surge of shale oil production in the United States, which has turned the country from a large oil importer to an increasingly important exporter. The second is the alliance between Saudi Arabia and Russia, which recently have cooperated in trimming production to try to counter shale’s impact.

Now that cooperation between two of the world’s three largest oil producers — the third is the United States — appears to be at an end. Saudi Arabia, as the dominant member of the Organization of the Petroleum Exporting Countries, last week proposed production cuts to offset the collapse in demand from the spreading coronavirus outbreak. Russia, which is not an OPEC member, refused to go along. And the impasse has turned into open hostilities.

After talks with OPEC members in Vienna, Russia’s energy minister, Alexander Novak, returned to Moscow for consultations on Thursday. In his absence, OPEC officials met and came up with what amounted to an ultimatum. The group as a whole would trim production by 1.5 million barrels a day, or about 1.5 percent of world supply. OPEC, meaning largely the Saudis, would make the bulk of the cutbacks, one million barrels, as long as Russia and other producers trimmed the rest.

The gambit was “something of a boss move,” said Helima Croft, an analyst at RBC Capital Markets, but it backfired badly. Russia had played hard to get before, but this time Mr. Novak was not playing. The answer was “no” again, and the Saudi oil minister, Prince Abdulaziz bin Salman, and other officials headed back to their hotels with no results and no communiqué.

Failing to tighten supplies, the Saudis threatened to flood the market.

The standoff was ominous for the industry. Not only had OPEC and a wider group of producers — together known as OPEC plus — failed to agree on new cuts, but they had also failed to sign off on the extension of 2.1 million barrels a day in previous trims that would expire at the end of March. That created the danger of a tremendous flow of oil coming onto a market that was already hugely oversupplied and experiencing a steep slump in demand.

Read more:

https://www.nytimes.com/2020/03/09/business/energy-environment/oil-opec-...

Read from top.

Note that fracking and shale oil is only "profitable" through HEAVY subsidies...

the goose killing the geese killing the renewables...

Saudi Arabia has raised the stakes by drastically lowering its export oil prices and pledging to raise output to record levels, setting the stage for a protracted price war, primarily aimed at Moscow. Russia — which last week refused to back Riyadh's plan for deeper oil cuts to stabilize the oil markets hurt by the coronavirus epidemic — has shot back, saying it, too, has the ability to raise output to record levels.

The price war, which on Monday led to oil prices registering their biggest drop since the 1991 Gulf War, would hurt all global oil producers, some more than the others. With several analysts projecting oil prices falling to $20 (€18) a barrel, exporters could suffer a prolonged period of pain.

Saudi Arabia

The price war launched by the world's biggest oil exporter has perplexed many analysts, especially when they see how much Riyadh stands to lose from it. Saudi Arabia, which has the highest spare capacity globally and can produce oil at the lowest cost in the world, has launched price wars in the past but has always emerged from them bleeding.

The oil and gas sector accounts for about half of Saudi Arabia's GDP and nearly 70% of its exports earnings. The country requires oil prices to be around $84 a barrel to balance its budget, according to the IMF, and even a record oil production would not be able to compensate for the low crude prices.

Lower oil prices mean that the struggling economy will once again be forced to dive into its cash reserves to meet its budgetary needs as has been the case in the past few years. It is also likely to deal a blow to Crown Prince Mohammed bin Salman's ambitious spending plans as he looks to reduce the country's heavy reliance on oil. That's why some analysts feel Riyadh's decision to launch a price war may have been influenced by geopolitical interests.

Russia

The budget of the world's second-largest oil producer, nearly half of which comes from the energy sector, is more resilient to low oil prices than most major oil producers, but Monday's collapse has pushed oil prices below Russia's breakeven price of $42 a barrel. It's likely to hurt President Vladimir Putin's infrastructure and social spending plans, aimed at keeping him in power.

Much of Putin's projects are to be financed by a $150 billion wealth fund, amassed through surplus oil and gas revenues. If oil prices remain around $25-$30 a barrel, Russia — which does not have much spare capacity to compensate for the low oil prices — would be forced to dive into the wealth fund to finance its budgetary commitments, putting Putin's plans on the backburner. Russia has said the reserves are sufficient to withstand low prices for as long as 10 years. Riyadh is gambling that perhaps the Kremlin would not want to stall its spending plans, especially at a time when Putin's popularity ratings are low, and return to the negotiating table.

United States

A protracted price war would be a nightmare for US shale producers, especially the smaller ones with weaker balance sheets, which have been struggling to stay afloat as low oil prices hurt their profits. US shale companies, many of which need oil prices to remain at $65 or higher to break even, will be forced to scale back operations, slash jobs and investments in exploration and production.

The latest price crash threatens to force dozens of debt-saddled producers into bankruptcy. The industry is unlikely to get any support from the Wall Street like it did during the previous oil price crash in 2015-16, when investors poured in billions into US shale companies. Investors have turned their backs on the US energy industry due to poor returns.

The fall in shale activity coupled with a record production by Saudi Arabia could dislodge the US as the world's biggest oil producer and mark the return of Riyadh to the top.

Nigeria

For Nigeria, the latest price war would revive memories of 2016 when low oil prices pushed its oil-dependent economy into a recession. Africa's biggest oil producer, which needs oil prices to be around $60 a barrel to balance its budget, is vulnerable to low oil prices as it depends on the commodity for 90% of its export earnings. The oil price shock would hurt its fragile economic recovery and push up inflation, already in double digits.

Angola

The oil rout could not have come at a worse time for Angola, Africa's second-largest oil producer, whose oil-heavy economy is already suffering from lower oil prices and production. The energy sector contributes about half of Angola's GDP and 90% of exports. Angola, which needs a breakeven oil price of around $60 a barrel, was hoping to emerge from an economic crisis caused by the 2016 price shock this year. That looks highly unlikely, if oil prices remain at current levels or fall further.

Read more:

https://www.dw.com/en/oil-price-war-saudi-arabia-russia-us-nigeria-angol...

The renewable industries are also getting a hit and run damage...

a “black eye” for the permian...

...

On Investor Day, Exxon had another problem. Falling oil prices had cut into the company’s profitability, raising red flags about heavy spending.

Here, too, Exxon tried to couch its growth strategy in measured terms to appease investors demanding restraint. “We are adjusting our execution pace” because of the “current business environment,” Neil Chapman, the head of Exxon’s upstream unit, told investors, acknowledging the fall in oil prices. Some in the trade press interpreted the new strategy as a “slowdown” in the Permian Basin.

However, while Exxon tweaked its spending plans and drilling pace a bit, the overall strategy remained the same. Despite deciding to deploy fewer rigs, Exxon plans to spend $30 to $35 billion each year through 2025 and aims to produce 1 million barrels per day in the Permian by 2024. Both of those metrics are unchanged from the company’s prior guidance. Exxon is “leaning in to this market when others have pulled back,” as Woods put it.

Oil prices have declined, but “the longer-term horizon is more clear,” Woods said. The oil major expects oil demand to continue to rise indefinitely, warranting ongoing drilling at an aggressive rate.

Less than 24 hours after Woods’ comments, the oil market went into a tailspin. The spread of the coronavirus and the onset of an OPEC price war sent oil prices careening down to multi-year lows. The downturn will likely force cutbacks in drilling, somewhat reducing the scourge of flaring in West Texas. But based on Exxon’s long-term plans, the reprieve may only be temporary.

Flaring in the PermianThe surge of fracking in the Permian has resulted in a massive increase in oil production, but also a spike in flaring, or the burning of gas from oil wells, as drilling has outpaced the construction of natural gas pipelines. The Permian Basin saw flaring and venting, the release of unburned gas, largely methane, directly into the atmosphere, jump to 810 million cubic feet per day in 2019. That means that the volume of gas burned each day exceeded the amount of gas consumed in all of Texas’ households.

Even the industry admits that rampant flaring has become a major problem for its reputation (a “black eye” for the Permian), and a number of reports in the past year have raised alarm about the role that gas plays in exacerbating climate change.

But the Texas Railroad Commission, which regulates the oil and gas industry in the state, has done almost nothing to rein in the practice of flaring. In 2019, the commission granted 6,972 flaring permits, and rejected none. In fact, by all accounts, the commission has not denied any of the 27,000 or so flaring permits over the past seven years.

The permissive attitude reached absurd proportions last year when the Railroad Commission granted a permit to Exco Resources, a shale driller that wanted to flare its gas even though it had access to a pipeline, simply because the company didn’t want to pay the fees to ship the gas. It was cheaper to burn the gas, and the Texas regulator gave the go-ahead.

The pressure on Texas has grown tremendously over the past year, as rampant flaring becomes increasingly indefensible. Under mounting pressure, Texas Railroad Commissioner Ryan Sitton released a report on flaring in February. While he is supposed to regulate the industry, he has consistently been one of fracking’s most powerful champions in the state.

Publicly available flaring data is scarce in Texas, so Sitton’s flaring report offered some useful information, even as he praised the benefits of fracking. For instance, the number one source of flaring over a 12-month period through October 2019 was XTOEnergy, which flared 23,350 million cubic feet of gas per day.

XTO is a subsidiary of ExxonMobil.

The Permian’s Toxic Air PollutionIn August 2019, a pipeline in Midland, Texas, owned by a company called ETC had to shut down for repairs. XTO Energy sends gas from some of its Permian wells to that pipeline, so the shutdown presented the company with a problem. With nowhere to put the gas coming out of the ground, XTO decided to burn it. Because of the pipeline outage, XTO flared gas for 91 hours, according to an event report filed with the Texas Commission on Environmental Quality (TCEQ).

Not only did XTO release an unknown volume of CO2 and methane into the atmosphere — the company is not required to report those volumes — but the flaring event also resulted in the release of more than 15,000 pounds of nitrogen oxides, 30,000 pounds of carbon monoxide, and 100 pounds of sulfur dioxide, among other contaminants.

The incident highlights how venting and flaring is not just a climate problem. Flaring often results in the release of other toxic air emissions. ExxonMobil is far from the only culprit; the entire region has a problem with unpermitted pollution from oil and gas drilling.

A 2019 report from the Environmental Integrity Project found that between 2014 and 2017, roughly 35 percent of Ector County, which includes Odessa, “experienced sulfur dioxide air pollution levels in excess of the federal health-based standard.” That included hundreds of individual incidents of illegal releases of sulfur dioxide. Drilling activity has only increased since then.

Sulfur dioxide can contribute to respiratory problems and make breathing difficult, more so for young children and for people with asthma, according to the U.S. Environmental Protection Agency. Nitrogen oxides can contribute to smog formation.

Despite the worsening air quality, the region only has three air quality monitors, and only one for sulfur dioxide, compared to around 60 monitors in the Houston area. That makes it difficult to obtain accurate and timely information.

Nevertheless, according to data from the TCEQ, the volume of unauthorized emissions of air contaminants —emissions above an allowed threshold, due to an accident, blowout, or other unplanned event — surged in fiscal year 2019, with an enormous increase in Midland. More than 60 million pounds of emissions of air contaminants occurred in FY19 in the Midland region, up from less than 30 million the year before. The increase, the TCEQ said, was “primarily due to heightened oil and gas operations in the Permian Basin.”

But even that might be understating the impact since the data comes from the companies themselves. “The operator estimates emissions based on standard guidelines set by EPA and the duration and magnitude of the release,” Gunnar Schade, Associate Professor of Atmospheric Sciences at Texas A&M University, told DeSmog. “Such estimates are at times crude and inaccurate, but it's the best we have in most cases.”

“But since this cannot be policed, I think it is fair to assume that ‘uncertainty’ cuts mostly one way, towards underestimation,” Schade added.

In a more significant incident in early February, drillers in the Permian Basin flared a massive amount of gas because of a winter storm. Power failures led to the temporary shutdown of several natural gas processing facilities, so multiple drillers resorted to flaring, emitting around 8.8 million pounds of air pollution, according to advocacy group Environment Texas. The release over just two days in February was equivalent to about one quarter of the pollution released in the region in all of 2018.

ExxonMobil’s Permian Plans on Thin IceShale drilling has slowed recently because of profound financial stress. As small and medium-sized drillers pull back, the oil majors have taken over. With deeper pockets, the majors can preside over loss-making fracking operations for years.

At its Investor Day in New York in early March, Exxon showed little sign of slowing down. Exxon is “pursuing a strategy that is destructive of both shareholder value and the planet,” Edward Mason, head of responsible investment at Church Commissioners for England, who attended the company’s investor meeting, told Reuters.

However, the most recent collapse in oil prices — with one measure, West Texas Intermediate (WTI) falling to the low-$30s — could be so painful, that even a company the size of Exxon might think twice. Chevron has already admitted that it might cut spending in response to the sudden Saudi-Russia price war. Exxon too might soon have to slam on the brakes.

Read more:

https://www.desmogblog.com/2020/03/11/future-exxon-permian-flaring-crisi...

Read from top.

human life revolves around the price of oil...

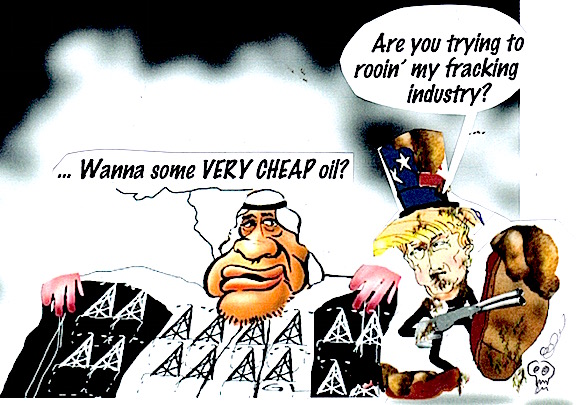

US President Donald Trump used to complain about the high oil prices that came as a result of the OPEC+ agreement, which saw many oil-exporting countries cut crude production. Now, however, is unhappy with the anomalously low price of black gold that is threatening to kill the American shale oil industry.

Commenting on the ongoing oil price free fall, US President Donald Trump accused Russia and Saudi Arabia of initiating a global price war, also claiming that their economies would suffer the most as a result.

What he didn't mention is that the US economy, specifically the shale oil sector, would also be affected as the price for oil has come close to the cost of production for American energy companies. Trump, however, promised that he might get "involved" in the situation on the global oil markets, albeit without going into details. A recent report by The Wall Street Journal, citing anonymous sources, suggested that this "involvement" could include measures to force the biggest producers to cut oil output: sanctions against Russia and diplomatic pressure on Saudi Arabia.

Why the Sudden Interest in the Oil Price Drop?The US president's interest in changing the situation on the oil markets is due to frustration over another setback on the road to energy independence, Dr Cyril Widdershoven, a veteran global energy market expert and advisor at several international think tanks, believes. As long as the US shale oil industry remains insecure and non-sustainable, Washington is dependent on external crude sources and hence can't fulfil its "long dream of less engagement in global geopolitics", the expert adds.

"In the short term, US shale is not going to die, long-term if all is kept in place, bankruptcies and financial clashes will be part of US shale for sure", Widdershoven said.Widdershoven points out that Trump just recently sought another change to the oil price - he actually complained about it being too high due to cuts as a result of the OPEC+ deal, blaming - unsurprisingly - Russia and Saudi Arabia the most. The situation has changed since then, not only thanks to these two countries' actions, but also due to the "toxic combination" of the coronavirus' effects on the global economy and the possible resulting recession, the economist notes.

Read more:

https://sputniknews.com/analysis/202003211078660310-why-us-better-stay-a...

See also:

http://www.yourdemocracy.net.au/drupal/node/26238

http://www.yourdemocracy.net.au/drupal/node/5758

http://yourdemocracy.net.au/drupal/node/12236

http://www.yourdemocracy.net.au/drupal/node/32016

http://www.yourdemocracy.net.au/drupal/node/33733

and remember:

and

Read from top.

cutting oil production to save the market...

There are no losers in the deal, Dmitry Peskov told journalists following negotiations on production cuts.

The decision benefits oil-producing nations, consuming nations and the world economy in general, which risked sliding into chaos if the deal could not be reached.

He added that Mexico, which has reportedly come on board with some cuts, “took a constructive stance.”

“We can say now all the 23 participating nations have reached a compromise. We are convinced it will have a positive stabilizing effect on the oil market,” Peskov stressed, adding that Russian President Vladimir Putin was “very positive”about the outcome of the talks.

“We are continuing our work with our Mexican partners. We hope we will be able to agree on the parameters that have been coordinated with the other 22 nations,” Peskov said, adding that the beneficial effect on the market “will only become stronger after Mexico joins in too.”

Mexico said on Friday it has reached an agreement with OPEC+ on oil production cuts that was better than the 400,000 barrel-a-day reduction proposed by the other producers on Thursday.

Read more:

https://www.rt.com/news/485501-opec-russia-deal-prevents-chaos/

pravda: US manipulating the oil market?...

US shale oil companies wipe tears away with fists

The USA has ceased to be a free market country - the market is being regulated depending on political considerations. Shale oil companies serve a vivid example to that.

Shale oil investment cut in half

In 2020, global investment in energy will be cut by $400 billion, which will be the largest annual decline in history, a new report from the International Energy Agency (IEA) says.

American shale companies will be affected more than others, capital investment in US-based shale oil makers will be decreased twice, the report says.

Hundreds of oil rigs have stopped their work, and since March, oil production in the United States has fallen by nearly two million barrels per day.

Top managers of the shale industry live beyond their means

However, while thousands of shale oil employees are becoming unemployed, the management of those companies continues to receive millions of dollars in salaries, Reuters reports. For example, National Oilwell Varco Inc. CEO, Clay Williams, received $3.3 million in February, despite the fact that company's revenues since 2017 fell by two-thirds.

Chesapeake Energy's management received an award worth $25 million at the end of the quarter, but the company simultaneously announced potential bankruptcy. Whiting Petroleum announced bankruptcy on April 1, but its top managers took care of receiving cash bonuses worth $14.6 million.

Large shale oil makers have the same "problems." According to a new report from the Institute of Energy Economics and Financial Analysis (IEEFA), four out of the five largest oil companies operating in the shale industry paid investors more dividends than they earned in the first quarter of this year. For example, Chevron made a profit of $1.6 billion, and paid $4 billion in dividend.

What is worse, the company planned to cut from 10 to 15 percent of its workforce in the shale industry in order to meet the projected levels of activity, Reuters says.

This is not a one-time coronavirus-related underlying condition, but the practice of the last ten years, IEEFA analysts write in their report.

"These five companies generated $340 billion in free cash flows from 2010 through 2019, while rewarding their shareholders with $556 billion in share buybacks and dividends-leaving a $216 billion cash flow deficit that these companies covered with other sources, including new borrowing and asset sales," the authors of the report note.

Who dared to destroy USA's new weapon?

This business model, which is not typical of capitalism, suggests that the shale industry in the United States has long been kept afloat by the state through toxic loans for political reasons.

The United States positions itself as the country that has become the largest oil exporter (13 million barrels per day), which supposedly allows it to keep "totalitarian states" - such as Russia and Saudi Arabia - in fear.

Excess supplies and administrative resources allowed the United States to dictate its rules on the oil market by 2020 ("buy our oil"). However, the coronavirus nullified that ambition. This explains why the Donald Trump administration is so outraged by the "Wuhan flu" - the Americans even ventured to announce a grant in order to prove that "the Russians are underestimating their COVID-19 victims." Was it the Russians and the Chinese who masterfully destroyed the new powerful weapon of the USA?

Читайте больше на https://www.pravdareport.com/world/144622-usa_shale_oil/

Read from top.