Search

Recent comments

- ukraine's agony has not started yet....

11 hours 33 min ago - all defeated.....

11 hours 45 min ago - beyond crime.....

12 hours 35 min ago - the end....

12 hours 46 min ago - odessa....

13 hours 53 min ago - weitz....

15 hours 43 min ago - bidenomics BS.....

15 hours 58 min ago - the defeat of ukraine is coming....

16 hours 46 min ago - paris is sick....

1 day 4 hours ago - German spies?....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

in the year of the rat, the rabbits might enjoy drinking chateau margaux...

China is threatening to impose bans on up to $6 billion of key Australian exports from Friday under a widely distributed notice sent to the country's food and wine distributors, raising fears of a second wave of economic coercion as diplomatic relations hit a new low.

The addition of copper ore and sugar to a growing list of commodities targeted by Chinese authorities alarmed the agricultural and mining sectors, which were on Tuesday scrambling to verify the authenticity of the notice.

Shares in major exporters to China fell on reports of the possible ban. Copper miner Sandfire Resources fell more than 8 per cent and Treasury Wine Estates, which holds its annual meeting on Thursday, lost more than 3 per cent.

The Morrison government is yet to confirm the existence of the sweeping edict against Australian goods but was working closely with the named industries and continued to seek clarification from Chinese officials.

"The numerous reports of difficulties that different Australian exports are facing on entry into China are of concern," Trade Minister Simon Birmingham said.

"China has consistently denied any targeting of Australia and spoken about its commitment to trade rules. In the spirit of their statements, we urge relevant Chinese authorities to address concerns of sectors like the seafood trade to ensure their goods can enter the Chinese market free of disruptions that threaten the quality of their products."

Some traders in China questioned the legitimacy of the directive, which also listed wine, coal, cotton, lobster, timber and barley as targets of a ban to be enforced from Friday. Those goods are either the subject of anti-dumping probes by China or have already had partial restrictions put in place.

Cancelled shipmentsHowever, Australian exporters said it was too widespread to ignore as some Chinese customers were already cancelling shipments based on the advice. "It seems very odd to me but for all our exporters, their importers are telling them things will happen this week and they are cancelling shipments," Tony Battaglene, chief executive of industry group Australian Grape and Wine, said.

The move came as China banned timber from Queensland and blocked trade from an Australian barley exporter after customs claimed pests found in the imports threatened the country's ecological security. There were also unconfirmed reports on Tuesday that China would target Australian wheat.

Grain Producers Australia chairman Andrew Weideman said recent strength in the wheat trade had offered hope of rebuilding relations between the industry and China.

“If the reports are true, it is of great concern to us. There is no question of that,” Mr Weideman said, noting the industry had previously hoped to rebuild relations off the back of the strength in recent trading.

Sources said China's Commerce Ministry had verbally told food and wine importers at meetings in three cities on Friday not to initiate further orders for the six Australian commodities ahead of a possible ban. But traders and distributors interviewed on Tuesday questioned the authenticity of the directive.

Two traders said they could not verify the list, which appeared to be from a city-level authority because it contained the word "bureau" and not "ministry", which would have indicated it was a China-wide directive.

Regardless, China was sending a clear message to Australian exporters that had spooked local food and wine distributors, who would start to cut back purchases anyway because they feared shipments would be either banned or subject to extensive inspections.

"The message is clear. China will be tough on Australian goods but no one knows how strictly this will be implemented," one distributor in the grains industry, who did not want to be named, told The Australian Financial Review.

Mr Battaglene said the grape and wine industry body was bracing for the worst for the $1.2 billion market.

"Importers are actively cancelling shipments," he said. "What we don't know is whether it is importers trying to toe the line or directions from above. We are all pretty sure that come Friday the market will be closed."

Threat of inspectionsThe latest move comes ahead of the US election and follows restrictions on Australian barley, beef, coal and cotton. China has warned its students and tourists to avoid Australia and has begun an anti-dumping investigation into wine. Under that probe, China could technically impose tariffs at any time.

Madeleine King, shadow minister for trade, called on the government to appoint a trade minister and rethink the way it dealt with China. "The government should be more measured in the way it communicates about China," she said.

China confirmed on Monday night it had detected cases of pests in timber imported from Australia since January but refused to directly address suggestions on a second wave of possible restrictions on other goods.

China's Foreign Ministry said its inspection and quarantine measures on imported seafood were in line with its laws but several times emphasised "mutual trust" as the foundation for a trading relationship between the two countries.

"We hope Australia can do more things conducive to mutual trust, bilateral co-operation and the spirit of China-Australia comprehensive strategic partnership, and bring the bilateral relations back to the right track as early as possible," a Foreign Ministry spokesman said, when asked if the latest reported restrictions were designed to punish Australia politically.

Emerald Grain, an Australian-based trading company owned by Japan's Sumitomo, said on Tuesday it was the victim of a trumped-up and politically motivated ban after big Chinese malt-makers continued to buy Australian barley in defiance of Beijing's efforts to shut the trade.

Sandfire Resources said it was aware of reports that China may be considering a ban on imports of copper ore and concentrate but was not aware of any reasons for the reported restrictions.

Shares in the miner fell 6.5 per cent at lunchtime on Tuesday. The company said it was confident of increasing sales to non-Chinese markets if necessary.

China's Foreign Ministry said it had asked Australia to investigate the presence of live pests in timber, such as longicorn and buprestid beetles, which had been found in imports since January.

"We hope that the Australian side will take effective measures to strengthen export quarantine and ensure the exported timber meet China's quarantine requirements," the spokesman said.

China did not deny allegations it was conducting a campaign of economic coercion on Australia following the Morrison government's call for an inquiry into the origins of coronavirus.

Customs officials on Sunday warned they would step up inspections on timber, barley and lobster as rumours swirled of restrictions on other key agricultural commodities such as wine, sugar and copper.

About 21 tonnes of live lobster worth $2 million has been held up at Shanghai airport since Friday after Chinese customs officials changed inspection procedures. The exports were sent to China on Australian taxpayer-subsidised flights.

https://www.afr.com/world/asia/china-targets-6-bln-of-australian-exports...

Meanwhile:

Australia, India, Japan and the US have kicked off drills showcasing military hardware and tactical capabilities with warfare operations and live firing drills, as Beijing says it’s concerned for the region's peace and stability.

On Tuesday the four countries began the three-day Malabar naval exercises off the Visakhapatnam coast in the Bay of Bengal to strengthen coordination between their militaries amid increasing tensions with China.

The three-day exercise will involve anti-submarine and anti-air warfare operations, cross-deck flying, air asset refueling and live firing drills.

China however remains skeptical about the allied exercises. On Tuesday, Chinese Foreign Ministry spokesman Wang Wenbin reiterated Beijing’s hopes “that relevant countries’ military operations will be conducive to peace and stability in the region instead of the contrary.”

The US, India, Australia and Japan are utilizing a number of naval assets, including destroyers, frigates, naval helicopters and a submarine. Warships on show include the guided-missile destroyer USS John S. McCain and the equally immense JS Onami, the second of five Takanami-class destroyers commissioned by Japan between 2003 and 2006.

The Malabar exercises started in 1992 as drills between the US and Indian navies. Japan has participated permanently since 2015 and this year Australia is joining for the first time in 13 years in response to what it views as China’s increasingly aggressive stance in the region.

Beijing has also been concerned by the actions of the US and its allies in the region. China recently condemned Washington’s military exercises in the South and East China Seas as well as attempts to build strategic alliances with regional partners, including the sale of arms to Taiwan.

Further Malabar drills will take place later in November in the Arabian Sea.

https://www.rt.com/news/505376-quad-naval-exercise-china-india/

Chinese nationals are buying Australian vineyards and wineries at unprecedented levels, with up to 10 per cent of South Australia's iconic Barossa Valley now in Chinese hands.

"If I look at the last seven transactions I have personally done … six of them have been to Chinese parties," said Stephen Strachan, director of Langley and Co, a company dealing in wine industry acquisitions.

"Most probably 50 per cent of the calls that we get into our office are from Chinese parties or from parties representing Chinese interests."

The former chief executive officer of the Winemakers' Federation of Australia said the investments had become "more sophisticated".

"Probably five years ago when this started all roads led to the Barossa, and the typical conversation would be 'I want to buy Penfolds'," he said.

"A lot of the original parties were looking for trophy assets and the Barossa was number one, but progressively that has changed and other regions like McLaren Vale, the Yarra Valley, there's been strong interest in Margaret River, and a little bit in Coonawarra, so Australia's other regions are starting to have some significant success in China."

https://www.abc.net.au/news/2018-10-27/china-invests-wine-barossa-valley/10429078

———————

ARVEYRES, France — The rabbit — the “Imperial Rabbit” — looks out quietly from the vineyard’s sign, sandwiched between the familiar words ‘‘Great Wine of Bordeaux.’’

But there are no rabbits in this vineyard, imperial or otherwise. Nor are there any “Golden Rabbits” or “Tibetan Antelopes” or even “Grand Antelopes” in the vineyards not far away.

That has not stopped the new Chinese owner in one of France’s most fabled wine regions from naming his newly acquired chateaus after them — to more than a little consternation among tradition-bound French.

“Up until now, the rabbit has not enjoyed a great reputation in the Bordeaux vineyards,’’ noted Le Résistant, the local newspaper in the regional capital, Libourne. ‘‘The trend has been, rather, to eradicate it.”

https://www.nytimes.com/2019/04/06/world/europe/france-china-wine.html

—————————

China’s President Xi Jinping has told thousands of foreign exporters that Beijing does not want to hurt other economies as Chinese state media reports a $6 billion ban on seven key Australian products is imminent.

Australian businesses across seafood, wine, barley, sugar, copper, coal and timber industries are bracing for a sudden halt to their exports to China today as up to 200 gather in Shanghai for one of the country’s largest import conferences.

Xi told the China International Import Expo on Wednesday night that countries must work together to find a way out of the coronavirus recession.

‘‘It is ill advised to pursue unilateral dominance, or choose to hurt others’ interests, which diminishes one’s own interests,’’ he said.

Trade Minister Simon Birmingham escalated Australia’s response to Chinese authorities yesterday, addressing Xi’s comments directly as trade negotiators prepare for the possibility that key exports could be locked out of China within 24 hours.

Some Australian wine exporters have stopped sending product to China in anticipation of being blocked at Chinese ports, while lobster fishermen have stopped fishing in Australian waters after tonnes of live lobster were destroyed on the tarmac at Shanghai airport this week. Up to 90 per cent of Australia’s lobster goes to China. Queensland timber logs have also been blocked over pest control concerns.

‘‘Continued uncertain and inconsistent messages from China are heightening risks and undermine the statements made by President Xi at this year’s China International Import Expo,’’ Senator Birmingham said.

‘‘If China is to be true to the statements of its government then it should provide confidence that normal customs and related processes will apply to imports of goods such as seafood and wine.’’

The trade dispute escalated this year following Australia’s push in April for an inquiry into the origins of the coronavirus. The Australian government has also raised concerns about the future of Hong Kong, Xinjiang and China’s ambitions in the South China Sea.

The Chinese Foreign Ministry has denied it is ratcheting up economic pressure to win diplomatic concessions. On Wednesday, a day after a verbal notice relayed by customs agents was delivered to traders telling them to stop importing Australian products, it said any restrictions on imports were a matter for individual companies.

Chinese state media outlet The Global Times yesterday said China had ‘‘halted seven categories of Australian goods from the market’’. The report came as Graham Fletcher, Australia’s ambassador to Beijing, prepared to attend the trade expo in Shanghai, where dozens of representatives from Australian companies were due to gather under ‘‘the Oz-Town Australian Pavilion’’.

The Australian industries targeted by Chinese authorities have produce that can be sourced from elsewhere and are not seen as critical to China’s economic recovery.

Australia’s largest exports, iron ore and coal, account for more than $120 billion of Australia’s annual exports to China.

China is heavily reliant on Australia to supply the huge quantity of iron ore it needs to produce steel for construction and infrastructure projects.

However, coal imports are more vulnerable to restrictions as China has a significant domestic coal mining sector, which Beijing has been seeking to strengthen.

Xi told the expo China had set out to foster ‘‘a new development paradigm with domestic circulation as the mainstay’’ and domestic and international trade reinforcing each other.

SMH

- By Gus Leonisky at 7 Nov 2020 - 4:49am

- Gus Leonisky's blog

- Login or register to post comments

closures...

China has temporarily banned the entry of foreigners from at least eight countries as COVID-19 cases rise in Europe and elsewhere.

Citizens from Russia, France, Italy, the United Kingdom, Belgium, the Philippines, India, and Bangladesh can no longer enter the country — even if they hold a valid visa or residence permit for China.

Health authorities on Friday reported 30 imported cases in the most recent 24-hour period, including 15 in Shanghai. That brought the total number of imported cases during the pandemic to 3,510.

Vietnam has pursued an aggressive anti-COVID strategy that includes mass testing, military-run quarantine centers, and early border closures.

On Friday, its coronavirus task force said it would stick with that containment method, which has seen just 35 people die from the virus there.

Its tally of infections is just 1,210 cases and officials say there have been two months without community transmission.

Australia's highest court dismissed a lawsuit from billionaire businessman Clive Palmer (below), who argued Western Australia's state-border closure to non-essential travel was unconstitutional.

Read more:

https://www.dw.com/en/coronavirus-digest-china-tightens-border-rules-as-...

“The whole of Australia is impacted no doubt by the amount of money that’s not going to be circulating around in the economy.”

Home Affairs Minister Peter Dutton said the issue was “not easy” to resolve and that the Morrison goverment “will work with China” to ensure markets stay open to Australian exporters.

“In the end, it’s not a decision of the Australian government,” he told Nine’sToday show.

Read more:

https://thenewdaily.com.au/news/national/2020/11/07/effect-of-rumoured-china-ban-on-australian-exporters/

Sorry, Peter... it is A DECISION OF THE AUSTRALIAN GOVERNMENT... We do not have to participate in MILITARY EXERCISES (see at top) designed to annoy China...

See also: of terrorists and potato heads...

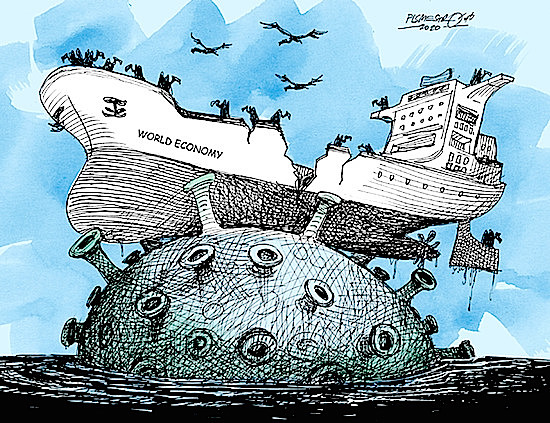

Cartoon at top by Petar Pismestrovic | China Daily :

http://www.chinadaily.com.cn/a/202011/02/WS5f9f4464a31024ad0ba82652.html