Search

Recent comments

- "the west won!"....

26 min 20 sec ago - wagenknecht......

1 hour 7 min ago - the game of war....

3 hours 31 min ago - three packages....

4 hours 51 min ago - russian oil.....

4 hours 58 min ago - crime against peace....

13 hours 10 min ago - why is Germany supporting the ukrainian nazis?....

14 hours 23 min ago - sanctioning....

17 hours 7 min ago - politico blues....

17 hours 46 min ago - gender muddles....

18 hours 7 min ago

Democracy Links

Member's Off-site Blogs

the days of the aussie machines: wifi, cask wines, concrete trucks, black box and robodebt...

At the beginning of Australia's winter last year, Kath Madgwick read the last message she'd received from her only child.

"I love you mum," her son Jarrad, 22, had texted.

Her son had made her extremely proud, wrote Ms Madgwick in a letter later read out to a parliamentary inquiry. A former school captain, and state-ranked swimmer, Jarrad had been a respectful young man, kind and helpful to others.

But in the year before his death, he had fallen on hard times. There had been a relationship break-up and bullying at work. Newly unemployed and struggling with his mental health, he moved back in with his mum.

He applied to join the army around the same time he applied for unemployment benefit.

When his claim was rejected, he was devastated. On the day of his suicide, he rang up Australia's welfare office to ask why.

"Um hello. I'm like in a pretty desperate situation here," he told the Centrelink officer.

"I've waited a month and I've jumped through all the hoops and I'm just wondering why I haven't even had an explanation? We can't afford rent and I'm thinking about stealing food… like, we need this money," he said.

After that call, Ms Madgwick says, Jarrad checked his welfare account. That was when he learnt that he owed A$2,000 (£1,100; $1,500) to the government. The debt was an apparent overpayment of a previous student benefit he had received - and this had barred his new claim.

"From then on, he was just distressed and inconsolable. But he was still desperately trying for jobs right up until the moment he left the house," Ms Madgwick told the BBC.

Read more:

https://www.bbc.com/news/world-australia-54970253

You can guess the rest of this story... Meanwhile, the monkeys who suggested and invented ROBODEBT should be sacked from their jobs and exposed like thieves, not hidden like glorious lepers...

- By Gus Leonisky at 23 Nov 2020 - 6:19am

- Gus Leonisky's blog

- Login or register to post comments

the need for a royal commission...

The Robodebt class action bought by Gordon Legal has been settled at a cost to the government of around $1.2 billion. According to federal Labor frontbencher Bill Shorten, this is the biggest class action in Australian legal history.

This comprised refunds of $721 million to 373,000 people, $112 million in compensation and $398 million in cancelled debts.

As is well-known, “Robodebt” is the label commonly applied to the initiative starting in 2016 designed to increase recoveries by government of “overpayments” made to social security recipients, retrospectively dating back to 2010.

This table sets out a chronology of the major developments in Robodebt from 2016 up to this week.

-----------------

Public pressure is growing for a royal commission into the controversial robodebt scheme.

After calls from the Greens this week, Labor also demanded an inquiry.

As Opposition leader Anthony Albanese said: “how can we ensure that a debacle like this never happens again?”

Read more: Government to repay 470,000 unlawful robodebts in what might be Australia's biggest-ever financial backdown

But Prime Minister Scott Morrison quickly shot down the idea, telling reporters it wasn’t necessary, “because we’re fixing the problem”.

The tide has turned on robodebtIn the past few months, the campaign against robodebt has enjoyed a series of unprecedented wins.

Last November, the Federal Court declared the robodebt of Melbourne woman Deanna Amato was “not validly made”.

Read more:

https://theconversation.com/the-problem-is-not-fixed-why-we-need-a-royal-commission-into-robodebt-141273

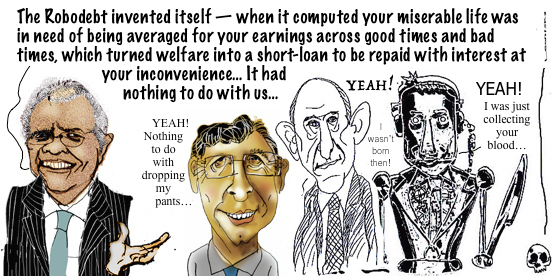

A royal commission would expose the inventors of this crap — mostly the geezers in the toon at top.

no liability? BULLSHIT!

The 400,000 Australians unwittingly caught up in the Robodebt scandal will get little more than their own money finally paid back, after Scott Morrison appeared to rule out any further compensation for people hounded over unlawful debts.

“We’re resolving the issue by ensuring that the money is paid, $1.2 billion,” the Prime Minister told The New Daily at a press conference over the weekend.

But the money Mr Morrison refers to is simply refunding cash wrongfully claimed from welfare recipients under the automated income averaging system.

The government essentially admitted fault in this system by settling a class action lawsuit on the morning it was due to appear in the Federal Court, agreeing to a billion-dollar payout despite claiming the agreement was “not an admission of liability”.

More than $720 million of that is money already paid by some of Australia’s most vulnerable people to the government, after trusting the arguments of Centrelink that they had been overpaid, or – as many did – simply surrendering in the face of debt collectors.

Another $398 million is in outstanding debts being cancelled by the government.

The final $112 million in the $1.23 billion settlement was described by law firm Gordon Legal as “compensation”, but Government Services Minister Stuart Robert said it was for “interest payments”.

The sum represented approximately what those who paid their wrongful debt notices could have earned in simple interest if they’d left it in the bank, instead of forking it over to Centrelink.

Which leaves the welfare recipients simply getting a reimbursement of money that was inaccurately gouged from them.

In financial terms, they simply go back to square one – potentially, even a little further back, considering the interest/compensation will have Gordon Legal’s fees skimmed off the top.

This essentially means the victims of Robodebt have gone through years of stress and financial hardship, to only get their money reluctantly reimbursed.

Countless hours devoted to bureaucratic nonsense, paperwork, endless phone calls to Centrelink, disputing debts, chasing ancient payslips from former employers, and not a dollar of extra compensation for the inconvenience.

Read more:

https://thenewdaily.com.au/news/2020/11/22/robodebt-compensation-morrison/

Read from top.