Search

Recent comments

- a peace deal....

6 hours 5 min ago - peace now!

7 hours 31 min ago - a nasty romance....

7 hours 36 min ago - blackmail?.....

10 hours 7 min ago - ukraine's agony has not started yet....

1 day 3 hours ago - all defeated.....

1 day 3 hours ago - beyond crime.....

1 day 4 hours ago - the end....

1 day 4 hours ago - odessa....

1 day 5 hours ago - weitz....

1 day 7 hours ago

Democracy Links

Member's Off-site Blogs

a moment in history...

John Robert Hewson AM (born 28 October, 1946) is a former Australian politician who served as leader of the Liberal Party from 1990 to 1994. He led the Coalition to defeat at the 1993 unloosable federal election. Hewson has a doctorate in economics from Johns Hopkins University. He is a global warming warrior against the awful sceptics and denialists… A good man.

Dr Hewson’s specific work on climate change and sustainability, ranges from the '93 Fightback policy promising a 20% cut in emissions by 2000, off a 1990 base, through his role as Member and Chairman of National Business Leader's Forum on Sustainable Development, and as Chair Asset Owners' Disclosure Project, as well as a businessman recognising the opportunities in a genuine response to the challenge of climate change by starting businesses in garbage recycling, energy efficient lightbulbs, bio-diesel plants, green data centres, converting sugar cane into electricity and ethanol, producing ultra pure graphite for lithium-ion batteries and heat storage, coal refining, base load solar, and many others. John was also a Member of the South Australian Government’s Expert Panel on the Transition to a Low Carbon Economy, and Patron of the Smart Energy Council, and Chair BioEnergy Australia and Business Council for Sustainable Development Australia.

Read more:https://climate.anu.edu.au/about/people/academics/dr-john-hewson

——————————

A strange birthday cake sill haunt our memory...

Mike Willesee — who has died at the age of 76 from cancer of the throat — was a giant of current affairs journalism.

Willesee has been described by peers as "quality and class", a journalist with a sharp mind and a great instinct for the right question for ordinary Australians.

A bad interview with him could turn an "unlosable election". And that's exactly what happened to former Liberal leader John Hewson during the 1993 federal election.

The interview that sank a political leader's career

During the campaign, Willesee interviewed the then opposition leader on Channel Nine's A Current Affair program.

Mr Hewson was trying to spruik his party's proposed tax reforms, but a simple question from Willesee about the cost of a birthday cake seemed to throw him off completely.

https://www.abc.net.au/news/2019-03-01/mike-willesee-interview-current-affair-john-hewson-career/10862440

———————————

John Hewson was possibly the most honest of politicians. Trying to introduce a GST into the Australian Landscape was a difficult sell and we, cartoonists, did not hold fire… Keating had tried to introduce a GST nearly a decade before — and this did not pass mustard with anyone… So selling the GST to the sophisticated Aussies, was like selling a reheated soufflé. Stale:

THE beginning of the end of a beautiful friendship between prime minister Bob Hawke and treasurer Paul Keating in 1985 is revealed in cabinet documents released by the National Archives.

Cabinet strongly backed Mr Keating's tax reform centrepiece - a consumption tax - but Mr Hawke, although an initial supporter, baulked amid opposition from unions, the welfare lobby and business and pulled the rug from under his treasurer. It was John Howard, 15 years later, who was to introduce a GST.

https://www.smh.com.au/national/how-the-hawke-keating-team-unravelled-over-tax-20121231-2c2t8.html

—————————

It took John Howard, the master of lies, bullshit, cons, deceit and porkies inc, elected in 1996, to introduce the Goods and Services Tax after he promised he would NEVER EVER do it. Under various threats of damnation and promises of heavenly state taxes being abolished, John Winston Howard pulled it off a few years later in 1999. The whole thing was a way to unify tax systems across the developed world — a tax system concocted by the World Bank, except for America which of course controls the World Bank. The US still has “State Taxes”…

The John Hewson birthday cake was a source of confusion as some items, raw food, were GST exempt, but processed foods were not. Retailing such a cake by a cake shop was a nightmare of accounting.

One of the fear that has not eventuated has been that, set at 10 per cent added to the added value of whatever, the tax can easily be cranked up to various levels, like those in Denmark, where the GST stands at 25 per cent. Most of Europe and the UK hold back the tax at 20 per cent, but trying to increase the fuel excise in France created the Yellow Vest Revolution. Sill simmering (then came El Covido-diecinueve).

Why is Gus mentioning the GST? Well, despite Aussies being suave sheep and trailblazing thongs wearers, they may not like a rise of the caper in order to pay for the HUGE DEFICIT that is growing daily due to the Covidemic. The alternative would be to charge a inheritance tax that would be simply bypassed by the rich class Family Trusts and the Increase of GST would not affect the north shore drivers who drive their kiddies to school in their SUVs, because the capers are supposed to be for farmers and have a discounted tax system. Bless the SUV gas guzzlers.

So, I can smell the wind, as Labor, in YET ANOTHER moment of weakness would approve a rise of the GST to 12.5 per cent but to make the maths a bit easier, the Scomologist government would set it a 15 per cent… There had been such rumours before.

The alternative to raising the GST is to sell more crap to the Chinese and this is an unlikely caper… Meanwhile, Negative Gearing is still very popular amongst politicians and the removal of which is as popular as a redback spider on a toilet seat and taxing the family home is also appetising like the sewer network.

Meanwhile, back in the black is not a necessity as long as we all live well… The final option is not to worry about the deficit. Done. See you later.

GL.

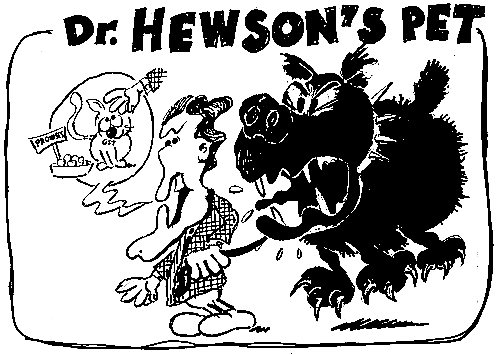

Cartooning since 1951. Cartoons of Dr John Hewson from 1992-93.

- By Gus Leonisky at 30 Dec 2020 - 11:07am

- Gus Leonisky's blog

- Login or register to post comments

the hungry tax...

Cartoons by Gus Leonisky (1992/93)...

In regard to taxes, a cartoon in the New Yorker c 1930s, shows the RICH ESCAPING California IN A CONVOY, because of new State TAX. Here is section of this quite large toon:

See also:

of taxes and revolutions...don't worry, the orchestra is still playing...

There’s a big issue in terms of the properties that will no longer be paying rent, Max Keiser says.

He points out that landlords won’t be able to pay back loans to the banks which, in turn, won’t be able to service their portfolios, meaning that the Central Bank will have to bail them out. However, the central bankers are “already completely constrained with their ability to bail out the system anymore after they’ve been bailing out the system nonstop for 12 years,” he explains.

“This is just another piece of the sinking of the global financial Titanic. They hit the iceberg in 2008,” he concludes, adding, “That’s where we are at now – the beginning of the end.”

Read more/see more:

https://www.rt.com/business/502673-global-financial-titanic-sinking/

Read from top.

ps: The US deficit is approaching $30 trillion, so a couple more or less trillion won't make much difference... That's what the denialists of global warming tell us: a couple of degrees more is okay and climate changes all the time.

the price of beer...

A three-year pitched political battle to put in place the goods and services tax so dominated the thinking of the Howard government that it had to decide when to shut the nation's pubs while fighting off internal concerns on everything from petrol to the red tape faced by businesses.

Cabinet papers from 2000 released on Friday by the National Archives of Australia reveal the extent then-Prime Minister John Howard, Treasurer Peter Costello and other senior ministers wrestled with the minutiae of a generational change in the nation's tax system.

Mr Howard, who had previously ruled out a GST, narrowly won the 1998 election promising the consumption tax would replace the wholesale tax system, deliver guaranteed revenue to the states and shift tax off personal income.

After Mr Howard struck a deal with the Australian Democrats to get the GST through the Senate, he, Mr Costello and the rest of the government had to focus on how to put in place the tax that started operation on July 1, 2000.

Read more:

https://www.smh.com.au/politics/federal/it-was-heated-cabinet-papers-show-john-howard-s-government-grappled-with-how-to-introduce-the-gst-20201223-p56pv8.html

Read from top.