Search

Democracy Links

Member's Off-site Blogs

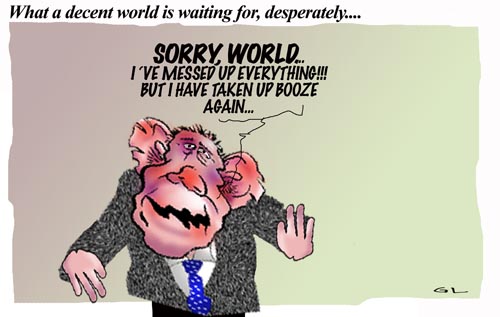

bottle futures .....

from Crikey …..

Markets correct, Bush urges calm. Uh oh

Eureka Report publisher Alan Kohler writes:

There is absolutely nothing more worrying for an investor than seeing a US President telling "The American People" not to panic.

I was doing more or less OK last week until George W. Bush appeared on the box flanked by his entire team of economic advisers looking gravely reassuring and saying: "The world economy is strong. And I happen to b’lieve that the world is strong because American is strong."

Uh oh. This is bad. Dubya didn’t materialise before us and tell us not to panic during last February’s correction, or even last year’s big one.

Nobody, especially President Bush, knows how this correction will play out, or whether we have seen a long-term peak in the markets and the end of the debt-funded leveraged buyout boom.

So given the uncertainties around, it is too early to start buying into the correction: subscribers should hold their fire. Good buying opportunities may come up in the months ahead but given the unpredictable panicky contagion that has gripped the markets you should hold off for the time being.

The bedrock of this bull market has been the best global growth environment for four decades, brought on by the strength of global trade and the emergence of China and India.

Today’s rise in BHP Billiton’s price, which kept the morning damage on the local market to a minimal 0.5% or so, is a reminder that those things are still in place.

What’s more share price valuations have still not gone to the level that usually precedes a bear market.

But a fire has broken out that has not been brought under control, so it is best to watch from as safe a distance as possible.

What happened last week was that some investment banks couldn’t get away low grade debt issues to fund leveraged buy outs (US$22 billion for Boots and Chrysler and Tyco pulled a US$1.5 billion issue on Thursday). That sparked the equities rout.

If all that happens now is that a renewed episode of risk aversion increases the price of risk as investors flip temporarily from greed to fear, then we have a correction.

If that risk of a debt conflagration turns into the reality of an economic downturn, then we have something else entirely.

This is an extract of today’s extended coverage in Eureka Report on the shake-out in global markets.

- By Gus Leonisky at 30 Jul 2007 - 7:53pm

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

3 hours 8 min ago

4 hours 19 min ago

5 hours 30 min ago

6 hours 1 sec ago

6 hours 11 min ago

6 hours 15 min ago

7 hours 44 min ago

10 hours 2 min ago

11 hours 30 min ago

12 hours 23 min ago