Search

Recent comments

- waste of cash....

1 hour 18 min ago - marles' bluster....

1 hour 39 min ago - fascism français....

1 hour 43 min ago - russian subs in swedish waters....

2 hours 22 min ago - more polling....

1 hour 51 min ago - they know....

6 hours 39 min ago - past readings....

7 hours 38 min ago - jihadist bob.....

7 hours 44 min ago - macronicon.....

9 hours 39 min ago - fascist liberals....

9 hours 40 min ago

Democracy Links

Member's Off-site Blogs

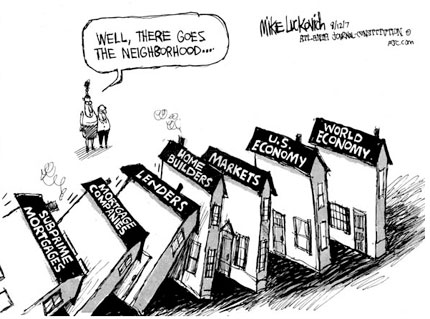

betting the house .....

from the Center for American Progress

Bear Stearns chairman James Cayne was known for his love of playing bridge and often criticized for being "out of touch from his embattled Wall Street firm." Caynes, however, now finds himself squeezed out as the federal government made a high-stakes gamble to keep capital markets from collapsing around him. On Sunday, the Federal Reserve decided to "essentially finance the takeover of collapsing investment bank Bear Stearns" by J.P. Morgan.

In what is believed to be the "largest Fed advance on record to a single company," the government will provide as much as $30 billion in financing collateralized by Bear Stearns's less-liquid "difficult to value" assets, such as mortgage-backed securities that the firm has been unable to sell.

This move by the Bush administration appears to follow a familiar double standard coming from officials who chastise members of Congress trying to help stabilize housing markets about the harm of government intervention. Once again, the rules that bar help to American families don't apply when it comes to Wall Street.

The administration may have been right that our economy had too much at stake to let a run on Bear Stearns drag down the whole financial system. But the same contagion theory applies to the housing market, where a downward spiral of home prices is spinning out of control with the potential for even more devastating effects on communities and the economy.

In 1996, William Cohen, then a Republican senator from Maine, said, "We have been saying for so long that government is the enemy. Government is the enemy until you need a friend." Indeed, over the weekend, Wall Street - which has balked at government regulation and paying capital gains taxes - barely seemed to hesitate before turning to the federal government for help. Concerned about the serious consequences for the rest of the financial system if one of Wall Street's largest companies was lost, the Fed "offered Bear Stearns a financial lifeline but demanded control over the bank's fate in return for keeping it out of bankruptcy." J.P. Morgan was able to buy Bear Stearns for only $2 a share. Unwilling to "take the risk of about $30 billion worth of assets on Bear Stearns's books, in particular bonds linked to troubled mortgages, the Fed agreed to guarantee those securities" for J.P. Morgan.

The federal government would receive any profit from the sale of these assets, but taxpayers would also "be on the hook" for any losses. As William W. Beach, a senior fellow of economics at the conservative Heritage Foundation noted, "Last week, the position of the Bush administration was to let markets correct themselves and to allow no bailouts and no subsidies. Somewhere over the last four days, that policy changed. They discovered the rules of the road just didn't apply."

Experts worry that Lehman Brothers, in particular, is also on shaky ground; the firm's shares were down 19 percent after the weekend's news. Europe's largest bank, UBS, "which has recorded huge losses from mortgage investments like those at its U.S. counterparts," also "suffered its sharpest drop in European trading in nearly 10 years."

In order to avert a wider financial meltdown, the Fed cut the rate on direct loans to banks and "took the extraordinary measure of allowing securities firms to borrow from the central bank under terms normally reserved for regulated banks." In today's Washington Post, columnist E.J. Dionne wonders whether Wall Street will "feel a bit of gratitude, perhaps by being willing to have the wealthy foot some of the bill or to acknowledge that while its denizens were getting rich, a lot of Americans were losing jobs and health insurance."

In his weekly radio address - just one day before the government stepped in and bailed out Bear Stearns - President Bush said, "If we were to pursue some of the sweeping government solutions that we hear about in Washington, we would make a complicated problem even worse - and end up hurting far more homeowners than we help."

In the end, the Bush administration threw out its conservative principles and saved the firm from complete collapse to protect the larger market. As recently as Sunday, Paulson was still insisting that "government intervention" for homeowners would "raise more problems and do more harm than they would do good."

Center for American Progress Senior Fellow David M. Abromowitz notes the contradictions in the Bush administration's approach: "Bear Stearns is too important to allow to fail, but millions of homeowners can end up on the street when home prices plummet sharply.The Wall Street holders of overvalued mortgage pools are too important to fail, but homeowners drowning in debt are told to keep paying [no] matter what. Or consider that big oil company tax breaks are too integral to our energy plan, but relief for millions of drivers squeezed by rising gasoline prices would be bad economic policy."

- By John Richardson at 19 Mar 2008 - 10:43pm

- John Richardson's blog

- Login or register to post comments

sublime bushit .....

Former Federal Reserve Chief Alan Greenspan says the U.S. economy is in the worst shape in 60 years: "The current financial crisis in the US is likely to be judged in retrospect as the most wrenching since the end of the Second World War," Greenspan said in a Financial Times commentary.

But no need to panic folks …..

President George W. Herbert Hoover Bushit says his government has stabilized the crisis & it wasn't even all that difficult. It just required putting in a little overtime ….

"I want to thank you, Mr Secretary, for working over the weekend," bushit said as he met with his economic advisors at the White House. "You've shown the country & the world that the United States is on top of the situation."