Search

Recent comments

- faceblock......

1 hour 45 min ago - 22-......

2 hours 51 min ago - biden's tall tales.....

3 hours 30 min ago - borrell's bargain.....

3 hours 34 min ago - "restraint"......

4 hours 39 min ago - with US seals?.....

5 hours 12 min ago - bettering hitler ......

5 hours 31 min ago - half understanding....

6 hours 15 min ago - fighting nazis....

6 hours 43 min ago - ballooningomics....

21 hours 2 min ago

Democracy Links

Member's Off-site Blogs

oil futures .....

- By Gus Leonisky at 12 Aug 2008 - 9:00pm

- Gus Leonisky's blog

- Login or register to post comments

snake oils...

An Empty Promise

By BOB HERBERT

Senator John Kerry was on the phone and the words were coming in a rush.

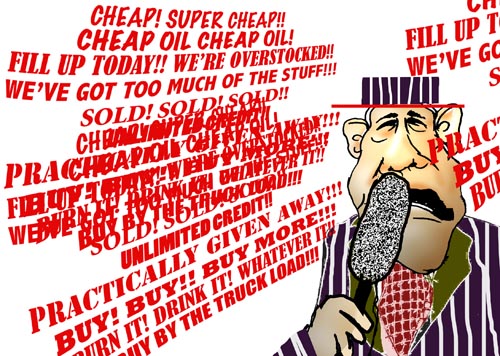

“It’s a completely fraudulent argument,” he said. “It’s misleading. It’s snake oil salesmanship of the worst order.”

He was talking about the latest smoke screen in the presidential election, the bogus contention that lifting restrictions on offshore oil drilling would somehow, in the foreseeable future, bring down the price of gasoline for American motorists.

This absurd contention is now one of the main issues of the campaign. It’s the latest example of a very real fear (that sky-high energy prices will undermine the average family’s standard of living) being exploited shamelessly for political purposes.

Senator John McCain told cheering bikers at a giant motorcycle rally in South Dakota: “We’re gonna drill offshore! We’re gonna drill here, and we’re gonna drill now!” He told an audience in Lafayette Hill, Pa.: “We have to drill here and drill now. ... Drill here and drill now.”

With Senator McCain and the Republicans painting a false portrait of drilling as a method of relief for today’s high prices, and with polls showing the G.O.P. gaining traction on this issue, Senator Barack Obama has eased off his previous opposition to new offshore leases.

And so dies the possibility of the presidential campaign offering any real clarification of this important issue.

As Senator Kerry and many others have pointed out, it would be nearly 10 years before any oil at all would be realized from new offshore leases. So your adorable 7- or 8-year-old would be just about 17 and clamoring for a license when this new oil started coming online.

Maximum capacity from these new leases wouldn’t be reached until 2030, when that 7- or 8-year-old is approaching 30, finished with college and graduate school, and very likely married with children.

And even then — after more than two decades and who knows how many graduations, weddings, funerals and family cars — even then, the amount of oil expected to come from these leases would have little or no effect on the price of gasoline at the pump.

Assuming that everything over all those years goes all right, it is estimated that an additional 200,000 barrels of oil a day would come from the additional offshore drilling. That’s a tiny share of the world’s daily output of 85 million or so barrels.

Here’s what the Energy Information Administration, the statistical agency that provides official data for the federal government, had to say about the anticipated additional output from offshore drilling:

“Because oil prices are determined on the international market ... any impact on average wellhead prices is expected to be insignificant.”

moneypoly...

From George Monbiot at The Guardian

To keep the pudding flowing, the administration must exaggerate the threats from nations that have no means of nuking it - and ignore the likely responses of those that do. Russia is not without its own corrupting influences. You could see the grim delight of the Russian generals and defence officials last week, who have found in this new deployment an excuse to enhance their power and demand bigger budgets. Poor old Poland, like the Czech Republic and the UK, gets strongarmed into becoming America's groundbait.

If we seek to understand American foreign policy in terms of a rational engagement with international problems, or even as an effective means of projecting power, we are looking in the wrong place. The government's interests have always been provincial. It seeks to appease lobbyists, shift public opinion at crucial stages of the political cycle, accommodate crazy Christian fantasies and pander to television companies run by eccentric billionaires. The US does not really have a foreign policy. It has a series of domestic policies which it projects beyond its borders. That they threaten the world with 57 varieties of destruction is of no concern to the current administration. The only question of interest is who gets paid and what the political kickbacks will be.

oils ain't (yesteryear's) oils

As Oil Giants Lose Influence, Supply Drops

By JAD MOUAWAD

Oil production has begun falling at all of the major Western oil companies, and they are finding it harder than ever to find new prospects even though they are awash in profits and eager to expand.

Part of the reason is political. From the Caspian Sea to South America, Western oil companies are being squeezed out of resource-rich provinces. They are being forced to renegotiate contracts on less-favorable terms and are fighting losing battles with assertive state-owned oil companies.

And much of their production is in mature regions that are declining, like the North Sea.

The reality, experts say, is that the oil giants that once dominated the global market have lost much of their influence — and with it, their ability to increase supplies.

“This is an industry in crisis,” said Amy Myers Jaffe, the associate director of Rice University’s energy program in Houston. “It’s a crisis of leadership, a crisis of strategy and a crisis of what the future looks like for the supermajors,” a term often applied to the biggest oil companies. “They are like a deer caught in headlights. They know they have to move, but they can’t decide where to go.”

pocket power...

From the BBC

With gold prices skyrocketing, the Mayans of Guatemala find themselves caught up in a new rush for the precious metal.

Mario Tema sits across from me, a Mayan with a mission.

We are in the town of Sipacapa in the Western Highlands of Guatemala, washing down a breakfast of tamale and beans with a cup of freshly brewed coffee.

As he tells me of the town's fight against a huge open pit gold mine, that famous picture of Che Guevara gazes at us from the wall. Here in Sipacapa, Mario Tema is an anti-mining icon.

Last year he travelled to Vancouver, where the mine's Canadian owner, Goldcorp, has its headquarters. He went to speak out against the mine at the company's annual shareholders meeting.

"After I spoke at the meeting," he says, "a shareholder approached me and he told me 'I don't care about your cause, all I care about is the money in my pocket."

profession: speculator...

A Few Speculators Dominate Vast Market for Oil Trading

By David Cho

Washington Post Staff Writer

Thursday, August 21, 2008; A01

Regulators had long classified a private Swiss energy conglomerate called Vitol as a trader that primarily helped industrial firms that needed oil to run their businesses.

But when the Commodity Futures Trading Commission examined Vitol's books last month, it found that the firm was in fact more of a speculator, holding oil contracts as a profit-making investment rather than a means of lining up the actual delivery of fuel. Even more surprising to the commodities markets was the massive size of Vitol's portfolio -- at one point in July, the firm held 11 percent of all the oil contracts on the regulated New York Mercantile Exchange.

The discovery revealed how an individual financial player had gained enormous sway over the oil market without the knowledge of regulators. Other CFTC data showed that a significant amount of trading activity was concentrated in the hands of just a few speculators.

The CFTC, which learned about the nature of Vitol's activities only after making an unusual request for data from the firm, now reports that financial firms speculating for their clients or for themselves account for about 81 percent of the oil contracts on NYMEX, a far bigger share than had previously been stated by the agency. That figure may rise in coming weeks as the CFTC checks the status of other big traders.

Some lawmakers have blamed these firms for the volatility of oil prices, including the tremendous run-up that peaked earlier in the summer.

"It is now evident that speculators in the energy futures markets play a much larger role than previously thought, and it is now even harder to accept the agency's laughable assertion that excessive speculation has not contributed to rising energy prices," said Rep. John D. Dingell (D-Mich.). He added that it was "difficult to comprehend how the CFTC would allow a trader" to acquire such a large oil inventory "and not scrutinize this position any sooner."

As the price of oil tumbles...

As the price of oil takes the plunge, relatively, who or what is responsible? Is this the slack before the bum rush and sky-rocketing prices? Who benefits from the lower price at the moment, apart from the pumps. Did someone stockpile oil at the high price and now waiting for the cost to double?

Or is it because:

Dollar Gains Strength Against Euro As European Economies Shrink

By Ye Xie and Agnes Lovasz

Bloomberg News

Wednesday, September 3, 2008; D06

NEW YORK, Sept. 2 -- The dollar on Tuesday rose to the highest level against the euro in almost seven months as crude oil fell and traders speculated that the Federal Reserve's monetary policy would help the U.S. economy outperform Europe's and Asia's.

The British pound fell to a two-year low versus the dollar on evidence of a looming recession in Britain. Australia's dollar declined to its weakest level in almost a year after the central bank cut interest rates for the first time since 2001 and said economic growth would slow.

-------------

In a way: a bit of consolidation rather than expansion should be welcome. Too much credit has created a fluctuating slosh that may have profited the clever swimmers but most of us would have struggled against the tide of exaggerated borrowings, even if the water was balmy. Drowning in debt is not pleasant.

see toon at top...

grease pole

September 17, 2008

As Oil Declines, Surge in Gasoline Prices Slows

By CLIFFORD KRAUSS

HOUSTON — The surge in gasoline prices slowed a bit on Tuesday as oil companies reported that the damage from Hurricane Ike to production platforms and refineries appeared to be relatively minor.

The upbeat reports, though preliminary, were one of several reasons oil prices continued their slide Tuesday, dropping to $91.42 a barrel, down $4.29 on the New York Mercantile Exchange. It was the second consecutive day of big retreats that have brought crude down more than $50 below its peak of $145.29 a barrel in July.

The collapse in oil prices appears to be stem mainly from a growing perception that the global economy is sliding into a recession. It comes despite escalating rebel attacks on oil operations in Nigeria and two major hurricanes that have shut down 20 percent of the nation’s refining capacity and almost all of the oil and natural gas production in the Gulf of Mexico.

But even as oil prices are sliding, gasoline prices are going up because of tightening supplies. The average price for a gallon of unleaded gasoline rose about a penny overnight, to $3.85, according to AAA, the automotive club. That is an unusually large rise, but it was considerably slower than the 16-cent-a-gallon rise in recent days as Ike passed through the Gulf and damage reports began to come in.

The oil companies have flown over their oil and gas platforms and begun sending crews to their most important production and refining facilities. The preliminary news is good, with only 28 mostly older and smaller platforms out of a total of 3,800 oil and gas platforms reported destroyed and little flooding or structural damage to more than 20 refineries in and around Hurricane Ike’s path.

Gulf oil and gas production trickled back Tuesday, but 97.2 percent of oil production and 84.2 percent of gas production was still off line, according to the Minerals Management Service.

“We did better than we thought,” said Chip Johnson, president and chief executive of Carrizo Oil and Gas.

--------------

read more at the NYT and see toon at top... I though I was flippant but reality overtook the toon... I am more of an expert on this than the "industry experts" analysts mentioned in the article below the toon...

50 % off....

OPEC Ponders Choices As Oil Prices Plummet

By JAD MOUAWADAt the beginning of the year, OPEC producers felt confident that strong economic growth and tight supplies would keep oil prices high. When oil crossed the $100-a-barrel threshold in February, the cartel’s president blamed speculators and said there was not much OPEC could do.

But now, panic is gripping producers as prices drop. Oil is down by half since July, and the speed of the decline has stunned oil-rich governments that have become dependent on high prices.

As the global economy continues to weaken, the Organization of the Petroleum Exporting Countries faces its toughest test in years.

The problem for the oil exporters, who meet for an emergency session in Vienna on Friday, is to find a way to stop the price drop at a time when oil consumption is falling markedly in industrialized countries. Even the Chinese economy, long the biggest engine of growth for oil demand, seems to be cooling.

Most analysts expect the group to announce a production cut of at least a million barrels a day, which would be more than 1 percent of the world oil supply. Chakib Khelil, OPEC’s president, said last week that an output cut was “obvious” and suggested the group might meet often in coming months for further adjustments.

History suggests that OPEC will face a tough time propping up prices as oil consumption slows and the world teeters on the edge of a global recession, analysts said. Some experts warn that if the cartel took too much oil off the market, it could push prices up so much as to worsen the global economic crisis.

“OPEC’s problem is they don’t know how much demand is falling,” said Jan Stuart, an energy economist at UBS. “So the risk they run is either they don’t do enough, or they do too much. That’s a tough choice.”

Nobuo Tanaka, the executive director of the International Energy Agency, said a cut in production could harm consumers and delay an economic recovery. “The slowdown may be prolonged,” Mr. Tanaka told reporters on Monday in Paris, where the energy agency, which advises industrialized countries, is based.

Oil prices settled at $70.89 a barrel on Tuesday, down $3.36 and near the 14-month low they reached last week.

see toon at top...

oily ups and downs

Some Regret Locking In Price for Oil

By KEN BELSONAfter the rapid run-up in oil and gas prices over the past two years, many consumers have been happy to see them subside in recent weeks.

But then there are those who tried to outsmart the market by signing contracts this summer — when prices peaked — locking in rates for delivering home heating oil through the winter. They will most likely end up paying more than their neighbors to heat their homes and apartments this winter.

Barbara Daley, who is 76 and lives on Long Island, signed up in September at $4.22 a gallon. Now, with prices around $3.10, she is looking for a little sympathy. Mrs. Daley said her heating oil company, which she did not want to antagonize by naming, told her it would cost $599 to terminate the contract — about what she paid to fill up her 250-gallon tank one time last winter.

“They said it might go up to $6, so I locked in a fixed price,” Mrs. Daley said. “I’ve been with this company 30, 35 years. You would think you would get some consideration. I’m not asking for the world.”

oil barons' barrel cuts

OPEC Orders Cut in Oil Production

By NELSON D. SCHWARTZ and JAD MOUAWADVIENNA — Stung by what it called “a dramatic collapse” in crude prices, the OPEC cartel said Friday that it would reduce output by a steeper-than-expected 1.5 million barrels a day, and suggested more production cuts are coming as the global economic slowdown crimps oil demand.

The announcement was made after a brief emergency meeting here Friday morning. While it marks the deepest production cut since 2003, OPEC’s move failed to establish the price floor that members wanted. Oil fell as much as $5 a barrel by midday Friday and was trading below $65 in New York, down from $145 in July.

The cartel is not scheduled to meet again until Dec. 17 in Algeria, but OPEC’s president, Chakib Khelil, the Algerian oil minister, said “there will definitely be another cut” at that meeting or possibly earlier, if crude keeps falling.

“The fundamentals are not good,” Mr. Khelil said in an interview after the meeting. “This is a crisis situation.”greasy dollars

we've written and cartooned the same guff here and here and here and here and especially here before but it's worth repeating...

From the ABC unleashed:

Why oil is so important to US interests is best described by economist Henry CK Liu who was arguably the first to coin the term "dollar hegemony". Dollar hegemony describes a geopolitical phenomenon that emerged after the 1973 oil crisis in which the US dollar, a fiat currency since 1971, continues to serve as the primary reserve currency for international trade.

The US achieved this by switching from the Bretton Woods regime, established in 1945, which required a fixed exchange rate regime based on a gold-backed dollar, to an OPEC oil-backed dollar in 1973. This tectonic shift in the US exchange rate from US gold reserves to Middle Eastern black-gold reserves allowed the US dollar to become a fiat currency and the primary reserve currency internationally.

Henry CK Liu continues, "This was the price extracted from defenceless oil-producing nations for allowing them to nationalize the Western-owned oil industry on their soil. As long as oil transactions are denominated in fiat dollars, the US essentially controls all the oil in the world financially regardless of specific ownership, reducing all oil producing nations to the status of commodity agents of dollar hegemony."

As a result of this monopoly, in recent years the United States has absorbed around 85% of total global capital flows (about $500 billion each year) from Asia, Europe, Russia and the Middle East .

Any nation that seeks to break this oil denominated monopoly becomes a threat to US economic interests and may find itself vilified, destabilised or attacked as Saddam Hussein found to his dismay after he began selling Iraqi oil under the UN's Oil-for-Food program, in Euros in 2000.

see toon at top... and there others as mentioned.