Search

Recent comments

- ukraine's agony has not started yet....

15 hours 49 min ago - all defeated.....

16 hours 2 min ago - beyond crime.....

16 hours 51 min ago - the end....

17 hours 2 min ago - odessa....

18 hours 10 min ago - weitz....

20 hours 14 sec ago - bidenomics BS.....

20 hours 14 min ago - the defeat of ukraine is coming....

21 hours 2 min ago - paris is sick....

1 day 8 hours ago - German spies?....

1 day 9 hours ago

Democracy Links

Member's Off-site Blogs

one born every minute .....

Just days after the United States government brokered the sale of the nation’s largest failed savings and loan, Washington Mutual, regulators in Britain and Belgium swooped in this weekend to engineer emergency rescues of two leading European banks with heavy exposure to soured mortgages.

In the latest sign of trouble to hit Europe from the global credit crisis, Jean-Claude Trichet, the president of the European Central Bank, took the unprecedented step of joining Prime Minister Yves Leterme of Belgium and Dutch ministers in Brussels on Sunday to discuss an outright seizure or rescue of the Belgian-Dutch financial conglomerate Fortis. The shares have fallen by a third in two weeks and plunged 20 percent on Friday on concern over its ability to raise funds and remain solvent following an ill-timed, costly purchase of ABN Amro with a consortium of other banks.

The Belgian finance minister, Didier Reynders, said Sunday that “all options are open.” The government was also assessing interest for the largest bank in Belgium and Luxembourg from BNP Paribas of France and Dutch rival ING. But as was the case with buyouts arranged by the American government for Bear Stearns and, to some degree, Washington Mutual, these banks were demanding state guarantees, according to Belgian media reports.

Less than 200 miles away, British regulators were preparing to seize the troubled mortgage lender Bradford & Bingley after no private buyers emerged. The government held marathon meetings over the weekend to try to broker a deal to sell assets to various bidders or sell the bank to a rival, much as the Federal Deposit Insurance Corporation did when it took over Washington Mutual and immediately sold it to JPMorgan Chase on Thursday- By Gus Leonisky at 29 Sep 2008 - 8:31pm

- Gus Leonisky's blog

- Login or register to post comments

crooks, shonks and greedy operators

US must halt recession

Jon Stanford

The US Treasury chief Hank Paulson has really set the cat amongst the pigeons with his proposal to buy US$700 billion worth of bank debt. The US Congress is unhappy about many aspects of the plan - what particularly grates with them is the feeling that it is a plan by a Wall Street insider to advantage Wall Street. They are not wrong about this. But the issue which brought the plan up is so serious that positive and urgent action is necessary.

The underlying issue is that without some such plan the US economy will tip into a recession with a fall in economic activity and GDP, a rise in unemployment and the prospect of a continued downward spiral. This would be disastrous for the US and cause shock waves around the world.

World trade will slow as will China's growth and its demand for Australia's exports. A recession of any size will impact on Australia in other ways through an increased credit squeeze and a loss of confidence.

Both Paulson and Federal Reserve chairman, Ben Bernanke, are aware that continuation of the financial turmoil will cause banks to freeze lending to business, households and consumers even more than they have to date. Herein lies the road to recession.

The sole objective they are trying to achieve is the maintenance of economic activity at the current level, at least. Other effects which are not palatable such as bailing out more financial institutions, saving finance capitalism, running up a large debt for the US taxpayers and even increasing inflationary pressures can be ignored if recession is kept at bay.

.....

For me, there is no choice - give me the plan. You had better believe that this is serious because it really is. A five per cent fall in GDP would be the worst recession in the US after World War II.

There is anger in the US about Wall Street and the "Masters of the Universe" who run investment banks. A good kicking would be good for them. The problem Congress faces is how to find a way to shaft Wall Street and its nasty inhabitants without causing a recession which will bring grief to millions of people around the world.

-------------------------

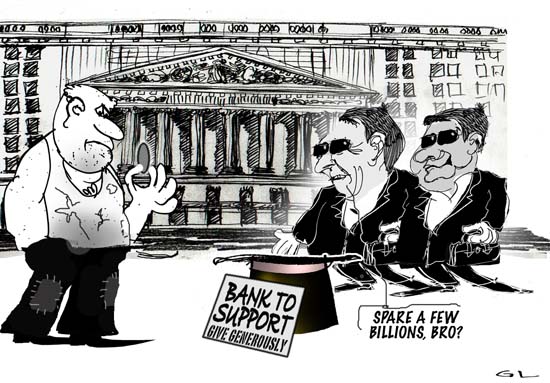

Gus: I disagree somewhat. The sweet rescue package will not do what it's "supposed" to do. We are sold that if Wall Street is protected from a crash it will protect us... Crap. All the package does is give a cushioned exit strategy to some crooks, shonks and greedy operators who knew they were manipulating the markets beyond its limits — not on our behalf but to line their pockets and that of their greedy masters — while taking us to the cleaners.

In fact this recession, whether it comes or not, might be the way to clean up the air and reset the parameters of trade and money lending. The US$ 700 Bn package does not do that, despite some window dressing... It leaves room opened for more abuse and some swiftly siphoning of cash away from where it's needed. People will resent anyone who's goofed to profit from it.

I would not be surprised if in six month time we are in the same boat and another bigger package is needed because the first one, this one, did not work well to spook or imprison the swindlers. And there are far too many out there. In my estimate, about 50 per cent of this 700 billions will be "wasted"— pocketed by an elite contigent of tricksters to the detriment of the greater community that has been conned...

New rules need to be set so that everyone can profit without costing the health of the planet. A recession could be the first step towards a new economic and environmental reality that reduces humanity's carbon footprint. We'll need to be more thrifty and clever rather than ruthless and greedy. This package encourages more of the latter in a lazy way...

I could be wrong.see toon at top.

bold rejection...

from the New York Times

Another Texas Republican, John Culberson, spoke scathingly about the unbridled power he said the bill would hand over to the Treasury secretary, Henry M. Paulson Jr., whom he called “King Henry.”

A third Texan, Lloyd Doggett, a Democrat, said the negotiators had “never seriously considered any alternative” to the administration’s plan, and had only barely modified what they were given. He criticized the plan for handing over sweeping new powers to an administration that he said was to blame for allowing the crisis to develop in the first place.

The administration accepted limits on executive pay and tougher oversight; Democrats sacrificed a push to allow bankruptcy judges to rewrite mortgages. But Republicans fell short in their effort to require that the federal government insure, rather than buy, the bad debt.

The final version of the bill included a deal-sealing plan for eventually recouping losses; if the Treasury program to purchase and resell troubled mortgage-backed securities has lost money after five years, the president must submit a plan to Congress to recover those losses from the financial industry.

Presumably that plan would involve new fees or taxes, perhaps on securities transactions.

The deal would also restrict gold-plated farewells for executives of companies that sell devalued assets to the Treasury Department. But by mid-afternoon on Monday, no one could safely predict whether the provisions in the 110-page bill were strictly academic.

“The legislation has failed,” Speaker Pelosi said at a news conference after the vote. “The crisis has not gone away. We must continue to work in a bipartisan manner.”

on planet confusion...

'Different world'

Fellow analyst Masamichi Adachi said global financial markets were unlikely to stabilise even if the House does pass the bill on Friday.

"It's a completely different world now," he said.

"All the things US authorities are doing now are simply aimed at preventing a global meltdown.

"They might trigger a short rally in markets but won't offer a fundamental solution."

Japanese Prime Minister Taro Aso said his government would co-operate with the Bank of Japan to maintain financial stability in Japan.

The Bank of Japan said it had injected one trillion yen ($9.5bn) into the financial system, for the 12th straight business day.

zilch it is...

True Confessions of a Conflicted Money Guru

By Joel Lovell

Sunday, March 1, 2009; B01

I write a monthly column for GQ magazine called "Men + Money," and I had this moment recently, as I was writing about how to rethink 401(k) allocations, when I got to the end of a paragraph and reread it and thought, "There's a good chance that what I just wrote is precisely the wrong advice." I tried to figure out how to acknowledge that in the column itself and say, basically, "Please don't make any important financial decisions based on what I'm telling you to do. I honestly don't know. But also please come back and read what I have to say next month!" It wasn't the kind of column that inspired a ton of confidence, money-management-wise.

--------------------

Gus' advice: put the cash under the bed and use it as required to buy essentials, repay your debts as soon as possible and brace yourself till the end of the storm in 2022... Who knows... The rules of games and the goal posts have shifted by a million miles...