Search

Recent comments

- the game of war....

48 min 31 sec ago - three packages....

2 hours 8 min ago - russian oil.....

2 hours 15 min ago - crime against peace....

10 hours 27 min ago - why is Germany supporting the ukrainian nazis?....

11 hours 40 min ago - sanctioning....

14 hours 24 min ago - politico blues....

15 hours 3 min ago - gender muddles....

15 hours 24 min ago - war crimes and war crimes....

18 hours 13 min ago - new yourp....

18 hours 53 min ago

Democracy Links

Member's Off-site Blogs

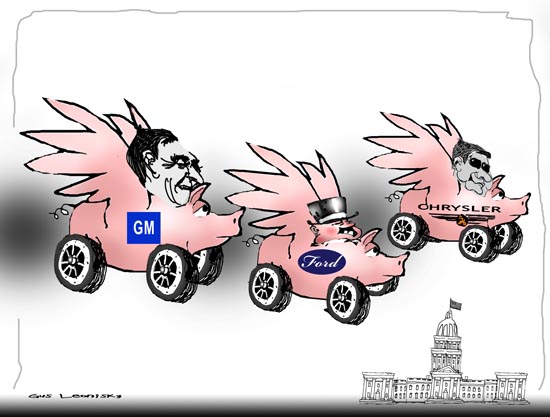

from the auto club .....

Detroit came to Capitol Hill on Tuesday, cap in hand and requesting $25bn in alms.

As if to underline the fact that the financial crisis is shaping every corner of industry, the three top executives of what is still known as the Big Three companies of the US car industry appeared at the US Senate banking committee asking for a slice of the US's $700bn (£467bn) financial rescue package.

Alan Mulally, president and chief executive of Ford Motor, Robert Nardelli, chairman and chief executive of Chrysler, and Rick Wagoner, chairman and chief executive of General Motors, invoked the prospect of ruin for the sector if the loan they sought was not forthcoming, with devastating effects for the US economy. "We're in probably the worst economic situation that the industry has ever been in," Mr Mulally said before the hearing.

Detroit's Executives Go Cap In Hand For $25bn

along the way …..

There are 24 daily nonstop flights from Detroit to the Washington area. Richard Wagoner, Alan Mulally and Robert Nardelli probably should have taken one of them.

Instead, the chief executives of the Big Three automakers opted to fly their company jets to the capital for their hearings this week before the Senate and House - an ill-timed display of corporate excess for a trio of executives begging for an additional $25 billion from the public trough this week.

"There's a delicious irony in seeing private luxury jets flying into Washington, D.C., and people coming off of them with tin cups in their hands," Rep. Gary L. Ackerman (D-N.Y.) advised the pampered executives at a hearing yesterday. "It's almost like seeing a guy show up at the soup kitchen in high-hat and tuxedo. . . . I mean, couldn't you all have downgraded to first class or jet-pooled or something to get here?"

The Big Three said nothing, which prompted Rep. Brad Sherman (D-Calif.) to rub it in. "I'm going to ask the three executives here to raise their hand if they flew here commercial," he said. All still at the witness table. "Second," he continued, "I'm going ask you to raise your hand if you're planning to sell your jet . . . and fly back commercial." More stillness. "Let the record show no hands went up," Sherman grandstanded.

By now, the men were probably wishing they had driven -- and other members of the House Financial Services Committee weren't done riding the CEOs over their jets. "You traveled in a private jet?" Rep. Nydia M. Velázquez (D-N.Y.) contributed. Rep. Patrick T. McHenry (R-N.C.) felt the need to say that "I'm not an opponent of private flights by any means, but the fact that you flew in on your own private jet at tens of thousands itself dollars of cost just for you to make your way to Washington is a bit arrogant before you ask the taxpayers for money."

Flying From Detroit On Corporate Jets, Auto Executives Ask Washington For Handouts

& finally, at the last pit stop …..

The chief executives of Detroit’s Big Three automakers departed Washington empty-handed on Wednesday night after two days of pleading for a financial lifeline on Capitol Hill.

As the public hearings and intense behind-the-scenes negotiations appeared to come to naught, the Senate majority leader, Harry Reid of Nevada, went to the floor seeking to bring up the Democrats’ plan to provide $25 billion in aid from the $700 billion financial bailout program. The Republicans objected, effectively killing the plan.

Senator Christopher S. Bond, Republican of Missouri, then requested that the Senate consider a compromise measure that would speed access to $25 billion in federally subsidized loans that have been signed into law by President Bush. Those loans, however, were meant to help the auto companies retool their plants to make fuel-efficient vehicles, so Mr. Reid objected to that.

In an interview on Wednesday evening in his Washington office, Rick Wagoner, the chief executive of General Motors, the most imperiled of the auto companies, struggled to remain upbeat after two days of grueling testimony. Lawmakers had criticized Mr. Wagoner and the two other chief executives for failing long ago to build better cars or to revamp their operations. They were even attacked for traveling to Washington in corporate jets, which some lawmakers mocked as hardly a sign of frugality.

- By Gus Leonisky at 22 Nov 2008 - 8:33pm

- Gus Leonisky's blog

- Login or register to post comments

skyrocketing on tires...

Executive Proposals Push Funding Past $25 Billion

By Kendra Marr and William Branigin

Washington Post Staff Writers

Tuesday, December 2, 2008; 5:02 PM

Detroit's Big Three automakers painted a bleak outlook for Congress today in making their case for federal funding.

The price tag to sustain the industry through a prolonged economic slump could skyrocket past the $25 billion in emergency loans that the companies' top executives pleaded for last month, according to documents submitted by the automakers.

Under a worst-case scenario, assuming that the nation's recession persists into 2010, General Motors predicts it would need up to $18 billion in government funding and Ford says it would need up to $13 billion. In a forecast based on vehicle sales at "current rates" and a recession that lasts through 2009, Ford pegs its funding needs at "up to $9 billion" but says it hopes to avoid drawing on such a federal bridge loan. During a first round of congressional hearings last month, Chrysler estimated it would need between $7 billion and $8 billion.

GM announced today that it is in particularly dire straits. The automaker said it will collapse without a $4 billion cash injection by the end of this month.

Assuming that economic conditions do not change, GM said it would need $12 billion by late March to keep operating. It is also asking the government to provide an additional $6 billion in a committed line of credit to ensure stability if the economy erodes drastically -- bringing its total request for federal funding to as much as $18 billion.

In releasing its new business plan, GM said it would concentrate on four brands -- Chevrolet, GMC, Buick and Cadillac -- and would turn Pontiac into a niche brand that would complement Cadillac and GMC. The automaker said it plans to sell its Saab division and would begin discussions with Saturn dealers to fold or sell the brand.

democrats will not be driving toyotas...

Democrats in Congress Agree to Push Auto Bailout Plan

By DAVID M. HERSZENHORNWASHINGTON — Faced with staggering new unemployment figures, Democratic Congressional leaders said on Friday that they were ready to provide a short-term rescue plan for the cash-strapped American automakers, and expected to hold votes on the legislation during a special session next week.

Details of the rescue package were not immediately available but senior Congressional aides said that it would include billions of dollars in short-term loans to keep the automakers afloat at least until President-elect Barack Obama takes office.

Ending a weeks-long stalemate between the Bush administration and House Speaker Nancy Pelosi, senior aides said that the money would likely come from $25 billion in federally subsidized loans intended for developing advanced fuel efficient cars.

Ms. Pelosi had resisted using that money, which was approved as part of an energy bill last year, and Democrats had called repeatedly on the Bush administration or the Federal Reserve to act unilaterally, using existing authority, to aid the auto companies.

On Friday, Ms. Pelosi said that she would allow that money to be used provided “there is a guarantee that those funds will be replenished in a matter of weeks” and that there was no delay in working toward higher fuel-efficiency.

Word of a breakthrough came as Congress wrapped up two days of hearings at which lawmakers grilled the chief executives of the companies, Chrysler, Ford and General Motors, and experts warned that GM could collapse by the end of this month.

But it was the Labor Department’s report of 533,000 jobs lost in November that seemed to put a final halt to the hand-wringing on Capitol Hill and prompted the Democrats to announce that they would draw up legislation for votes next week.

------------------------

Gus: There is no point making motorcars unless someone buys them... and that the someone can afford putting fuel in it... The need to retool to make more efficient smaller cars, the need to reduce executive salaries, the need to change perceptions — including more efficient "public" transport, all are necessary not so much to save the car industry but to save the planet as well. This financial crisis brought by too much credit and too much greed at many level should be used positively to massively reduce our energy consumption, as well as realigning our many social disparities. Will we be grown up enough to do it or will the same rule of grab-all and run still apply in a free, yet very expensive in the long run for the planet as a whole, "free market" economy? Will these "bailouts" making the dinosaurs such as banks and the car industry survive beyond their used-by-dates to the detriments of us all? We need to rethink the system fast. Should we rebuilt the same economic system, even with warning bells and whistles, we'll destroy the planet faster than we can imagine.

----------------

December 5, 2008 The Energy ChallengeEnergy Goals a Moving Target for States

By KATE GALBRAITH and MATTHEW L. WALDIn hopes of slowing global warming and creating “green jobs,” Congress and the incoming administration may soon impose a mandate that the nation get 10 or 15 percent of its electricity from renewable sources within a few years.

Yet the experience of states that have adopted similar goals suggests that passing that requirement could be a lot easier than achieving it. The record so far is decidedly mixed: some states appear to be on track to meet energy targets, but others have fallen behind on the aggressive goals they set several years ago.

The state goals have contributed to rapid growth of wind turbines and solar power stations in some areas, notably the West, but that growth has come on a minuscule base. Nationwide, the hard numbers provide a sobering counterpoint to the green-energy enthusiasm sweeping Washington.

Al Gore is running advertisements claiming the nation could switch entirely to renewable power within a decade. But most experts do not see how. Even with the fast growth of recent years, less than 3 percent of the nation’s electricity is coming from renewable sources, excepting dams.

“I think we are really overselling how quick, how easy and how complete the transition can be,” said George Sterzinger, executive director of the Renewable Energy Policy Project, a Washington advocacy group.

More than half the states have adopted formal green-energy goals. In many states the policies, known as renewable portfolio standards, are too new to be evaluated. But so far the number of successes and failures is “sort of a 50-50 kind of affair,” said Ryan Wiser, a scientist at Lawrence Berkeley National Laboratory and co-author of a recent report on the targets.

----------

Meanwhile the picture is grim... The democrats in the US should not be driving "exotic" cars... Only locally manufactured, otherwise there is no point for the bailout...

my point exactly....

Nobel economics prize winner Paul Krugman says the beleaguered US auto industry will likely disappear.

"It will do so because of the geographical forces that me and my colleagues have discussed," the Princeton University professor and New York Times columnist told reporters in Stockholm on Sunday. "It is no longer sustained by the current economy."

Krugman won the 10 million kronor ($A2.17 million) Nobel Memorial Prize in economics for his work on international trade patterns. Some of his research on economic geography seeks to explain why production resources are concentrated in certain locations.

Speaking to reporters three days ahead of the Nobel Prize ceremony, Krugman said plans by US politicians to bail out the Big Three automakers are a short-term solution, resulting from a "lack of willingness to accept the failure of a large industry in the midst of an economic crisis".

see toon and comment above...

no spare tire... all wheels deflated...

Shares slump as car firms and banks hit

World markets were shaken today after US plans to bail out the beleaguered car industry stalled in the Senate.

At lunchtime, the FTSE 100 Index was down 3.5 per cent - or 153 points at 4235 - as investors also reacted to further trading woes at Halifax Bank of Scotland.

Details of the company's spiralling bad debts in retail and corporate lending caused shares across the banking sector to fall.

Royal Bank of Scotland, which is 58 per cent owned by the Government, was the heaviest faller, with a drop of more than 11 per cent. HBOS was down by 10 per cent, while merger partner Lloyds TSB slumped 9 per cent.

Today's falls come after the FTSE 100 Index added more than 300 points during the first four sessions of the week.

But Joshua Raymond, market strategist at City Index, said the rally looked to have run out of steam amid uncertainty over the car industry.

He said: "We have seen a lot of investors taking their profits and watching and waiting."

Mr Raymond added: "If we do not get a swift resolution for the US automaker bail-out, the consequences for the market and the US economy could be devastating.

-------------

Senate Abandons Automaker Bailout Bid

By DAVID M. HERSZENHORNWASHINGTON — The Senate on Thursday night abandoned efforts to fashion a government rescue of the American automobile industry, as Senate Republicans refused to support a bill endorsed by the White House and Congressional Democrats.

The failure to reach agreement on Capitol Hill raised a specter of financial collapse for General Motors and Chrysler, which say they may not be able to survive through this month.

After Senate Republicans balked at supporting a $14 billion auto rescue plan approved by the House on Wednesday, negotiators worked late into Thursday evening to broker a deal but deadlocked over Republican demands for steep cuts in pay and benefits by the United Automobile Workers union in 2009.

The failure in Congress to provide a financial lifeline for G.M. and Chrysler was a bruising defeat for President Bush in the waning weeks of his term, and also for President-elect Barack Obama, who earlier on Thursday urged Congress to act to avoid a further loss of jobs in an already deeply debilitated economy.

“It’s over with,” the Senate majority leader, Harry Reid of Nevada, said on the Senate floor, after it was clear that a deal could not be reached. “I dread looking at Wall Street tomorrow. It’s not going to be a pleasant sight.”Wagoner will leave immediately...

The chief executive of struggling US car company General Motors has been ordered to step down by President Barack Obama.

Rick Wagoner will leave immediately, a government official confirmed.

Mr Obama is preparing to outline terms for offering more help to GM and fellow car giant Chrysler.

The two firms have already received $17.4bn (£14.4bn) in bail-outs. Chrysler has requested a further $5bn while GM says it needs $16.7bn more.

Plans rejected

Reports have suggested that a frustrated Mr Obama will reject GM and Chrysler's turnaround plans as unrealistic, raising the risk of the carmakers' bankruptcy.

The auto task force appointed by Mr Obama released two reports on Monday on the financial health of both carmakers, saying that Chrysler was "not viable" in its current form.

burning dougnuts...

From The NYT

Detroit’s Bitter Pill

By Eric EtheridgePresident Obama announced his plans for G.M. and Chrysler this morning, including tough terms and tight deadlines for both companies. He also raised the possibility of bankruptcy as one way forward.

Obama’s official Monday morning announcement came after word had leaked over the weekend of one of his toughest love gestures for Detroit: demanding the head of G.M. chief Rick Wagoner.

That move had set many bloggers to point out the apparent double standard between the administration’s approaches to Motown and Wall Street, or as Mark Allender at Pruning Shears put it, “Responding to the looting of Wall Street by busting the U.A.W. feels an awful lot like responding to 9/11 by invading Iraq.”

While others were suggesting that folks like Bank of America chief Ken Lewis are deserving of a Wagonering, Peter Cohan at Daily Finance was marveling at the ability of Wall Street to evade the requirements forced on the car companies to produce detailed recovery plans:

I am just amazed that Wall Street continues to get ever more money from us taxpayers and the U.S. does not require those cash recipients to put together a plan for viability.

So I am suggesting here that before another bank gets any more money from the U.S. it should be required to produce a credible plan for showing a positive net present value, which is what the auto industry is required to do.

The Detroit Free Press also noticed the inconsistency, but instead of calling for tougher treatment on Wall Steet, the editors asked for a more Wall-Street like approach in Detroit:

---------------------

Meanwhile:

From the Guardian:

Global stockmarkets tumbled today as fears that the US car industry might go bust crushed hopes that the economic crisis might be easing.

Shares fell in Europe and across Asia, ending their recent rally, after Barack Obama's administration rejected turnaround plans from ailing carmakers General Motors and Chrysler. Fears that this week's G20 summit in London might not deliver a rescue plan for the world economy also added to the gloom, as did the collapse of a Spanish bank.

---------------------

Meanwhile:

March 31, 2009Canada Paints a Stark Picture of Chrysler

By IAN AUSTENOTTAWA — In announcing an immediate loan of 250 million Canadian dollars, or $201 million, to Chrysler Canada on Monday, Tony Clement, the minister of industry for Canada, suggested that the company was on the verge of insolvency.

“Very clearly if the money had not been flowed today, they would not have been able to make payroll,” Mr. Clement told a news conference in Ottawa. “That was the stark choice we were faced with.”

The governments of Canada and Ontario, which have been consulting with the Obama administration, more or less echoed the president’s remarks, setting similar timetables and conditions for further government assistance to the two automakers.

While the two Canadian governments first offered assistance in December, Monday’s loan to Chrysler was the first time that either Chrysler or G.M. had accepted help in Canada. Mr. Clement said that Chrysler’s Canadian operation would be given a total of 1 billion Canadian dollars in bridge financing by the end of April.

The two automakers have asked for $10 billion in assistance from Canada. Currently, the governments are offering 4 billion Canadian dollars, or $3.2 billion.

----------------

"...given a total of 1 billion Canadian dollars in bridge financing?"

Is this a loan? is this a grant? is this a gift? is this a one-way bridge? is this a pie in the sky? Shouldn't the car industry be retooling at light speed to manufacture solar powered electric tricycles? Or bigger big tanks for the US army to defend the oil wells? do we want to burn the oil till the last drop is wrung out from the ground before considering the reality of global warming? Hum....

Let's burn doughnuts till it's Mad Max season......

electric cars...

...

Vice President Joseph R. Biden Jr. was in Wilmington, Del., on Tuesday at a defunct G.M. plant that Fisker Automotive, backed by a $528.7 million government loan, will refurbish and use to make hybrids.

But years before the sleek Tesla Roadster hugged California highways or General Motors unveiled the Chevrolet Volt, Chetan Kumar Maini was making and selling stubby electric vehicles turned out by a nondescript factory here. Reva has more all-electric vehicles on the road than any other company, but it still has a long haul before it can make the vehicles marketable for the masses.

Last month, the company won a important stamp of approval when General Motors said it would use Reva’s technology in the electric version of its Chevrolet Spark, a small car whose conventional gasoline version G.M. sells here already. The electric version of the Spark is expected to go on sale in India by the end of next year, according to G.M. officials.

Reva’s technology is “second to none,” said Karl Slym, president and managing director of G.M. India, adding that Reva’s appeal came from its drive train, the collection of components that move the car, which is easily installed in different vehicles and works with various batteries.

see toon at top...