Search

Recent comments

- ukraine's agony has not started yet....

10 hours 23 min ago - all defeated.....

10 hours 35 min ago - beyond crime.....

11 hours 25 min ago - the end....

11 hours 36 min ago - odessa....

12 hours 43 min ago - weitz....

14 hours 33 min ago - bidenomics BS.....

14 hours 47 min ago - the defeat of ukraine is coming....

15 hours 35 min ago - paris is sick....

1 day 2 hours ago - German spies?....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

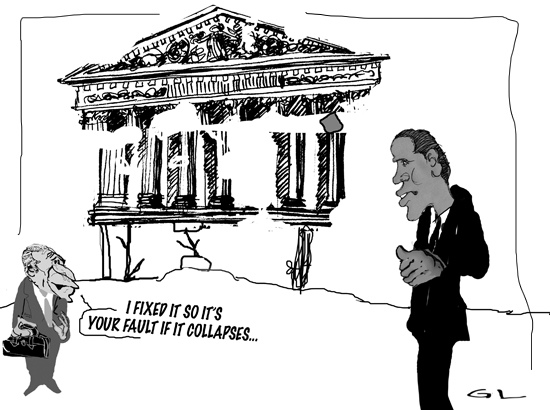

backing the house .....

So goes the old saw about bankers: they loan you an umbrella when the sun is shining, only to ask for it back when it rains.

But with our economy and markets in a world of hurt, the nation’s banks were supposed to stow their self-interest and help start lending again.

When the Troubled Asset Relief Program of the Treasury Department handed over $125 billion in taxpayer money to nine banks a month ago, they were supposed to lend to small businesses, home buyers and other worthy borrowers to keep the economy’s gears in motion.

At the time, the Federal Reserve Board and three bank regulatory agencies said: “The agencies expect all banking organizations to fulfill their fundamental role in the economy as intermediaries of credit to businesses, consumers, and other creditworthy borrowers.”

Alas, that admonition wasn’t accompanied by any real requirements to lend. When the Treasury gave taxpayer billions to the banks, it attached no strings. So is it any surprise that lending is tight?

Reports from institutional and individual borrowers across the country indicate this. Nervous lenders are demanding that even healthy loans be paid back. Banks and other financial institutions, meanwhile, are reducing exposures to borrowers and doing whatever they can to discourage the assumption of further debt.

Borrowers I have heard from don’t want to get into trouble with their lenders by speaking publicly about their experiences. As a result, they will remain nameless. But their stories are all the same.

The problem is, unless the government puts serious pressure on the nation’s banks to start lending, the value of assets used as collateral will fall as individuals and institutions everywhere are forced to sell.

meanwhile …..

The US government has announced a rescue plan for troubled banking giant Citigroup after its shares plunged by more than 60% last week.

The US Treasury is set to invest $20bn (£13.4bn) in return for preferred shares in Citigroup.

The Treasury and the Federal Deposit Insurance Corp will also guarantee up to $306bn (£205bn) of risky loans and securities on Citigroup's books.

The plan follows a $25bn injection of public funds in the bank last month.

Citigroup's market value fell to $20.5bn on Friday, compared with $270bn in 2006.

Last week the company announced 52,000 job losses worldwide, on top of 23,000 job cuts previously announced. It employs around 12,000 people in the UK.

Citigroup has lost more than $20bn in the past year because of the global financial crisis, suffering four straight quarterly losses.

Citibank UK deposit holders are covered by the Financial Services Authority. The Financial Services Compensation Scheme guarantees up to £50,000 per Citibank account holder, should the bank go bust.

- By Gus Leonisky at 26 Nov 2008 - 9:37pm

- Gus Leonisky's blog

- Login or register to post comments

billionaire socialists...

Michael Evans trawls through the debris of 2008 to find someone worthy of a gong.

IT WAS the year the penny dropped.

And, for that matter, the markets. And asset valuations. And bonuses. And reputations. And egos.

Thankfully, executive salaries weathered the storm.

It was the year the big boys of capitalism thought it high time to reconsider the merits of socialism.

The year we dived for the dictionary to check the spelling of subprime, subordinated debt and collaterised debt obligations. The year of the margin loan and rumourtrage. And piles of debt.

Banks went bust, bankers were busted, and lawyers just kept charging in six-minute increments.

The China story of stronger for longer just sounded wronger and wronger. Wall Street banks wilted.

-----------------------

read more at the SMH and see toon at top.

cloudless collapse...

In Davos, Russia and China Blame Capitalists for Crisis

By CARTER DOUGHERTY and KATRIN BENNHOLDDAVOS, Switzerland — The leaders of the former bastions of the Communist bloc took the stage here on Wednesday to rebuke their capitalist brothers for dragging the world into crisis but also to assure them that, working together, they can rapidly restore the global economy to health.

In the official opening address of the World Economic Forum, Prime Minister Vladimir V. Putin of Russia spoke of a financial “perfect storm” that has decimated the old system, rendering it obsolete.

“A year ago, American delegates speaking from this rostrum emphasized the U.S. economy’s fundamental stability and its cloudless prospects,” he said, speaking through a translator. “Today, investment banks, the pride of Wall Street, have virtually ceased to exist.”

But the damage goes beyond Wall Street, he said. “The entire economic growth system, where one regional center prints money without respite and consumes material wealth, while another regional center manufactures inexpensive goods and saves money printed by other governments, has suffered a major setback.”

The Chinese premier, Wen Jiabao, left little doubt that Beijing blamed the United States for the economic breakdown. “Inappropriate macroeconomic policies,” an “unsustainable model of development characterized by prolonged low savings and high consumption,” the “blind pursuit of profit” and “the failure of financial supervision” all contributed, he said.

-------------------

see toon at top...