Search

Recent comments

- a peace deal....

35 min 4 sec ago - peace now!

2 hours 44 sec ago - a nasty romance....

2 hours 6 min ago - blackmail?.....

4 hours 37 min ago - ukraine's agony has not started yet....

22 hours 7 min ago - all defeated.....

22 hours 19 min ago - beyond crime.....

23 hours 9 min ago - the end....

23 hours 20 min ago - odessa....

1 day 27 min ago - weitz....

1 day 2 hours ago

Democracy Links

Member's Off-site Blogs

another brownout .....

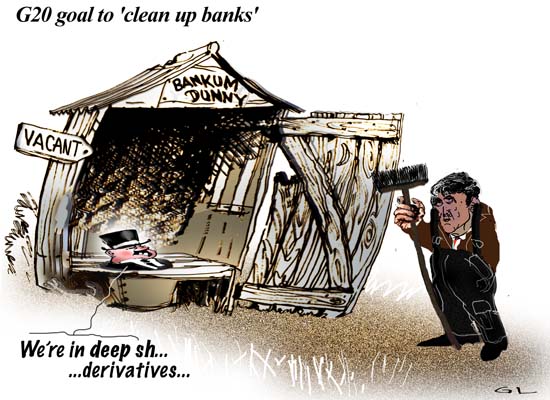

The main aim of the G20 summit must be to "clean up" the global banking system, Gordon Brown will say later.

Ahead of Thursday's crunch meeting of world leaders in London, Mr Brown will say it is vital banks relearn common values like honesty and responsibility.US President Barack Obama will arrive in the UK later on Tuesday.

Scotland Yard is describing the G20 policing plan as one of the largest, and complicated public order operations it has ever devised.Mr Brown's speech to faith and charity leaders at St Paul's Cathedral in London will emphasise that he understands the "pain" the recession is causing.

"In our families we raise our children to work hard and to do their best and do their bit," he will say.

"We don't reward them for taking risks that would put them or others in danger, and we don't encourage them to seek short-term gratification at the expense of long-term value.

meanwhile …..

A BBC World Service survey of 29,000 people has found broad support for reform of the international economic system ahead of the G20 summit.Over 70% of people in 29 countries think major changes are needed in the way the global economy is run.

Nearly two-thirds - 62% - of the public say the downturn has negatively affected them, and half say the downturn will last more than two years.- By Gus Leonisky at 1 Apr 2009 - 5:54am

- Gus Leonisky's blog

- Login or register to post comments

hiding the goal posts

Standards Board Gives Banks More Leeway in Valuing Assets

Revision of Mark-to-Market Accounting Rules Had Been Urged by Some Lawmakers

By Zachary A. Goldfarb

Washington Post Staff Writer

Thursday, April 2, 2009; 12:49 PM

The nation's accounting board voted today to give more leeway to banks when assigning a dollar value to distressed assets, following an aggressive lobbying campaign by lawmakers and the financial industry to change the rules.

The move by the Financial Accounting Standards Board revises fair value, or mark-to-market, accounting, which has been blamed for exacerbating the financial crisis by forcing banks to value home loans and other assets below their worth.

The new rules give banks more judgment in deciding how to value assets when the market for those assets is not functioning.

The impact of the rules change is so far unclear. Banks, which have been calling for the change since the onset of the financial crisis, say it will boost their financial position. But investor groups and auditors say the previous rules gave investors a transparent accounting of the real value of assets held by banks and today's decision could in fact intensify banks' troubles.

The accounting board's move today might boost banks' financial position because they have had to take heavy write-downs, or losses, by marking assets to market over the past year.

The change in rules could also free up banks to do more lending and build up more capital, potentially reducing the need for government money.

But some financial analysts say rule change will only worsen the crisis because it will only give banks the chance to conceal how bad their financial conditions are.

-------------

playing futbol in the dark on a foggy night...

ride into the sunset...

Bank Test Results May Strain Limits Of Bailout Funding

Much Rides on Size of Capital Needs

By David Cho

Washington Post Staff Writer

Thursday, April 16, 2009

As the Obama administration works to complete its stress tests for gauging the health of major banks, it could confront another problem: how to pay for shoring up any weaknesses the tests reveal.

No one yet knows the extent of the banks' needs. But a senior administration official said yesterday this will be clear once tests on the nation's 19 major banks are done and the results are released early next month.

The administration would be hard-pressed to ask Congress for more rescue funds to plug the holes. Anger on Capitol Hill is high, especially after the furor over bonuses paid to employees at American International Group. The troubled insurer had earlier received more than $170 billion in bailout funds.

But if the capital requirements of banks prove large, the government may need billions of dollars in federal aid back from strong financial firms, which have received that money within the past few months. The administration may even have to carve money from other rescue programs being funded from the $700 billion bailout program.

-----------------

If my calculations are right, the banks in the US have a 3 trillion dollar debt and a 1.5 trillion exposure to toxic adventure... Who knows... see what happens... see toon at top.