Search

Recent comments

- a peace deal....

14 hours 2 min ago - peace now!

15 hours 28 min ago - a nasty romance....

15 hours 34 min ago - blackmail?.....

18 hours 5 min ago - ukraine's agony has not started yet....

1 day 11 hours ago - all defeated.....

1 day 11 hours ago - beyond crime.....

1 day 12 hours ago - the end....

1 day 12 hours ago - odessa....

1 day 13 hours ago - weitz....

1 day 15 hours ago

Democracy Links

Member's Off-site Blogs

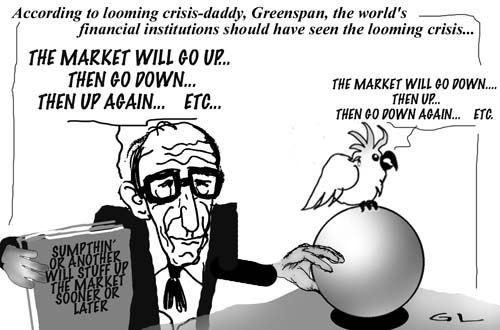

ups and downs

The world will suffer another financial crisis, former Federal Reserve chief Alan Greenspan has told the BBC.

"The crisis will happen again but it will be different," he told BBC Two's The Love of Money series.

He added that he had predicted the crash would come as a reaction to a long period of prosperity.

But while it may take time and be a difficult process, the global economy would eventually "get through it", Mr Greenspan added.

"They [financial crises] are all different, but they have one fundamental source," he said.

"That is the unquenchable capability of human beings when confronted with long periods of prosperity to presume that it will continue."

-------------------

"That is the unquenchable capability of human beings when confronted with long periods of prosperity to presume that it will continue."

Dear guru of the financial tricks, this is untrue. There are clever men who bet on a market crash sometimes or another and make oodles of money out of it on the derivative market. The derivative market is worth five times that of the entire money market and about ten times that of the GDP of the entire world... Someone somewhere sometimes is going to lose their pants.

Further more, by reducing regulations on the market, you have encouraged its overheating in illusionary prosperity that led to burning the house down...

And as you know, people can manipulate the market using many tricks from advertising to straight lies...

And please, we all know the market is a yo-yo... up and down, enough trusims, please...

- By Gus Leonisky at 9 Sep 2009 - 6:21pm

- Gus Leonisky's blog

- Login or register to post comments

honor amongst thieves...

In order to prevent the situation arising again financiers and governments should look to clamp down on fraud and increase capital requirements for banks, the former central banker said.

Regulations targeting the latter would mean banks would be forced to hold enough money to cover their normal operations and honour withdrawals.

---------------------

From the man who let loose, that's a bit rich...

at the captain's table...

from Frank Rich at the NYT

“I was right 70 percent of the time, but I was wrong 30 percent of the time,” said Alan Greenspan as he testified last week on Capitol Hill. Greenspan — a k a the Oracle during his 18-year-plus tenure as Fed chairman — could not have more vividly illustrated how and why geniuses of his stature were out to lunch while Wall Street imploded. No doubt he applied his full brain power to that 70-30 calculation. But the big picture eludes him. If the captain of the Titanic followed the Greenspan model, he could claim he was on course at least 70 percent of the time too.

--------------

Gus: actually, the captain of the Titanic was right 99 per cent of the time... see toon at top.