Search

Recent comments

- UK-israhell.....

27 min 33 sec ago - albania.....

35 min 28 sec ago - israhell crap.....

53 min 29 sec ago - waste of cash....

3 hours 31 min ago - marles' bluster....

3 hours 53 min ago - fascism français....

3 hours 57 min ago - russian subs in swedish waters....

4 hours 36 min ago - more polling....

4 hours 4 min ago - they know....

8 hours 52 min ago - past readings....

9 hours 52 min ago

Democracy Links

Member's Off-site Blogs

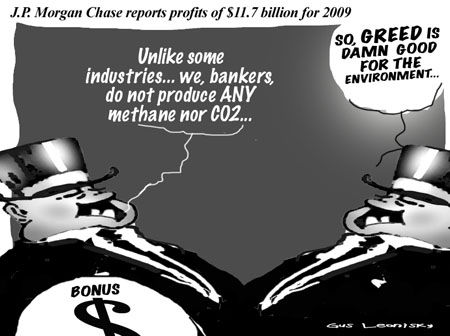

we, bankers...

Remember when (April 14, 2009)

NEW YORK (Fortune) -- Goldman Sachs reported a much stronger-than-expected first-quarter profit Monday, bouncing back from its worst quarter as a public company

Goldman (GS, Fortune 500) also set plans to raise $5 billion through a sale of stock, saying it wants to become the first big bank to repay the federal loans extended during last fall's financial sector meltdown

In reporting its results a day earlier than expected, New York-based Goldman said it earned $1.81 billion, or $3.39 a share, for the quarter ended March 31. Analysts surveyed by Thomson Financial were looking for a profit of $1.64 a share

Goldman shares, which have surged more than 70% during the past month, continued rising late Monday, gaining about 4.7% for the day. Shares were down slightly in after-hours trading,

With the results, Goldman bounced back decisively from the last quarter of 2008, when it posted its only quarterly loss since becoming a public company in 1999.

-------------

Staff at Goldman Sachs staff can look forward to the biggest bonus payouts in the firm's 140-year history after a spectacular first half of the year, sparking concern that the big investment banks which survived the credit crunch will derail financial regulation reforms.

A lack of competition and a surge in revenues from trading foreign currency, bonds and fixed-income products has sent profits at Goldman Sachs soaring, according to insiders at the firm.

Staff in London were briefed last week on the banking and securities company's prospects and told they could look forward to bumper bonuses if, as predicted, it completed its most profitable year ever. Figures next month detailing the firm's second-quarter earnings are expected to show a further jump in profits. Warren Buffett, who bought $5bn of the company's shares in January, has already made a $1bn gain on his investment.

-------------

And now...:

Will Obama's tax go global?Robert Peston 15 January 2010

President Obama's levy on bank leverage or wholesale funding - and the way he explicitly linked it to the "obscene" (his word) bonuses being paid by banks - has surprised European ministers, central bankers and regulators.

They note that it was America which was most reluctant to agree global rules on how bonuses should be paid in recent negotiations between the heads of the G20 leading economies.

What's more, although the US is implementing the new rules - ordaining that bonuses should be paid largely in shares, released to recipients in tranches over a few years and subject to clawback for poor future performance - it is doing so a year later than everyone else (so for next year's bonus round, not this one).

Maybe it was just the proximity of the bonus announcements which persuaded the president that he had to signal his displeasure with the magnificent size of bankers' rewards.

According to calculations by the Wall Street Journal, 38 big US banks and securities firms are likely to pay their employees a record $145bn for their performance in 2009.

That's almost a fifth higher than 2008's haul and even more than in the boom boom year of 2007.

Now not all of that is bonus. But bonuses are back - and big.

At just three leading investment banks, Goldman Sachs, JP Morgan and Morgan Stanley, aggregate bonuses will in aggregate nudge $30bn.

---------------------

AND:

For those working in the City, this is the time to go shopping for Ferraris or Aston Martins and to stock up on Chateau Petrus, as the fat bonuses roll in.

This year will be especially good for the 350,000 or so who work in the City. Bonuses this year are expected to reach £8.8bn, with stock markets trading at five-year highs, a raft of mergers and acquisitions and competition for top executives.

Such big bonuses no longer elicit cries of "obscene". That would be too Old Labour. Harriet Harman, a Labour minister, did call for curbs on "excessive, ridiculous bonuses" that were creating "a sick society" at the Labour party conference. But New Labour generally has no such problems with extreme wealth.

Ed Balls, the economic secretary to the Treasury, has defended the payouts, on the grounds that they are good for tax revenue and job creation. "If the City is doing well, we are all doing well," he said.

But, quite apart from issues of excess, City bonuses tell us much about the short-termism that is so ingrained in the financial world and that undermines efforts to address long-term environmental problems, such as climate change.

-----------------

Climate Change? Has not this issue gone on the back-burner since the Copenhagen fiasco? Are we still on the same planet? More soon...

- By Gus Leonisky at 18 Jan 2010 - 9:01am

- Gus Leonisky's blog

- Login or register to post comments

we, consumers...

Jan. 14 (Bloomberg) -- The Obama administration’s proposal to tax financial firms may cost JPMorgan Chase & Co. and Bank of America Corp. more than $1.5 billion each, hinder the industry’s recovery and stifle investor interest in bank stocks, analysts and investors said.

“This is not conducive to an investor-friendly environment,” said Peter Sorrentino, who helps manage $13.8 billion at Huntington Asset Advisors in Cincinnati. “Profit will be hampered by this tax. It keeps the industry hobbled and it never gets healthy or out from under the thumb of the government.”

Bank of America, the largest U.S. lender, would owe $1.53 billion, or 18 cents a share, while JPMorgan, the No. 2 U.S. bank, would owe $1.52 billion, or 38 cents a share, according to a report today by Wisco Research LLC analyst Sean Ryan. The tax would amount to 22 percent of Bank of America’s expected 2010 earnings per share and 12 percent of JPMorgan’s, Ryan wrote.

“Using tax policy to punish people is a bad idea,” JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said in Washington yesterday after a hearing of the Financial Crisis Inquiry Commission. “All businesses tend to pass their costs onto customers.”

----------------------

Obviously, a banking tax is not good for the environment. Greed does not fart nor belches nor pollutes with CO2. Money is carbon neutral. isn't it?... And more so these days since one does not need to mint it, nor print it, nor transport it... — one just virtually count it in someone else's pocket, mixed with the hype of fudge and hedge, like lollies. Big frothing lollies.

While we consumers, eat mud cakes. see toon at top...

we, the lobyists...

How do you regulate banks effectively, if the Senate is owned by Wall Street?

This week, a disaster hit the United States, and the after-shocks will be shaking and breaking global politics for years. It did not grab the same press attention as the fall of liberal Kennedy-licking Massachusetts to a pick-up truck Republican, or President Obama's first State of the Union address, or the possible break-up of Brangelina and their United Nations of adopted infants. But it took the single biggest problem dragging American politics towards brutality and dysfunction – and made it much, much worse. Yet it also showed the only path that Obama can now take to salvage his Presidency.

For more than a century, the US has slowly put some limits – too few, too feeble – on how much corporations can bribe, bully or intimidate politicians. On Tuesday, they were burned away in one whoosh. The Supreme Court ruled that corporations can suddenly run political adverts during an election campaign – and there is absolutely no limit on how many, or how much they can spend. So if you anger the investment bankers by supporting legislation to break up the too-big-to-fail banks, you will smack into a wall of 24/7 ads exposing your every flaw. If you displease oil companies by supporting legislation to deal with global warming, you will now be hit by a tsunami of advertising saying you are opposed to jobs and the American Way. If you rile the defence contractors by opposing the gargantuan war budget, you will face a smear-campaign calling you Soft on Terror.

------------------------

sigh... see whatever...

we, the legal stamps...

By ADAM LIPTAK

WASHINGTON — Overruling two important precedents about the First Amendment rights of corporations, a bitterly divided Supreme Court on Thursday ruled that the government may not ban political spending by corporations in candidate elections.

The 5-to-4 decision was a vindication, the majority said, of the First Amendment’s most basic free speech principle — that the government has no business regulating political speech. The dissenters said that allowing corporate money to flood the political marketplace would corrupt democracy.

The ruling represented a sharp doctrinal shift, and it will have major political and practical consequences. Specialists in campaign finance law said they expected the decision to reshape the way elections were conducted. Though the decision does not directly address them, its logic also applies to the labor unions that are often at political odds with big business.

The decision will be felt most immediately in the coming midterm elections, given that it comes just two days after Democrats lost a filibuster-proof majority in the Senate and as popular discontent over government bailouts and corporate bonuses continues to boil.

President Obama called it “a major victory for big oil, Wall Street banks, health insurance companies and the other powerful interests that marshal their power every day in Washington to drown out the voices of everyday Americans.”

we, the stats...

Bankers have indicated that they may agree to far-reaching reforms, as the World Economic Forum in Davos ends.

Top regulators warned that they could take drastic action to take some of the risk out of the financial industry.

However, the annual meeting of some of the world's most powerful business leaders and politicians ended with few new plans or real achievements.

There was agreement though that job creation and free trade had to be key ingredients of any economic recovery.

Larry Summers, economics adviser to US President Barack Obama, probably coined the most memorable phrase of this year's Davos when he said the world was experiencing a "statistical economic recovery, but a human recession".

------

see toon at top...

we, the ungrateful banks....

Anger doesn't sit easily on the urbane, vaguely cuddly frame of Joe Stiglitz. His beard and open-necked shirt lend him an unbuttoned air, and he has the veteran teacher's ability to put the intellectually inferior at their ease, which I am grateful for. A career that includes a spell as Chair of the President's Council of Economic Advisers in the Clinton White House, chief economist at the World Bank and now a professorship at Columbia Business School has endowed him with patience. And yet I sense also some tension, that maybe he cannot quite struggle out from under the sense of pain many of us feel about the events of the last couple of years. Even in the calm, elegant surroundings of the Palm Court at London's Langham Hotel, where I join him for a cappuccino, his coffee his not the only thing that is, figuratively speaking, frothing away.

He is appalled that the banks have expressed "not a note of gratitude" about the funding and subsidies they have received from taxpayers "without which they would not exist", and that they have had the cheek to turn around and say that they don't have enough money to lend to small businesses or would-be homeowners, but that they have to spend vast sums of money raised from often hard-up taxpayers on obscene bonuses – amounting to $33bn in bonuses in the US alone. This perverse redistribution of income from the poor to the rich, a gigantic reverse exercise in the usual Robin Hood approach, is unprecedented in human history. The US government, Stiglitz says, was reduced to the role of garbage disposal service for the banks' toxic assets, bad loans and worthless securities they themselves had created. Why, Stiglitz asked, did the White House under Bush and Obama spend so much on keeping the banks going but so little on helping struggling homeowners, a policy that would have helped keep a roof over their heads, slow the slide in property values and protect the banks from the fundamental cause of their troubles, the crumbling value of securities based on those residential mortgages: "The current crisis has seen the government assume a new role – the 'bearer of risk of last resort'. When the private markets were at the point of meltdown, all risk was shifted to the government. The safety net should focus on protecting individuals; but the safety net was extended to corporations, in the belief that the consequences of not doing so would be too horrific. Once extended, it will be difficult to withdraw.

read more at the Independent and see toon at top...

illusionary cash bonuses...

from the onion comedy team:

What began as a routine report before the Senate Finance Committee Tuesday ended with Bernanke passionately disavowing the entire concept of currency, and negating in an instant the very foundation of the world’s largest economy.

“Though raising interest rates is unlikely at the moment, the Fed will of course act appropriately if we…if we…” said Bernanke, who then paused for a moment, looked down at his prepared statement, and shook his head in utter disbelief. “You know what? It doesn’t matter. None of this—this so-called ‘money’—really matters at all.”

“It’s just an illusion,” a wide-eyed Bernanke added as he removed bills from his wallet and slowly spread them out before him. “Just look at it: Meaningless pieces of paper with numbers printed on them. Worthless.”

------------------

Gus: it's spooky. I wrote very similar sentiments, using same words such as "social construct" and expressed that in the end — nothing matters, especially when perusing my credit card un-balance going at a rate of knots into the redder red... AND I wuz serious... That's why we shouldn't begrudge the extravagant bonuses paid to bank executive. These massive bonuses are just illusions and they're none the wiser. Eh eh!!! We'll have the last laugh... won't we? er...

bitter pill increases the fat on the bottom line...

from the BBC

Cash bonuses for Wall Street bankers rose by 17% to $20.3bn (£13.2bn) in 2009, figures have shown.

The data, from the New York state Comptroller Thomas DiNapoli, also said that profits at the firms could be in excess of $55bn for last year.

Mr DiNapoli added that the payouts were a "bitter pill" and "hard to comprehend" for American taxpayers who had bailed out Wall Street firms.

The total does not include bonuses taken in stock options instead of cash.

"Wall Street is vital to New York's economy, and the dollars generated by the industry help the state's bottom line," said Mr DiNapoli.

But he acknowledged that while bonuses were well below the level paid in 2007 and were more closely tied to company performance, it was inevitable that many would consider them excessive.

--------------

see toon at top

the minimum grease...

from the Independent

Royal Bank of Scotland is to pay bonuses totalling £1.3 billion to its investment bankers despite expectations of grim annual results tomorrow.

The payout is thought to have been given the green light by UK Financial Investments (UKFI), the body set up to manage the Government's stakes in banks.

RBS, which is 84% taxpayer-owned after a string of bailouts, is expected to post losses of more than £5 billion for the year to December.

But it is the bank's controversial bonus pot that will prompt howls of outrage from the public as it comes despite the deficit and an expected admission that it has not met Government lending targets, which were laid out as part of the terms of its bail-out.

RBS boss Stephen Hester, who has waived his own payout for last year, has said the bank must give competitive bonuses to its key staff but that it would pay "the minimum we can get away with" to the investment bankers.

---------------------------

Gus: Ah ah... So... there is the minimum wage for the working bums of the populace and the "minimum" bonuses for the bankers. Now we know this we should feel better. See toon at top

tax havens, bank secrecy, and tricks....

from Lucy Komisar...

MIAMI, Inter Press Service (IPS), July 14, 2009 – At a recent conference in Miami organised by Offshore Alert, a specialised media organisation focused on financial crime, IPS correspondent Lucy Komisar sat down with veteran investigator Bob Roach to discuss the hurdles facing regulators trying to crack down on tax havens, which cost the U.S. alone an estimated 100 billion dollars annually.

Worldwide, financial centres with bank secrecy laws are blamed by the Organisation for Economic Cooperation and Development (OECD), which represents 30 developed economies, for hiding some 5 to 7 trillion dollars offshore so the profits they produce evade taxes.

The Miami conference dealt with these offshore financial centres, and the significance and global impact of the myriad of business transactions that is conducted in and through them.”

Excerpts of the interview follow. He is speaking not on behalf of the committee, but rather expressing his own views.

read more of Lucy Komisar... see toon at top.

desperate bankers wives...

The legend of Dick Fuld, the chief executive known as ''the Gorilla of Lehman Brothers'', lives on. It is almost two years since he presided over the company's bankruptcy. The images of former employees leaving Lehman offices clutching cardboard boxes containing their once promising careers are fading from memory. Yet the stories of his reign of terror remain fresh in the minds of bankers who once called him the scariest man on Wall Street.

...

Actually, you can tell a lot about Lehman Brothers by looking at the Lehman wives. This is what the British journalist Vicky Ward discovered as she began to research a book about the fall of the bank.

In The Devil's Casino, published last week, Ward exposes the almost cult-like company that Fuld and his fellow executives ran. The Lehman motto was ''One Firm'' and that extended to the personal lives of the powerful men who worked there. As Ward puts it, Fuld expected the top brass to ''get married and stay married''. Their wives may not have been employed by Lehman but, to all intents and purposes, they were owned by Lehman.

insecurely running naked...

From George Monbiot

You think you've seen the worst of it; you haven't. Last week I wrote about how the British government, while imposing extra taxes and devastating cuts on ordinary mortals, has quietly engineered a new tax exemption for the banks and corporations, which also encourages these businesses to shift some of their operations overseas. I thought that was as bad as it got. I was wrong.

On the day I wrote that column the Conservatives were doing something just as repulsive, and far more dangerous. On Wednesday George Osborne told the House of Commons "we will make sure we learn every lesson that needs to be learned – so that this [the financial crisis] never happens again". Two days before, his government demonstrated that nothing has been learned at all. Let me first explain the context.

Most people obtain shares or bonds or other securities in the hope that their value will rise. Short sellers hope their price will fall. They might borrow, for instance, 10,000 shares and sell them for £1 a piece. Then they pray that the value collapses. If they're in luck, and the share price halves, for instance, they can buy the same number as they sold for 50p each. They return the shares to the broker who lent them, and pocket £5,000 (minus fees).

It's a controversial practice. Some people say that it helps markets find the right price for their wares. Others maintain that it exacerbates risk, as the sellers are using assets they don't possess to take on potentially unlimited liabilities (while share prices can't fall below zero, there is no fixed limit to their increase in value). Short selling also creates an incentive to try to drive down the price of securities, amplifying or even creating economic crises. An example was the Asian financial crisis of 1997, triggered by a co-ordinated attack by short sellers on the Thai baht. It destituted tens of millions.

You don't like the idea? Then take a look at naked short selling. In this case sellers not only don't own the assets they're selling, they haven't even borrowed them. They sell a promise of shares, hope the price falls, then try to obtain the shares they've sold. In the surreal traditions of modern finance they're effectively selling securities that don't yet exist (perhaps they should be called insecurities). Naked shorting may grant short sellers golden opportunities to wreck companies and economies, by flooding the market with low-cost ghosts.

http://www.guardian.co.uk/commentisfree/2011/feb/15/condemns-naked-short-selling-not-treasury

see toon at top

----------------------

the untouchables...

Americans know that banks have mistreated borrowers in many ways in foreclosure cases. Among other things, they habitually filed false court documents. There were investigations. We’ve been waiting for federal and state regulators to crack down.

Prepare for a disappointment. As early as this week, federal bank regulators and the nation’s big banks are expected to close a deal that is supposed to address and correct the scandalous abuses. If these agreements are anything like the draft agreement recently published by the American Banker — and we believe they will be — they will be a wrist slap, at best. At worst, they are an attempt to preclude other efforts to hold banks accountable. They are unlikely to ease the foreclosure crisis.

All homeowners will suffer as a result. Some 6.7 million homes have already been lost in the housing bust, and another 3.3 million will be lost through 2012. The plunge in home equity — $5.6 trillion so far — hits everyone because foreclosures are a drag on all house prices.

The deals grew out of last year’s investigation into robo-signing — when banks were found to have filed false documents in foreclosure cases. The report of the investigation has not been released, but we know that robo-signing was not an isolated problem. Many other abuses are well documented: late fees that are so high that borrowers can’t catch up on late payments; conflicts of interest that lead banks to favor foreclosures over loan modifications.

The draft does not call for tough new rules to end those abuses. Or for ramped-up loan modifications. Or for penalties for past violations. Instead, it requires banks to improve the management of their foreclosure processes, including such reforms as “measures to ensure that staff are trained specifically” for their jobs. The banks will also have to adhere to a few new common-sense rules like halting foreclosures while borrowers seek loan modifications and establishing a phone number at which a person will take questions from delinquent borrowers. Some regulators have reportedly said that fines may be imposed later.

But the gist of the terms is that from now on, banks — without admitting or denying wrongdoing — must abide by existing laws and current contracts. To clear up past violations, they are required to hire independent consultants to check a sample of recent foreclosures for evidence of improper evictions and impermissible fees.

The consultants will be chosen and paid by the banks, which will decide how the reviews are conducted. Regulators will only approve the banks’ self-imposed practices. It is hard to imagine rigorous reviews, but if the consultants turn up problems, the banks are required to reimburse affected borrowers and investors as “appropriate.” It is apparently up to the banks to decide what is appropriate.

It gets worse. Consumer advocates have warned that banks may try to assert that these legal agreements pre-empt actions by the states to correct and punish foreclosure abuses. Banks may also try to argue that any additional rules by the new Consumer Financial Protection Bureau to help borrowers would be excessive regulation.

http://www.nytimes.com/2011/04/10/opinion/10sun1.html?_r=1&hp=&pagewanted=print

see toon at top...

wealthy termites...

Staff at an Indian bank have been blamed for allowing termites to eat their way through banknotes worth millions of rupees.

Staff at the bank, in the state of Uttar Pradesh, are reported to have been found guilty of "laxity".

The insects are believed to have chewed their way through notes worth some 10 million rupees ($225,000/£137,000).

A similar incident happened in 2008, when termites in Bihar state ate a trader's savings stored in his bank.

The State Bank of India says an enquiry into the latest incident has been held.

Replaced

"The branch management has been found guilty of laxity due to which the notes were damaged by termites in the Fatehpur branch of Barabanki district," State Bank of India Chief General Manager Abhay Singh told the Press Trust of India.

"Action will be taken against those responsible in the matter."

http://www.bbc.co.uk/news/world-south-asia-13194864

Gus: meanwhile the wealthy termites who created the WFC (world financial crisis) are still munching through the loot of bonuses and "options", all from the comfort of their mansion and their tax haven islands...

"No action will be taken..." of course...

risks associated with debt securities...

Barclays has emerged victorious in a long-running legal battle over its actions on the eve of the credit crisis, during which it allegedly dumped hundreds of millions of dollars of toxic mortgage assets on to unsuspecting investors.

The New York Supreme Court approved the dismissal of a lawsuit from the French fund manager Oddo Asset Management, which said Barclays had used off-balance-sheet vehicles as a "dumping ground" for mortgage assets that the bank knew were about to plunge in value.

The case involving the British bank was one of hundreds working its way through the US legal system.

Supreme Court Justice Barbara Kapnick had ruled last year that there was no case for Barclays to answer. "As Barclays contends, Oddo is a sophisticated entity in the position of appreciating the inherent risks associated with debt securities, including the fact that, under certain circumstances, interest payments may cease and the principal may be lost," she wrote then.

And last week, a Supreme Court panel turned down Oddo's appeal, saying there was no evidence of a breach of fiduciary duty by Barclays or by Standard & Poor's, which gave a credit rating to the controversial vehicles, and whose parent company, McGraw Hill, was also dismissed from the suit. Barclays said on Friday: "We are pleased with the court's ruling."

The attorney for Oddo, Geoffrey Jarvis, said the company would consider an application to appeal the Supreme Court's rulings. In New York, there is a further appeals court that sits above the Supreme Court's appellate division.

The case centred on the collapse of two investment vehicles, Mainsail and Golden Key, in August 2007, in which Oddo lost its entire $50m investment. Just two months earlier, the vehicles purchased, at face value, several hundred million dollars of mortgage derivatives that had previously been sitting on Barclays' balance sheet.

http://www.independent.co.uk/news/business/news/new-york-court-clears-barclays-of-dumping-toxic-mortgages-2293039.html

landmark settlement...

Five of the top banks in the United States have agreed to pay a record $23 billion settlement to homeowners following allegations of foreclosure abuses.

The landmark deal - involving Bank of America, Citigroup, Wells Fargo, JPMorgan Chase, and Ally Financial - was negotiated jointly by federal and state authorities.

Announcing the settlement, president Barack Obama said the banks pushed ahead with foreclosures and repossessions without verifying documents, improperly forcing people from their homes during the housing collapse five years ago.

"It was wrong and it cost more than 4 million families their homes to foreclosure," he said.

"We have reached a landmark settlement with the nation's largest banks that will speed relief to the hardest hit homeowners in some of the most abusive practices of the mortgage industry and begin to turn the page on an era of recklessness that has left so much damage in its wake."

http://www.abc.net.au/news/2012-02-10/billions-paid-out-for-us-homeowners/3821998

See toon at top...

the burden of wealth...

People from wealthy backgrounds are more likely than poorer people to break laws while driving, take lollies from children, and lie for financial gain, a United States study says.

The seven-part study by psychologists at the University of California Berkeley and the University of Toronto analysed people's behaviour through a series of experiments.

For instance, drivers of expensive vehicles were observed to be more likely to break the rules at four-way intersections, and were more likely to cut off pedestrians trying to cross the street than drivers of cheaper cars.

In another test using a game of dice, given the opportunity to win a prize, people who self-reported high socio-economic status were more likely than the rest to lie and say that they had rolled higher numbers than they actually had.

"Even in people for whom $50 is a relatively small amount of money, cheating was three times as high," said lead author Paul Piff of UC Berkeley.

"It really shows the extreme lengths to which wealth and upper-rank status in society can shape patterns of self-interest and unethicality."

http://www.abc.net.au/news/2012-02-28/upper-class-people-more-likely-to-cheat-says-study/3856172

see toon at top...

taking lollies from children...

There has never been a better time to be a criminal in Australia — so long as you’re a white-collar criminal in the finance industry, writes Philip Soos from Deakin University comments (via The Conversation).

RECENTLY, the head of the Australian Securities and Investments Commission (ASIC), Greg Medcraft, called Australia a “paradise” for white-collar criminals (note image right).

Soon after, he recanted, claiming he didn’t want the country to become a haven for financial fraudsters. This rephrasing likely followed on from Finance Minister Mathias Cormann leaning on Medcraft.

The mass media has done an admirable job bringing the Commonwealth Bank (CBA) financial planner scandal to light, forcing the ASIC to finally investigate, the Senate to inquire and the CBA to apologise and provide compensation. Despite this, frauds like these are universally downplayed as isolated events, perpetrated by “bad apples” in an otherwise trustworthy FIRE (finance, insurance and real estate) sector.

Australia’s economic history shows otherwise.

Our past is littered with a surprisingly large number of control frauds, which government and regulators have done next to nothing to prevent and rarely prosecute. The mounting frauds appear emboldened by deregulation and liberalisation of banking and finance.

read more: http://www.independentaustralia.net/business/business-display/control-fraud-australian-banksters-rort-with-impunity,7061

See toon at top...