Search

Recent comments

- peace now!

1 hour 7 min ago - a nasty romance....

1 hour 12 min ago - blackmail?.....

3 hours 43 min ago - ukraine's agony has not started yet....

21 hours 14 min ago - all defeated.....

21 hours 26 min ago - beyond crime.....

22 hours 16 min ago - the end....

22 hours 26 min ago - odessa....

23 hours 34 min ago - weitz....

1 day 1 hour ago - bidenomics BS.....

1 day 1 hour ago

Democracy Links

Member's Off-site Blogs

overvaluing the future...

buffett

buffett

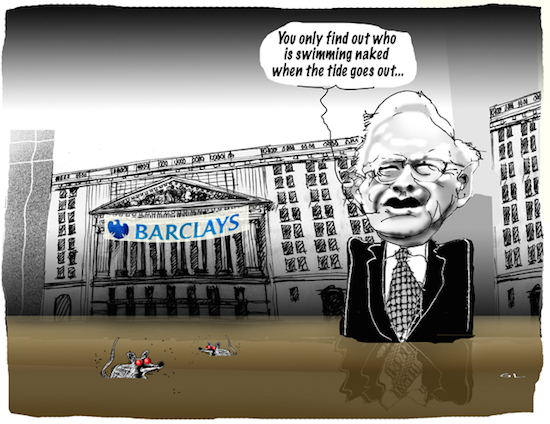

IT’S ONLY WHEN the tide goes out that you learn who’s been swimming naked,” the billionaire investor Warren Buffett has famously said.

During the crash of 2008, the whole world learned just how dangerously nude Wall Street was. Now evidence is accumulating that suggests that many financial institutions are skinny-dipping once more — via similar types of lending that could lead to similar disasters as the water recedes again due to the Covid-19 pandemic.

A longtime industry analyst has uncovered creative accounting on a startling scale in the commercial real estate market, in ways similar to the “liar loans” handed out during the mid-2000s for residential real estate, according to financial records examined by the analyst and reviewed by The Intercept. A recent, large-scale academic study backs up his conclusion, finding that banks such as Goldman Sachs and Citigroup have systematically reported erroneously inflated income data that compromises the integrity of the resulting securities.

The analyst’s findings, first reported by ProPublica last year, are the subject of a whistleblower complaint he filed in 2019 with the Securities and Exchange Commission. Moreover, the analyst has identified complex financial machinations by one financial institution, one that both issues loans and manages a real estate trust, that may ultimately help one of its top tenants — the low-cost, low-wage store Dollar General — flourish while devastating smaller retailers.

This time, the issue is not a bubble in the housing market, but apparent widespread inflation of the value of commercial businesses, on which loans are based.

Those who remember news coverage at the time know that the tale of the 2008 financial implosion involved an enormous swirl of numbers and acronyms. But when boiled down to its essence, the story of the housing bubble of the 2000s, and plausibly Wall Street’s actions today, is simple: It’s counterfeiting.

Traditional counterfeiters print money: pieces of paper that supposedly are worth their face value but in fact are worth nothing.

Wall Street counterfeiters during the housing bubble printed securities: pieces of paper that supposedly were worth their face value but in fact were worth much less.

In the mid-2000s, companies like Countrywide Financial Corp. issued so-called liar loans. Often without informing the borrowers themselves, Countrywide and other loan companies would claim that, say, a bartender was making $500,000 a year, allowing them to borrow enough money to buy a home that they couldn’t possibly afford. The originating banks then took the loans, which could never be paid back on the bartender’s real income, and securitized them — i.e., bundled them together into a trust, which was then sliced up into bonds called residential mortgage-backed securities. These securities behave similarly to regular bonds, coming with a quality rating and an interest rate that they pay out. These securities, sold to credulous investors such as pension funds, were the counterfeit paper of the period, remaining valuable as long as home prices rose, which allowed the bartender to refinance or sell the property when the payments got out of hand.

When prices stopped rising, the housing bubble collapsed, and those at both ends of the transaction were ruined. Borrowers, unable to sell or refinance, were thrown out of their homes. Many investors, who generally thought that they were buying risk-free bonds, lost huge sums. But by then, middlemen like Countrywide’s CEO Angelo Mozilo had taken home hundreds of millions of dollars from the fees for originating and packaging the mortgage loans.

Now it may be happening again — this time not with residential mortgage-backed securities, based on loans for homes, but commercial mortgage-backed securities, or CMBS, based on loans for businesses. And this industrywide scheme is colliding with a collapse of the commercial real estate market amid the pandemic, which has business tenants across the country unable to make their payments.

JOHN M. GRIFFIN and Alex Priest are, respectively, a prominent professor of finance and a Ph.D. candidate at the McCombs School of Business at the University of Texas at Austin. In a study released last November, they sampled almost 40,000 CMBS loans with a market capitalization of $650 billion underwritten from the beginning of 2013 to the end of 2019.

“Overall,” they write, “actual net operating income falls short of underwritten income by 5% or more in 28% of loans.” This was just the average, however: Some originators — including an unusual company called Ladder Capital as well as the Swiss bank UBS, Goldman Sachs, Citigroup, and Morgan Stanley — were significantly worse, “having more than 35% of their loans exhibiting 5% or greater income overstatement.”

Read more:

https://theintercept.com/2021/04/20/wall-street-cmbs-dollar-general-ladd...

Free Julian Assange Now !!!!!!!!!!!!!!!

- By Gus Leonisky at 21 Apr 2021 - 8:23am

- Gus Leonisky's blog

- Login or register to post comments

buffett's views....

see also:

the great unwind .....

down to the bones …..

exceptionally favourable terms

a packet for a good bucket...

the midas touch...

as the tide goes by...the world for sale...

The World for Sale

Money, Power and the Traders Who Barter the Earth's Resources

By: Javier Blas, Jack Farchy

Published: 2nd March 2021

ISBN: 9781847942661

Number Of Pages: 416

Meet the traders who supply the world with oil, metal and food - no matter how corrupt, war-torn or famine-stricken the source.

'The definitive, eye-opening story of the most powerful and secretive traders in the world.' Bradley Hope, co-author of Billion Dollar Whale

The modern world is built on commodities - from the oil that fuels our cars to the metals that power our smartphones.

We rarely stop to consider where they come from. But we should.

In The World for Sale, two leading journalists lift the lid on one of the least scrutinised corners of the economy: the workings of the billionaire commodity traders who buy, hoard and sell the earth's resources.

It is the story of how a handful of swashbuckling businessmen became indispensable cogs in global markets: enabling an enormous expansion in international trade, and connecting resource-rich countries - no matter how corrupt or war-torn - with the world's financial centres.

And it is the story of how some traders acquired untold political power, right under the noses of Western regulators and politicians - helping Saddam Hussein to sell his oil, fuelling the Libyan rebel army during the Arab Spring, and funnelling cash to Vladimir Putin's Kremlin in spite of strict sanctions.

The result is an eye-opening tour through the wildest frontiers of the global economy, as well as a revelatory guide to how capitalism really works...

Read more:

https://www.booktopia.com.au/the-world-for-sale-javier-blas/book/9781847942661.html?

British government tried to steal Venezuela’s money

Like all states, the Bolivarian Republic of Venezuela has deposited assets in foreign banks for the purpose of insuring its exports, oil in particular. Consequently, she deposited several billion dollars in the Bank of England. However, in early 2019, when she decided to sell off some of her assets to meet both her export difficulties and her growing food needs, the Bank kept them back.

Causing a stir worldwide, it gave rise to a diplomatic battle at the United Nations and a legal battle in the UK. At the first instance, the British courts justified the seizure on the grounds that the Crown no longer recognized the government of Venezuela, but that of its opponent, Juan Guaidó. Ultimately, the London Court of Appeals overturned this decision and ordered the funds to be reurned to Venezuela.

In a recently published book (The World for Sale), Javier Blas, head of Bloomberg’s energy department, reveals that Sir Alan Duncan (then Deputy Foreign Minister for Europe and the Americas) acknowledged having pressured Bank of England Governor Mark Carney to reject Venezuela’s request.

Wikileaks had already exposed Sir Alan Duncan’s behaviour in Libya, when, during the 2011 war, he pressured fuel exporters to stop supplying the Libyan Arab Jamahariya and sell it instead to the secessionists in Benghazi.

Read more:

https://www.voltairenet.org/article212832.html