Search

Democracy Links

Member's Off-site Blogs

Gus Leonisky's blog

wanted: salvage expert .....

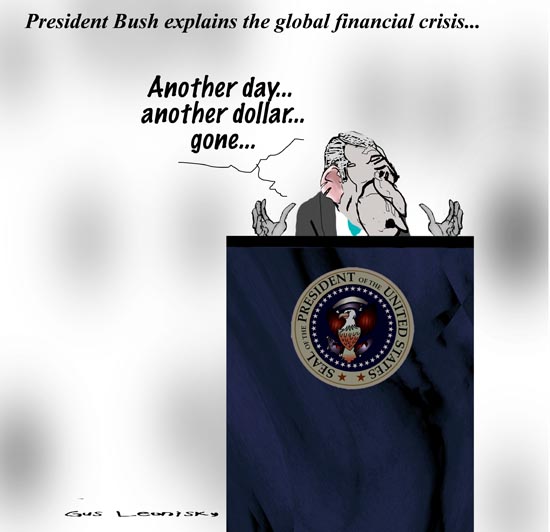

If Sen. Barack Obama wakes up as the president-elect on Nov. 5, he will immediately assume responsibility for fixing a shredded economy while the Bush administration is still in office.

- By Gus Leonisky at 20 Oct 2008 - 5:53am

- 3 comments

- Read more

from struggle street .....

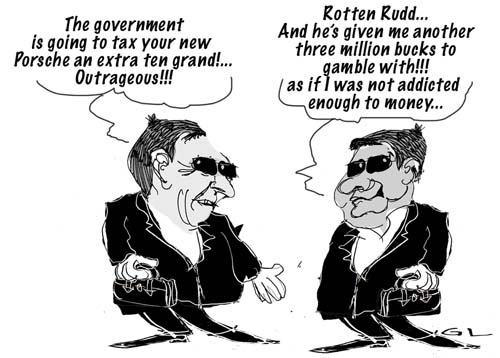

Financial workers at Wall Street's top banks are to receive pay deals worth more than $70bn (£40bn), a substantial proportion of which is expected to be paid in discretionary bonuses, for their work so far this year - despite plunging the global financial system into its worst crisis since the 1929 stock market crash, the Guardian has learned.

- By Gus Leonisky at 19 Oct 2008 - 3:53pm

- 16 comments

- Read more

the death of the budgie smuggler .....

Scanners being tested at Melbourne Airport will not blur the genitals of passengers.

Transport security authorities are trialling the new 'X-ray backscatter' body scanner, which has been described by critics as a 'virtual strip search'.

- By Gus Leonisky at 18 Oct 2008 - 11:40am

- 3 comments

- Read more

look at me, look at me .....

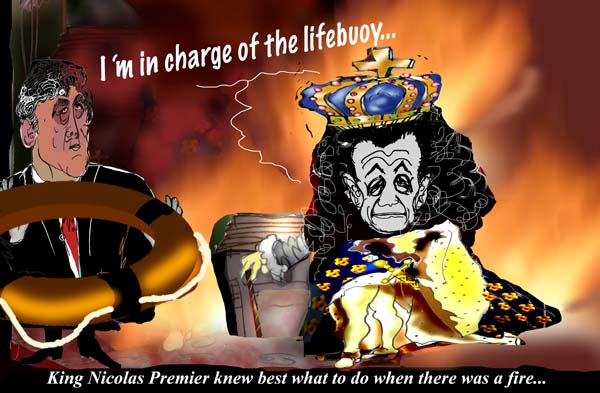

Gordon Brown's key role in heading off a global financial crisis was challenged last night by the French President, Nicolas Sarkozy.

The two leaders jostled for position at a European summit in Brussels amid tensions between them over who should get the credit for the landmark decision by governments around the world to take stakes in ailing banks.

- By Gus Leonisky at 18 Oct 2008 - 7:27am

- 1 comment

- Read more

running of the bull .....

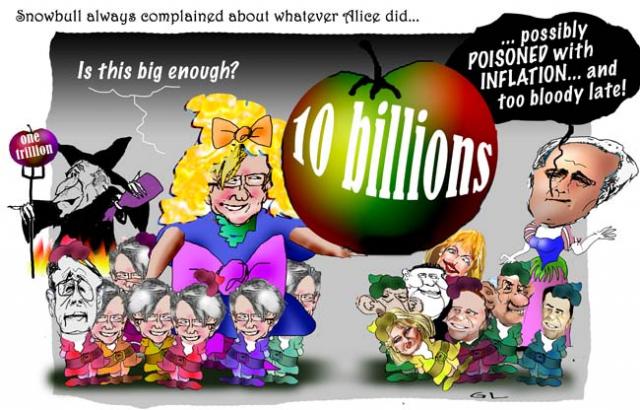

Opposition Leader Malcolm Turnbull has addressed the nation a day after the Prime Minister, accusing the Federal Government of missing the warning signs ahead of the financial crisis.

- By Gus Leonisky at 15 Oct 2008 - 10:25pm

- 5 comments

- Read more

bipartisanship .....

The Anchor Baby summarizes the wingnut pushback on the unmasking of the diseased Republican base:

- By Gus Leonisky at 15 Oct 2008 - 9:06pm

- 1 comment

- Read more

oh damn .....

In a televised address to the nation Prime Minister Kevin Rudd said the Government will do whatever is necessary to maintain economic stability, as dire global conditions continue.

- By Gus Leonisky at 15 Oct 2008 - 8:24pm

- 2 comments

- Read more

the great unwind .....

The rapidly growing trade in derivatives poses a 'mega-catastrophic risk' for the economy and most shares are still 'too expensive', legendary investor Warren Buffett has warned.

- By Gus Leonisky at 13 Oct 2008 - 10:38pm

- 7 comments

- Read more

restoring public confidence .....

The problem is that the markets no longer have any faith that the world financial system they helped create has any future.

The model is bust. It is encouraging that both the Americans and Germans are now moving towards what they considered ideologically unthinkable a fortnight ago - they are preparing to follow the British lead, take big public stakes in banks and offer guarantees to the interbank market.

- By Gus Leonisky at 13 Oct 2008 - 10:17pm

- 1 comment

- Read more

protection rackets .....

The Federal Government says its move to guarantee all bank deposits for the next three years does not mean there is a problem with Australian banks.

Prime Minister Kevin Rudd has announced that the Government will guarantee all deposits in banks, building societies, credit unions or Australian subsidiaries of foreign banks.

- By Gus Leonisky at 13 Oct 2008 - 10:05pm

- Login or register to post comments

- Read more

in search of optimism .....

The four most dangerous words for investors are: This time is different.

In 1999, technology companies with no earnings or sales were valued at billions of dollars. But this time was different, investors told themselves. The Internet could not be missed at any price.

- By Gus Leonisky at 12 Oct 2008 - 10:12pm

- 6 comments

- Read more

the little trooper .....

Republican vice-presidential candidate Sarah Palin yesterday shrugged off the findings of a state inquiry into the 'Troopergate' affair, which concluded that she had used her position as governor to pursue a private feud with a State Trooper.

- By Gus Leonisky at 12 Oct 2008 - 9:56pm

- 2 comments

- Read more

pass the lippy please .....

A new opinion in the United States gives the Democratic presidential candidate Barack Obama a 6 per cent lead over his Republican rival John McCain.

The poll shows 49 per cent support Senator Obama compared with 43 per cent for Senator McCain.

- By Gus Leonisky at 12 Oct 2008 - 9:35pm

- 3 comments

- Read more

from the outhouse .....

Derivatives traders were yesterday nervously picking their way through the wreckage of the Lehman Brothers bankruptcy in what was the biggest test to date of the unregulated $60 trillion (£35.4 trillion) credit default swaps market.

Investors who had placed bets on Lehman's creditworthiness held an auction aimed at clarifying who owes what to whom after the investment bank went bust four weeks ago, and analysts believe that several hundreds of billions of dollars will change hands.

- By Gus Leonisky at 11 Oct 2008 - 11:37pm

- 1 comment

- Read more

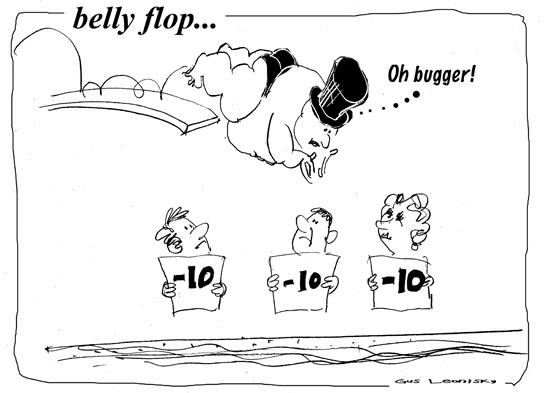

at the potomac pool .....

Until 3 pm on Thursday, it seemed as if the stock market might escape another dark day.

Then the selling hit — and hit and hit again, mimicking trading on Tuesday and Wednesday. What had been a moderately down day ended in a rout, with the Dow Jones industrial average closing down 679 points, or 7.3percent, leaving it below 9,000 for the first time in five years.

- By Gus Leonisky at 11 Oct 2008 - 6:23am

- 3 comments

- Read more

Recent comments

1 hour 10 min ago

1 hour 20 min ago

1 hour 37 min ago

1 hour 50 min ago

2 hours 1 min ago

2 hours 5 min ago

9 hours 56 min ago

10 hours 18 min ago

11 hours 48 min ago

12 hours 54 min ago