Search

Democracy Links

Member's Off-site Blogs

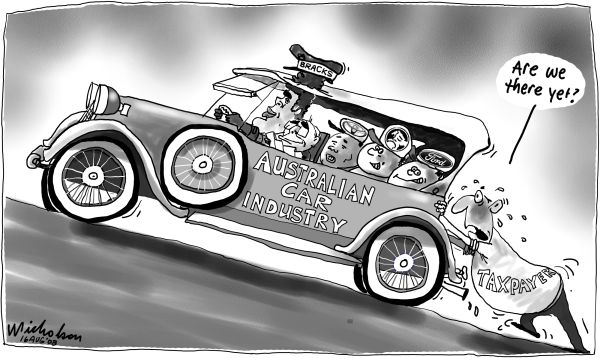

picking winners .....

It is no coincidence that each week brings news of another manufacturer forced to lay off staff, reduce their hours or shut up shop completely. Confronting a high Aussie dollar and an army of cheap labour overseas, it was the turn of Holden and the manufacturers of Mortein, Reckitt Benckiser, to announce job losses this week. Such events are invariably accompanied by calls for more industry assistance.

What you might not hear so much about is that the government already pours many billions of taxpayers' dollars each year into assisting industries to survive. The two most common forms of assistance are tariffs - duties imposed on imported goods to give local producers a leg up - and direct budgetary assistance, comprising direct subsidies and tax concessions.

''Hey, didn't they abolish all the tariffs already?'' I hear you thinking. Well, no, tariff rates have been dramatically reduced since the 1980s, but remain in place on many manufactured goods like cars, clothing and food. Did you know that Australia still imposes tariffs on grapes and softwood conifers?

The Productivity Commission's latest annual review of industry assistance shows the gross value of these tariffs to Australian import-competing industry was $9.4 billion in 2009-10.

However, such tariffs also impose a penalty on other businesses which rely on imported goods to do business, such as construction firms and retailers. This input penalty is estimated to cost about $8 billion a year, bringing the net value of tariff assistance to the entire Australian economy down to just $1.4 billion.

But while tariffs have fallen out of fashion, and rightly so given the costs they impose on consumers and other businesses, industry continues to clamour for direct government subsidies and tax concessions. Australian industry received some $7.9 billion from such assistance in 2009-10. About half came in the form of direct payments and half in tax concessions.

To put that into perspective, the cost of budgetary assistance to Australian industry is approaching half of the federal government annual spending on defence ($21 billion) and a third of what it spends each year on education ($30 billion). These are no small bickies.

So where does it all go?

Across all industries, about one-third goes to research and development. A quarter is spent on industry-specific assistance, followed by small business grants and tax offsets (18 per cent) and 8 per cent on export assistance.

Manufacturing continues to enjoy the most privileged position of government protection due to tariffs. But its share of budgetary assistance has shrunk recently, from 36 per cent of assistance in 2003-04 to 23 per cent in 2009-10. Services industries, which employ around two-thirds of workers, have enjoyed an increasing share of assistance, up from 28 per cent to 46 per cent.

Peering closer, property and business services enjoy the highest level of budgetary assistance, $799 million a year, of all the 34 industries tracked by the commission.

Coming in second place is finance and insurance ($794 million), thanks to tax concessions designed to transform Australia into a ''finance hub''. Vehicles and parts comes in third, with $721 million, thanks largely to the Automotive Competitiveness and Investment Scheme. Car industry assistance, then, accounts for a little under 10¢ in every government dollar spent on industry assistance.

Next time you hear an industry calling for more assistance, remember it all adds up. The hidden cost for tax taxpayers is either higher taxes or less spending on health, education and other services - sometimes both.

- By John Richardson at 4 Feb 2012 - 3:13pm

- John Richardson's blog

- Login or register to post comments

Recent comments

1 hour 19 min ago

1 hour 25 min ago

3 hours 44 min ago

3 hours 52 min ago

11 hours 27 min ago

12 hours 26 min ago

22 hours 6 min ago

1 day 1 hour ago

1 day 3 hours ago

1 day 13 hours ago