Search

Democracy Links

Member's Off-site Blogs

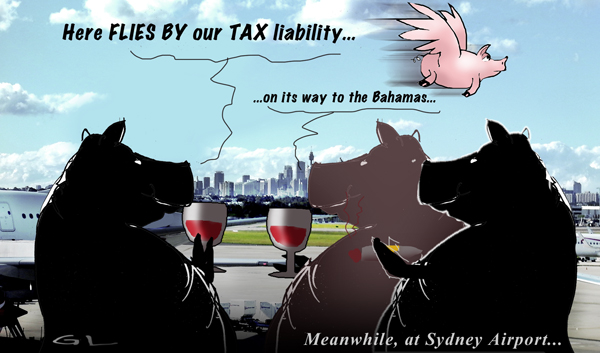

fly bye byes...

Sydney Airport has paid no tax in the 10 years since it was privatised by the government.

While other international gateways such as Melbourne and Auckland are also held in private hands and regularly pay corporate tax, the last time Sydney Airport paid tax was before its sale to Macquarie Bank in 2002.

Not only has the company that controls the airport continued to structure its affairs so that it has no tax liability, it has won a tax benefit also.

An examination of Sydney Airport Corporation's financial accounts since its first full year of privatisation in 2003 shows the airport booked almost $8 billion in revenues during that time and gained tax benefits of almost $400 million. Although its report for June 2006 shows an entry of $425,000 for corporate tax, the picture is clouded by the complexity of the financial statements which includes a tax gain of $137 million in the interim accounts for that year.

In light of the potential sale of Australia Post, Medibank Private and assorted state-owned electricity assets after the election, Sydney Airport's failure to contribute to the national coffers lends another weapon to the armoury of those who oppose privatisation.

Further, it reflects the profound dilemma aggravating governments around the world; how to compel recalcitrant corporations to pay their fair share. Google Australia for instance is yet to contribute any meaningful corporate tax in this country, despite earning billions.

Google routes its revenues through low-tax jurisdictions such as Ireland. It paid a miserly $74,000 in 2011 on sales estimated in the order of $2 billion.In its profit results handed down on Thursday, however, Sydney Airport Corporation makes Google look like a half-decent corporate citizen.

Read more: http://www.smh.com.au/business/airports-pot-of-gold-20130822-2segw.html#ixzz2ckCNXE2L

- By Gus Leonisky at 23 Aug 2013 - 10:07am

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

9 hours 10 min ago

9 hours 20 min ago

9 hours 25 min ago

9 hours 31 min ago

13 hours 20 min ago

14 hours 46 min ago

15 hours 3 min ago

19 hours 45 min ago

20 hours 53 min ago

1 day 6 hours ago