Search

Democracy Links

Member's Off-site Blogs

we'll be rooned .....

Remember the existential threat to our nation’s survival represented by Labor’s abject failure to rein-in the country’s spiralling, out-of-control debt?

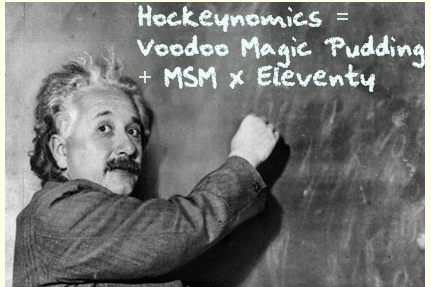

Well of course, now Joe’s in-charge & abracadabra, hocus-pocus, acetabulariishilly-kazzam, hey presto, sim sala bim & voila, there’s absolutely no problem at all.

I wonder if Rupert is aware of this amazing transformation in our nation’s fiscal fortunes?

================================================================

from Crikey …..

The September update of Australia’s debt and deficit is an intriguing document. Well, as intriguing as any general government sector monthly financial statement might be expected to be.

First, it shows that the Abbott government is on track to double the debt left by Labor -by about Christmas next year. Second, it confirms budget deficits will also double those projected under Labor over the next four years. The third item implicit in the document - although not exactly spelled out - is that Australia’s debt is not “spiralling out of control” and never was. Fourth, this was a timely release of finance data - within the month - for the first time since the May figures.

Releasing a statement on a Friday night usually suggests it contains unpalatable data the government would rather the mainstream media ignore. This one does, and indeed they have.

The September figures from the Finance Department reveal:

* The government’s net debt projection for 2014-15 remains where it was at the time of the May budget at $226.39 billion. That is $48.3 billion, or 27.1%, above last year’s target set by the previous Labor government;

* Just from June 30 to September 30 this year - three months for which the current government must accept complete responsibility - the debt expanded from the actual 2013-14 outcome of $202.46 to $221.33 billion;

* Just in that three months, the government has borrowed 79% of all the new money it had planned to borrow for the whole financial year;

* Australians are now paying $38.8 million in interest on debt each day; and

* The year-to-date deficit at the end of September is $19.16 billion, just a whisker below the level projected in the May budget.

As shown here a fortnight ago, the monthly reports from Finance between July and December last year all show the forecast end of year net debt for 2013-14 steady at $178.10 billion. Labor must own that level.

The total increase at the end of September above Labor’s level is now a cool $43.2 billion ($221.3 - $178.10). That’s up 24.3% already.

Just since June 30 this year, the increase in borrowings has been almost $19 billion, a rate of increase above 3% per month, or 43% annually. If maintained, that rate would double Labor’s debt by about December next year. So it is a slightly slower rate than just for July and August.

Will that rate continue, slow down further, or accelerate? The figures for October and November will be instructive.

On interest payments, the September numbers suggest the total bill for 2014-15 is likely to exceed the forecast $14.7 billion. Already, in the first three months of this financial year, total interest paid is $3.6 billion [note 3, page 6]. At that rate, if borrowings do not expand, the total for the year will be $14.4 billion. But borrowings are projected to increase - by another $5 billion at least.

It has already been established that the budget deficits under the Coalition’s economic program will double those projected under Labor over the four-year forward estimates period. That was comprehensively shown in an ABC news fact-check investigation last June, after the budget was released. The latest figures do not challenge this.

It is a curious thing that there appears so little interest in all this from Australia’s mainstream media. Before the last election, they were very keen to report the many assurances like this from Tony Abbott in opposition:

“The first priority of an incoming Coalition government will be to end Labor’s waste and get debt and deficits under control as quickly as possible. This is what’s most needed to restore confidence and to get the economy moving again.”

It seems that was then. This is now.

Abbott government to double Australian government debt

- By John Richardson at 27 Oct 2014 - 2:40pm

- John Richardson's blog

- Login or register to post comments

Recent comments

1 hour 11 min ago

2 hours 5 min ago

3 hours 6 min ago

3 hours 32 min ago

4 hours 25 min ago

4 hours 51 min ago

5 hours 28 min ago

1 day 1 hour ago

1 day 2 hours ago

1 day 2 hours ago