Search

Democracy Links

Member's Off-site Blogs

the usual suspect ....

ANZ says administrative error behind $30m compensation …..

Adele Ferguson: Banks' rotten financial planning structure is teetering

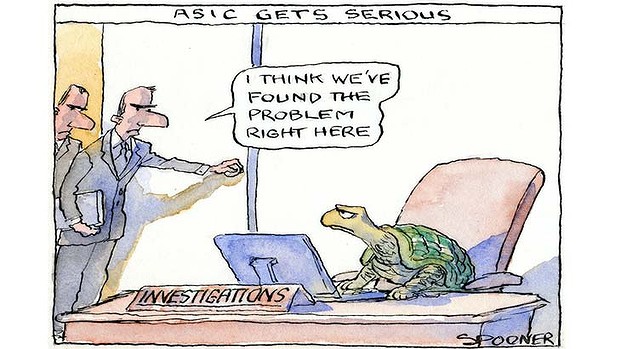

After ASIC's exposure as a "weak and hesitant regulator" in the Senate Inquiry last year, it has ramped up its activity level and is now desperate to look like it is doing its job.

God alone knows how an organisation can demonstrate such systemic incompetence yet survive without significant personnel changes.

But this latest revelation on unearned fees did not come about due to institutional honesty and self-disclosure, or due to ASIC's "after the horse has bolted – let's try and save our skins" review of the six major institutions.

This is what I said in one of my submissions to the Senate inquiry a year ago:

"The attitude at CBA to harvesting this recurring income in return for providing no service may have been among the worst in the industry but it is a pretty prevalent attitude."

ASIC throws whistleblowers to the wolves and tries to pretend they don't exist, then frowns at the camera and shamelessly triesto take the credit as a "tough regulator" for what it has been spoon fed.

At least though, thanks to whistleblowers, investigative journalists and a bipartisan group of senators doing the work of ASIC, significant progress is now being made in exposing systemic malfeasance in financial services that has ruined the lives of tens of thousands, if not hundreds of thousands of innocent people over the years.

Imagine how much more rottenness would be exposed by a royal commission?

How much longer can this government run interference for its mates – the big financial institutions – by refusing to call a royal commission that is justified in spades?

Particularly as this government set the bar so low with its blatantly political Pink Batts Royal Commission?

Meanwhile the evidence keeps rolling in and rolling in and rolling in.

ASIC has shown its systemic incompetence

- By John Richardson at 19 Apr 2015 - 8:39am

- John Richardson's blog

- Login or register to post comments

Recent comments

9 hours 8 min ago

9 hours 36 min ago

9 hours 49 min ago

9 hours 59 min ago

10 hours 10 min ago

10 hours 24 min ago

10 hours 51 min ago

11 hours 8 min ago

11 hours 33 min ago

14 hours 41 min ago