Search

Recent comments

- macronleon de gaulle.....

21 min 32 sec ago - nazis in washington.....

29 min 53 sec ago - blinkenings.....

8 hours 4 min ago - georgia's NGOs

9 hours 3 min ago - breeding insanity....

18 hours 43 min ago - american "diplomacy"

21 hours 40 min ago - deceit america....

23 hours 59 min ago - police-state....

1 day 9 hours ago - the war continues....

1 day 10 hours ago - scott is angry.....

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

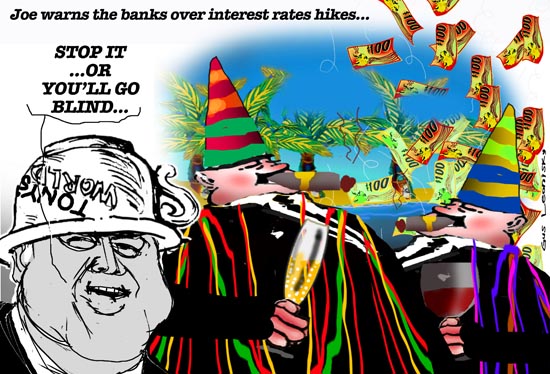

yikes hikes...

Opposition treasury spokesman Joe Hockey has foreshadowed the Coalition might find the numbers in Parliament to act against banks that raise interest rates above the level recommended by the Reserve Bank.

He has criticised Treasurer Wayne Swan for not being effective in preventing the banks from lifting rates by more than the increase in the cash rate.

Mr Hockey says there are other levers Mr Swan should be using, including punitive ones, and he says the Parliament might act if the Government does not.

"I think the banks have successfully intimidated the Government into weakness," he said.

"The banks ought to understand they rely heavily on a Government and a Parliament that delivers good will and if the banks trade off that good will to gouge Australian consumers, then if the Government doesn't move to put pressure on the banks then the Parliament will."

Mr Hockey says the Treasurer should be pointing out that the latest Reserve Bank minutes damage the banks' arguments that they face higher fundraising costs.

http://www.abc.net.au/news/stories/2010/10/21/3043966.htm

-----------------------

Yes-yes Joe... We know all that... Nothing new... But rather than bagging the government for the banks' possible hike of interest rates — which they haven't done yet — ease off!!... Take a foreshadowing vacation!!! Tell Abbott, your mate, to do the same too. That will make our life far less stressful, even if the banks steal a bit more of our money...

- By Gus Leonisky at 21 Oct 2010 - 8:13am

- Gus Leonisky's blog

- Login or register to post comments

ficticious leverage...

Mr Hockey suggested the coalition might be able to garner sufficient crossbench support in the parliament to take action against the banks if Mr Swan did not act.

But his frontbench colleague Mr Turnbull was reluctant to say how parliament could intervene.

"Parliament has got plenty of legislative scope ... but I'm not aware of any precedent for parliament regulating interest rates," he told ABC Radio.

http://www.smh.com.au/business/swan-must-limit-rate-rises-hockey-20101021-16ump.html

Gus: may I remind the two clowns, Joe and Malcolm that even John Howard with all his cunning might could do zip with the banks...

a sea of complete financial idiocy...

Michael Pascoe SMH

Nice to see Joe Hockey multiskilling, demonstrating his talents as a potential talkback radio shock jock. The secret to successful demagoguery is telling the punters what they want to hear - and not letting facts get in the way of a populist story.

Thus the shadow treasurer's amazing performance suggesting the government consider legislating bank interest rates. Heck, why stop there? Nationalise the bludgers! Electing Menzies in 1949 was a terrible mistake - Ben Chifley had been right.

Hockey's immediate lampooning from left, right and centre - well, from Wayne Swan and his own party anyway - missed the point.

Sure Sloppy Joe was talking nonsense, or seeking membership of the Greens, but the legion of voters who have mortgages or want to have mortgages don't care. They just don't want interest rates to rise any more when every day brings another headline along the lines of the Reserve Bank champing at the bit, desperately keen to bludgeon the economy with its blunt instrument.

http://www.smh.com.au/business/never-let-facts-get-in-the-way-of-good-demagoguery-20101021-16va7.html?autostart=1

--------------------

Gus: one of the thing that amazes me as well is that the Liberals (Libshit conservatives) are the champions of "free enterprise" and "free market" and are anti-keynesian practice of running deficit to help the poor in hard times. But because the Labor party is letting the banks find the balance of their social ethics, Joe decides they need to be punished if they don't... The Libshits are the champions of the "trickle-down" effect... In hard times, they'd be giving banks money for managers to cushion their bonuses before helping the nation as a whole.

Joe is lost in a sea of complete financial idiocy.

revolutions in the street

LONDON — The British economist John Maynard Keynes may live on in popular legend as the world’s most influential economist. But in much of Europe, and most acutely here in the land of his birth, his view that deficit spending by governments is crucial to avoiding a long recession has lately been willfully ignored.

In Britain, George Osborne, chancellor of the Exchequer, delivered a speech on Wednesday that would have made Keynes — who himself worked in the British Treasury — blanch.

He argued forcefully that Britons, despite slowing growth and negligible bank lending, must accept a rise in the retirement age to 66 from 65 and $130 billion in spending cuts that would eliminate nearly 500,000 public sector jobs and hit pensioners, the poor, the military and the middle class because of what he insisted was the overwhelming need to reduce the country’s huge budget deficit.

In Ireland, where the economy is suffering through its third consecutive year of economic slump, Keynes is doing no better. Devastated by a historic property crash and banking bust, the Irish government is preparing another round of spending cuts and tax increases.

Combined with what Dublin has already imposed, the cuts could add up to as much as 14 percent of Ireland’s gross domestic product, an extraordinary amount for a modern industrial country. Ireland’s budget deficit reached 32 percent of total economic output this year.

Indeed, across Europe, where the threat of a double-dip recession remains palpable, governments from Germany to Greece are slashing public outlays. But even as students and workers in France clash with the police and block fuel shipments to protest a rise in the retirement age, the debate in Europe is more on how fast to cut government spending rather than whether such reductions are the right thing to do under the circumstances.

“Everything Keynes established about the primacy of maintaining demand at a steady pace is gone,” Brad DeLong, a liberal economist and blogger at the University of California, Berkeley, said mournfully.

http://www.nytimes.com/2010/10/21/world/europe/21austerity.html?hp=&pagewanted=print

-------------------

Gus: one is lucky that most average people are "okay" despite complaining about the price of fish... But it does not take much extra to send the revolutions into the street... This was what Keynes wanted to avoid: the destitution of most of the population because of "hard times"... These days, hard times mean nothing much for most... But it could just turn around in a jiffy if the wrong buttons are pressed...

incomprehensible and reckless...

Treasurer Wayne Swan says Joe Hockey's call to act on bank interest rates is driven by his own leadership ambitions.

Last night the Opposition Treasury spokesman called on Mr Swan to do more to stop banks raising interest rates beyond the official cash rate, foreshadowing a move in Parliament if the Government did not act.

His comments came after Liberal Senator David Bushby questioned in Estimates whether the Government could use the Banking Act to lean on banks considering raising rates.

But Mr Swan has ridiculed Mr Hockey's comments, calling them "reckless", and accused him of attempting to re-regulate the banks.

"The statements from Mr Hockey are simply incomprehensible and completely reckless," he told The World Today.

"What he seems to be saying is that we should jump in the time machine and remove the Reserve Bank's independence by re-regulating interest rates.

"These statements have not been well thought out.

"I think they're all frankly driven by internal politics within the frontbench of the Liberal Party and his contest with [Andrew] Robb."

http://www.abc.net.au/news/stories/2010/10/21/3044519.htm

ruling porcine class...

Poor old Joe Hockey.

It's a tough day at the office when Don Randall calls you a loony.

But nothing is static in politics any more, and no blooper is so egregious that its history can't be rewritten, or at least comfortingly blurred.

And so it proved yesterday, for Mr Hockey.

Just as the Seven Commandments of Orwell's Animal Farm evolve over the course of the novel to spare the blushes of the ruling porcine class, Mr Hockey's demands were massaged, over the course of yesterday, into something all of his colleagues could live with.

So while at sunrise Mr Hockey was issuing an ultimatum to the Treasurer to use the "levers" of government regulatory policy to stop the banks putting up interest rates, by sundown he was merely calling for a national debate and a "new social compact with the banks".

"This is not about additional regulation or punitive measures," Mr Hockey wrote in The Australian this morning, blithely abandoning the "levers" he had so openly fancied just 24 hours earlier.

A "new social compact" is vague enough for the most ardent free-market economist to support, and might even keep Mr Hockey out of trouble at home, where Mrs Hockey (an extremely senior banker who co-juggles three kids with the shadow treasurer) has enough to worry about without her husband barging into her workplace and messing around with levers.

http://www.abc.net.au/news/stories/2010/10/22/3045800.htm?site=thedrum

joe is standing in his caca....

Opposition treasury spokesman Joe Hockey has come under fire from ANZ's chief executive, who has unveiled a massive increase in full-year profit for the bank.

ANZ has posted a 53 per cent rise in its bottom-line profit to $4.5 billion after tax for the year to September.

That puts it in between National Australia Bank's $4.2 billion result and the Commonwealth's $5.7 billion result.

Last week, Mr Hockey called on Treasurer Wayne Swan to do more to stop banks raising interest rates beyond the official cash rate, foreshadowing a move in Parliament if the Government did not act.

His comments came after Liberal Senator David Bushby questioned in Estimates whether the Government could use the Banking Act to lean on banks considering raising rates.

But ANZ chief executive Mike Smith has told ABC's AM program the comments are out of step with the Coalition's history of economic reform.

"I think it's a real shame that the Coalition, which I think had a good track record in economic management, has now come down to some of the comments of Mr Hockey," he said.

"I think it's very unfortunate. This is pure populism."

But Mr Hockey is standing by his calls for government intervention in the banking sector.

http://www.abc.net.au/news/stories/2010/10/28/3050390.htm

---------------------------

The duplicitous bum.

Joe, the mining industry is making far more dosh than the banks, AT THE EXPENSE OF OUR FINITE NATIONAL RESOURCES, and you, and your little turdy leader, want to stop the government placing a super profit tax on those, all in the name of "free enterprise". But when in comes to populism about banks ripping people off (which they don't in general), you place your best foot forward to shoot it through.

Pathetic Joe... (caca)

brains and brawn...

The Greens have thrown their support behind Opposition treasury spokesman Joe Hockey's push to rein in the banks.

Mr Hockey's nine-point plan has made headlines for much of the week after he outlined his proposal in a speech on Monday.

Mr Hockey has been ridiculed by the Government over his plan and also copped a lashing from ANZ chief Mike Smith, who accused him of having a personal vendetta against the banks.

Mr Hockey was also forced to deny the details of a damaging leak which alleged his shadow Cabinet colleagues were strongly critical of his actions.

But Greens Leader Bob Brown says his ideas make sense.

"I'm very mindful of the massive profits the banks have announced this week," he said.

"Following the global downturn, alternatives for consumers - for average Australians - have been restricted.

http://www.abc.net.au/news/stories/2010/10/29/3051867.htm?section=justin

----------------------

Gus: imagine for a moment the banks not making any profits in a system that DEMANDS banks making profit... We'd soon be in trouble. It's not the banks that are the source of trouble... The whole system stinks and destroys the earth in the process... So, why pick on banks when the mining industry is doing far more damage and making humongous profits...

At least in the banking business, there's a bit of brainiac about counting dosh. In mining, it's mostly unsophisticated brawn that scoops up that industry...

cynical grab by bankers...

The Commonwealth Bank has been the first to react to the Reserve Bank's interest rate hike, raising interest rates by 45 basis points.

The Reserve Bank announced this afternoon it would increase rates by 25 basis points, taking the official cash rate to 4.75 per cent.

CBA announced to the share market just before 4:00pm AEDT that its standard variable mortgage rate would be rising to 7.81 per cent per annum on Friday November 5.

That will add $88 a month to a $300,000 standard variable mortgage on a 25-year term, according to CBA's own mortgage calculator.

However, its deposit rates are only rising in line with the RBA's 25-basis point increase.

Federal Treasurer Wayne Swan says he is disappointed with the Commonwealth Bank's move.

"This is a cynical cash grab by the Commonwealth Bank - there's no other way to look at it," he said.

"I think Australians deserve a lot better, especially on Melbourne Cup Day, than to have this sort of cynical decision from the Commonwealth Bank."

The Federal Opposition's treasury spokesman, Joe Hockey, says the Reserve Bank's increase could have been avoided if the Government cut back on stimulus spending.

http://www.abc.net.au/news/stories/2010/11/02/3055277.htm

-------------------------

Gus: Joe gets it wrong again. The stimulus has "already been cut back" and to some extend the Reserve Bank got it wrong... The more you hammer with interest rates, the more the Aussie Dollar is going up, wiping out all the moderate gains done by most of the ordinary Australian people, and helping the miners line their pockets by plaing the money market as well... Now, it's mining gains versus the forthcoming destruction of agriculture... And one thing is for sure, one cannot eat dirt. But once the agriculture of this country is sent kaput by the rising dollar due to the Reserve Bank, we all can eat dust — or imported crap.

Importing staple food in this country is stupid...

The Reserve Bank cannot see beyond its single lever — up and down — to drive a complexity... And as far as the commonwealth, we all know the name is misleading...

running riot with dosh

Treasurer Wayne Swan is preparing to announce a package of banking reforms that is likely to include a number of the Coalition's ideas.

The Reserve Bank announced yesterday it would increase rates by 25 basis points, taking the official cash rate to 4.75 per cent.

The Commonwealth Bank was the first bank to react, raising interest rates by 45 basis points.

Mr Swan says the Government will announce a range of policy changes next month to boost competition in the banking sector which he says will put downward pressure on rates.

"We've been working very closely with our regulators, putting together further reform," he said.

"It will put pressure on the major banks to behave in a better way."

Mr Swan says the banks need to be reined in.

"There's a culture of arrogance among the banks," he said.

http://www.abc.net.au/news/stories/2010/11/02/3055441.htm

----------------------

Gus: whoever wrote this shit-piece at the ABC should know better. The Labor government has been working for a long time on reining in the banks without trying to frighten the pants out of them — what Joe Hockey has been doing lately... Thus the "likely to include a number of the Coalition's ideas" is a lot of crap. Ideas to make sure the money market is not out of hand have been floating for a while in the Labor camp. The Libs (conservatives) are mostly in favor of "free market"...

The main culprit as well is the Reserve Bank that is hammering the primary producers and the home owners while the banks and the miners are running riot with dosh... The higher the Aussie dollar, the more machinery they can import, the more they can dig up of OUR resources, all without affecting their private sales...

have a lousy xmas...

He says the RBA's decision, and subsequent increase in home loan rates by the nation's biggest lender the Commonwealth Bank, packs a double-punch for many retailers.

"If you've got consumers who aren't spending money, and you've got a bank overdraft or a bank loan, and you've got to pay that bank loan back and you're not getting the income in, how do you service your bank loan?" added Mr Zimmerman.

"So it's a huge double whammy, quite frankly."

Sympathy for the RBAHowever, Morgan Stanley's global strategist Gerard Minack says self-interest is behind most of the criticism.

He says the Reserve Bank needed to move, to prepare for the impact of the coming mining boom.

"Would you want people loading up on Christmas shopping and then whack them with their big credit card bills in February? I mean better to give the man on the street a warning that rates have to go up, delaying it perhaps to make a better Christmas seems to defeat the purpose," he explained.

http://www.abc.net.au/news/stories/2010/11/03/3056195.htm?section=justin

Gus: preempting mining boom to make sure you have a lousy christmas... That's brilliant — sympathy for the devil... seen that one coming!!!... "self-interest is behind most of the criticism"???? Oh boy...