Search

Recent comments

- police-state....

2 hours 9 min ago - the war continues....

2 hours 58 min ago - scott is angry.....

9 hours 58 min ago - a catastrophe?....

13 hours 37 min ago - 3Xwars is 3Xpeace?....

15 hours 36 min ago - futile trousers....

15 hours 59 min ago - reading reality....

16 hours 31 min ago - colonel blimp....

16 hours 40 min ago - ambassador, please!

1 day 54 min ago - yuckraine is corrupt....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

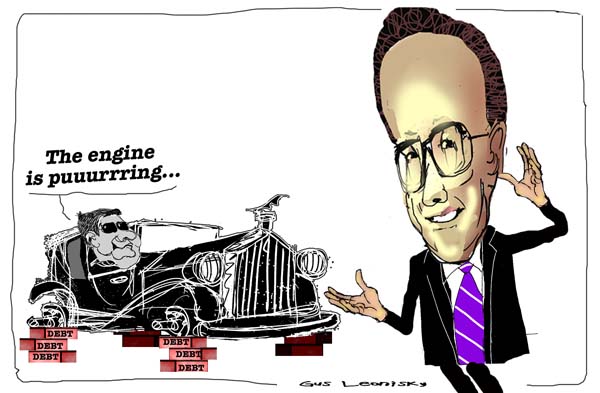

tanking economy...

The global economy is in the midst of its second growth scare in less than two years. Get used to it. In a post-crisis world, these are the footprints of a failed recovery.

The reason is simple. The typical business cycle has a natural cushioning mechanism that wards off unexpected blows. The deeper the downturn, the more powerful the snapback, and the greater the cumulative forces of self-sustaining revival. Vigorous V-shaped rebounds have a built-in resilience that allows them to shrug off shocks relatively easily.

But a post-crisis recovery is a very different animal. As Carmen Reinhart and Kenneth Rogoff have shown in their book This Time is Different, over the long sweep of history, post-crisis recoveries in output and employment tend to be decidedly subpar.

Such weak recoveries, by definition, lack the cushion of V-shaped rebounds. Consequently, external shocks quickly expose their vulnerability. If the shocks are sharp enough - and if they hit a weakened global economy that is approaching its "stall speed" of around three per cent annual growth - the relapse could turn into the dreaded double-dip recession.

That is the risk today. There can be no mistaking the decidedly subpar character of the current global recovery. Superficially, the numbers look strong: world GDP rebounded by 5.1 per cent in 2010, and is expected to rise another 4.3 per cent in 2011, according to the International Monetary Fund. But because these gains follow the massive contraction that occurred during the Great Recession of 2008-2009, they are a far cry from the trajectory of a classic V-shaped recovery.

http://english.aljazeera.net/indepth/opinion/2011/07/20117313339774928.html

- By Gus Leonisky at 5 Jul 2011 - 8:19pm

- Gus Leonisky's blog

- Login or register to post comments

no shock absorbers...

It's hard to know when the next shock will hit, or what form it will take; otherwise, it wouldn't be a shock. But, as night follows day, such a disruption is inevitable. With policymakers reluctant to focus on the imperatives of structural healing, the result will be yet another growth scare - or worse. A failed recovery underscores the risks of an increasingly treacherous endgame in today's post-crisis world.

http://english.aljazeera.net/indepth/opinion/2011/07/20117313339774928.html

potholes and wet patches...

By Ethel Hazelhurst

The world can look forward to slow growth, not low growth. That was the good news from economists at two separate presentations in Johannesburg yesterday.

Despite a range of threats to the global economy, Investec portfolio manager Chris Freund and Absa economists Jeff Gable and Gina Schoeman said the world was not on the brink of another recession – and predicted life after the soft patch.

Freund, who manages the Investec Balanced Fund, said the cooling of China’s economy, the timing of the Greek default and what would happen after the soft patch were the big issues troubling investors.

http://www.iol.co.za/business/business-news/world-growth-hits-soft-patch-say-economists-1.1093951