Search

Recent comments

- workers party GB.....

20 hours 47 min ago - insurer's scam....

21 hours 52 min ago - pissing on the EU....

22 hours 2 min ago - hypocrites....

22 hours 21 min ago - clueless.....

22 hours 36 min ago - meanwhile.....

1 day 14 hours ago - young losers....

1 day 15 hours ago - bulgarian slow train....

1 day 15 hours ago - a six-minute read...

1 day 18 hours ago - inexpensive....

1 day 20 hours ago

Democracy Links

Member's Off-site Blogs

walking the dog...

Fears about Europe’s deteriorating finances intensified on Sunday as new doubts about the health of French banks, as well as Germany’s willingness to help Greece avert default, left investors bracing for another global stock market downturn this week.

http://www.nytimes.com/2011/09/12/business/global/german-dissent-magnifies-uncertainty.html?hp

- By Gus Leonisky at 12 Sep 2011 - 9:26pm

- Gus Leonisky's blog

- Login or register to post comments

let's panic today...

In Greece, the epicenter of the Continent’s financial disarray, government officials announced new austerity measures on Sunday, even as the country’s finance minister, Evangelos Venizelos, warned that the Greek economy was expected to shrink much more sharply this year than previously anticipated. In a revision, a contraction of 5.3 percent in 2011 was predicted, rather than the 3.8 percent forecast in May.

Slower growth could make it harder for Greece to pay its debts, even as it tries to reduce them by cutting government spending and raising taxes.

While the Greek drama has been running for more than a year, only recently has it threatened French and German banks, unnerving investors around the world and sending stocks tumbling in Europe and the United States.

http://www.nytimes.com/2011/09/12/business/global/german-dissent-magnifies-uncertainty.html?hp

One economic model versus another...

The ABC Chairman, Maurice Newman, gave a speech on Wednesday night to the Sydney Institute. And while the following passage was not the central theme of his address, it is nevertheless a statement of major importance.

We may think we are all Keynesians now, but perhaps contemporary teachings of Keynes are not faithful to the original doctrine, or, maybe, Keynes is now a defunct economist. Perhaps post modernist economics has so captivated our journalists that they have suspended the spirit of enquiry, open-mindedness and scrutiny that an informed democracy so desperately needs.

Under relentless pressure, classical economics has become all but a relic of a bygone era. Yet the work of classical economists most likely holds the solution to today's economic ills.

Perhaps it does take someone from outside the economics profession to state the obvious. The stimulus packages that were applied across the world, failures each and every one of them, were applied in the name of Keynes. Why, then, did these stimulus packages not work?

...

Keynesian solutions are not working. Classical economic theory holds the answers to the problems we have. That is what Maurice Newman is saying and that is what I am saying. We might still reject classical theory when we have examined what these classical economists once wrote. But let us at least examine their works just in case they actually did know more about recessions and their cures than we are currently led to believe.

Steven Kates is senior lecturer in economics in the School of Economics, Finance and Marketing at RMIT University in Melbourne.

http://www.abc.net.au/unleashed/3592316.html

------------------------

Gus: I smell a dead rat here...

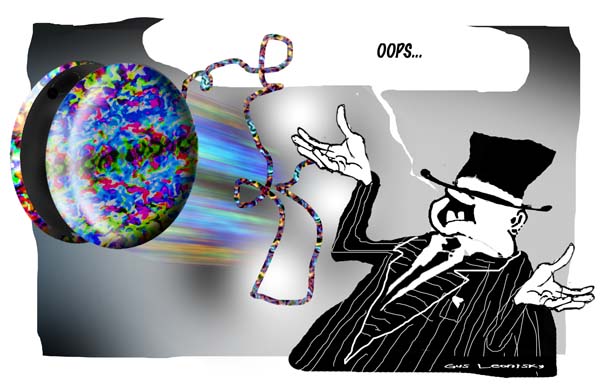

One economic model versus another?... Classical economy versus Keynesian economy? Bollocks... Classical economy mostly relies on just the value of trade... But when the traders stuff up by selling inferior goods to the claimed value, the buyer is either in deep shit unless he sues the sellers or on-sell the valueless package to someone else... In all cases, there is room for trouble... Eventually the increasing differential of value will blow the package appart...

Keynesian economy is usually used when the "classical" system is so poorly balanced that people become hungry, jobless and a revolution is brewing in the ranks...

So I believe that Steven Kates (and Newman) is off the planet...

If we let only the market forces to dictate the way we do business, just call this an invitation to charlatanism or snake-oil merchandizing... by enticing people to buy something "they don't need with money they don't have (can't spare)"...

What should certainly be at the core of all our economic systems is the value of the environment — especially the natural environment and the developed minimum environment of survival, for human and other species. For example when 20 per cent of workers are "unemployed" or having nothing to do, the kudos of the social moire drops quite a few notches. Especially when, to give them something to do, they are sent to the salt mines... As well when rich people become obsessed at getting more than they need, at the expense of the common good, things will fray.

Thus, though Steven Kates is a senior lecturer in economics, I can say with a strong relative certainty that he is wrong.

The point of the Keynesian rescue packages is to reduce the wealth disparity and minimise the collapses of earnings, in times of "economic troubles". In this recent time, unfortunately, most of the world's countries have goofed by using the extra cash to prop up their loopy bank systems and cuddled the cream-elite who pocketed the money.

In Australia, the Labor government was smart enough to see that a stimulus starts at the bottom (despite some derision and horror by the rich plus ingratitude by some of the ritewingnut recipients), by empowering most of the people who can't all be geniuses with money (otherwise we all would be bankers and stockbrokers) but have the honest ability to survive with their own way to make things, usually. When things go tough, these people are the one who bear the brunt of retrenchment, casualism, firing and other diseases, thus they need a bit of extra help when the private cash dries up from the top-down. In short, in hard times, the poorest people will never see the color of money, UNLESS THE GOVERNMENT GIVES IT TO THEM DIRECTLY — FOR SPENDING... bypassing the money-and-death merchants in the process.

Karl Marx did not think much of the "classical" economic system either.

Note: I am not an economist...