Search

Recent comments

- ambassador, please!

4 hours 44 min ago - yuckraine is corrupt....

7 hours 34 min ago - reviving bucha....

7 hours 55 min ago - US complaints.....

10 hours 30 min ago - worse than worst.....

13 hours 55 min ago - of hostages...

13 hours 58 min ago - pf hostages...

16 hours 40 min ago - switzerland sux.....

16 hours 43 min ago - whoever they are....

18 hours 28 min ago - unaligned world....

18 hours 41 min ago

Democracy Links

Member's Off-site Blogs

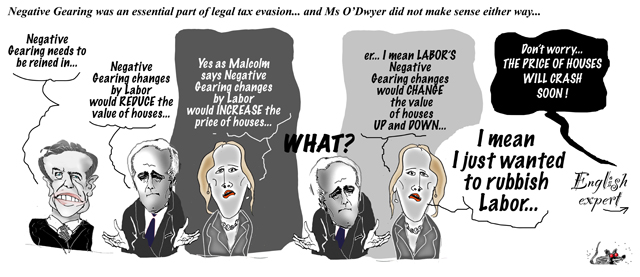

confusion in the turdball government's own policy agenda...

On Seven's Sunrise program on Wednesday, Ms O'Dwyer said Labor's proposal to limit negative gearing to new properties was irresponsible and would drive up house prices.

"They have got a policy that will increase the cost of housing for all Australians, for those people who own a home and for those people who would like to get into the housing market through their negative gearing policy," she said.

The claim house prices would rise was in stark contrast to Mr Turnbull's argument that the policy would "smash" house prices, driving them down and making people poorer.

"The consequence of it will be a decline in property prices, every home owner in Australia has a lot to fear from Bill Shorten," Mr Turnbull said on Friday.

Mr Turnbull was peppered with questions about the contradiction during a press conference at Parliament House.

Ms O'Dwyer, who became a cabinet minister in September, later moved to clean up the mess.

"The point I was making is that under Labor's policy there will be increased demand for new property, pushing up prices for new property," she said in a statement.

"It is clear from Labor's ill-considered policy that existing house prices will decline."

In her Sunrise appearance, Ms O'Dwyer also admitted that "there has been confusion" over the government's economic plans but blamed speculation and misleading statements.

The government has struggled to find the right sell for its tax policies this week, with the Prime Minister ruling out increasing capital gains tax on Monday before clarifying on Tuesday that changes are actually being considered.

On Monday, Mr Turnbull said "increasing capital gains tax is no part of our thinking whatsoever".

The next day, leaked Coalition talking points outlined that the government would not emulate Labor's plans but the "government is still carefully considering some other changes".

Labor recently announced a policy to reduce capital gains tax concessions from 50 per cent to 25 per cent and restrict negative gearing to new properties.

Read more: http://www.smh.com.au/federal-politics/political-news/kelly-odwyer-forced-to-clarify-comments-after-contradicting-malcolm-turnbull-on-live-tv-20160223-gn20mb.html#ixzz413rMPDxg

Follow us: @smh on Twitter | sydneymorningherald on Facebook

- By Gus Leonisky at 24 Feb 2016 - 3:44pm

- Gus Leonisky's blog

- Login or register to post comments

two years ago, the housing crash was a shoe-in...

Are we heading for a house price catastrophe?American economist Harry S. Dent, Jr. predicts Australian house prices could fall as much as 27 per cent. Personal finance editor John Collett and columist David Potts investigate.

Most local economists say we do not have a bubble in Australian house prices. A bit overvalued, yes. But not a bubble. So why is it that overseas economists - such as Nouriel Roubini, the professor at New York University who predicted the collapse of US house prices that led to the global financial crisis, and Yale professor Robert Shiller, joint winner of the Nobel prize for economics - beg to differ?

Another American economist, Harry S. Dent jnr, in his new book: The Demographic Cliff- he's promoting it in Australia next month - makes special mention of Australia. He believes that house prices are unsustainable. But while others warn of a bubble in Australian house prices, Dent also identifies a possible deflation trigger - a crash in the Chinese housing market

Read more: http://www.theage.com.au/money/borrowing/us-experts-claim-property-bubble-is-set-to-pop--but-have-they-missed-something-20140127-31jaz#ixzz413t2GE2k Follow us: @theage on Twitter | theageAustralia on Facebook

-------------------------

So far the price of housing has been steady up... Should the housing market fall about 3 per cent, the Australian economy which is now EXCLUSIVELY reliant on building rabbit warrens and truganoff boxes would GO INTO RECESSION and collapse. The "negative gearing" changes by Labor would not affect the market, as first home buyers would still need to buy something and would be able to get a better leg in...

The only thing that will change the market is the slow destruction of the Australian economy by the incompetent, imbecilic, juvenile, inequitable, stupid, scientifically ignoramus, purposeless Liberal (CONservative) government of a) Abbott and now of b) Turnbull.

But most people can see through the fudge — despite the Murdoch press glorifying the CONservatives, while hating Turnbull in a painful contradiction.

The price of housing in major cities might "plateau" but won't crash... I could be wrong but then I could be right since I'm not an expert...

Here is a Pommy expert:

Jonathan Tepper, a UK based economist and founder of research house Variant Perception, is convinced Australia is in the midst of "one of the biggest housing bubbles in history".

The Australian Financial Review reports about how he and local hedge fund manager John Hempton scoped out the apparent epicenter of this bubble, Sydney's western suburbs, and walked away thinking it was even worse than they'd originally thought. It's a fascinating story.

In a subsequent report to clients, obtained by Fairfax Media, Tepper uses the following charts to support his thesis.

http://www.smh.com.au/business/the-economy/the-charts-that-suggest-the-housing-bubble-is-out-of-control-20160224-gn2b46.html

up, up, up and away in the magic unbreakable bubble...

Another year, another doomsday theory for the housing market. And likely with it, a stack of book sales.

It has practically become an annual sport for Australia’s economists to swat away the latest predictions of researchers and think tanks who are waiting for the rug to be pulled out from under the property market.

“There have been numerous calls of a looming crash in Australian property over the last decade or so, but they have proved to be well off the mark,” said AMP Capital chief economist Shane Oliver.

“Lately it seems to me that some people have just seen The Big Short and want to be film stars.”

This week it was London-based macroeconomic researcher Jonathan Tepper whose claims made headlines, with six graphs he claims show the housing bubble is out of control in Australia.

read more: http://www.domain.com.au/news/doomsday-theorists-morbid-obsession-with-australian-property-20160225-gn3173/

whatever...

Prime Minister Malcolm Turnbull is "inept at running a scare campaign", Labor says, after he contradicted himself while fighting against its negative gearing policy.

Mr Turnbull today argued the Opposition's proposal would favour wealthy investors, despite yesterday saying "all investors would be gone".

The Government has already made two clarifications this week during debate about Labor's tax plans.

The Opposition's plan would restrict negative gearing to new properties from mid-2017, while protecting existing landlords.

But investors would be able to purchase established homes after 2017 and claim losses against investment income, like shares.

http://www.abc.net.au/news/2016-02-25/labor-says-pm-running-bad-scare-campaign-over-negative-gearing/7200560