Search

Recent comments

- a peace deal....

8 hours 45 min ago - peace now!

10 hours 11 min ago - a nasty romance....

10 hours 17 min ago - blackmail?.....

12 hours 48 min ago - ukraine's agony has not started yet....

1 day 6 hours ago - all defeated.....

1 day 6 hours ago - beyond crime.....

1 day 7 hours ago - the end....

1 day 7 hours ago - odessa....

1 day 8 hours ago - weitz....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

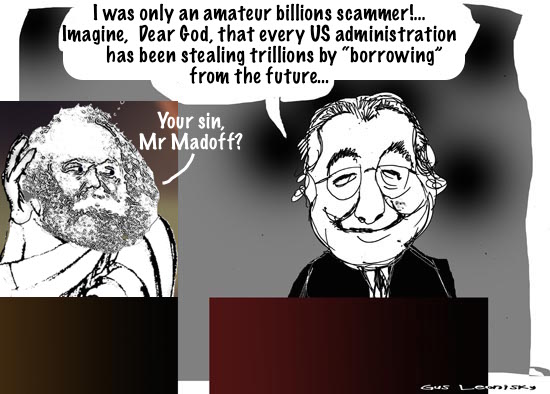

ponzi and ponzi...

madoff

madoff

Bernard L. Madoff, the one-time senior statesman of Wall Street who in 2008 became the human face of an era of financial misdeeds and missteps for running the largest and possibly most devastating Ponzi scheme in financial history, died on Wednesday in a federal prison hospital in Butner, N.C. He was 82.

The Federal Bureau of Prisons confirmed the death, at the Federal Medical Center, part of the Butner Federal Correctional Complex.

Mr. Madoff, who was serving a 150-year prison sentence, had asked for early release in February 2020, saying in a court filing that he had less than 18 months to live after entering the final stages of kidney disease and that he had been admitted to palliative care.

In phone interviews with The Washington Post at the time, Mr. Madoff expressed remorse for his misdeeds, saying he had “made a terrible mistake.”

“I’m terminally ill,” he said. “There’s no cure for my type of disease. So, you know, I’ve served. I’ve served 11 years already, and, quite frankly, I’ve suffered through it.”

Mr. Madoff’s enormous fraud began among friends, relatives and country club acquaintances in Manhattan and on Long Island — a population that shared his professed interest in Jewish philanthropy — but it ultimately grew to encompass major charities like Hadassah, universities like Tufts and Yeshiva, institutional investors and wealthy families in Europe, Latin America and Asia.

Buttressed by elaborate account statements and a deep reservoir of trust from his investors and regulators, Mr. Madoff steered his fraud scheme safely through a severe recession in the early 1990s, a global financial crisis in 1998 and the anxious aftermath of the terrorist attacks in September 2001. But the financial meltdown that began in the mortgage market in mid-2007 and reached a climax with the failure of Lehman Brothers in September 2008 was his undoing.

Hedge funds and other institutional investors, pressured by demands from their own clients, began to take hundreds of millions of dollars from their Madoff accounts. By December 2008, more than $12 billion had been withdrawn, and little fresh cash was coming in to cover redemptions.

Faced with ruin, Mr. Madoff confessed to his two sons that his supposedly profitable money-management operation was actually “one big lie.” They reported his confession to law enforcement, and the next day, Dec. 11, 2008, he was arrested at his Manhattan penthouse.

Read more:

https://www.nytimes.com/2021/04/14/business/bernie-madoff-dead.html

- By Gus Leonisky at 15 Apr 2021 - 8:59am

- Gus Leonisky's blog

- Login or register to post comments

ponzier than ponzi...

Max Keiser and Stacy Herbert look at the easy sell of Ponzi economics as the human imagination prefers the fantasy of impossible gains to the hard slog of actually producing or manufacturing profits.“In the case of bond market, there’s no bonds, that’s what negative interest rate is,” Max says, adding, “Now we’ve got a multi-billion-dollar NFT market, non-fungible token market, and the so-called art market, where there is no art.”

He goes on: “There is no original art, there’s only copies, which can be copied infinitely with absolute fidelity. There’s only copies of the art, but now it’s a multi-billion-dollar industry, obviously a Ponzi scheme, obviously a fraud.”

According to Max, “It is sold as if it’s something in a can – they just need to add what it is, what it says it is.”

Read more:

https://www.rt.com/business/521094-nft-industry-obviously-fraud/

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!!