Search

Recent comments

- google bias...

5 hours 36 min ago - other games....

5 hours 40 min ago - נקמה (revenge)....

6 hours 40 min ago - "the west won!"....

8 hours 43 min ago - wagenknecht......

9 hours 24 min ago - the game of war....

11 hours 48 min ago - three packages....

13 hours 8 min ago - russian oil.....

13 hours 15 min ago - crime against peace....

21 hours 27 min ago - why is Germany supporting the ukrainian nazis?....

22 hours 40 min ago

Democracy Links

Member's Off-site Blogs

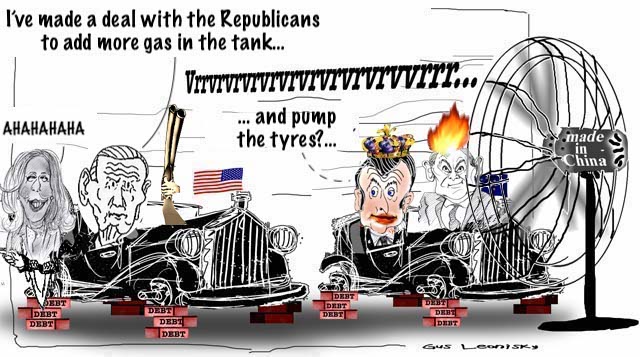

the thieves of washington: a bad role model to the youth of today......

The dismantling of the US as a normal, functional nation-state continues. America’s gun neuralgia continues to worsen, and now we see new evidence that its fiscal neuralgia – a phobia for properly funded government – is deepening too.

The US commitment to unchecked mass murder of its citizens through preventable gun violence is as entrenched in America as it is incomprehensible to every other developed nation. Even after so many mass shootings, so much wanton murder, death’s dismal Danse Macabre through US society can still shock: In 2020, guns became the leading cause of death among American children aged 19 and under.

And even when Congress managed in June last year to agree to some token federal efforts to monitor gun sales, the very next day the Supreme Court overturned a New York state attempt to control handgun purchases.

In its pursuit of this madness, America is discarding one of civilisation’s greatest achievements. When kings and potentates decided to control citizenry’s arms and assert that the state would monopolise the use of force, it produced the most consistent reduction in violence in history, according to Harvard’s Steven Pinker:

“When bands, tribes and chiefdoms came under the control of the first states, the suppression of raiding and feuding reduced their rates of violent death fivefold,” he writes in The Better Angels of our Nature.

“And when the fiefs of Europe coalesced into kingdoms and sovereign states, the consolidation of law enforcement eventually brought down the homicide rate another thirty-fold. Pockets of anarchy that lay beyond the reach of government retained their violent culture.”

And while the political right largely is responsible for the fierce refusal to regulate firearms, the American left is playing its own part in this trend to mayhem. The movement to “defund the police” is a return to the law of the jungle by another route.

As for the US resistance to funding its government properly, the latest evidence is contained in the agreement between Republicans and Democrats over the government debt ceiling. The headline news is not the bad news. The world is sighing with relief that the White House and Congress have struck in-principle agreement to allow US government debt to increase. This means the US government will still be able to pay its debts.

To do otherwise, of course, would be for the US effectively to repudiate its outstanding Treasury bonds. It would have run out of money to service its debts on June 5. The US could not expect to retain its status as the global reserve currency if it did so.

The Chinese Communist Party would have been the biggest winner as America surrendered any claim to be a responsible nation.

One measure of the American self-harm that would have been inflicted by an American debt default is that Donald Trump thought it was a good idea. “You might as well do it now because you’ll do it later,” he said.

No, the bad news was contained in the terms of the agreement itself. Joe Biden campaigned for the presidency on the promise to increase funding of the US tax office, the Internal Revenue Service. Why? The reason was twofold. First, to allow the tax office to better enforce tax law. The prime targets were to be the biggest evaders, the irresponsible rich. Second, to offer better customer service with new computer systems. Biden’s Democrats succeeded in allocating an extra $US80 billion a year to the IRS accordingly.

But in the negotiations over the national debt limit, the Republicans demanded that this extra IRS funding be cancelled. The outcome was a compromise – the tax office lost $US21.4 billion.

It’s bad enough that the US political system operates under the expectation that the national budget will not be approved in the manner long considered “normal”. That is, it used to be “normal” that an annual set of appropriations bills was approved by Congress and signed by the president by the end of the US fiscal year on September 30, ready to fund the government for the new year beginning on October 1. But the last time the US managed to pass a traditional, orderly budget for a whole year – a “normal” budget – was 1998.

American politics has become so fractious that stop-gaps, emergency funding and perpetual negotiations have kept the government lurching from crisis to crisis for a quarter-century. This has now become the new normal.

And it’s bad enough that this has put the US into a perpetual state of argument over whether to “shut down” the national government or to keep it “open”. As if a functioning national government is some sort of luxury.

One result has been increasingly frequent government shutdowns – 1995, 2013, 2018, 2019. It’s normal for legislators to negotiate over how much tax to raise and money to spend. But it’s not normal for a developed nation to accept continuous fiscal brinkmanship and threats of government shutdown.

READ MORE:

THANKS TO PETER HARTCHER FOR SHOWING US WHY WE SHOULD NOT ALIGN AUSTRALIA WITH THE THIEVES OF WASHINGTON.

THE ONLY THINGS THE THIEVES OF WASHINGTON KNOW TO DO IS PRINT MONEY AND GO TO WAR (OR SHOOT SOMEONE). TIME TO GIVE UP DRINKING THEIR PISS.

FREE JULIAN ASSANGE NOW..............

- By Gus Leonisky at 30 May 2023 - 3:09pm

- Gus Leonisky's blog

- Login or register to post comments

multinational thieves....

Woohoo! Two of the biggest tax cheats, ExxonMobil and Chevron (auditors for both are PwC) have finally begun to pay a mite of income tax in Australia but they also ripped out more than $13bn in dividends and returns of capital last year. Michael West reports their latest financials.

The financial statements for the year to December for ExxonMobil Australia and Chevron Australia filed recently with ASIC show the stupendous profits being made and puny taxes being paid by the foreign oil and gas giants in this country.

For the eight years prior, Exxon had racked up $82bn in total income in Australia without paying a cent in corporate income tax, according to ATO Transparency reports. Both companies, despite their disgraceful records paying tax, are demanding public money from government for carbon capture and storage (CCS) projects.

As Australians prepare for further hikes in their gas bills – and their electricity bills too (gas determines the price of electricity) – they can draw mean comfort from the fact that these multinationals are failing abjectly to pull their weight, to earn or deserve a social licence to operate in Australia.

Their lobbyists too. Meanwhile, gas industry peak body group APPEA (of which they are key financiers), is concealing its own financial statements and no longer files them with the corporate regulators.

Yet they bemoan what the mainstream media decry as the “gas tax hike”, a tiny $2.4bn in PRRT which is less a tax increase than an ‘upfronting’ or bringing forward of that tiny $2.4bn by 5 years – tax they were due to pay anyway.

The 2022 financial reports for the oil giants also show ExxonMobil confessing to tax cheating. It is the same sort of caper for which the Tax Office pinged Chevron in historic litigation five years ago, cheating on the price at which they lend money to themselves. Typically this ‘transfer pricing’ of loans entails a foreign entity lending money to an Australian entity at higher interest rates than the local entity needs to pay – therefore the interest is siphoned offshore with no obligation to pay tax.

READ MORE:

https://michaelwest.com.au/exxon-confirms-tax-office-in-pursuit-as-it-and-chevron-rip-13bn-dividends-out-of-australia/

READ FROM TOP.

FREE JULIAN ASSANGE NOW!!!!!!!!!!!!!!!!!!!!!!!!!!!

military, of course.....

House Republicans only demanded non-military spending cuts in the debt ceiling negotiations

by Dave DeCamp Posted on May 29, 2023

Categories News

The debt ceiling agreement reached between the White House and House Republicans that was announced Sunday caps military spending at $886 billion for 2024, matching President Biden’s requested budget.

Republicans negotiating the debt ceiling deal only sought non-military spending cuts. The $886 billion cap for military spending represents about a 3.3% increase from 2023.

The White House and House Speaker Kevin McCarthy (R-CA) still need to get the debt ceiling agreement passed through Congress. Many hawkish Republicans will likely oppose the deal as they previously blasted Biden’s massive $886 billion request as “inadequate.”

Sen. Lindsey Graham (R-SC) slammed the debt limit deal in an appearance on Fox News on Sunday. “The Biden defense budget was a joke before, and if we adopt it as Republicans, we will be doing a big disservice to the party of Ronald Reagan,” Graham said.

“The biggest winner of the Biden defense budget is China because they’ll have a bigger navy,” Graham added.

Hawks in Congress have gotten their way over the past two years as they approved significantly more military spending than what President Biden requested for 2022 and 2023. For 2023, President Biden asked for $813 billion in military spending, but Congress added $45 billion, bringing the finalized National Defense Authorization Act to $858 billion.

A similar increase for 2024 could bring the NDAA close to $1 trillion. The US also authorizes other national security spending that is not included in the NDAA. According to analyst Winslow Wheeler, factoring in other types of expenditures on the national security state, including interest on debt and the Veteran Affairs budget, would bring the total defense budget for 2024 to around $1.5 trillion.

READ MORE:

https://news.antiwar.com/2023/05/29/biden-mccarthy-agree-on-886-billion-military-budget/

READ FROM TOP.

FREE JULIAN ASSANGE NOW!!!!!!!!!!!!!!!!!!!!!!!!!!!