Search

Recent comments

- crime against peace....

7 hours 53 min ago - why is Germany supporting the ukrainian nazis?....

9 hours 6 min ago - sanctioning....

11 hours 50 min ago - politico blues....

12 hours 30 min ago - gender muddles....

12 hours 50 min ago - war crimes and war crimes....

15 hours 39 min ago - new yourp....

16 hours 19 min ago - piracy not included....

16 hours 48 min ago - faceblock......

18 hours 45 min ago - 22-......

19 hours 51 min ago

Democracy Links

Member's Off-site Blogs

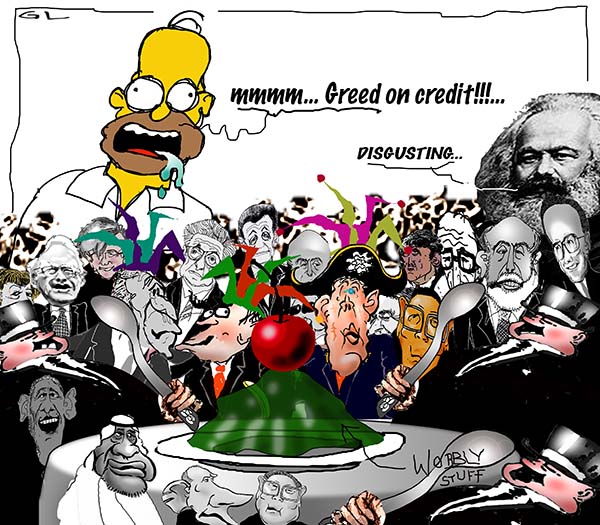

greed with IOUs = welfare for the super-rich and the military.......

Consider this. As you are beginning to read this article, global debt is surging higher. In fact, global debt has never been higher than it is today. But in the few minutes that it will take you to finish reading this article, global debt will have surged even more.

Every second of every day, 24 hours a day, every day, global debt is climbing. The “big secret” is this: it can’t ever stop.

The Global Debt Market Time Bomb Is Close to Going Off.

By Gregory Mannarino TradersChoice.net

It can’t ever stop because at its core the “modern” monetary system is debt based. The entire worldwide financial system is totally dependent on the relentless acquisition of exponentially more debt in greater and greater amounts just to function. And what it cost an hour ago just for the system to function will require even more debt an hour from now just to function. And so on…

For many months now, but especially as of late, we have been witnessing a phenomenon, a “whipsaw” action in global bond yields- and that is a problem.

The entire financial system, the economy, and the world’s stock markets depend on a stable bond market. The recent “whipsaw/up and down” gyration action in the world’s debt market is a clear signal that something is breaking. The bigger issue is that although the world is flooded with debt, it operates in a perpetual debt deficit, as the system constantly demands even more debt be pulled into the system in order to keep functioning.

Central banks, to keep the debt-based system going, must inflate. That is, they must create more debt. Central banks create only one product, debt. The ability of a central bank to produce debt and then issue that debt is how they stay in power.

Central banks understand that the current monetary system has been pushed to the breaking point, they themselves have done this. Moreover, they have been aware for decades that this would eventually happen- they have been planning for it.

The first stage in the breakdown of the current system is well underway, which can be seen in skyrocketing worldwide inflation and rising labor costs.

The second stage is also well underway, with debts and deficits hyper-ballooning.

What central banks are currently in the process of doing, in order to push off what will eventually be a complete locking up on the system, is lessening the availability of credit to small businesses and the consumer, but making sure to keep credit flowing to the large institutions. Keeping credit flowing to the large, multinational institutions fulfills the corporate agenda of eliminating small business- they do not want any competition, especially when the new system is rolled out.

Consolidating the banking system is stage three, and that as well is underway. In fact, the entire system itself is being consolidated, a concentration of power and control.

Stage four must involve a “crisis,” something big enough to crater the current system only for central banks to offer a solution, their solution.

An implosion in the global debt market would be that “crisis” which would bring the current system to its inevitable end, only to be used as a conduit for the new system.

READ MORE:

https://gregorymannarino.substack.com/p/the-global-debt-market-time-bomb

SEE MORE:

https://www.youtube.com/watch?v=4mAB3G1AoA4

FREE JULIAN ASSANGE NOW.....

IMAGE AT TOP FROM https://yourdemocracy.net/drupal/node/7603 POSTED FEBRUARY 2009 —13200 reads.

We've been on the subject for a while......

- By Gus Leonisky at 31 May 2023 - 9:21am

- Gus Leonisky's blog

- Login or register to post comments

doom doom doom....

https://www.youtube.com/watch?v=50WLVs29k04

Gerald Celente says there are RED FLAGS all over the banking industry. He predicts the commercial real estate crash will drag down the banks which with hurt the small businesses which will go on a lay off spree to survive. He said the banking crisis has only just begun, the likes of which we have never seen before. The US dollar failing also won't help. Thank you @gcelente for joining me today! Chase bank, Wells Fargo, Bank of America will all be in trouble!

READ FROM TOP.

FREE JULIAN ASSANGE NOW """"""""""""""""""""""""!!!

the main war....

https://www.youtube.com/watch?v=RbSiN-0xeMA

How U.S. Sanctions On Russia Caused De-dollarizationREAD FROM TOP.

SEE MORE:

https://yourdemocracy.net/drupal/node/43171

https://www.youtube.com/watch?v=GSbvzLHsMCs

As we are all aware, "de-dollarization" refers to the economies' decreased reliance on the US dollar as a reserve currency. Over the past 40 years, this debate has gone in and out of favor, but it has lately acquired ground as a result of the invasion of Russia and the sanctions that the West subsequently imposed. After an economic analyst stated that we are entering a new economic global order based on commodity-backed money rather than fiat, the debate gained traction (again).

There won't be just one dominant currency; rather, there will be a wide variety of currencies as a reflection of a multipolar globe. Rubles, if you want Russian oil, you know. If you want to export something from China, use RMB. It is a disjointed system where commodities play a lot larger role and price stability is a major concern in some areas of the growth because you have the dollar if you trade the United States. We must therefore negotiate this incredibly complicated patchwork.

FREE JULIAN ASSANGE NOW """"""""""""""""""""""""!!!

credit bomb...

https://www.youtube.com/watch?v=2Hs3ftS3gTk

BE PREPARED: $1.13 TRILLION in Consumer Credit Card Debt Hits Record High as Delinquencies SURGEREAD FROM TOP.

FREE JULIAN ASSANGE NOW..................../////////////