Search

Recent comments

- workers party GB.....

17 hours 51 min ago - insurer's scam....

18 hours 56 min ago - pissing on the EU....

19 hours 6 min ago - hypocrites....

19 hours 24 min ago - clueless.....

19 hours 40 min ago - meanwhile.....

1 day 11 hours ago - young losers....

1 day 12 hours ago - bulgarian slow train....

1 day 12 hours ago - a six-minute read...

1 day 15 hours ago - inexpensive....

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

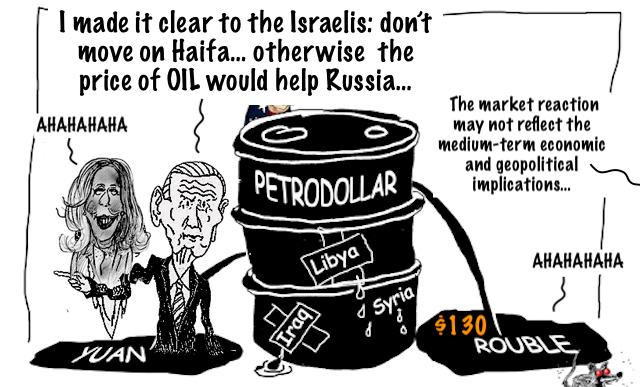

oil and the cost of war, with a dithering aged foggy....

US President Joe Biden told an interviewer that he’d warned the Israeli government against attacking itself, in what appears to be the aging leader’s latest gaffe, and one that has again raised concerns over his mental state.

Speaking with Nexstar Media’s Reshad Hudson in an interview published on Wednesday, the 81-year-old president detailed his plans to win back pro-Palestinian voters, despite his ongoing support for Israel in its conflict with Hamas.

Biden claimed that, aside from meeting with pro-Palestinian activists, he had also “made it clear to the Israelis: don’t move on Haifa,” a renowned port city in northern Israel.

The president then appeared to lose his train of thought, before going on to speak about the weekend’s Iranian attack.

Rather than warning Israel against attacking its own city, the US President apparently meant to refer to Rafah, a Palestinian city in Southern Gaza, which has become the last refuge for displaced civilians in the besieged enclave.

https://www.rt.com/news/596190-biden-israel-attack-gaffe/

An all-out war between Israel and Iran could drive oil prices up by $30-$40 per barrel, Bank of America experts have told clients in a research note seen by CNBC.

Tehran and West Jerusalem have traded threats since Iran conducted its first direct military attack on the Jewish state last weekend, in retaliation for a suspected Israeli airstrike on the Iranian diplomatic mission in Syria earlier this month.

If hostilities escalate into a protracted conflict that impacts energy infrastructure and disrupts Iranian crude supplies, the price of global benchmark Brent could rise “substantially” to $130 in the second quarter of this year, a Bank of America research note stated on Tuesday, according to CNBC. It added that US crude oil could soar to $123.

The scenario reportedly assumes that Iranian oil production falls by up to 1.5 million barrels per day (bpd). According to the International Energy Agency (IEA), Iran, a founding member of the Organization of the Petroleum Exporting Countries (OPEC), produces about 3.2m barrels of oil a day. Last year it ranked as the world’s second largest source of supply growth after the US.

If a conflict led to disruptions outside Iran, such as the market losing 2 million bpd or more, prices could spike by $50 a barrel, according to the note. Brent would eventually settle around $100 in 2025, while US benchmark West Texas Intermediate (WTI) would come down to $93, it predicted.

The price of Brent crude spiked to over $91 per barrel earlier this month after Tehran threatened retaliation against Israel. However, as the bank’s global economics team has pointed out, in the days following the retaliatory strike crude oil prices fell due to “[the] limited casualties and damage” it caused.

https://www.rt.com/business/596167-bank-of-america-oil-warning/

it's time for being earnest.....

- By Gus Leonisky at 19 Apr 2024 - 6:14am

- Gus Leonisky's blog

- Login or register to post comments

russian oil.....

Russian Crude Shipments Surge to the Highest in Almost a YearExports swelled to 3.95 million barrels a day in the week to April 14

Russia’s seaborne crude exports soared to an 11-month high in the second week of April with flows from all major ports near peak levels.

Last week’s jump propelled total weekly flows to the highest since May 2023, for a level that has been exceeded only twice since the start of 2022, vessel-tracking data compiled by Bloomberg show. The less volatile four-week average also rose sharply, climbing to the highest since early June.

https://www.bloomberg.com/news/articles/2024-04-16/russia-s-oil-exports-hit-an-11-month-high-in-the-week-to-april-14READ FROM TOP

FREE JULIAN ASSANGE NOW....