Search

Recent comments

- waste of euros....

2 days 11 hours ago - macron l'idiot....

2 days 13 hours ago - pomp and charity....

2 days 13 hours ago - overshoot days....

2 days 13 hours ago - "americamaidan"

2 days 14 hours ago - australia sux....

2 days 14 hours ago - the little children....

2 days 14 hours ago - delayed food....

2 days 22 hours ago - free expression....

2 days 22 hours ago - macrolympicus....

3 days 8 min ago

Democracy Links

Member's Off-site Blogs

from the land of slapstick & lipstick .....

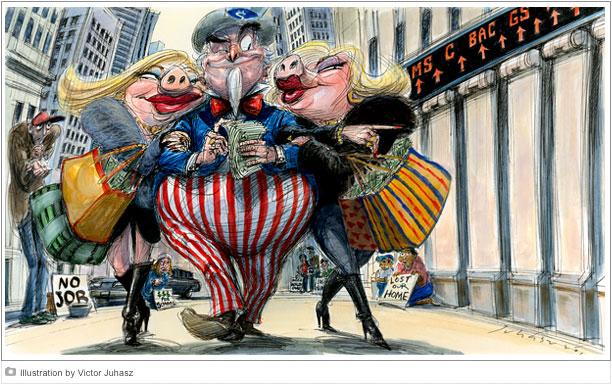

After a two-year bipartisan probe, a Senate panel has concluded that Goldman Sachs Group Inc. profited from the financial crisis by betting billions against the subprime mortgage market, then deceived investors and Congress about the firm's conduct.

Some of the findings in the report by the Senate's Permanent Subcommittee on Investigations will be referred to the Justice Department and the Securities and Exchange Commission for possible criminal or civil action, said Sen. Carl Levin (D-Mich.), the panel's chairman.

"In my judgment, Goldman clearly misled their clients and they misled the Congress," Levin told reporters before the report was made public late Wednesday.

Goldman said it disagreed with many of the subcommittee's conclusions and denied its executives misled Congress. The firm agreed last year to pay $550 million to settle a civil fraud case brought by the SEC regarding its actions in the market for mortgage securities. The latest allegations go beyond the conduct covered by the SEC suit.

The giant investment bank was just one focus of the subcommittee's probe into Wall Street's role in the financial crisis. The 639-page report - based on internal memos, emails and interviews with employees of financial firms and regulators - casts broad blame, saying the crisis was caused by "conflicts of interest, heedless risk-taking and failures of federal oversight."

"It shows without a doubt the lack of ethics in some of our financial institutions," said Sen. Tom Coburn (R-Okla.), the subcommittee's top Republican, who approved the report along with Levin.

Senate Panel: 'Goldman Sachs Profited From Financial Crisis'

and from the sublime to the obscenely ridiculous ....

Now, following an act of Congress that has forced the Fed to open its books from the bailout era, this unofficial budget is for the first time becoming at least partially a matter of public record. Staffers in the Senate and the House, whose queries about Fed spending have been rebuffed for nearly a century, are now poring over 21,000 transactions and discovering a host of outrages and lunacies in the "other" budget.

It is as though someone sat down and made a list of every individual on earth who actually did not need emergency financial assistance from the United States government, and then handed them the keys to the public treasure.

The Fed sent billions in bailout aid to banks in places like Mexico, Bahrain and Bavaria, billions more to a spate of Japanese car companies, more than $2 trillion in loans each to Citigroup and Morgan Stanley, and billions more to a string of lesser millionaires and billionaires with Cayman Islands addresses. "Our jaws are literally dropping as we're reading this," says Warren Gunnels, an aide to Sen. Bernie Sanders of Vermont. "Every one of these transactions is outrageous."

But if you want to get a true sense of what the "shadow budget" is all about, all you have to do is look closely at the taxpayer money handed over to a single company that goes by a seemingly innocuous name: Waterfall TALF Opportunity. At first glance, Waterfall's haul doesn't seem all that huge - just nine loans totaling some $220 million, made through a Fed bailout program. That doesn't seem like a whole lot, considering that Goldman Sachs alone received roughly $800 billion in loans from the Fed. But upon closer inspection, Waterfall TALF Opportunity boasts a couple of interesting names among its chief investors: Christy Mack and Susan Karches.

Christy is the wife of John Mack, the chairman of Morgan Stanley. Susan is the widow of Peter Karches, a close friend of the Macks who served as president of Morgan Stanley's investment-banking division. Neither woman appears to have any serious history in business, apart from a few philanthropic experiences. Yet the Federal Reserve handed them both low-interest loans of nearly a quarter of a billion dollars through a complicated bailout program that virtually guaranteed them millions in risk-free income.

- By John Richardson at 15 Apr 2011 - 11:11pm

- John Richardson's blog

- Login or register to post comments

rich in obscenity .....

We live in a very, very rich country. Yet we seem to be utterly consumed by a collective hysteria that we're about to go broke. Historians are certain to look back at this period and wonder why the richest country in history consumed itself in a struggle over how many teachers to fire.

How rich are we?

Just take a look at the latest reports on what the top hedge fund managers haul in. In 2010 John Paulson led the list with a record $4.9 billion in personal earnings. That's a whopping $2.4 million an HOUR. Here's a factoid to make you wretch: It would take the median US household over 47 years to earn as much as Paulson pocketed in just 60 minutes. And, every hedge fund manager pays a lower tax rate than the average family.

The top 25 hedge fund earners took in $22.07 billion in 2010. Thanks to a generous tax loophole these billionaires will pay a top tax rate of 15 percent instead of 35 percent. Closing that loophole on just those 25 individuals - just 25 guys who wouldn't miss a penny of it - would raise $4.4 billion, which is enough to rehire 126,000 laid-off teachers.

Wait a second. This is America, not Russia. Don't we want our entrepreneurs to go out there and earn as much as possible? We don't want to punish the successful who are building up our economy, do we?

Maybe that's a strong argument when you're talking about the CEO billionaires of Apple and Google and other successful companies that make products we use. But when it comes to financial billionaires, we don't even know what they do for a living.

Each and every day I ask people and I get a blank stare or something like: "they invest. They make money." Sure enough, but how do they make so much money? Where does it come from? How can hedge fund firms with fewer than 100 employees make as much profit as companies like Apple with tens of thousands of employees?

Hedge Fund Gamblers Earn the Same In One Hour As a Middle-Class Household Makes In Over 47 Years