Search

Recent comments

- georgia's NGOs

32 min 47 sec ago - breeding insanity....

10 hours 12 min ago - american "diplomacy"

13 hours 9 min ago - deceit america....

15 hours 28 min ago - police-state....

1 day 1 hour ago - the war continues....

1 day 1 hour ago - scott is angry.....

1 day 8 hours ago - a catastrophe?....

1 day 12 hours ago - 3Xwars is 3Xpeace?....

1 day 14 hours ago - futile trousers....

1 day 14 hours ago

Democracy Links

Member's Off-site Blogs

consumer blues...

We’re Spent

By DAVID LEONHARDT

THERE is no shortage of explanations for the economy’s maddening inability to leave behind the Great Recession and start adding large numbers of jobs: The deficit is too big. The stimulus was flawed. China is overtaking us. Businesses are overregulated. Wall Street is underregulated.

But the real culprit — or at least the main one — has been hiding in plain sight. We are living through a tremendous bust. It isn’t simply a housing bust. It’s a fizzling of the great consumer bubble that was decades in the making.

The auto industry is on pace to sell 28 percent fewer new vehicles this year than it did 10 years ago — and 10 years ago was 2001, when the country was in recession. Sales of ovens and stoves are on pace to be at their lowest level since 1992. Home sales over the past year have fallen back to their lowest point since the crisis began. And big-ticket items are hardly the only problem.

The Federal Reserve Bank of New York recently published a jarring report on what it calls discretionary service spending, a category that excludes housing, food and health care and includes restaurant meals, entertainment, education and even insurance. Going back decades, such spending had never fallen more than 3 percent per capita in a recession. In this slump, it is down almost 7 percent, and still has not really begun to recover.

The past week brought more bad news. Retail sales in June were weaker than expected, and consumer confidence fell, causing economists to downgrade their estimates for economic growth yet again. It’s a familiar routine by now. Forecasters in Washington and on Wall Street keep saying the recovery’s problems are temporary — and then they redefine temporary.

If you’re looking for one overarching explanation for the still-terrible job market, it is this great consumer bust. Business executives are only rational to hold back on hiring if they do not know when their customers will fully return. Consumers, for their part, are coping with a sharp loss of wealth and an uncertain future (and many have discovered that they don’t need to buy a new car or stove every few years). Both consumers and executives are easily frightened by the latest economic problem, be it rising gas prices or the debt-ceiling impasse.

http://www.nytimes.com/2011/07/17/sunday-review/17economic.html?pagewanted=print

----------------------------------

Wary shoppers have nothing to fear but fear itself

Hugh Mackay

July 16, 2011

Anxiety ... "We've snapped our purses shut and turned into a nation of savers."

Is anyone surprised that the Westpac-Melbourne Institute index of consumer confidence has plummeted? Consumer confidence is one of the most reliable indicators of the mood of a society: when confidence levels fall, it almost always means our anxiety levels are rising.

But anxiety is an unpredictable beast. Sometimes we respond to it with bravado, hoping to distract ourselves from our fears. Sometimes we try to pretend it isn't happening, perhaps masking it with large doses of alcohol or other drugs. Sometimes - like right now - we stare it in the face and decide we are right to be spooked and we'd better proceed cautiously.

Ten years ago, we saw a classic case of the first response. Seeking relief from our assorted anxieties (GST, terrorism, refugees, climate), and encouraged by talk of a mining boom, we turned our backs on the "big picture" and retreated into a cocoon of self-absorption. To the delight of retailers, we abandoned ourselves to self-indulgence, fuelled by unprecedented levels of personal debt.

Not this time. Our current anxieties are translating into a sense of caution and restraint. In spite of the apparent soundness of our economy - low unemployment, low interest rates, rising wages - we've snapped our purses shut and turned into a nation of savers. So why the difference?

This time, our anxieties are more immediate. We're worried about the quality of leadership on both sides of politics and about the degeneration of the political process itself. We're still uneasy about the inherent instability of our hung parliament. We're edgy about the cost of living and beginning to grasp the meaning of the "two-speed economy". We know that, three years ago, we came within a whisker of a recession that would have caught many of us with unsustainable debt hanging round our necks

Read more: http://www.smh.com.au/opinion/society-and-culture/wary-shoppers-have-nothing-to-fear-but-fear-itself-20110715-1hhxm.html#ixzz1SLTxUm1Q

Gus: most of the personal debts in Australia were enlarged under the previous John Howard government who reduced wages and pushed up the price of housing...

- By Gus Leonisky at 17 Jul 2011 - 6:20pm

- Gus Leonisky's blog

- Login or register to post comments

the price of debt...

By Neil Irwin, Published: July 16In the American political conversation, the national debt has become something almost mythical. It has become a metaphor for all that ails the United States, a scary monster under the bed.

It isn’t. It’s an accounting concept.

The debate over deficits and debt is frequently clouded with sloppy language and sloppy thinking. Here, as something of a primer, are some basic concepts every American — and every member of Congress — should understand about the U.S. fiscal situation. In honor of our colleagues over in the Outlook section, who often offer “five myths” on this or that, here are five truths about the deficit and the debt.

1. That gap between revenue and spending? It’s the deficit.

The U.S. government took in about $7,000 in revenue for every man, woman and child in the United States last year. It spent more than $11,000 per person. The gap between those numbers, about $4,000 per person, is the deficit, and it was covered by borrowing money.

Some politicians speak as if high levels of government spending and a large budget deficit are the same thing. This isn’t so. You could have a government that spends $11,000 per person — but with taxes to match it — and no deficit. Or you could have a bare-bones government of a libertarian’s fantasy that spends only $7,000 per person but that runs a large deficit because it raises only $3,000 per person in taxes.

Inevitably, the debates over the proper size of government and the proper level of the deficit are intertwined. But they’re separate questions.

Think of it this way: There are rich people who borrow a lot of money, and there are poor people who live within their means. The question of whether someone is rich or poor is separate from the question of how much money they borrow.

2. How did we get all this debt? From deficits accumulated over 200 years.

http://www.washingtonpost.com/business/five-truths-about-the-deficit-and-the-debt/2011/07/13/gIQAcjbFGI_print.html

bonuses for billionaires...

By NICHOLAS D. KRISTOF

The first few times I heard House Republicans talk about our budget mess, I worried that they had plunged off the deep end. But as I kept on listening, a buzzer went off in my mind, and I came to understand how much sense the Tea Party caucus makes.

Why would we impose “job-crushing taxes” on wealthy Americans just to pay for luxuries like federal prisons? Why end the “carried interest” tax loophole for financiers, just to pay for unemployment benefits — especially when those same selfless tycoons are buying yachts and thus creating jobs for all the rest of us?

Hmmm. The truth is that House Republicans don’t actually go far enough. They should follow the logic of their more visionary members with steps like these:

BONUSES FOR BILLIONAIRES Republicans won’t extend unemployment benefits, even in the worst downturn in 70 years, because that makes people lazy about finding jobs. They’re right: We should be creating incentives for Americans to rise up the food chain by sending hefty checks to every new billionaire. This could be paid for with a tax surcharge on regular working folks. It’s the least we can do.

Likewise, the government should take sterner measures against the persistent jobless. Don’t just let their unemployment benefits expire. Take their homes!

Oh, never mind! Silly me! The banks are already doing that.

LET JOBS TRICKLE DOWN Leftist pundits say that House Republicans don’t have a jobs plan. That’s unfair! Granted, the Republican-sponsored Cut, Cap and Balance Act would eliminate 700,000 jobs in just its first year, according to the Center on Budget and Policy Priorities, but those analysts are no doubt liberals. America’s richest 400 people own more wealth than the bottom 150 million Americans, and the affluent would feel renewed confidence if the Republican plan passed. We’d see a hiring bonanza. Each of those wealthy people might hire an extra pool attendant. That’s 400 jobs right there!

Cut, Cap and Balance would go even further than the Ryan budget plan in starving the beast of government. Sure, that’ll mean cuts in Social Security, Medicare and other programs, but so what? Who needs food safety? How do we know we really need air traffic control unless we try a day without it?

read more at http://www.nytimes.com/2011/07/21/opinion/21kristof.html?_r=1&src=ISMR_HP_LO_MST_FB&pagewanted=print

we could drink water and walk...

These are interesting times — and I mean that in the worst way. Right now we’re looking at not one but two looming crises, either of which could produce a global disaster. In the United States, right-wing fanatics in Congress may block a necessary rise in the debt ceiling, potentially wreaking havoc in world financial markets. Meanwhile, if the plan just agreed to by European heads of state fails to calm markets, we could see falling dominoes all across southern Europe — which would also wreak havoc in world financial markets.

We can only hope that the politicians huddled in Washington and Brussels succeed in averting these threats. But here’s the thing: Even if we manage to avoid immediate catastrophe, the deals being struck on both sides of the Atlantic are almost guaranteed to make the broader economic slump worse.

In fact, policy makers seem determined to perpetuate what I’ve taken to calling the Lesser Depression, the prolonged era of high unemployment that began with the Great Recession of 2007-2009 and continues to this day, more than two years after the recession supposedly ended.

Let’s talk for a moment about why our economies are (still) so depressed.

The great housing bubble of the last decade, which was both an American and a European phenomenon, was accompanied by a huge rise in household debt. When the bubble burst, home construction plunged, and so did consumer spending as debt-burdened families cut back.

Everything might still have been O.K. if other major economic players had stepped up their spending, filling the gap left by the housing plunge and the consumer pullback. But nobody did. In particular, cash-rich corporations see no reason to invest that cash in the face of weak consumer demand.

Nor did governments do much to help. Some governments — those of weaker nations in Europe, and state and local governments here — were actually forced to slash spending in the face of falling revenues. And the modest efforts of stronger governments — including, yes, the Obama stimulus plan — were, at best, barely enough to offset this forced austerity.

So we have depressed economies. What are policy makers proposing to do about it? Less than nothing.

http://www.nytimes.com/2011/07/22/opinion/22krugman.html?_r=1&src=ISMR_HP_LO_MST_FB&pagewanted=print

-------------------------------

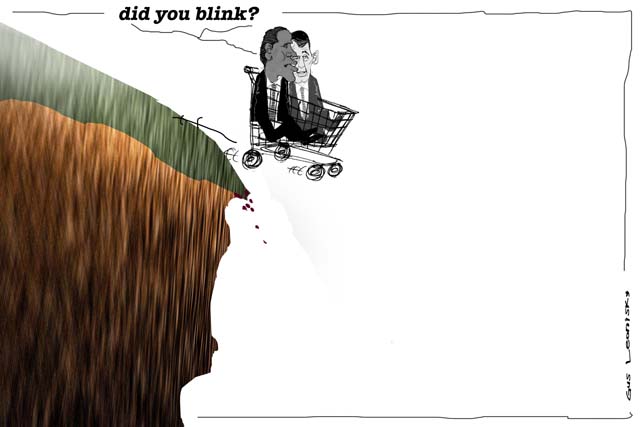

Picture by Gus

Gus: in what professor Bronowski would tell us it is time to revive or properly implement a "small is beautiful" economic revival as a second tier in the production of goods and services... For too long, we have become accustomed to big checks, big towers, employment that produces nothing but paperwork in various money shuffling sectors — all working mostly like a giant ponzi scheme where the future of everyone — born and unborn — has already been borrowed upon — and onsold — a hundred times. Pumping more fuel into the fire from the top, like adding chocolate to a chocolate fountain, is not going to help the fudge because we've run out of proper chocolate and in order to get the fountain running, we would have to add more water to the sauce. By now the screaming kids are distracting us because the electricity company has cut our supply because we did not pay the bill. We need to be creative at the middle and bottom rungs of society.

At present businesses are built on strong neo-nazi principles in which the structure and culture are designed to make sure it survives and will do anything to survive. For example in Australia "business" is fighting a Labor government that has managed quite well to stop the country falling into the downward spiral that most western countries have got themselves into.

Why is "business" fighting the government? Because the government is implementing a few solid policies that will make the sharing of the spoils more equitable — spoils that belong to the "country" but are used for private profit by private enterprise. Second, business does not want to pay for the major damage it does to the environment. Business is claiming it does not do damage (while it does) and if it admits to doing damage, it cannot blame itself without blaming its consumers — they are the bread and butter of business.

Competition between these Hitlerian business monolith is tooted as the main price regulator and this compettion is cultivated through the advertising and public relationism of their products so that consumers consume. For the last 40 years, for the largest proportion of population (I'd say 95 per cent) this consumption is based on credit. Massive credit.

What we consume now is NOT based on what we make (could afford in direct exchange of agreed value) but on what we would be making over say the next 20 years (where the value could be iffy — we don't know). This for effect is that we do not own what we have until the last mortgage payment is made. At any time we can loose our glorious comforts should we get into a spot of bother. This turns us into a different kind of slaves — different from previous times, Egyptians and Romans — whose lives is now comfortable, exciting and all consuming with no quiet time in sight... All this activity is controlled by the value of what we have, versus the price it will have in the future and what we have to pay next. Depreciation, replacement and revaluation by working harder or slower at things that really don't matter, except for the comfort of what we can gain.

There are softer structures within and external to the Neo-Nazi structures, in which symbiosis have to develop in order to keep all relationships going. At other levels, large business is owned by many shareholders, spreading the risk across. But the more astute bandits will only be passing through, buying and selling shares for profit — sometimes even if they don't own the shares, and are allowed to profit from this little visit. This undermine the purpose of sharing but greed is the fuel of business, thus one needs protection, often disguised as derivatives extortion that can only be paid for by sheer volume of production, thus tilted to make sure there is consumption of, say, gas at the pump, that people buy cars and houses, that everyone drink fizzy-cola and are getting fatter on sugar.

But the consumers need to live long enough to pay for the debt (which they rarely do without on-selling the goods to someone else, prepared to pay more for the goods which the banks own). Thus there is another dynamic of personal health/unhealth that concerns the society at large with a huge network of (costly) medical systems to make sure we do not die from indigestion by over-eating, keel over from hospital bugs and kill ourselves from distress, after depression from being unable to manage our debt... Some of us fall through the net because we forgot to pay our insurance premiums — themselves a bet against a system in which the odds are that we'll pay far more than we will receive...

Meanwhile our songs and dance — our daily dose of entertainment — is paid for by the advertising of goods that we HAVE TO consume (at least a certain proportion of us) for the consuming system to work. Meanwhile, we live on a limited planet, the dynamics of which are thrown out of kilter by our "indispensible" consumption.

Yet we could drink water, eat carrots and nuts — and walk.

a ransom and a violation...

The Republican Wreckage

House Republicans have lost sight of the country’s welfare. It’s hard to conclude anything else from their latest actions, including the House speaker’s dismissal of President Obama’s plea for compromise Monday night. They have largely succeeded in their campaign to ransom America’s economy for the biggest spending cuts in a generation. They have warped an exercise in paying off current debt into an argument about future spending. Yet, when they win another concession, they walk away.

This increasingly reckless game has pushed the nation to the brink of ruinous default. The Republicans have dimmed the futures of millions of jobless Americans, whose hopes for work grow more out of reach as government job programs are cut and interest rates begin to rise. They have made the federal government a laughingstock around the globe.

In a scathing prime-time television address Monday night, President Obama stepped off the sidelines to tell Americans the House Republicans were threatening a “deep economic crisis” that could send interest rates skyrocketing and hold up Social Security and veterans’ checks. By insisting on a single-minded approach and refusing to negotiate, he said, Republicans were violating the country’s founding principle of compromise.

http://www.nytimes.com/2011/07/26/opinion/26tue1.html?_r=1&hp=&pagewanted=print

raise taxes, you american bludgers!...

A Denial of Reality

http://www.nytimes.com/2011/07/27/opinion/27wed2.html?_r=1&hp=&pagewanted=print

How can so many Republican lawmakers justify pushing their country toward catastrophic default just to score ideological points? The answer can be found in their statements and writings: They are constructing an alternative reality far different from that of most Americans.

A large number of Republican lawmakers, for example, simply don’t accept that the United States is going to be in default as of Tuesday. (Wall Street banks say the nation will run out of money within a few days of that date.)

The Treasury Department, which keeps the government bankbook, set the Aug. 2 deadline, but they say it cannot be trusted because it is an arm of the Obama administration. Representative Joe Walsh, a freshman from Illinois, recorded an instantly notorious video in which he accused President Obama of “lying” about the dangers of default. “There’s plenty of money to pay off our debt and cover all of our Social Security obligations,” he said, without saying where all these billions might be hidden.

Representative Michele Bachmann, the Tea Partier running for president, went even further, saying there would be no default at all because the government would always find a way to pay the interest on its debt. Her level of disbelief in any statement made by the White House is so complete that she disregarded the possibility that the global financial system could impose its own devastating downgrade on the government’s obligations.

Mrs. Bachmann’s denial of economic reality puts her at the far-right end of the House, alongside eight other Republicans who voted against the “Cut, Cap and Balance Act” last week because it was too liberal. More typical are those who are sticking by that bill and its balanced-budget amendment, though the Senate effectively rejected it.

Jim Jordan of Ohio, who leads an influential group of House conservatives, said he is willing to go down with the cut, cap and balance ship even if default is the only option, since he, too, is not persuaded that the Treasury is telling the truth. He and several members of his Republican Study Committee said Tuesday they could not support Speaker John Boehner’s watered-down version of “cut, cap,” because it does not require passage of a balanced-budget amendment before the debt ceiling can go up.

(In Mr. Boehner’s alternative reality, by the way, it just popped into Mr. Obama’s head to ask for “the largest debt increase in American history, on the heels of the largest spending binge in American history.” The president was required to ask for an increase by law, and the spending was mostly incurred by his Republican predecessor.)

--------------------------

In some ways, apart from some hard working Americans, the USA have been bludging from the rest of the world for too many years... For this, the USA have used the "we're the world-cops" routine and we owe them, but in many cases, their intervention have made the planet far worse than doing nothing.

The illusion the USA want us to have is that they have the biggest dick, when it has been about three years now that China has taken over. Of course China does not want the role of world cop... The Chinese know the pitfalls and they would think that the distrust and rattle between christians, jews and muslims is at the height of silliness..

If there was to be a major war in the next ten years, it would happen between China and the Muslim world, so most Muslim (apart from the bin Ladens) in their wisdon have sucked up to the USA, a christian country that is basically run by the jewish mafia... The whole thing is perverse.

Will The Chinese want their money in full, soon...? That should worry the Yankee doodle... see toon at top...

Boehner blinked...

The US debt crisis has escalated after Republicans were forced to rewrite their proposal to lift the debt ceiling, because they miscalculated how much the original plan would cut spending.

In an embarrassing development for John Boehner, the Republican Congress speaker, the Congressional Budget Office (CBO) ruled on Tuesday night that his bill would have only cut spending by $850bn (£517bn)over the next decade, not the $1.2tn he had aimed for. Republicans are now racing to rewrite the legislation, and have pushed back a congressional vote on the plan from Wednesday to Thursday at the earliest.

Although Boehner was already struggling to find support for his package, the delay increases the risk that Washington will fail to agree a deal to raise the debt ceiling before 2 August, when the federal government is expected to run out of money.

http://www.guardian.co.uk/business/2011/jul/27/debt-crisis-republicans-plan-bungle

the cliff and the us economy...

In Pa., Obama pushes for his debt-reduction approach

By Zachary A. Goldfarb and David Nakamura, Saturday, December 1, 12:32 PMHATFIELD, Pa. — President Obama traveled to this Philadelphia suburb Friday to deliver the same sharp message he gave directly to House Speaker John A. Boehner earlier in the week: Get on board with the White House’s tax proposal, or get out of the way.

The relationship between the two most powerful men in Washington, who together will effectively decide the fate of negotiations over the feared “fiscal cliff,” has broken down badly since the heady days 17 months ago when they shared a golf course.

Obama’s 14-minute speech at a toy manufacturing company here amounted to a verbal poke in the eye, warning that taxes will go up without a plan — and likening Boehner and other Republicans to one of the most reviled figures of the holiday season.

“That’s sort of like the lump of coal you get for Christmas,” Obama said at K’NEX, the maker of Tinkertoys. “That’s a Scrooge Christmas.”

Boehner (R-Ohio) fired back less than an hour later on Capitol Hill, saying House Republicans had reached a “stalemate” with the White House. “It’s not a serious proposal,” he said of Obama’s plan.

The increasingly antagonistic tone has stoked fears in Washington and on Wall Street that an inability to compromise, or even communicate, could lead the country over the fiscal cliff, a series of automatic tax increases and spending cuts that are to take effect in January. Economists have warned that the measures could jolt the economy back toward recession.

Any political negotiation involves a good deal of bluster, particularly in Washington. Such discussions often involve a period of theatrical posturing, even as staffers continue to hammer out specifics behind closed doors. Both sides also have reason to play to their respective constituencies, even if some level of compromise is inevitable.

White House advisers point to the president’s conversations with Boehner — including a 28-minute phone call Wednesday — as evidence that they are still on speaking terms and that Obama is not trying to bypass Congress.

http://www.washingtonpost.com/politics/in-pa-obama-pushes-for-his-debt-reduction-approach/2012/11/30/66bfadde-3b0b-11e2-8a97-363b0f9a0ab3_print.html

Gus was on the edge of cliff a long time ago taking pictures... see toon at top...

a tax on speculation?...

Ralph Nader on a simple way to avoid the fiscal cliff: Tax stock trades

By Ralph Nader, Published: December 1In the debate over the “fiscal cliff,” President Obama and congressional Republicans have returned to the proposals that they were sparring over before the election. They remain at odds over key elements of revenue and spending. Yet both sides are unwilling to consider a minuscule tax on financial transactions that could be a major source of income.

A financial transaction tax would apply to purchases and sales of derivatives, options and stocks. The tax would be small, half a penny or less on each dollar of the transaction value, depending on the product. This idea is often called a “speculation tax,” because it would hit hardest at frothy high-volume trading as opposed to sober long-term investment.

Wall Street might object, but taxing its sales is hardly a radical idea. Americans in all but five states pay state sales taxes, ranging as high as 7 percent, every time they buy a car, an appliance, a pair of pants or piece of furniture, but a trader on Wall Street can buy and sell millions of dollars’ worth of financial products each day without paying a cent in sales taxes. A teacher or police officer who buys a $100 pair of shoes in the District or Maryland pays $6 in sales taxes. Meanwhile, if a financial speculation tax were applied to stock trades at a rate of 0.25 percent, a day trader would pay just 25 cents on every $100 worth of stock bought.

A speculation tax isn’t a new idea, either. Congress enacted one in 1914, and it remained in effect until 1966; initially it imposed a tax of 2 cents on every $100 sale or transfer of stock. The late Nobel Prize-winning economist James Tobin proposed a version to curb foreign exchange speculation in the 1970s. And I wrote about it a year ago, urging Congress to use it to show that it wasn’t deaf to the sentiments of the Occupy Wall Street movement.

It is an idea whose time has come once again.

At the heart of the debate over the fiscal cliff is the need to shrink our nation’s deficit while safeguarding a lackluster economic recovery by limiting the financial impact on average Americans. A speculation tax could do just that by raising revenue while having little effect on most Americans’ pocketbooks and reducing the devastation of runaway speculative trading on Wall Street.

http://www.washingtonpost.com/opinions/ralph-nader-why-a-tax-on-stock-trades-should-be-part-of-a-fiscal-cliff-deal/2012/11/30/d6a1285e-3a38-11e2-8a97-363b0f9a0ab3_print.html