Search

Recent comments

- workers party GB.....

8 hours 24 min ago - insurer's scam....

9 hours 30 min ago - pissing on the EU....

9 hours 40 min ago - hypocrites....

9 hours 58 min ago - clueless.....

10 hours 13 min ago - meanwhile.....

1 day 2 hours ago - young losers....

1 day 2 hours ago - bulgarian slow train....

1 day 2 hours ago - a six-minute read...

1 day 5 hours ago - inexpensive....

1 day 7 hours ago

Democracy Links

Member's Off-site Blogs

a withering commentary...

stuffed...

stuffed...

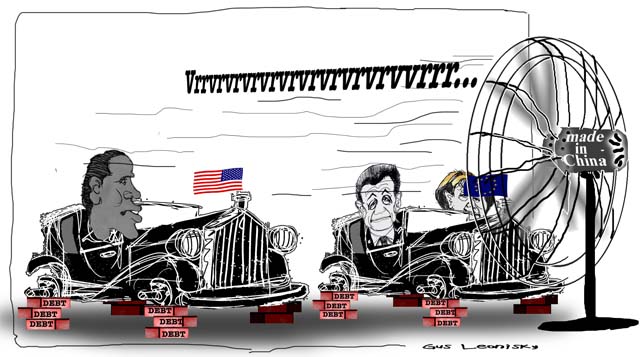

China says recent debt agreements by U.S. and European governments are unlikely to salvage their economies, and that "concrete steps" should be taken to reshift the global economy.

"The only way the Americans have come up with to improve economic growth has been to take on new loans to repay the old ones," said a withering commentary published in by the official Xinhua News Agency.

"To eat May's grain in April, however, will never be a permanent solution to a problem," it said.

China warned that the recent deal in Washington did little to solve the U.S. "debt bomb," and hinted that Beijing may further diversify its assets and holdings away from the U.S. dollar.

http://www.newsroomamerica.com/story/157496.html

Meanwhile on Oz...

ONE more time for the dummies: we [Australia] are not part of the US economy. Every day, the US matters less and Asia matters more. The American-centric mindset that a recession in the US means a recession in Australia is hopelessly out of date. It hasn't for the past two and shouldn't for the next.

The arch folly of American politics is compressing into a few years a historic sea change that should have taken decades. The downgrading of Washington's credit rating merely reflects that reality - and just helps make us look even better.

Leaving aside the disruptive impact on financial markets and concentrating on the real economy, America's impact on Australia is filtered through Asia - a buffer that grows stronger every year.

Read more: http://www.smh.com.au/business/forget-us-woes-china-keeps-our-economy-strong-20110806-1igpw.html#ixzz1ULRBWFJm

- By Gus Leonisky at 7 Aug 2011 - 10:27pm

- Gus Leonisky's blog

- Login or register to post comments

a mountain of cash...

As the West contemplates a new bout of financial meltdown, the second biggest economy on Earth might appear to be well placed to ride above the angst ripping through the markets – or even use its wealth to come to the rescue of the richer world.

On the surface, China seems to have many reasons to smile. In the first half of this year, it registered growth of 9.5 per cent, with exports 24 per cent higher than in the same period of 2010. It sits on a $3trillion mountain of foreign reserves, and has become the lender of last resort to the US administration. Foreign governments, meanwhile, have muted criticism of its human rights record: as Hillary Clinton has remarked, “How do you talk tough to your banker?”

http://www.telegraph.co.uk/finance/financialcrisis/8684245/China-cant-and-wont-save-the-world.html

jobs, jobs, jobs...

from Bob Ellis

...

... Einstein said insanity was doing over and over and again and again what didn't work the first time. Global economic practice is, by this definition, insane. 'We must fight rising market panic,' it says, 'by cutting back the money that goes to people who use it to buy things, and by cutting back government jobs. It's by cutting back government jobs that we fight unemployment because, because'...

No, no, no. No. It doesn't work that way. As I wrote once in First Abolish the Customer, my most successful book, in 1988, every lost job, every sacked worker, means four people not buying things any more, and not having their teeth fixed and not going on school camps, and this in turn means more lost jobs, more strain on public service, and more public service jobs lost, which... And so on.

...

Yet the Tea Party 'economists' tell us the rich must not be taxed, not a farthing more, not ever. And the poor must be sacked, and unemployment reduced that way. It's a religious fixity, a pious and foolish formula like faith, 'the substance of things hoped for, the evidence of things not seen', that is cracking open and gutting the world. Or it's an adolescent stubbornness: not paying for what you glory in. We'll have bigger and stupider wars, but we're not paying for them, buster, no way. We're lowering, moreover, the taxes on those who profit by them. And we're keeping our AAA rating, buster, or else... or else...

None of us dare even suggest the obvious, which is socialism, the emergency socialism we have in wartime, because this is a kind of war. We don't dare even whisper it.

With emergency wartime powers to do the bleeding obvious, we could lower all rents by two thirds and solve everything, pretty much. We could power Australia with wind, sun, waves and Hot Rocks. We could take in a hundred thousand Hazaras. We could buy and protect the Indonesian forests, and bring down global warming by 20 per cent and incidentally save the orangutan. We could do the right thing, for a change.

...

Jobs lost bust up the economy. And so it will go, and go, and go, till a socialist economy, China, owns us all.

...

http://www.abc.net.au/unleashed/2829934.html

undervalued china...

From Le Monde (translation by Google)

On the other side, China shows a healthy insolent thirty-third consecutive year without a recession, growth in gross domestic product (GDP) to 10% a year for twenty years, an unemployment continues to decline, reserves change, which, after all, already exceeded 4500 billion (3165 billion) at the end of June 2011 ...

This contrast is due to the huge undervaluation of the yuan imposed by China to its partners and rivals. Thanks to a draconian exchange control is limited to totalitarian states, China maintains the yuan at 0.15 to 0.11 dollar and euro, when, according to the International Monetary Fund (IMF) and the UN it should be worth $ 0.25 and 0.21 euro!

Western countries have remained completely passive in the face of the yuan that China dictates. Since in 2001 they admitted China to the World Trade Organization (WTO), reinforced its exchange controls, they are private, it is true, the only weapon that could make it sell: retaliation customs.

The result was both a major de-industrialization of Western and intense industrialization of China

http://www.lemonde.fr/idees/article/2011/08/08/la-strategie-chinoise-du-yuan-ruine-les-finances-en-occident_1557315_3232.html#ens_id=1216746

Hello? Anyone there?... The biggest mistake that the "West" did was to treat mainland China in the 1980s like they treated Taiwan in the early 1970s... In the 1970s, it was easier to buy cheap goods from Taiwan than to manufacture them, though the goods then were of lesser quality... The same happened during the 1960s with the West trading with cheap goods from Japan (which now heads the list of most insolvent countries — not just due to tsunamis)... But China is a "massive" country, with "massive" human resources and, of all things, a "massive" will to be... Chinese are very patient people who in their wisdom can entertain themselves without the illusion of gods and other trapclap. Despite many "localised" incidental problems, they have stuck to their grand plans and it is paying off. One could see that, a mile away, in the 1980s... The West did not plan for it, though a few economists might have seen it coming, but eventually greedy arrogance is ingrained in "capitalism"... But let's forget history. While most of the West were creating jobs in useless disposable inflated titled areas, Chinese were the boot makers and stuck to it.

Sure, trading with China has the undervalued Yuan to deal with, but no need to complain about it... One could see this coming. China has deliberately and painfully stopped its human population growth in favour of a betterment for its citizen... It has a socialist (communist) government that would make a Wolfowitz spit chips... But China has also created a buffer with the capitalist system where some of their citizen can fully profit from the Western style capitalism. It has an efficient governmental structure which deal with nearly 1.5 billion people while in the Westminster system we have can't even shit straight when there is an Abbott about...

Chinese "outside China" own more than China itself, but China provides the ethics that underpins every Chinese success: hard work... and... China...

bye bye chips...

from Patrick J. Buchanan at the American Conservative...

The decision by Standard & Poor’s to strip the United States of its AAA credit rating, for the first time, has triggered a barrage of catcalls against the umpire from the press box and Obamaites.

S&P, we are reminded, was giving A ratings to banks like Lehman Brothers, whose books were stuffed with suspect subprime paper, right up to the day Lehman Brothers fell over dead.

Moreover, S&P made a $2 trillion error in its assessment of U.S. debt and used political criteria in making its downgrade.

All of which may be true. But none of which is relevant.

This downgrade is deeply deserved. For no one really believes the United States is going to pay its creditors back the $14 trillion it owes them, or the $21 trillion it will owe them at decade’s end, with dollars of the same value as those that the United States is borrowing today.

In the last year alone, the U.S. dollar has lost 30 percent of its value against the Swiss franc.

A Swiss citizen who exchanged francs for $100,000 in dollars in June 2010 to buy one-year T-bills, then cashed those T-bills in this June, would have gotten back $100,000 in U.S. dollars. But those dollars would now be worth 30 percent less in Swiss francs.

On “Meet the Press,” Alan Greenspan insisted that the United States is not going to default. Why not? Because our debt is denominated in dollars, and we can print dollars to pay off our creditors. Which is pretty much what Chairman Ben Bernanke and the Fed have been doing.

With the dollar down 5 to 10 percent this year alone against the world’s more respected currencies, we are engaged in what the Romans called coin-clipping — official stealing from citizens and foreigners.

Why are the Chinese so upset?

Because they are sitting on more than $1 trillion in U.S. bonds and Treasury bills bought with dollars we paid them for Chinese-made goods, while the purchasing power of the dollars that those bonds and T-bills represent withers away every week.

“I believe this is, without question, the ‘Tea Party downgrade,’” says Sen. John Kerry.

How so? Because the Tea Party blocked the big deal President Obama sought to cut with House Speaker John Boehner to resolve the deficit-debt crisis.

The president, we are told, was prepared to accept $3 trillion in reduced future spending for entitlements like Social Security, Medicare and Medicaid, but the Tea Party caucus refused to let Boehner agree even to $1 trillion in “revenue enhancement.”

http://www.amconmag.com/blog/2011/08/08/whos-really-downgrading-america/