Search

Recent comments

- a six-minute read...

10 min 57 sec ago - inexpensive....

2 hours 3 min ago - obviously....

2 hours 9 min ago - macronleon de gaulle.....

4 hours 28 min ago - nazis in washington.....

4 hours 37 min ago - blinkenings.....

12 hours 11 min ago - georgia's NGOs

13 hours 10 min ago - breeding insanity....

22 hours 50 min ago - american "diplomacy"

1 day 1 hour ago - deceit america....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

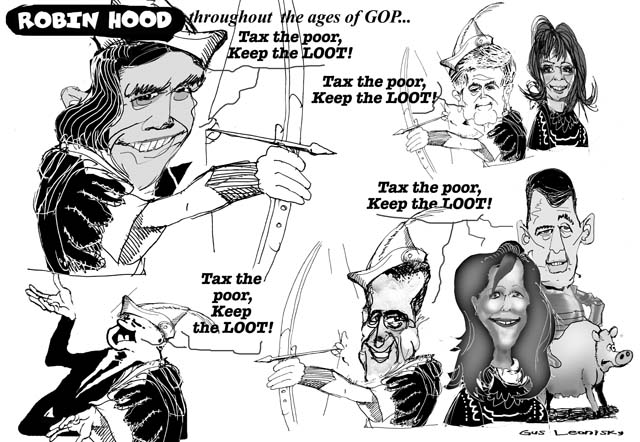

why the rich need the poor...

- By Gus Leonisky at 31 Aug 2011 - 8:46pm

- Gus Leonisky's blog

- Login or register to post comments

without poor there's no rich...

In a decade of frenzied tax-cutting for the rich, the Republican Party just happened to lower tax rates for the poor, as well. Now several of the party’s most prominent presidential candidates and lawmakers want to correct that oversight and raise taxes on the poor and the working class, while protecting the rich, of course.

These Republican leaders, who think nothing of widening tax loopholes for corporations and multimillion-dollar estates, are offended by the idea that people making less than $40,000 might benefit from the progressive tax code. They are infuriated by the earned income tax credit (the pride of Ronald Reagan), which has become the biggest and most effective antipoverty program by giving working families thousands of dollars a year in tax refunds. They scoff at continuing President Obama’s payroll tax cut, which is tilted toward low- and middle-income workers and expires in December.

Until fairly recently, Republicans, at least, have been fairly consistent in their position that tax cuts should benefit everyone. Though the Bush tax cuts were primarily for the rich, they did lower rates for almost all taxpayers, providing a veneer of egalitarianism. Then the recession pushed down incomes severely, many below the minimum income tax level, and the stimulus act lowered that level further with new tax cuts. The number of families not paying income tax has risen from about 30 percent before the recession to about half, and, suddenly, Republicans have a new tool to stoke class resentment.

Representative Michele Bachmann noted recently that 47 percent of Americans do not pay federal income tax; all of them, she said, should pay something because they benefit from parks, roads and national security. (Interesting that she acknowledged government has a purpose.) Gov. Rick Perry, in the announcement of his candidacy, said he was dismayed at the “injustice” that nearly half of Americans do not pay income tax. Jon Huntsman Jr., up to now the most reasonable in the Republican presidential field, said not enough Americans pay tax.

http://www.nytimes.com/2011/08/31/opinion/the-new-resentment-of-the-poor.html?hp=&pagewanted=print

innovative ways to "not pay taxes"...

By DAVID KOCIENIEWSKIAt least 25 top United States companies paid more to their chief executives in 2010 than they did to the federal government in taxes, according to a study released on Wednesday.

The companies — which include household names like eBay, Boeing, General Electric and Verizon — averaged $1.9 billion each in profits, according to the study by the Institute for Policy Studies, a liberal-leaning research group. But a variety of shelters, loopholes and tax reduction strategies allowed the companies to average more than $400 million each in tax benefits — which can be taken as a refund or used as write-off against earnings in future years.

The chief executives of those companies were paid an average of more than $16 million a year, the study found, a figure substantially higher than the $10.8 million average for all companies in the Standard & Poor’s 500-stock index.

The financial data in the report was taken from the companies’ regulatory filings, which can differ from what is actually filed on a corporate tax return. Even in a year when a company claims an overall tax benefit, it may pay some cash taxes while accumulating credits that can be redeemed in future years. For instance, General Electric reported a federal tax benefit of more than $3 billion in 2010, but company officials said they still expected to pay a small amount of cash taxes.

The authors of the study, which examined the regulatory filings of the 100 companies with the best-paid chief executives, said that their findings suggested that current United States policy was rewarding tax avoidance rather than innovation.

http://www.nytimes.com/2011/08/31/business/where-pay-for-chief-executives-tops-the-company-tax-burden.html?hp=&pagewanted=print

keep the loot...

2:24 p.m. | Updated The White House said on Monday that it would cover most of the cost of his payroll tax cut and other job initiatives by limiting the deductions that can be claimed on the tax returns of wealthier taxpayers.

President Obama, repeating what is clearly going to be the mantra for his stump speeches this fall, called on lawmakers Monday to “pass this bill” — his $447 billion jobs package.

At the White House, his budget director described how the administration would propose to pay for the plan, as the president has promised to do.

Jack Lew, the director of the White House Office of Management and Budget, said the bulk of the plan –- some $400 billion over ten years — would be raised by limiting the itemized deductions, such as those for charitable contributions and other expenditures, that may be taken by individuals making more than $200,000 a year and families making over $250,000 a year. The rest would come from provisions affecting oil and gas companies, hedge funds, and the owners of corporate jets.

Mr. Lew said that the congressional panel charged with finding at least $1.2 trillion in savings this fall as part of the agreement to raise the debt ceiling will have the option of accepting the payment proposals submitted by Mr. Obama, or proposing new ones of their own.

Republicans were quick to signal their continuing opposition to the tax increases that Mr. Lew described, which have been suggested by the administration before.

http://thecaucus.blogs.nytimes.com/2011/09/12/obama-pleads-for-congress-to-approve-jobs-bill/?hp

"keep the loot" or "of the permanence of temporary tax cuts (for the rich)..."

a friend in need is a GOP governor...

But to truly understand Rick Perry's "pay-to-play" approach, TPJ executive director Craig McDonald said, one must also look at contributions to the Republican Governors Association, which Rick Perry chaired from 2008 through August 2011.

True origins

In an apparent and possibly illegal attempt to hide the money's true origins, Bob Perry has routed $11,450,000 - five times the amount he has contributed to Governor Perry directly - through the Governors Association since 2006.

That same year, Bob Perry donated $1m to the Governors Association, which days later channelled $1m to Governor Perry's troubled reelection campaign. When Chris Bell, Governor Perry's Democratic challenger in 2006, filed suit alleging campaign finance violations, Perry's campaign agreed to settle the case and pay Bell $426,000, nearly half the amount of the contribution at issue.

The Governors Association, however, refused to settle. In 2010, state Judge John K Dietz ruled that the group had violated Texas law by not registering as a political committee and not reporting the $1m contribution until after the election. The judge awarded $2m to Bell, a ruling the Governors Association is appealing.

"Bob Perry had contributed hundreds of thousands of dollars to Rick Perry's campaign prior to 2006," Bell said. "So why else would he pass it through the Republican Governors Association, if they weren't trying to hide the source of the contribution?"

As reporters Murray Waas and David Henderson of Reuters revealed on Wednesday, court documents describing Romney's role indicate that two of Governor Perry's closest aides may have given "false or misleading testimony under oath" in their depositions for Chris Bell's civil suit:

"[T]he testimony of [top Rick Perry] aides David Carney and Deirdre Delisi was directly contradicted by a sworn statement from Perry's own gubernatorial campaign committee … which said that Delisi and Carney met with Romney in Washington DC on October 4, 2006 to discuss a last-minute contribution to [Perry's campaign]."

Carney has long been Perry's top political advisor. Delisi, who served as his chief of staff in the governor's office, is now senior policy advisor to the campaign.

When asked about the October 4, 2006, meeting, Mark Miner, press secretary of the Perry presidential campaign, stated that "due to a settlement by both sides we cannot comment on this case". The Romney campaign did not respond to questions about the meeting.

http://english.aljazeera.net/indepth/opinion/2011/10/20111010162019302852.html

the real robin hood...

Three hundred French protestors wearing Robin Hood outfits paraded in Nice this week. More importantly the issue is now seriously on the agenda of the G20, and has the powerful support of the French and the Germans.

Nighy, sitting in a lurid green press centre restaurant, says: "The campaign is going from strength to strength. We started this campaign one year nine months ago, and it was greeted with howls of derision from certain elements of the community, but they don't howl quite so loudly now. The support has been gained not just from Nicholas Sarkozy and Angela Merkel, but also the money men Warren Buffet and Bill Gates – who was sceptical initially – and now the Archbishop of Canterbury.

http://www.guardian.co.uk/business/2011/nov/03/bill-nighy-robin-hood-tax-g20

See the fake Robin Hoods in toon at top...

the rich don't want to help...

There’s nothing partisan about a road or a bridge or an airport; Democrats and Republicans have voted to spend billions on them for decades and long supported rebuilding plans in their own states. On Thursday, though, when President Obama’s plan to spend $60 billion on infrastructure repairs came up for a vote in the Senate, not a single Republican agreed to break the party’s filibuster.

That’s because the bill would pay for itself with a 0.7 percent surtax on people making more than $1 million. That would affect about 345,000 taxpayers, according to Citizens for Tax Justice, adding an average of $13,457 to their annual tax bills. Protecting that elite group — and hewing to their rigid antitax vows — was more important to Senate Republicans than the thousands of construction jobs the bill would have helped create, or the millions of people who would have used the rebuilt roads, bridges and airports.

Senate Republicans filibustered the president’s full jobs act last month for the same reasons. And they have vowed to block the individual pieces of that bill that Democrats are now bringing to the floor. Senate Democrats have also accused them of opposing any good idea that might put people back to work and rev the economy a bit before next year’s presidential election.

There is no question that the infrastructure bill would be good for the flagging economy — and good for the country’s future development. It would directly spend $50 billion on roads, bridges, airports and mass transit systems, and it would then provide another $10 billion to an infrastructure bank to encourage private-sector investment in big public works projects.

http://www.nytimes.com/2011/11/04/opinion/the-senate-puts-millionaires-before-jobs.html?_r=1&hp=&pagewanted=print

In Australia, the rich party called the "Liberal Party" which is ultra-rite conservative outfit with no understanding on how the planet works — except that god gave Moses some tablets on which number seven dictum forbid to lust after the neighbour's wife, which the Libs engage in, like all other humans of whatever creed, secretly — did oppose anything the government could do along the lines of infrastructure creating jobs... Their idea of course, similar to the republicans in Yankeedooddleland, is that it's better to give money to the rich and then it will trickle down to the poor via a variety of ways, including charity.

Job creation? nil... Charitable tax exemption? 10. Dignity? zip. Keep the poor under the thumb? 10 points.... Lucky this country by whatever coincidence got a minority government with a few independents and some greens who can see through the "Liberal" Crap — and of course all led by an atheist RED-HEAD woman living in sin, as Prime Minister... She has a few black marks against her ledger but who hasn't?... Opposing the welcoming of Palestinians to the Unesco family was one. The other one is on refugees whom she is trying to have processed overseas — both policies also being standards of the Liberals (conservative nitwits) as well.

But in general apart from these two blots, she leads a tight ship which, of course, the Murdoch press is trying to sink at every opportunism.

stealing from pommy grannies...

Budget 2012: 'Granny tax' hits five million pensioners

George Osborne mounted a £3 billion “stealth” raid on middle-class pensioners to fund a cut in the 50p top rate of income tax and free millions from paying income tax altogether in the Budget.http://www.telegraph.co.uk/finance/personalfinance/how-budget-affect-me/9159295/Budget-2012-Granny-tax-hits-five-million-pensioners.html

see toon at top...