Search

Recent comments

- ambassador, please!

7 hours 6 min ago - yuckraine is corrupt....

9 hours 56 min ago - reviving bucha....

10 hours 17 min ago - US complaints.....

12 hours 52 min ago - worse than worst.....

16 hours 17 min ago - of hostages...

16 hours 21 min ago - pf hostages...

19 hours 3 min ago - switzerland sux.....

19 hours 5 min ago - whoever they are....

20 hours 51 min ago - unaligned world....

21 hours 4 min ago

Democracy Links

Member's Off-site Blogs

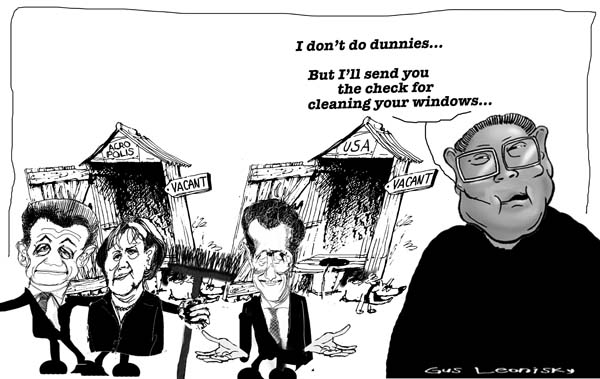

at the cleaners...

- By Gus Leonisky at 25 Sep 2011 - 6:51pm

- Gus Leonisky's blog

- Login or register to post comments

double dipping...

Some say that financial armageddon is nigh - and that it's already too late to stop it.

WHEN the respective heads of the World Bank, the International Monetary Fund and the Federal Reserve each warn within a day or so, as they did last week, that the likelihood of a double-dip global recession has increased and that ''we are entering a danger zone'', it's pretty hard to ignore.

Shares tanked on the news, with the Australian market ending 5.6 per cent lower for the week and at a 26-month low. So did commodity prices - copper was down 7 per cent on Thursday evening and another 6 per cent on Friday night. Gold wasn't spared, while silver was crunched 18 per cent overseas in the Friday session alone.

The Australian dollar was also dumped in the commodity sell-off, dropping firmly below parity with the greenback to finish at US97.7¢, and with Commonwealth Bank currency strategist Joseph Capurso deeming the near-term risks to remain on the downside.

Everyone in a position of power in the northern hemisphere continued telling someone else to start acting decisively. But no one offered up exactly what should be done to solve Europe's sovereign debt ball and chain and the potential euro-zone banking crisis it is creating, nor how to kick-start a US economy with a dysfunctional US political situation and huge unemployment.

The G20 meeting of finance ministers said they would undertake a ''strong and co-ordinated international response to address the renewed challenges facing the global economy'' but offered nothing of substance on what that response may be. They'll come back to us from Cannes in November apparently.

So the bumbling along in the northern hemisphere continues as the economic indicators worsen and with Greece's next €8 billion ($A11 billion) bailout lifeline still up in the air as its default deadline looms. This is despite Greece pressing ahead with what Deutsche Bank senior economist Phil O'Donaghoe describes as ''incredibly draconian austerity measures''.

Read more: http://www.smh.com.au/business/buckle-up-for-apocalypse-dow-20110924-1kqsq.html#ixzz1Yx7YAkis

crooked slanted sloping playing field...

Again Australian naivety and US hypocrisy are undeniably on show.

The American Senate has just voted to punish Beijing for undervaluing its currency.

The bill, which doesn't mention China by name, is designed to impose punitive tariffs on all countries which manipulate their currencies to subsidise their exports. While there are many hurdles before it becomes law, it's an example in black and white of how the US throws its weight around on world markets while protecting and subsidising its own companies at home.

Last week at the jobs summit, Andrew Liveris, the Australian who heads Dow Chemical internationally, suggested that we were often too free-market. ''Countries really cannot afford to sit back and let the forces of globalisation drive them to these economic imbalances within their national borders,'' he said. ''Passivity is not a good strategy, and it's certainly not a jobs strategy.''

Australian governments, both Labor and Coalition, sit back passively or worse, actively undermine whole sectors of the economy in the name of free trade purity, getting little or nothing in return.

Remember Howe Leather? In 1999/2000 Victoria's Howe Leather had cornered the American leather car seat market and its stateside competitors, large donors to the Republican Party, didn't like it. Through the WTO, the US government bullied Australia into rescinding an export rebate plus two subsequent loans designed to keep the company afloat. Howe Leather was forced to move most of its capacity to its factory in Mexico (a NAFTA country) just to maintain access to the US market. Good bye Australian jobs.

So that sort of thing didn't happen after the Howard government signed the US Australia Free Trade Agreement (FTA) in 2004 did it?

The Jones Act mandated that all US domestic shipping was to be built in American shipyards, no ifs no buts. So the FTA was duly signed without reference to the Jones Act leaving politicians and bureaucrats red-faced. Our high tech, multi-hull aluminium ship builders, Incat from Tasmania and Austal from Western Australia had to form US-based joint ventures to sell their ships in the land of the not so free trade. Ciao jobs, enjoy the gumbo in Louisiana!

http://www.abc.net.au/unleashed/3581492.html

bankrupt under the sun...

By KEITH BRADSHERSeven American makers of solar panels filed a broad trade case in Washington against the Chinese solar industry on Wednesday, accusing it of using billions of dollars in government subsidies to help gain sales in the American market.

The companies also accused China of dumping solar panels in the United States for less than it costs to manufacture and ship them.

The trade case, filed at the Commerce Department, seeks tariffs of more than 100 percent of the wholesale price of solar panels from China, which shipped $1.6 billion of the panels to the United States in the first eight months of this year.

The filing, which the Commerce Department must review under federal rules, is certain to be controversial. For one thing, if successful, it would drive up the price of solar energy in the name of trying to breathe life into a flagging American industry. High costs have already kept solar power from becoming more than a niche energy source in the United States.

The case also coincides with criticism by Congressional Republicans of the Obama administration’s efforts to support American clean energy companies. Republicans argue that federal loan guarantees of more than a half-billion dollars to the now-bankrupt solar company Solyndra show the folly of the administration’s efforts to guide industrial policy in that field.

The filing might also add fuel to the anti-China sentiments that are running high in some Washington corridors and have started to seep into the presidential campaign.

Chinese commerce officials had no immediate comment about Wednesday’s solar panel filing, but have vehemently opposed such trade cases. A Chinese solar company manager, speaking on condition of anonymity, said in a telephone interview that in any trade case filed by the American industry, “We would be well prepared and are confident we could defend it.”

http://www.nytimes.com/2011/10/20/business/global/us-solar-manufacturers-to-ask-for-duties-on-imports.html?hp=&pagewanted=print

a lifebuoy made in china...

By LIZ ALDERMANand DAVID BARBOZAPARIS — A day after European leaders unveiled their latest plan to save the euro, top officials opened talks with China in a bid to lure tens of billions of dollars in additional cash, giving China perhaps its biggest opportunity yet to exercise financial clout in the Western world.

China is expected to demand significant concessions, including financial guarantees and limits on what Beijing sees as discriminatory trade policies, in exchange for any investment in an Europe’s emergency stability fund. The head of the rescue fund, Klaus Regling, got a cautious reply from Chinese officials Friday during a visit to Beijing, where he said he did not expect to reach an investment deal with China anytime soon.

A senior Chinese official, Vice Finance Minister Zhu Guangyao, said China — like the rest of the world — was still waiting for the Europeans to deliver key details on how the rescue fund, the European Financial Stability Facility, would operate and be profitable before deciding on whether to participate.

That Europe would turn so openly to China to help stabilize the sovereign debt crisis shows how quickly the Chinese economic juggernaut has risen on the world stage. Indeed, China coming to Europe’s aid would signal a new international order, with China beginning to rival the role long played by the United States as the world’s pivotal financial power.

“This would be a tectonic shift,” said Pieter P. Bottelier, an expert on China who teaches at the School of Advanced International Studies at Johns Hopkins University. “It would be so important economically and politically.”

Arvind Subramanian, a senior fellow at the Peterson Institute for International Economics in Washington, said this was another sign that China is already a dominant global power.

http://www.nytimes.com/2011/10/29/world/asia/europe-seeks-chinese-investment-in-euro-rescue.html?_r=1&hp=&pagewanted=print

Asian futures...

From Yuriko Koike

China's free-floating rise, unanchored in any regional structure or settlement, makes this mindset particularly worrying. At the Hawaii summit, Obama must orchestrate the first steps toward constructing an effective multilateral framework within which the complications posed by China's rise can be addressed.

The absence of such a structure of peace has been obscured, to some extent, by the dominant role of the US in Asia since the Pacific War. But China's rise and the other global and domestic concerns of the US have left many Asians wondering just how enduring those commitments will be in the future. Nevertheless, China's recent strategic assertiveness has led many Asian democracies to seek to deepen their ties with the US, as South Korea has done with a bilateral free-trade agreement. The US is reciprocating by pledging not to cut Asia-related defence spending, despite the large reduction in overall US defence spending that lies ahead.

What Asia needs most today is a well-conceived regional system, embedded in binding multilateral institutions. A "Trans-Pacific Partnership" between Australia, Brunei, Chile, Malaysia, New Zealand, Peru, Singapore, the US, and Vietnam to govern supply-chain management, intellectual-property protection, investment, rules on state-owned firms, and other trade issues - likely to be announced in Hawaii - is a good start in the economic sphere. But much more is needed.

Ultimately, the best way for peace to prevail in the region is for the US and China to share responsibility for a regional order with Asia's other powers, particularly India, Indonesia, Japan, and South Korea.

Asia's choice is clear: Either the region embraces a multilateral structure of peace, or it will find itself constrained by a system of strategic military alliances. In Hawaii, Obama and the other assembled Asian leaders - particularly the Chinese - must begin to choose between these two Asian futures.

Yuriko Koike is Japan's former Minister of Defence and National Security Adviser.

chinese store...

The Australian share market staged a turnaround midway through the session after a choppy morning of trade.

Fresh promises by China that it would continue to invest in eurozone debt helped investors overcome nerves on a second bailout for Greece.

There is speculation that Greece will not receive this round of bailout funds because it will not follow through on crippling austerity measures approved this week.

The ASX 200 index gained 0.3 per cent to 4,253 and the All Ordinaries index rose 0.2 per cent to 4,327.

The Commonwealth Bank defied analysts' estimates and recorded a net profit of $3.6 billion, up 19 per cent on the same period last financial year.

Investors welcomed the result, pushing the share price up more than 0.5 per cent to $50.23, giving it the strongest result of the big four banks, with ANZ adding just 1 cent to finish on $21.70.

Shares in Westfield Group rose sharply to $8.81 after it announced a share buyback scheme.

http://www.abc.net.au/news/2012-02-15/australian-share-market-ticks-higher/3832288