Search

Recent comments

- ukraine's agony has not started yet....

3 hours 48 min ago - all defeated.....

4 hours 28 sec ago - beyond crime.....

4 hours 50 min ago - the end....

5 hours 1 min ago - odessa....

6 hours 8 min ago - weitz....

7 hours 58 min ago - bidenomics BS.....

8 hours 12 min ago - the defeat of ukraine is coming....

9 hours 46 sec ago - paris is sick....

20 hours 22 min ago - German spies?....

21 hours 33 min ago

Democracy Links

Member's Off-site Blogs

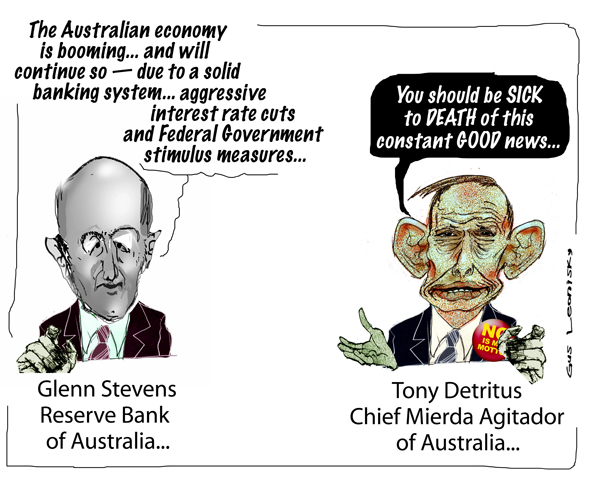

compare the pair...

- By Gus Leonisky at 24 Jul 2012 - 4:54pm

- Gus Leonisky's blog

- Login or register to post comments

tonicchio is preparing to muck it up...

Glenn Stevens says Australia's passage through the financial crisis relatively unscathed is not just down to luck, and there is every reason to believe the nation's record run of economic growth can continue.

Speaking at the annual Anika Foundation luncheon hosted by Australian Business Economists, the Reserve Bank governor said Australia's solid banking system, strong public finances and flexible exchange rate leading into the financial crisis stood it in good stead to withstand the global downturn.

Glenn Stevens says the aggressive interest rate cuts and Federal Government stimulus measures also helped maintain Australia's economy.

"In both the monetary and fiscal areas, of course, having used the scope we had so aggressively, it was also necessary, as I argued in 2009, to re-invest in building further scope, by returning settings to normal once the emergency had passed," he observed.

Mr Stevens also maintains a much more positive view of China than many market economists.

"The recent data suggest that, so far, this is a normal cyclical slowing, not a sudden slump of the kind that occurred in late 2008," he argued.

"The data are quite consistent with Chinese growth in industrial output of something like 10 per cent, and GDP growth in the 7 to 8 per cent range."

The Reserve Bank governor again also played down concerns about an Australian property crash, while at the same time urging caution to those who believe prices will soon resume an upward trajectory.

"It is a very dangerous idea to think that dwelling prices cannot fall. They can, and they have," Mr Stevens said.

"The point is simply that historical or international comparisons, to the extent they can be made, do not constitute definitive evidence of an imminent slump."

The nation's head central banker pointed to a graph showing that while the Australian house price to income ratio is more than double that of the US, it is comparable to Belgium, New Zealand, the UK, Canada and post-housing crash Ireland.

Mr Stevens says housing affordability has "improved significantly" over recent years due to rising incomes and declining home values, and 99 per cent of bank mortgages are being serviced fully.

http://www.abc.net.au/news/2012-07-24/reserve-bank-glenn-stevens-speech/4150764?WT.svl=news0

The Libs (conservatives) and their shit-stirrer in chief are preparing to make your life miserable... vote for them at the next election next year and then blame bad peer pressure for what you've done...

the boy has no shame...

Opposition Leader Tony Abbott has broken from bi-partisan tradition to urge China to embark on political reforms to match its "remarkable" economic transformation."As prime minister I would hope for political reform to match China's economic liberalisation, while acknowledging the government's right to maintain order and respecting China's growing place in the world," Mr Abbott told a business breakfast in Beijing this morning.

"We already have a strong relationship with China based on shared interests," he said.

"Over time, I hope it will be based more on shared values."

Read more: http://www.smh.com.au/world/abbott-to-china-time-for-reform-20120724-22maf.html#ixzz21Wd2z0OK

Sharing values with Tonicchio?... The kid is kidding!... He is a liar, a religious bigot, a denialist of global warming and a negative populist... and he's got the gall to tell the most polpulated country on earth how to run its business...

Deloitte Access Economics is bonkers...

Well this is embarrassing. The future of the private economic forecasting industry is under threat. Some cruel spoil sports have been keeping note on prior forecasts that failed. So what will Deloitte Access Economics do for free publicity?

The Deloitte Access Economics brand was plastered across media yesterday thanks to its forecast that the resources boom is all over in two years and that the federal budget surplus is no more.

Trouble is, it seems Access has been forecasting the imminent demise of the aforementioned boom almost since it started. Who knows, maybe this time they will be right.

By the nature of booms, one of these years they have to be, but the timing is rather important.

Which is why narky types keeping score on Access' timing calls damage the forecasting trade. In blogs and the comments section, critics started recalling earlier Access prognostications, which in turn leads to a critique on Crikey, well, make that critiques on Crikey.

Turns out the forecast of the boom ending in 2014-15 is actually a 12-month extension on a 2010 forecast that the boom would fizzle next year.

Read more: http://www.smh.com.au/business/accessing-a-headline-opinion-20120724-22m6k.html#ixzz21WnabtT9

the spectre of the little shit...

Fifthly and finally, into this seething mess, introduce Abbott and his band of humourless, talentless, right wing zealots. Effectively purged of any remnants of small ‘l’ liberalism, the Coalition is overtly taking its cues from the rabid Republican right over the Pacific, whose blitzkrieg pillage and rape tactics have brought politics in the US to its lowest ebb. The mass media is slavishly spreading the word. The big end of town is pouring in the dollars — which is another problem that the ALP has — not enough cash from a failing Union movement. The people have become an angry lynch mob, lapping it all up.

Abbott has already profoundly altered the Australian political landscape, probably forever, certainly for the worse. He has perfected the Howard art of dog-whistled approval for our most reprehensible national characteristics — think asylum seekers. He has conducted an unprincipled and mendacious blitzkrieg against a well-meaning and worthy – but, in truth, hapless – government of a level of violence that is new to this country and appears to have left the government, still a year out from election, more or less dead in the water — defenceless, dispirited and without direction. Aided and abetted by the mass media, Abbott has perfected the art of governing by continually fanning the flames of our selfish sense of entitlement and our innate fear of the other.

http://www.independentaustralia.net/2012/politics/australia-approaches-the-abbott-abyss/

the price of good news...

Retail sales posted a better than expected 1 per cent gain in June, backing up a strong rise in May.

Economist forecasts centred on a 0.7 per cent rise in June, and the Australian dollar climbed 0.2 cents to 104.75 US cents immediately after the retail and trade data were released at 11:30am (AEST) by the Bureau of Statistics.

The volume of retail sales was up 1.4 per cent for the June quarter, which also easily beat economist expectations of a 0.8 per cent gain and bodes well for an important part of the nation's economic growth.

The Bureau's figures show food retailing (up 0.9 per cent) and department stores (up 3.4 per cent) were the main drivers of increased sales.

http://www.abc.net.au/news/2012-08-02/retail-sales-surge/4172028Of course our chief shit-stirrer (merda-agitatore) Tony Abbott will tell you he'll soon fix this devastating continuum of good news that you are getting under Labor... See, you need to be flogged for your own salvation, flogged the catholic Abbott way!...

more good bad news...

Australia's jobless rate dropped in July to 5.2 per cent as the economy continued to show surprising vitality.

The workforce added 14,000 more jobs last month, according to the Australian Bureau of Statistics.

The July jobless rate improved from a revised 5.3 per cent for June. The ABS had earlier reported June's jobless rate as 5.2 per cent.

Read more: http://www.smh.com.au/business/the-economy/jobless-rate-drops-as-employers-add-staff-20120809-23vsi.html#ixzz231444l3i

Tony Abbott is spitting chips... but we'll vote him in and loose our job... or get hammered on the head... He's mad as a cut snake...

more good news will make detritus spew...

The Reserve Bank has flipped its forecasts back upwards, reflecting a recent run of more positive economic data.

In its quarterly Statement on Monetary Policy, Australia's central bank is now forecasting the economy will grow an average of 3.75 per cent over this calendar year, up from its May forecast of 3 per cent.

A large part of that is due to much stronger than expected first-quarter economic growth of 1.3 per cent.

That has forced the bank to shift its prediction for the financial year just ended to 3.75 per cent.

The Reserve also highlighted that business borrowing is growing at its fastest pace in three-and-a-half years, and that consumer spending was strong in the first half of the year, with liaison with some retailers suggesting it became even stronger after the Federal Government’s carbon price compensation payments in May and June.

However, the RBA expects this to ease as the Federal Government’s spending cuts to move back to surplus begin to bite in the broader economy.

Thus it expects a slight slowdown in the second half of the calendar year, and has also slightly lowered its outlook for 2013 and 2014, although it still forecasts growth to be roughly at or just below average.

http://www.abc.net.au/news/2012-08-10/rba-forecasts-back-up-again/4190538

see toon at top...

detritus will spew some more...

There is growing talk among Australian economists that the next move in interest rates will be up.

The interest rate hawks, as they are referred to, say there will soon be a need to slow the Australian economy, not speed it up.

The National Australia Bank today become the first among the big four banks forecasting higher rates.

There are still some economists, however, who are convinced that the cost of borrowing should fall further.

Alan Oster, NAB chief economist, says the speed of the economy will eventually need to be reined in through lifting interest rates.

"I think most people are very surprised by the first quarter GDP (gross national product) numbers and the second quarter GDP numbers look like they're going to be very strong," he said.

"And so the first half of the year was much stronger than I think everybody thought.

http://www.abc.net.au/news/2012-08-14/economists-foreshadow-interest-rate-rise/4198458

see toon of good news at top top top...

more bad news for litle rattus...

The Reserve Bank has forecast that the resources boom will continue for the next few years, countering suggestions that it has already peaked.

In the minutes from its August meeting released today, the RBA said resource investment would "continue rapidly over the next year or so, broadly in line with expectations."

However, in a reality check the RBA has pointed to the boom's "eventual decline", but expects the fallout to be offset in "a ramp-up in resource exports" as projects are completed.

The RBA has also signalled a recovery in non-mining parts of the economy which have been hurt by the multi-speed nature of resource investment.

The minutes refer to "a gradual strengthening in some parts of the non-resource economy that had been relatively weak."

http://www.abc.net.au/news/2012-08-21/reserve-bank-sees-positive-economic-outlook/4212576

see toon at top...

more more bad news for Mr Detritus...

Another sharp rise in China's benchmark iron ore spot price has lifted the Australian dollar and mining stocks.

After bottoming at $US86.70 a tonne on Wednesday last week, the benchmark price at Tianjin port has surged 13.5 per cent in four trading days to climb back above $US100 a tonne.

The rapid recovery is the steepest bounce in iron ore prices recorded by The Steel Index in the four-year history of the figures.

ANZ's head of global commodity research Mark Pervan says the surge in iron ore prices is being driven by investors covering off bets on the steelmaking material falling in price after the Chinese government said it would roll out infrastructure spending.

"What you'll find in iron ore is that its been heavily sold, in fact overly sold," he said.

http://www.abc.net.au/news/2012-09-12/iron-ore-prices-continue-rebound/4256692

see toon at top....

mining booms again...

The share market has closed higher, with miners among the top gainers.

The All Ordinaries ended up two-thirds of a per cent at 4,535 while the ASX 200 added 31 points to 4,517.

With the US stock market closed for a second day in the wake of superstorm Sandy, investors took the cue from European equities which were higher on a slew of shareholder-friendly corporate news.

The banks made solid gains, all except NAB which lost a third of a per cent after revealing a sharp slide in full-year profit.

Net profit was down by nearly 22 per cent to $4.1 billion because of rising bad debts and mounting losses in its troubled UK business.

Its Australian business however saw earnings rise around 10 per cent.

Rivals Commonwealth and Westpac put on around two-thirds of a per cent.

http://www.abc.net.au/news/2012-10-31/miners-among-top-market-gainers/4344606

printing money...

Global banking giant UBS says the Reserve Bank may be printing money to keep the Australian dollar under control.

UBS analysts Gareth Berry and Andrew Lilley say the evidence that the RBA may have been printing Australian dollars is compelling, but not yet conclusive.

The main evidence the analysts cite to support their theory is a rise in the Reserve Bank's foreign currency reserves at the same time as the deposits of foreign institutions lurched upwards by a similar amount.

"It is as though freshly-minted Australian dollars are being sold directly to foreign central banks and the proceeds added to the RBA's pool of FX [foreign exchange] reserves," they wrote in an analysis.

The UBS analysts say if the Reserve is printing money to satisfy increasing demand for Australian dollars from foreign central banks then it should put downward pressure on the domestic currency.

However, they say the Australian dollar is unlikely to fall sharply, with their forecasts centring on the local currency falling back to parity in three months' time.

If true, the moves to print dollars to satisfy foreign demand would fit with a recommendation by recent former Reserve Bank board member economist Warwick McKibbin.

http://www.abc.net.au/news/2012-11-07/rba-might-be-printing-money-for-foreign-banks/4358864

Gus: a simple strategy to protect Australian industries and manufacturing from a greater value in the Aussie dollar that would further sink exports...

more bad news... for tony...

Today's rise on the share market helped it to its biggest weekly gain in six weeks.

The All Ordinaries ended 0.6 per cent higher at 4,518 and the ASX 200 added 28 points to 4,507, which is off session highs.

The market was buoyed from the outset by a strong end to trade on global markets overnight.

That was due to an upward revision to third-quarter economic growth in the United States.

On the local market, resource, energy and bank stocks led the gains.

Global miner Rio Tinto jumped 2.8 per cent, while rival BHP Billiton added 0.5 per cent.

The banks were strong, headed by Westpac, which saw a 1 per cent rise.

http://www.abc.net.au/news/2012-11-30/local-market-buoyed-by-strong-global-trading/4401858

See toon at top...

astonishingly annoying for tony detritus...

A strong Australian dollar and robust competition have led to record national vehicle sales, which the industry has described as astonishing.

Despite the weakness in several parts of the economy in 2012, new vehicle sales rose 10.3 per cent to more than 1.1 million.

The previous record of 1.05 million was set in 2007.

The Federal Chamber of Automotive Industries chief executive Tony Weber says carmakers are pleasantly surprised by the result.

"10 per cent is actually an astonishing number," he exclaimed.

Mr Weber says the strong Aussie dollar helped make imported cars cheaper.

"I think the increase in sales reflects the fact that the market in Australia for cars is so competitive, prices are so low and it's probably the best time in a very long time to buy a car in Australia," he said.

"The price index shows that it is actually cheaper in 2012 than it has ever been before to buy a car."

Mr Weber says the high Australian dollar helped intensify competition, but locally made cars also performed well.

http://www.abc.net.au/news/2013-01-04/drivers-shrug-of-economic-gloom-buy-new-cars/4452868

see annoying toon at top...

more annoying news for tony abbott...

After slipping back for just one day, the ASX this morning defied global trends and started February by charging forward once again. At the close today, the ASX 200 was 42.3 points higher - 0.9 per cent - at 4921.1.

The rally has, after four long and lean years, sent superannuation balances back past their pre-GFC peaks, and stockbroking firms scrambling to fill empty desks.

Read more: http://www.smh.com.au/business/back-to-the-bull-market-75b-added-to-asx200-20130201-2dp6u.html#ixzz2JdHuH5UO

The stock market is not the whole economy but it is a good indicator on how things ar cooking in general, even if some sectors of the Australian economy are suffering from a high Aussie dollar... And why is the Aussie dollar high in comparison to the US dollar... It's because the Australian economy is doing well in general...

Tony Detritus won't like that, once more... Too much good news... See toon at top...

the economy has not tanked despite abbott's attempts...

TEN years ago Australian cities did not even rate in the top 50 most expensive in the world. Now Sydney is ranked third, behind Tokyo and Osaka, a new report shows.The price of unleaded petrol in Sydney is three times higher than it was 10 years ago. Table wine has nearly tripled in price, the price of bread has more than doubled, and cigarettes have soared to nearly four times as much, the Economist Intelligence Unit worldwide cost of living index 2013 shows.

Australian cities have been rising very quickly up the rankings.

Sydney is not the only Australian city featured in the top 10. Melbourne was ranked fifth, behind Oslo.An economist for the Commonwealth Bank, Savanth Sebastian, said the strong dollar was behind the high living costs in Australia.

''We didn't have the collapse and property prices that the rest of world saw, especially among the more advanced nations,'' he said.

''While goods may be more expensive here, we have seen pretty healthy wage increases over the last decade and if you look at wealth levels, they are getting back to those record highs we were seeing just before the [global financial crisis].''

Read more: http://www.smh.com.au/nsw/top-dollar-puts-sydney-higher-on-expense-scale-20130204-2duwk.html#ixzz2JyuArX00

See toon at top...