Search

Recent comments

- american "diplomacy"

1 hour 54 min ago - deceit america....

4 hours 13 min ago - police-state....

13 hours 54 min ago - the war continues....

14 hours 42 min ago - scott is angry.....

21 hours 43 min ago - a catastrophe?....

1 day 1 hour ago - 3Xwars is 3Xpeace?....

1 day 3 hours ago - futile trousers....

1 day 3 hours ago - reading reality....

1 day 4 hours ago - colonel blimp....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

some people kill themselves...

Figures released by the Victorian Coroner reveal an addiction to gambling has been linked to 130 suicides over the past 12 years.

Two of those were partners of problem gamblers.

The report reveals that 85 per cent of the victims were men aged 30 to 49 and that poker machines were the biggest problem.

Gambling researcher, Professor Alexander Blaszcynski, from the University of Sydney's Gambling Treatment Clinic says while the figures are a concern, there are many contributing factors to suicides.

"I think one could reasonably conclude that as gambling becomes more prolific within society then more people are going to get into serious problems," he said.

http://www.abc.net.au/news/2013-09-20/problem-gambling-linked-to-130-deaths-in-victoria/4970772

------------------------------

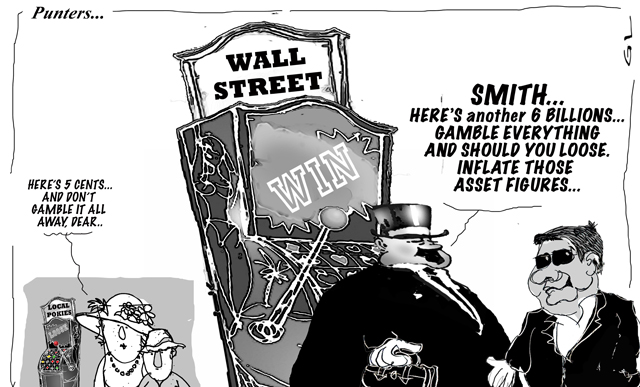

Meanwhile at super-gambling headquarters:

Banking giant JPMorgan Chase has agreed to pay $970 million ($US 920 million) in fines to US and British regulators and made a rare public admission of wrongdoing over actions involved in last year's "London whale" trading debacle.

Settlements with four US and British regulators resolve the biggest civil probes of the bank's $6.2 billion of Whale derivatives trading losses last year. Criminal investigations are still under way.

"JPMorgan failed to keep watch over its traders as they overvalued a very complex portfolio to hide massive losses," the US Securities and Exchange Commission said in announcing the settlement.

JPMorgan, the largest US bank by assets, lost about $US6.2 billion in 2012 on the soured trading bets.

The trading violations "demonstrated flaws permeating all levels of the firm: from portfolio level right up to senior management," said the Financial Conduct Authority (FCA), the British regulator.

The bank called the settlements "a major step in the firm's ongoing efforts to put these issues behind it."

It was cited for poor risk controls and failure to inform regulators about deficiencies in risk management that it knew about.

Bank makes rare public mea culpaBruno Iksil, the trader whose big bets earned him the nickname London Whale, has signed a cooperation agreement with prosecutors and has not been charged with any wrongdoing.

Two other traders who worked with Iksil in London, Javier Martin-Artajo and Julien Grout, have been criminally charged by US prosecutors over their role in the scandal, accused of trying to hide the mounting losses.

- By Gus Leonisky at 20 Sep 2013 - 2:55pm

- Gus Leonisky's blog

- Login or register to post comments

whale beaching... no CEO is in prison yet...

Banking giant JPMorgan Chase has agreed to pay $US920 million ($A974 million) in fines to US and British regulators over actions involved in last year's "London whale" trading debacle.

The global settlement includes an admission by JPMorgan that it violated US securities laws.

The admission is contained in a 15-page statement of facts in the case that JPMorgan, the biggest US bank by assets, shows it "violated the federal securities laws".

The US Securities and Exchange Commission pushed for the admission "because JPMorgan's egregious breakdowns in controls and governance put its millions of shareholders at risk and resulted in inaccurate public filings," said the SEC co-director of enforcement, George Canellos.

The violations stem from the mis-statement of financial results and poor internal controls over employees who were responsible for $US6.2 billion in trading losses in 2012.

The "London whale" trading violations "demonstrated flaws permeating all levels of the firm: from portfolio level right up to senior management," said the Financial Conduct Authority, the British regulator, which fined JPMorgan $US220 million in the case.

Read more: http://www.smh.com.au/business/world-business/jpmorgan-to-pay-us920-million-london-whale-fine-20130920-2u36j.html#ixzz2fPE27M5Y

some people get their dad to steal....

The daughter of a sacked RailCorp manager has admitted to investigators from the Independent Commission Against Corruption (ICAC) that she lied to get more than $1 million from him.

Former RailCorp maintenance manager Joseph Camilleri and his sister are accused of corruptly soliciting loans of more than $1.5 million from public officials and contractors.

A public inquiry, which has now finished hearing evidence, was told that they wanted the money to help Mr Camilleri's daughter, Jessica Camilleri.

She did not give evidence at the public inquiry - but the ICAC has released a statement in which she told investigators she lied to her father about needing the money for legal matters when it was really to pay back her gambling debts.

The 25-year-old said she was being pressured to pay loans back to other people, and that she played blackjack and poker machines, and went on holidays to Las Vegas, Melbourne and Queensland.

She said her father has helped her out on a number of occasions - once handing over $15,000 when she was kidnapped.

"I've always asked my dad for money and he's always helped. He helped me with my wedding," she said.

http://www.abc.net.au/news/2014-02-28/railcorp-managers-daughter-lied-for-more-than-1m/5291440

betting on jesus...

Gambling company Sportsbet has displayed "extraordinary arrogance and hubris" in floating a giant Jesus air balloon over Melbourne to promote betting on the World Cup, Reverend Tim Costello says.

Rev Costello, the chair of the Australian Churches Gambling Taskforce, said the stunt was an overreach and against the principles Jesus stood for.

"There seems to be no corporate or civic responsibility to say 'hang on, is nothing sacred?'" Rev Costello said.

"Is betting to absolutely dominate not just casino and gamble areas and TV rooms, but now literally the sky?

"This is extraordinary, if they knew anything about Jesus they'd know he'd be overturning tables in the gaming halls, because they're highly addictive and destroy lives."

http://www.abc.net.au/news/2014-06-10/sportsbet-giant-jesus-balloon-melbourne-stunt-tim-costello/5512520

See toon at top.

not betting on jesus...

from Peter FitzSimons

........

See what I really want to talk about is the compelling image this week of a sports-betting company floating a one-tonne 46-metre-high Jesus-shaped hot air balloon over Melbourne, with arms 41 metres wide – in the image the statue of Jesus that stands above Rio de Janeiro, where the World Cup starts on Friday – dressed in a jersey emblazoned with the name and logo of that betting shop.

“Suffer the children to come unto me?”

Sort of. It was more, “suffer, you poor losers who think that there is a chance in HELL, you will come out ahead by putting the rent money on who you think will do well in the World Cup, when you MUST bloody well know that poor bastards have been trying to do that since the dawn of time and they ALWAYS lose in the long-term to those who own whatever game it is.”

The outrage of the church was predictable, with the Anglican Archbishop of Melbourne, Dr Philip Freier, leading the way.

“The [betting] campaign,” he thundered, “is simply a blatant attempt to boost business ... But the campaign is hypocritical because the Jesus who overturned the money-changers’ tables in the Jerusalem Temple would not encourage betting.”

He, and many other religious people, were so highly offended they wanted it stopped.

But is the fact that the religious folk are offended, enough?

Personally, I have been offended for years by various religious types proselytising in the public domain that those with my belief system – a resolute refusal to believe transparent nonsense on no evidence – will, and should, burn in hell for all eternity because of it. But those religious types don’t seem to particularly care about my being offended, so why should I care about theirs?

So in response, it is surely fair enough to quote, the brilliant Stephen Fry: “It’s now very common to hear people say, ‘I’m rather offended by that.’ As if that gives them certain rights. It’s actually nothing more ... than a whine. ‘I find that offensive.’ It has no meaning; it has no purpose; it has no reason to be respected as a phrase. ‘I am offended by that.’ Well, so f--king what?”

What about legally then, with some people saying there oughta be a law against it?

Nuh.

If Christianity acknowledged itself to be a business, and paid taxes on their massive income – in the case of the Catholics, putting no less than $30 million of that income into buying a mansion hostel in Rome, where George Pell now lives – they would have every right to sue for breach of copyright. Jesus is their symbol, and can’t simply be stolen like that, for your money-making venture.

Which leaves us with what grounds of complaint then?

Ethics?

Bingo!

Legs-11!

The betting company is a massive operation, with only one aim in mind – and they know it – to separate fools from their money. To clothe that aim with the bullshit that you really might make money, this time on this World Cup, is bad enough. But by STEALING the feel-good image of a movement of 2000 years standing, that for all its sins has nothing to do with gambling and at its best is devoted to helping people, is ethically OUTRAGEOUS! And the wretches do the whole thing with full cognisance that with every sucker they bring in, the net amount of misery in Australia will rise. I say, a pox on their house!

And surely the Church would back me on this but, given their resolute opposition to ethics classes being taught in our schools, we can’t be sure.

Read more: http://www.smh.com.au/fifa-world-cup-2014/world-cup-news-2014/jesus-can-you-credit-the-fury-over-that-christ-balloon-20140611-zs4ai.html#ixzz34KC01OsC

losing bet...

The Victorian Government has been ordered to pay more than $450 million in compensation to gaming giant the Tatts Group, plus interest over changes to gaming licences introduced in 2008.

But Tabcorp lost a similar challenge after claiming more than $700 million.

The Victorian Supreme Court made the ruling after a trial was held earlier this year.

In reforms introduced by the Brumby Labor government, Tabcorp and Tatts were stripped of their long-standing poker machine duopoly in Victoria.

They had held the duopoly for 18 years, with 27,000 machines across the state.

The reforms, which came into effect in 2012, allowed pubs and clubs to take control of pokies outside Crown Casino.

The companies have been chasing compensation through the Victorian Supreme Court, where a trial was held earlier this year.

Tabcorp claimed almost $700 million in compensation, while the Tatts Group has claimed nearly $500 million.

Lawyers for Tabcorp told the court those figures could rise with interest accumulated every day until the case was resolved.

Tabcorp claimed money it paid in advance for its gambling licence should have been returned when the reforms were introduced.

It said the state's obligation to pay the compensation dated back to its privatisation of the TAB and listing of Tabcorp on the ASX in 1994.

It claimed that obligation was recognised by the state, including in its annual budget papers, over a 14-year period from 1994 to 2008.

The Government argued the legislation relied upon was repealed in 2008.

The Tatts Group said it was entitled to the lost funds because the Government never issued a new gaming licence as part of the restructure.

But the Government said the new licences were so different that past agreements did not apply.

Last August Tabcorp posted a net profit of $126.6 million, down 63 per cent on the previous year.

At the time, the company said it was important to note that the tens of billions of dollars reaped from the state's poker machines was merely flowing into other commercial coffers.

Anti-gambling campaigner Tim Costello said at that time that problem gambling continued to increase.

http://www.abc.net.au/news/2014-06-26/tatts-group-wins-bid-for-450-million-payout/5552772