Search

Recent comments

- patriotism....

5 hours 4 min ago - belittling russia......

5 hours 32 min ago - Запад толкает Украину на последнюю битву....

5 hours 46 min ago - fourteen points....

5 hours 55 min ago - der philosophische glaube....

6 hours 6 min ago - seriously?...

6 hours 20 min ago - AfD....

6 hours 47 min ago - undesirables...

7 hours 4 min ago - assistant spies......

7 hours 29 min ago - brics.....

10 hours 37 min ago

Democracy Links

Member's Off-site Blogs

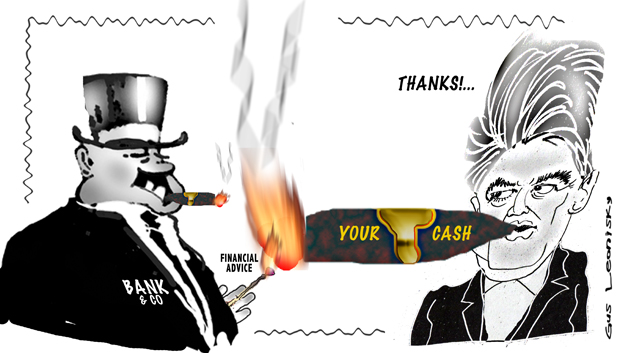

a big fat belgian cigar hell bent on removing your protection against losing your pants...

The Federal Government is pressing ahead with its plan to wind back Labor's financial advice laws aimed at protecting investors.

The Coalition has been under pressure over some of the controversial changes it flagged to the Future of Financial Advice (FoFA) reforms.

Labor introduced the FoFA reforms after a series of high-profile financial collapses rattled investor confidence in the sector.

The Coalition has sought to moderate them and, after a Senate inquiry largely backed the changes earlier this week, Finance Minister Mathias Cormann has told the ABC's AM program the Government will go ahead with most of them.

The Government will proceed with scrapping a legal obligation requiring financial advisers to take "any reasonable steps" in their clients' interests.

Senator Cormann says it is unnecessary as there are other safeguards in place, including six steps prescribed in the Corporations Act.

"That is adequate in order to ensure that financial advisers act in the best interests of their client," he said.

The proposed changes do not have the backing of Labor or super funds.

- By Gus Leonisky at 24 Jun 2014 - 9:24am

- Gus Leonisky's blog

- Login or register to post comments

hocus pocus advice versus proper investment...

John Brogden, the chief executive of the Financial Services Council, which supports the government’s changes, said they “provide a very significant amount of comfort to consumers that commissions are gone”.

But David Whiteley, the chief executive of Industry Super Australia, which opposes the changes, said the existing ban on commissions was “water tight” and the proposed changes “will allow some forms of conflicted remuneration and incentives to financial advisers to sell certain products”.

“If they didn’t want any kind of conflicted remuneration at all they would leave the legislation exactly as it is,” he said.

And the Greens spokesman Senator Peter Whish-Wilson said the government was “being cute with their definition of conflicted remuneration and the difference between personal and general advice. They are still going to allow incentives that by any definition, are conflicted remunerations such as sales-based bonuses that drive the culture that we need to change. This is particularly the case in large financial service companies and banks.”

The government also insists its proposed laws do still require a financial adviser to act in the best interests of a client, keeping a six-part check-list of specific things a financial adviser has to do, but removing a catch-all provision which “created too much complexity and uncertainty”.

Brogden said there had been “a malicious campaign of misinformation” about the government’s changes to the “best interest test” and that under its planned laws “it is hard to imagine … that we could ever again see the sort of [financial] scandals we have seen in the past”.

But the consumer group Choice, which is asking all federal politicians to oppose the changes, said the best interest test had been watered down.

“The government claims that it is improving the best-interests obligation when in it is removing a professional duty for advisers. You don’t go to a doctor expecting them to follow a check-list of tasks; you expect them to use their professional judgment to find the best solution for you. It should be the same for financial advisers.

http://www.theguardian.com/world/2014/jun/20/mathias-cormann-presses-on-with-fofa-reform-despite-unruly-incoming-senate

cormann obviously wants more banking bad advice...

The Federal Government is resisting calls for a royal commission into the corporate watchdog and the Commonwealth Bank.

A Senate inquiry into a fraud scandal that left thousands of customers millions of dollars out of pocket has slammed the Australian Securities and Investments Commission's (ASIC) handling of rogue financial planners working at the Commonwealth Bank.

The majority report suggests both organisations should face a royal commission.

However, Finance Minister Mathias Cormann says another inquiry into the financial system is already underway.

"I've had conversations with the senior leadership at the CBA in relation to some of these matters over the past week," Senator Cormann said.

"Once I've properly studied the report I would expect that I would have some further conversations.

"We already have a financial systems inquiry which is currently underway, so without pre-empting the Government's response, obviously that financial systems inquiry's considering the role of ASIC as part of our financial system."

While the Government believes the ongoing inquiry will help lift standards across the industry, it does want to put more pressure on the Commonwealth Bank to do more to help customers that lost money.

Senior sources say the bank's response to the committee's report has been "inadequate" and that there needs to be a "mea culpa" from the bank and a "more considered response" to the committee's findings.

"I have spoken to (CBA chief executive) Ian Narev about the findings of the Senate Economics Committee today and I am confident that he and the CBA will have more to say by way of a considered response to that report next week," Senator Cormann said.

http://www.abc.net.au/news/2014-06-27/government-resists-call-for-royal-commission-into-asic-cba/5554394

oversighted oversight...

Federal Finance Minister Mathias Cormann has said he didn't notice that he hadn't been charged more than $2,700 in flights for a January 2018 family holiday to Singapore — an amount he repaid yesterday after being contacted by the media.

Key points:Senator Cormann booked the January 2018 return flights for himself, his wife and two children through travel company Helloworld in July 2017.

He said an administrative error led to the company failing to charge his credit card, and only followed it up yesterday after the Sydney Morning Herald and The Age raised it with his office.

"At no point, until approached by the media yesterday, did I receive any reminders that the payment due remained outstanding, even though I now understand it appeared as outstanding and unresolved on the internal Helloworld system since that time," Senator Cormann said in a statement.

"The payment was processed immediately once it became apparent to me that it remained outstanding."

He said he thought his credit card had been charged when he booked the economy flights.

Liberal Party treasurer is Helloworld CEOSenator Cormann released a letter he received from Helloworld, dated February 19, 2019, in which chief financial officer Michael Burnett said reminder payment notices had not been sent to the Finance Minister despite the payment being listed as "outstanding".

"The flights were never 'free' and they were never intended to be free," Mr Burnett said in the letter.

The chief executive of Helloworld is federal Liberal Party treasurer Andrew Burnes.

Senator Cormann denied there was any link between the flights and a subsidiary of Helloworld being awarded a government travel contract.

"At no point did I influence or seek to influence the outcome of that tender process," he said.

"I had absolutely no role in the awarding of this tender or during the subsequent contract negotiations with the preferred tenderer."

Read more:

https://www.abc.net.au/news/2019-02-19/mathias-cormann-singapore-family-...

Read from top.

Note the item at top was way BEFORE the recent Royal COMMISSION INTO BANKING that revealed a lot of banks dirty tricks...

I have to say, I’ve got a close, personal oversight...

Mathias Cormann is having a tough morning on the chair. Let me bring you a quick summary of the evidence he’s given to date.

Cormann has told the hearing he booked three private trips to Singapore by calling the CEO of Helloworld, Andrew Burnes, direct.

Asked whether it is unusual to book travel by calling the CEO of a travel company on his mobile rather than calling a 1800 number, Cormann said: “I have to say, I’ve got close, personal relationships ... I’ve got a close personal relationship with Mr Burnes and I don’t think it is unusual to ask somebody who owns a business to sell products and services back to you on commercial terms”.

Cormann says he has no evidence the travel was provided to him at a discount. He says the travel was never intended to be free. His failure to pay the bill was an oversight.

Just to give some quick background on Burnes – he’s a Liberal party treasurer, and the company has made donations to the Liberal party. Cormann describes him as a friend he sees socially.

The finance minister says he had no involvement in a decision to give Burnes’ company a government travel contract, although he has given evidence that the CEO complained to him about the way the finance department was running the tender process. Cormann says he did not pass those complaints on to officials, and he told Burnes to take up his concerns with the bureaucrats.

Read more:

https://www.theguardian.com/australia-news/live/2019/feb/19/no-idea-math...

Meanwhile...:

Meanwhile, I’m thinking about getting Centrelink to install one of their famous phone services to remind people like me that it’s their responsibility to check their financial transactions when things look unusual.

They do something like that for the poor, don’t they?

Why not for finance ministers?

Read more:

https://www.smh.com.au/politics/federal/mathias-cormann-solves-the-parab...

Read from top...

his judgement is off. must be the cigars...

...

It's reasonable to take Senator Cormann at his word about missing that the charge hadn't been processed.

Even accepting this, however, the affair looks bad for Senator Cormann, who failed the "Caesar's wife" test.

He should not have booked through the chief executive, given the man is a political and personal associate, and the company has a commercial relationship with Senator Cormann's department.

If he wanted to use that company, he should have gone to the normal booking service. It would have been more prudent to have used another travel agency.

Helloworld's chief financial officer Michael Burnett said, in a letter Senator Cormann produced on Tuesday, that the flights were never intended to be free.

But Mr Burnett provided an odd explanation for no reminders:

"Because we held your credit card details at the time of the booking, payment reminders were not sent to you, even though the amount remained listed as 'Outstanding' on our internal system."

You'd expect the company would have either processed the payment or sent a reminder.

Prime Minister Scott Morrison's aggressive reaction — accusing Labor of going "to the bottom of the chum bucket" when the Opposition asked if Senator Cormann had any conflict of interest, given the contract — doesn't help the Government.

It's not the first time Cormann's judgement has been offThe public's default position is scepticism when it comes to politicians' conduct.

Giving Senator Cormann the benefit of all doubt, the matter smacks of cosiness and cronyism — a politician using his connections to smooth his way (just as that famous picture of Joe Hockey and Senator Cormann smoking cigars sent a signal of complacency and came to haunt both of them).

This is one more setback for Senator Cormann, who has seen his reputation badly dented in the past few months.

Read more:

https://www.abc.net.au/news/2019-02-20/mathias-cormann-overlooks-his-own...

Read from top.

Cormann should resign. more honest people would...