Search

Recent comments

- they know....

1 hour 23 min ago - past readings....

2 hours 22 min ago - jihadist bob.....

2 hours 29 min ago - macronicon.....

4 hours 23 min ago - fascist liberals....

4 hours 24 min ago - china

7 hours 59 min ago - google bias...

1 day 42 min ago - other games....

1 day 46 min ago - נקמה (revenge)....

1 day 1 hour ago - "the west won!"....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

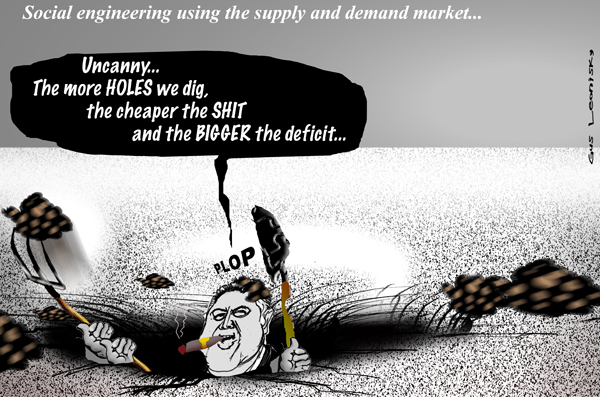

smoking-joe discovers economics...

Yes the Government has done well not to chase falling revenue by cutting expenditure after the mini budget, but it has done little to bolster economic growth other than saying it will be bolstered, writes Greg Jericho.

The mid-year economic and fiscal outlook (MYEFO) confirmed that all treasurers, even Joe Hockey, are Keynesians when things turn rotten. But his plan for the next four years appears rather optimistic given the dire hits to the budget that have occurred over the past 12 months.

When announcing the MYEFO, the Treasurer took a very sensible line, in noting that the major cause of the blowout in the budget deficit was due to falling revenue off the back of falling commodity prices. He noted that:

"In the last six months, unforeseen events have hit the Australian economy. In particular, we are now witnessing the largest fall in the terms of trade since records were first kept in 1959."

This is certainly true. The budget expects the terms of trade to now fall by 13.5 per cent in this financial year. But given in 2012-13 it fell by 10 per cent, it might involve a bit more context to say the fall in the terms of trade was the biggest for two years.

But of course that would suggest he was in the same position as was Wayne Swan and that's something Joe Hockey could never stomach, regardless of how true it might be.

The fall in revenue came mostly from lower company and lower personal income tax revenue. But there were other interesting falls. Clearly something must be going right with the anti-smoking push via the increased excise rate and the plain packaging, because tobacco excise revenue is now predicted to be 4.6 per cent lower ($400 million) than was expected in the May budget.

http://www.abc.net.au/news/2014-12-17/jericho-a-post-myefo-malaise-wont-fix-the-budget/5972726

- By Gus Leonisky at 18 Dec 2014 - 9:44am

- Gus Leonisky's blog

- Login or register to post comments

a deep-end felt pool...

ABC journalists were in tears on Wednesday afternoon after being told their positions could become redundant.

Close to a third of more than 300 ABC staff in pools with similarly skilled colleagues were expected to learn their possible fate by 5pm.

'People are devastated. You are looking at people with upwards of 20 years' experience.'

The Fair Work Commission on Monday recommended that staff should be notified of their potential redundancy by the close of business on Wednesday.

Federal Politics reporter Lyndal Curtis has also confirmed she was leaving the ABC. Fairfax Media understands Curtis had made her own decision to leave.

Another senior ABC journalist told Fairfax Media that at least four of her colleagues had been selected for possible redundancy at lunchtime.

"People are devastated," she said. "You are looking at people with upwards of 20 years' experience."

"A couple of journos have been in tears."

The husband of another senior journalist with more than 20 years' experience said he was appalled at the way his wife had been treated. He said she had been in floods of tears after being told she was on the list of people earmarked for redundancy.

"Coming into Christmas, it is breathtaking in its brutality," he said.

"She feels like she has been treated with contempt.

"There was no recognition of all the work she has done or her achievements."

http://www.smh.com.au/national/abc-journalists-informed-of-potential-redundancies-before-christmas-20141217-1290eg.html

joe's social de-engineering...

The closure of a national youth support program means hundreds of vulnerable teenagers are at risk of falling through the cracks, youth workers say.

When 17-year-old Lucy Newman was first referred to a Youth Connections program in Brisbane she was homeless, a school dropout, battling drug addiction and had serious mental health issues.

But a year on, she had graduated from grade 12, got an internship, and said she wanted to be an actor.

"I was homeless for 18 months and I was having a really bad downhill [run] and they've helped me out," she said.

"They help with housing and mental health - I had really bad mental health issues and they've just got me back on my feet.

"It's definitely brought me back to who I was a long time ago.

http://www.abc.net.au/news/2014-12-18/youth-connections-program-cut/5967908

should we subsidise holes for profits?...

"You have to go back to look at the origin of Royalties for Regions which really was ... money that's going to go back into the regions, being spent in places where hospitals, exploration, buildings, whatever wasn't going to happen without it," he said.

"One of the undertakings that was made was that Royalties for Regions wouldn't be spent on areas where central funding would normally have paid for those things.

"If it would've gone ahead, I think we need to question whether that was money well spent or not."

Helping a large company to be 'a bit more profitable'?Mr Park said careful thought had to be given before providing drilling funding to miners.

"You have to be pretty hard-headed about this," he said.

"Are we facilitating a new project or we just helping a large company make it a bit more profitable?"

The funding source for the exploration scheme changed this year.

It was paid for under Royalties for Regions until the end of June but now it comes out of state revenue.

Official and unofficial websites and other information online is yet to be updated on this point.

Whatever the specific source, it is still a publicly-funded scheme and the Government said it is good value because it generates jobs, and gains new geological information.

The $100 million spent so far included $50 million for drilling while the rest went on Department of Mines and Petroleum geological mapping, geophysical and geochemical surveys and improvements to client processing via online initiatives.

Nurses want funding to go to local facilitiesBut the Australian Nursing Federation, which also supports the Royalties for Regions program, questions whether drilling programs should be subsidised at all.

read more: http://www.abc.net.au/news/2014-12-19/questions-over-exploration-funding/5980680

See toon at top...

the more we dig, the more we lose cash...

The latest official trade figures show Australia's net foreign debt has hit a new record and is approaching $1 trillion.

The Australian Bureau of Statistics (ABS) data shows net foreign debt grew to $924.8 billion in the December quarter.

That is 4 per cent higher than the prior quarter's debt of $886.8 billion.

"Our high level of foreign debt represents a risk - if export income was to dry up it would constitute a problem," CommSec chief economist Craig James said of the figures.

"But exports continue to rise, resulting in our debt servicing ratio improving to the best levels in almost 30 years."

Today's data also suggests that Australian economic growth data due out on Wednesday could be better than expected.

The ABS figures show net exports will add 0.7 percentage points to the gross domestic product (GDP) growth in the three months to December.

That is better than the 0.6 percentage points economists surveyed by Bloomberg had expected.

The current account deficit in today's figures was also better than had been anticipated, falling from a revised $12.13 billion in the September quarter to $9.59 billion.

read more: http://www.abc.net.au/news/2015-03-03/australias-net-foreign-debt-approaches-1-trillion/6277126

See toon at top...

selling more for less or selling less for more...

An investigation has been launched into Andrew "Twiggy" Forrest's comments after the mining magnate suggested a cap on iron ore production, the chairman of the Australian Competition and Consumer Commission (ACCC) said.

Media player: "Space" to play, "M" to mute, "left" and "right" to seek. Twiggy Forrest calls for iron production cap to force up price (AM)

Rod Sims warned Mr Forrest may have breached the law with his comments on ABC's AM program that it would be good for Australia to limit iron ore capacity and to drive the price up.

"Attempting to cap pricing, or fix pricing, even making the attempt is illegal," Mr Sims told AM business editor Peter Ryan.

"We need to examine very closely what was said but what I've heard on this morning's [ABC program] AM does raise very serious concerns," he said.

"We propose to make contact immediately with Mr Forrest and his company to get more detail from them.

"The law says that not only can't you do things that are a breach of the competition provisions of the Act, but you can't attempt to do them.

"And so it's the attempt issue that we will be looking at to assess whether there has indeed been a breach of the Act here."

Earlier today, Mr Forrest told AM that Australia should cap iron ore production.

"Look, I'm absolutely happy to cap my production right now," he said.

read more: http://www.abc.net.au/news/2015-03-25/accc-investigation-into-twiggy-comments/6346426

the toon at top tells it straight...

The cost of iron ore has fallen below US$50 a tonne for the first time in more than a decade, heaping more pressure on Joe Hockey’s federal budget plans and the share prices of the big mining companies.

Iron ore for immediate delivery to the port of Tianjin in China fell to US$49 a tonne, from US$51, while ore at the port of Qingdao was fetching US$49.53.

After starting last year at US$135 a tonne, the fall has already deprived the treasurer of billions of dollars in tax revenues from exports.

The continued slump is estimated to have cost him a further $3bn, according to a Deloitte Access Economics director, Chris Richardson. The mid-year budget update assumed a price per tonne of US$60.

“What we’re now seeing is that commodity prices around the world are going back to normal,” Richardson told the Australian. “That is a big problem for Australia. It’s an old mistake to assume that a boom is permanent. In this particular case it was a very large boom and both sides of politics spent a lot.”

A further cut in interest rates is also more likely as a result.

read more: http://www.theguardian.com/australia-news/2015/apr/02/ron-ore-falls-below-us50

Meanwhile the tonnage of iron export is increasing... See toon at top...