Search

Recent comments

- paris is sick....

2 hours 4 min ago - German spies?....

3 hours 15 min ago - US arrogance....

4 hours 26 min ago - down and up.....

4 hours 55 min ago - worse than nazis....

5 hours 7 min ago - amazing hypocrite....

5 hours 11 min ago - julius vogel's ....

6 hours 40 min ago - be worried....

8 hours 58 min ago - alexei was a liar....

10 hours 26 min ago - april 20, 2024....

11 hours 19 min ago

Democracy Links

Member's Off-site Blogs

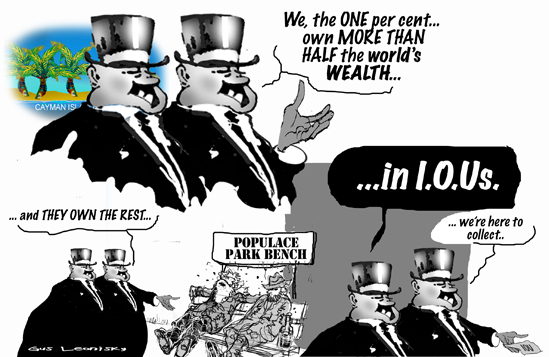

addicted to I.O.Us...

Debt was the trigger for the financial crisis in 2008, and what followed - from the collapse of Lehman Brothers to the Greek debt crisis - suggested that the world would no longer fall foul of debt.

But debt continues to pile up around the world. It has actually increased by $57tn to $199tn (287 percent of global GDP), according to the McKinsey Global Institute - stifling global economic growth and heightening the risk of more defaults and market turmoil.

Is the world addicted to debt? Are we heading towards another economic collapse? And what can be done to prevent a potential financial meltdown?

We look at the story of oil giant Petrobras, once the motor behind Brazil's spectacular transformation into a global superpower, which was hit hard by the sharp decline in oil prices, the slowdown of China's economy, and a corruption scandal of epic proportions.

Susan Lund, the director of research at the McKinsey Global Institute, joins the programme to discuss why global debt keeps rising and why the world is addicted to debt.

http://www.aljazeera.com/programmes/countingthecost/2015/10/world-addicted-debt-151009180256315.html

- By Gus Leonisky at 15 Oct 2015 - 7:02am

- Gus Leonisky's blog

- Login or register to post comments

squirrelfish, sponges, goliath groupers, urchins and more...

Labor knows Malcolm Turnbull is very unlikely to have avoided Australian tax on his considerable investments. Having waited so long to win the prime ministership he would surely have guaranteed he didn’t come unstuck because of something as obvious as that.

But proving tax avoidance is almost certainly not the point.

...

By day’s end the Coalition was pointing out that Labor MPs, including Bill Shorten, have their money in super funds that also have investments that are domiciled in the Caymans.

But tactically Labor is betting more people will remember that Turnbull’s riches are stashed in an opaque tax haven in the Caribbean.

They calculate that Turnbull’s frustration at shadow ministers’ “inability to understand the way in which these funds operate” just plays into the their hands. Because most Australians wouldn’t.

http://www.theguardian.com/australia-news/2015/oct/14/labors-attack-on-turnbulls-cayman-islands-investments-is-all-about-image

The Cayman Islands are a major international financial centre. The largest sectors are "banking,hedge fund formation and investment, structured finance and securitisation, captive insurance, and general corporate activities".[47] Regulation and supervision of the financial services industry is the responsibility of the Cayman Islands Monetary Authority (CIMA).

The Cayman Islands are the fifth-largest banking centre in the world, with $1.5 trillion in banking liabilities.

https://en.wikipedia.org/wiki/Cayman_Islands

the perfectly legal ways of avoiding taxes...

Bill Shorten has argued Labor’s focus on Malcolm Turnbull’s investment in funds registered in the Cayman Islands is not about any allegation of criminality, but whether leaders can understand the plight of ordinary Australians.

The Labor leader – who was accused of “throwing mud” at the wealthy prime minister – said most people did not have the capacity to put millions of dollars into funds domiciled in the Cayman Islands.

The real issues were tax transparency and the ability of “a lucky few” to access generous concessions not available to other people, Shorten said on Thursday.

Labor pursued Turnbull in parliamentary question time on Wednesday in relation to three of his investments in Cayman-registered funds: Bowery Opportunity, Zebedee Growth and 3G Natural Resources.

The Labor senator Sam Dastyari had earlier used parliamentary privilege to suggest that people invested in the Cayman Islands “so they do not have to play by the same rules as the rest of us”. He said the Bowery Opportunity Fund required a minimum investment of $1m.

Turnbull told parliament many of his and his wife Lucy’s investments were in overseas managed funds in order to avoid conflicts of interest, but all their income from those investments was “taxed in full in Australia”.

On Thursday, Shorten was asked about his own superannuation account with Australian Super. The super fund’s website indicates 1.29% of its holdings are in Tencent Holdings Ltd, which is incorporated and registered in the Cayman Islands.

Shorten said there “couldn’t be a bigger gap or difference between Malcolm Turnbull and his millions of dollars sent to the Cayman Islands and the superannuation of ordinary Australians”.

Shorten said the Cayman Islands were “cloaked in secrecy”. He was “uncomfortable that some people can shop around and get the best deals and minimise their tax and the rest … have to pay their tax because they can’t afford to go shopping in some of these exclusive tax jurisdictions”.

“No one is saying, none of my colleagues have said, anything illegal has occurred. We have no facts to say that and that is not what is being said,” Shorten said in Canberra.

“It’s a question of the sort of leadership that we expect in this country. Australians want to know that their leaders understand what they are doing, the lives they are leading.”

Shorten said there was “a sense of frustration in Australia” about access to tax concessions and deductions.

http://www.theguardian.com/australia-news/2015/oct/15/bill-shorten-attacks-on-turnbull-over-cayman-islands-all-about-ordinary-people

If you owe the banks more than you have or are likely to get, you're in deep dip shit... The banks, governments and enterprises plan (hope) that you will get deeper into debt though, like rats (or hamsters to be less controversial) so you will make the wheel of fortune spin faster and faster for them, while you see the carrot-fairy coming nearer to you until you reach retirement age and become an old farting bludger(ette) foggie... then die. But in the meantime you had plenty of exercise, plenty of fattening food, plenty of hopes and loads of overchemicalised bacon... You should be so happy: your dedicated slavery has helped many a hedge fund make billions tax free in a small sunny island where the hurricanes are always near-misses.

Consider these billions your gift to them. According to the law of Archimedes these billions come from your pockets.

tax fudge...

Labor gave Australian politics a mild Caribbean flavour this week by accusing Malcolm Turnbull of using an entity based in the Cayman Islands tax haven for some of his very considerable investments.

The Caymans only real claim to fame is as a place where tax liabilities go away. Corporations (including all the worlds biggest) and individuals (including the super-rich) use tax havens. Some arrangements can be diabolically complicated but the essential principle behind tax havens is pretty simple.

Profits or earnings that would be taxable in one country are moved to the tax haven and, like magic, you are clear of some or all tax obligations you’d otherwise have in the place the money originated – or where it goes next. But there’s no physical operation in these havens, it’s a effectively just a post-box. The whole thing is a fiction and very often a rort.

Labor senator Sam Dastyari, who has done really important work highlighting corporate tax avoidance and appalling behaviour by financial planners, led the charge against Turnbull. But on this occasion the senator didn’t quite go the distance.

Turnbull’s investment was via a managed fund – ie an investor gives money to a fund manager, which uses a Caymans entity in its structure. This probably insulates the prime minister from too much criticism.

Had he and Lucy established their own tax haven entity the charges would have much more strength. In fact, it would be a sound basis to call for a resignation. On Thursday Turnbull bridled at the implication that he had investments in the Cayman as way to avoid Australian tax, saying:

[B]ig funds, big companies, small funds invest in these offshore vehicles and when they do, the income comes back to Australia and all of the tax – not most of it, all of it – goes to the Australian taxation office.

In one sense the prime minister deserves a bit of a verballing, given he’s persisting with plans to repeal Labor initiatives to reduce tax secrecy by Australia’s wealthiest. The public are entitled to be suspicious of a very wealthy man leading a government currently trying to help the wealthy hide their tax affairs.

read more: http://www.theguardian.com/commentisfree/2015/oct/16/its-not-just-malcolm-turnbull-your-super-smells-like-the-caymans-too

democratically unequal...

Inequality has grown since the global financial crisis (GFC) and the richest 1 per cent now own half of all household wealth in the world, a report has found.

So much of the world remains relatively poor that it has taken a net worth of just $US3210 ($4400) this year to be among the wealthiest half of all world citizens, according to Credit Suisse's Global Wealth Report 2015.

And it doesn't take obscene amounts of money to rank among the richest of the world's 7 billion citizens. A net worth of more than $US68,800 puts you in the top 10 per cent of all global wealth holders. Once debts are subtracted, you need $US759,900 to be in the top 1 per cent, the report found.

The boom in wealth at the very top marks the reversal of a trend that had lasted from the turn of the millennium until the financial crisis of 2008-09, analysts said.

In 2000, the share of wealth owned by the richest 1 per cent was 48.9 per cent. This fell to 44.2 per cent in 2009.

Now the wealthy are ascendant once more, "overtaking the 2000 level within the last 12 months", according to the report. "We estimate that the top percentile now own half of all household assets in the world," the analysts wrote.

Read more: http://www.smh.com.au/business/the-economy/richest-1-per-cent-own-half-the-worlds-wealth-report-20151015-gkaide.html#ixzz3ohEAbvsT

Follow us: @smh on Twitter | sydneymorningherald on Facebook

Note that the world debt to itself is nearly three times the total world GDP...

colonial humping...

Sovereignty down under

As a federation of ex-colonies, with associated cultural baggage, the sovereignty of White Australia has not been a simple matter.

Australia came into existence courtesy of an act of the British Parliament. But there was no clean break. The Australian military was long an arm of the British military until World War II. Ditto Australia’s foreign policy, derivative, until an embassy was established in Washington in 1940.

Prime Minister Chifley’s attempt to nationalise the banking sector was defeated by appeal to the British Privy Council, then Australia’s “highest court”. Such arrogation of powers was belatedly not put to sleep until the Australia Act 1986.

Additionally, there are subtler forms of the loss of sovereignty, mostly notably reflected in the U.S. involvement in the sacking of Prime Minister Gough Whitlam in 1975. Given that the overthrow of national leaders or governments is a not unusual practice by imperial powers, sovereignty is evidently a tenuous affair.

Gough Whitlam's death revives doubts of US role in his sacking. #ausbiz#auspol http://t.co/r8u4ghBMD2 pic.twitter.com/aLexeMT1h0

— Financial Review (@FinancialReview) October 30, 2014And then there is Australia’s current head of state, who peculiarly resides beyond the oceans. Sovereignty is a more nebulous and tenuous concept than we assume.

Read more: https://independentaustralia.net/politics/politics-display/a-matter-of-sovereignty-part-1,8264

... they can't take it to paradise...

There are all sorts of reasons why such increases in inequality are troubling, and not just for those at the bottom of the income and wealth pyramid.

One is that aspirational people on lower incomes have massive incentives to take on too-great debts to support their living standards - which exacerbates the propensity of the economy to swing from boom to financial-crisis bust.

Another is that the poor in aggregate spend more than the rich (there are only so many motor cars and yachts a billionaire can own, so much of the super-rich's wealth sits idle. as it were), and therefore growth tends to be faster when income is more evenly distributed.

So President Obama's State of the Union address, which is expected to contain a proposal to tax the assets of the wealthy, perhaps should be seen as a belated attempt to promote economic and social stability that would benefit even the wealthy - who will nonetheless attempt to stymie him in Congress.

As it happens I am in the process of finishing a two-part Radio 4 documentary about all of this, due for broadcast in a few weeks.

And what is striking is the growing realisation - even by the extreme privileged, who are about to fly in their private jets to Davos to save the world from itself, at the annual gathering of the World Economic Forum - that it is no longer enough simply to argue that equality of opportunity is all that matters.

Or rather, there can be little equality of opportunity in a world where there is the kind of inequality of outcome we haven't seen since the early decades of the last century.

http://www.bbc.com/news/business-30878840