Search

Recent comments

- brics.....

1 hour 30 min ago - nuke fukus.....

5 hours 39 min ago - dead or alive?....

5 hours 49 min ago - who what when where?....

7 hours 25 min ago - elon vs kanbra.....

8 hours 19 min ago - tanked think-tank.....

9 hours 20 min ago - (PAUSE)....

9 hours 46 min ago - repeat....

10 hours 39 min ago - losing....

11 hours 5 min ago - was Pepe sold a pup?....

11 hours 42 min ago

Democracy Links

Member's Off-site Blogs

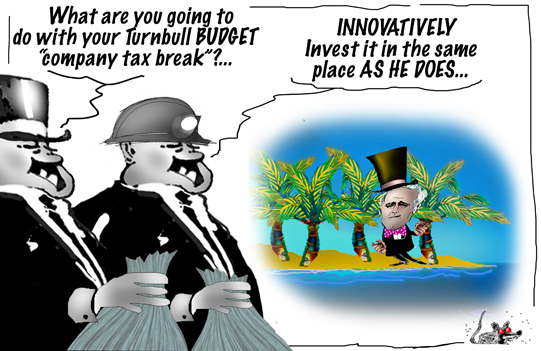

company tax cuts...

- By Gus Leonisky at 4 Apr 2016 - 4:39pm

- Gus Leonisky's blog

- Login or register to post comments

rich pickings...

Through a combination of political opportunism and simple mismanagement, the Coalition has simultaneously ramped up public expectations of significant tax relief while also limiting its reform options to the one area where voters think they're already being most taken advantage of: company taxes.

The Prime Minister and Treasurer Scott Morrison are set to unveil a "glide path" from the 30 per cent rate towards a much lower number, in the May 3 budget.

This would be the main positive feature after the government surrendered a higher GST, and blanched at trimming back negative gearing "excesses" despite initially suggesting otherwise.

But will voters see it that way? The process began with lofty ambitions, and with a heartfelt promise to return "bracket creep" to long suffering middle-income earners who, through no greater purchasing power, had drifted increasingly into the second highest marginal tax bracket.

Now the message is wait your turn.

Meanwhile, news stories abound exposing the prevalence of tax minimisation measures employed by the super rich, and by big companies, all of which have left PAYG taxpayers feeling like mugs for their good faith.

The latest installment, the Panama Papers, has identified hundreds of thousands of wealthy international clients of the Panama legal firm Mossack Fonseca. Among the prominent individuals linked to creative tax avoidance are powerful world leaders and business heavyweights, and many Australians. The Australian Tax Office is investigating as many as 800 such individuals linked to the firm.

This follows last month's admission by the ATO that of 321 companies with earnings over $200 million, 98 had not paid any company tax at all in 2013-14.

And on the weekend, Fairfax Media reported on work by the Melbourne Institute which shows the top 1 per cent of Australian earners had amassed 9 per cent of Australian income in 2013, more than double the rate of wealth concentration than was the case in the 1980s.

Read more: http://www.smh.com.au/federal-politics/political-opinion/malcolm-turnbulls-company-tax-cut-strikes-an-off-note-amid-abuse-revelations-by-rich-and-powerful-20160404-gnxmm7.html#ixzz44pz61BiN

Follow us: @smh on Twitter | sydneymorningherald on Facebook

moving the goal posts closer to the rich...

A new study by the IMF examining the impacts of tax cuts has found that while lowering tax rates for the rich will stimulate the economy, it does so at the great cost of increased inequality.

Most damningly, it finds the benefits of tax cuts targeted at the wealthiest 25% – such as the one the Turnbull government brought in last year – are far too weak to raise the welfare of the majority of the population and also never pay for themselves.

Last year, the government made great talk of the need for a tax cut for those earning more than $80,000.

The threshold for the 37% rate was raised to $87,000 to ensure – as the prime minister argued at the time that “middle-income Australians, those that are on average full-time earnings, which as you know is nudging $80,000, don’t move into the second top tax bracket”.

read more:

https://www.theguardian.com/business/grogonomics/2017/sep/10/tax-cuts-fo...

Read also:

trickle down or suck the middle?...See toon at top...