Search

Recent comments

- seriously?...

4 min 45 sec ago - AfD....

31 min 59 sec ago - undesirables...

48 min 32 sec ago - assistant spies......

1 hour 13 min ago - brics.....

4 hours 21 min ago - nuke fukus.....

8 hours 30 min ago - dead or alive?....

8 hours 40 min ago - who what when where?....

10 hours 16 min ago - elon vs kanbra.....

11 hours 10 min ago - tanked think-tank.....

12 hours 11 min ago

Democracy Links

Member's Off-site Blogs

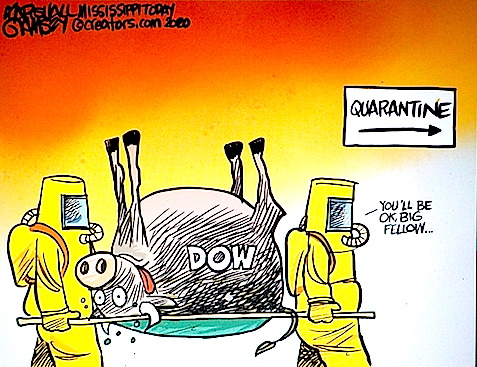

going to the slaughterhouse....

The Australian share market is down 4% in what could be the most turbulent day yet during this coronavirus-driven markets crisis.

Michael McCarthy, chief market strategist at CMC Markets and Stockbroking in Sydney, said

US stock futures are trading significantly lower this morning after crude oil futures dropped more than 20% at the opening of the US Sunday night session.

“Russia’s hard line at a Friday meeting of OPEC+ oil producing nations means it will no longer observe supply restraint to keep crude oil prices higher. The break down in supply agreements comes as the Covid-19 virus has many analysts revising demand forecasts downward, and the double-hit is playing havoc with prices.

The growing fears over the impact of virus containment measures and the slump in crude prices may see stocks outstrip falls foreshadowed on Saturday morning.”

Read more:

You will notice that Russia is to be blamed for the LOW price of petrol... Actually, the Saudis were on the stint as well. They refused to cut production, so the Ruskies followed suit... Hard to know who started it first...

But fear not... Most of the retirees who self-finance with the stock market are okay because they cannot afford to travel anymore as the Cruise Ship industry is being closed down by the US State Department (see cruise ships to the junk-yard?... )... and the older one gets, the more chance one can get the coronavirus death...

- By Gus Leonisky at 9 Mar 2020 - 9:45am

- Gus Leonisky's blog

- Login or register to post comments

the bear is dancing...

the machines stopped greed trading ...

Stocks on Wall Street fell by nearly 8 per cent overnight, triggering the first automatic halt in trading in over two decades, as coronavirus fears and a crash in oil prices sent a shudder through financial markets.

Key points:The Dow Jones plunged more than 8 per cent at one point during the day and closed down 7.8 per cent, or 2,014 points to 23,851 — its heaviest loss since the darkest days of the 2008 global financial crisis.

European markets also had their worst day since the GFC, with the FTSE in London down 7.7 per cent, echoing Australia's 7.3 per cent dip on Monday.

Japanese stocks entered a bear market as US stocks threatened to do the same. A bear market is defined as a drop of 20 per cent from its peak.

The 15-minute pause in trading on Wall Street was triggered by an automatic cut-off mechanism introduced after the Black Monday crash of 1987 and modified over the years to give investors a chance to catch their breath.

Read more:

https://www.abc.net.au/news/2020-03-10/wall-street-takes-dive-coronaviru...

down, going down, doh dow...

back from the dead...

Wall Street shares rallied on Friday after US President Donald Trump declared the coronavirus outbreak a national emergency, freeing up money to fight the spread of the disease.

As the president spoke, the three main US indexes jumped more than 9%.

Earlier, London's FTSE 100 closed up 2.5%, retreating from an early surge, while other European indexes made similar moves.

The rally comes a day after Wall Street suffered its biggest losses since 1987.

Investors fear economies could slide into recession as a result of the pandemic, as business is disrupted, events are cancelled and schools in many countries close in an effort to contain the spread of the virus.

Many indexes around the world have now fallen more than 20% from their recent highs - a red flag for recession.

On Friday, the European Union said it will put in place a package of measures, including a €37bn euro (£33bn) investment initiative.

And German finance minister Olaf Scholz said his country could part-nationalise firms to tackle the crisis.

'Whatever we need'In the US, House Speaker Nancy Pelosi, a Democrat, said her members would pass a bill that provides paid sick leave, among other aid. But Republicans and the White House have not said they will support it.

US Secretary Steven Mnuchin pledged the US would use "whatever tools we need". The national emergency declaration helps speed some kinds of funding to local governments.

Read more:

https://www.bbc.com/news/business-51849106

Read from top.