Search

Recent comments

- brics.....

35 min 56 sec ago - nuke fukus.....

4 hours 44 min ago - dead or alive?....

4 hours 54 min ago - who what when where?....

6 hours 30 min ago - elon vs kanbra.....

7 hours 24 min ago - tanked think-tank.....

8 hours 25 min ago - (PAUSE)....

8 hours 52 min ago - repeat....

9 hours 44 min ago - losing....

10 hours 11 min ago - was Pepe sold a pup?....

10 hours 47 min ago

Democracy Links

Member's Off-site Blogs

just gotta luve my stimulus .....

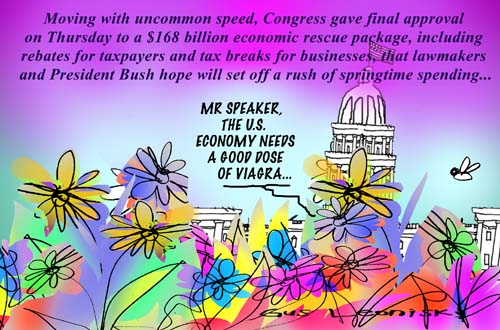

Moving with uncommon speed, Congress gave final approval on Thursday to a $168 billion economic rescue package, including rebates for taxpayers and tax breaks for businesses, that lawmakers and President Bush hope will set off a rush of springtime spending and spark the slowing economy.

A day after the Senate seemed mired in a partisan feud over a more expensive stimulus plan favored by Democrats, lawmakers cast that quarrel aside and approved a plan nearly identical to one the House adopted last week.- By Gus Leonisky at 9 Feb 2008 - 11:10am

- Gus Leonisky's blog

- Login or register to post comments

Happy placebo...

Prozac, used by 40m people, does not work say scientists

Analysis of unseen trials and other data concludes it is no better than placebo

Prozac, the bestselling antidepressant taken by 40 million people worldwide, does not work and nor do similar drugs in the same class, according to a major review released today.

The study examined all available data on the drugs, including results from clinical trials that the manufacturers chose not to publish at the time. The trials compared the effect on patients taking the drugs with those given a placebo or sugar pill.

When all the data was pulled together, it appeared that patients had improved - but those on placebo improved just as much as those on the drugs.

The only exception is in the most severely depressed patients, according to the authors - Prof Irving Kirsch from the department of psychology at Hull University and colleagues in the US and Canada. But that is probably because the placebo stopped working so well, they say, rather than the drugs having worked better.

"Given these results, there seems little reason to prescribe antidepressant medication to any but the most severely depressed patients, unless alternative treatments have failed," says Kirsch. "This study raises serious issues that need to be addressed surrounding drug licensing and how drug trial data is reported."

------------------

Gus: frankly, I'm not flabagggggasted... I only take placebo pills and red-ned for my old age ailments that include my brain outage from time to time... I find placebo less dangerous than the other little red or green or blue or puce coloured pills.

"placebo's the go" is my motto.

Sure I drink myself silly sometimes but that's for health reason... On that level I find alcohol is a good placebo... Plenty of tannin, preservatives, sugar and alcohol, like any good placebo should have — in moderation of course.

see toon at top

I am loopy if you are loopy...

Army of therapists to push aside pills for depression

The [UK] government yesterday released details of its £170m plan to train 3,600 more psychological therapists in the wake of a study showing that antidepressant drugs such as Prozac are no more effective than a placebo.

About 900,000 more people will be treated for depression and anxiety under the plan, according to the Department of Health, which predicts that 450,000 of them will be completely cured. The department also believes that 25,000 fewer people will claim sick pay and benefits because of mental health problems.

"The Improving Access to Psychological Therapies programme has already captured the imagination of primary care trusts up and down the country and is transforming the lives of thousands of people with depression and anxiety disorders in the areas that have been involved so far," said Alan Johnson, the health secretary.

----------------

Gus: from deep personal experience, I know the mental doldrums aren't a nice place to be... For many years I have thus treated myself to a variety of actions, including some simple physical exercises, to stop the blues... One of these actions is to bombard the world with my cartoons and rants (Before appearing on this site, I used to bombard them to every news organisation around the world I could find a contact for). It helps relieve my frustration of seeing rubbish being sold as gospel by tricky peddlers and cunning spruikers...

If I'm right or wrong, I do not know... I just let my gut instincts express my satirical bile, then I feel much better and can seriously work, playfully play and be as friendly as one can be... The stone in my shoe has thus been removed...

too much AAA fairy dust...

This article will appear in Sunday's New York Times Magazine.

The Ratings Game

In 1996, Thomas Friedman, the New York Times columnist, remarked on “The NewsHour With Jim Lehrer” that there were two superpowers in the world — the United States and Moody’s bond-rating service — and it was sometimes unclear which was more powerful. Moody’s was then a private company that rated corporate bonds, but it was, already, spreading its wings into the exotic business of rating securities backed by pools of residential mortgages.

Obscure and dry-seeming as it was, this business offered a certain magic. The magic consisted of turning risky mortgages into investments that would be suitable for investors who would know nothing about the underlying loans. To get why this is impressive, you have to think about all that determines whether a mortgage is safe. Who owns the property? What is his or her income? Bundle hundreds of mortgages into a single security and the questions multiply; no investor could begin to answer them. But suppose the security had a rating. If it were rated triple-A by a firm like Moody’s, then the investor could forget about the underlying mortgages. He wouldn’t need to know what properties were in the pool, only that the pool was triple-A — it was just as safe, in theory, as other triple-A securities.

Interesting conflict

A world-renowned Harvard child psychiatrist whose work has helped fuel an explosion in the use of powerful antipsychotic medicines in children earned at least $1.6 million in consulting fees from drug makers from 2000 to 2007 but for years did not report much of this income to university officials, according to information given Congressional investigators.

By failing to report income, the psychiatrist, Dr. Joseph Biederman, and a colleague in the psychiatryCharles E. Grassley, Republican of Iowa. Some of their research is financed by government grants. department at Harvard Medical School, Dr. Timothy E. Wilens, may have violated federal and university research rules designed to police potential conflicts of interest, according to Senator

Like Dr. Biederman, Dr. Wilens belatedly reported earning at least $1.6 million from 2000 to 2007, and another Harvard colleague, Dr. Thomas Spencer, reported earning at least $1 million after being pressed by Mr. Grassley’s investigators. But even these amended disclosures may understate the researchers’ outside income because some entries contradict payment information from drug makers, Mr. Grassley found.

In one example, Dr. Biederman reported no income from Johnson & Johnson for 2001 in a disclosure report filed with the university. When asked to check again, he said he received $3,500. But Johnson & Johnson told Mr. Grassley that it paid him $58,169 in 2001, Mr. Grassley found.

The Harvard group’s consulting arrangements with drug makers were already controversial because of the researchers’ advocacy of unapproved uses of psychiatric medicines in children.

In an e-mailed statement, Dr. Biederman said, “My interests are solely in the advancement of medical treatment through rigorous and objective study,” and he said he took conflict-of-interest policies “very seriously.” Drs. Wilens and Spencer said in e-mailed statements that they thought they had complied with conflict-of-interest rules.

cumulonimbus stimulus

August 1, 2008

G.D.P. Grows at Tepid 1.9% Pace Despite Stimulus

By PETER S. GOODMAN and MICHAEL M. GRYNBAUM

The American economy expanded at a weaker-than-expected 1.9 percent annual rate between April and June, the Commerce Department announced Thursday, while numbers for the last three months of 2007 were revised downward to show a contraction — the first dip since the recession of 2001.

Economists construed the disappointing quarter, combined with a surprisingly large surge of new claims for unemployment insurance, as clear indication that the economy remains snagged in the weeds of a widening downturn. Many said the data added to the likelihood that the economy fell into a recession sometime late last year.

“We already knew the economy was weak, and now you have both a negative growth number coupled with job losses,” said Dean Baker, a director of the liberal Center for Economic and Policy Research. “There’s a lot of real bad times to come.”

Those concerns about the weak economy were reflected on Wall Street on Thursday. The Dow Jones industrial average fell 205.67 points, or 1.78 percent, to 11,378.02. The Standard & Poor’s 500-stock index fell 16.88 points, or 1.31 percent, to 1,267.38, and the Nasdaq declined 4.17 points, or 0.18 percent, to 2,325.55.

President Bush zeroed in on the positive growth rate in the second quarter as a sign of resilience, dismissing the characterizations of professional economists.

“We got some positive news today,” the president said in West Virginia, addressing a coal industry trade association. “It’s not as good as we’d like it to be but I want to remind you a few months ago, there were predictions, and — that the economy would shrink this quarter, not grow.”

Fortunes in the spring were significantly improved by two factors — the roughly $100 billion in tax rebate the government sent out to households, and the robust expansion of American exports.

The government unleashed the rebate checks to spur consumer spending, which amounts to 70 percent of the economy. Such spending expanded at a 1.5 percent annual rate between April and June, after growing at a meager 0.9 percent clip in the previous quarter. Economists estimated that as much as half of the growth in the spring was the result of Americans spending their rebates.

see toon at top

stimulated stimulus

European and Asian markets have rallied in response to efforts by world leaders to end the recent financial turmoil.

The UK's FTSE 100, France's Cac 40 and Germany's Dax index all jumped more than 6%, tracking earlier gains on Asian markets.

Major central banks said they would offer financial institutions an unlimited amount of short-term dollar loans to help stem the crisis.

EU leaders said on Sunday no big bank would be be allowed to fail.

The financial viagra at present dosage (2 trillion bux worldwide) is starting to work?...will it stop the flaccidity of the US deficit, having presently run out of digits on a ten trillion measuring device....

see toon at top..